分析

March 2024 BoE Preview: A Placeholder After February’s Pivot

As noted, no policy shifts are expected from the ‘Old Lady’ this month, with Bank Rate set to remain at 5.25%, marking the fifth straight meeting at which policy has remained on hold, as the MPC continue to pursue what Chief Economist Pill previously described as a ‘Table Mountain’ approach to policymaking.

Unsurprisingly, the GBP OIS curve implies no chance of any move at this meeting, with money markets implying a 50/50 chance that the first 25bp cut is delivered in June, while fully pricing such a cut by August.

While the rate decision itself is likely to be relatively straightforward, the vote split is likely to be anything but.

The February MPC meeting produced a 3-way split on the 9 member Committee, the biggest divergence in votes in a decade and a half, with all three dissents against holding Bank Rate steady coming from external MPC members – uber-dove Dhingra voted in favour of a 25bp cut, citing lags in policy transmission, while hawks Haskel and Mann instead favoured a further 25bp hike, flagging concerns over inflation persistence.

Commentary since the prior meeting, while relatively limited, has indicated little by way of significant changes in the policy stance of any of the three dissenters. Dhingra is, again, likely to vote in favour of a 25bp cut, having recently noted that inflation is on a “firm downward path”, and that there is not “compelling” evidence to err on the side of overtightening. On the other hand, Mann has noted that services inflation is not decelerating as rapidly as the MPC had expected, while Haskel again stressed a focus on inflation persistence when determining policy. Consequently, another 3-way split in favour of maintaining Bank Rate seems the most likely outcome from the March MPC, albeit with the risk that one, or both, of the hawkish dissenters move back in line with the majority view.

Besides the vote split, the MPC’s guidance on the policy outlook will also be watched closely. In this regard, it seems unlikely that the policy statement will be dramatically altered from that issued after the prior meeting, with the Committee again set to flag a need for policy to remain “restrictive for an extended period of time” in order to ensure a ‘sustainable’ return to the 2% inflation target over the medium-term. The statement is also set to reiterate that the MPC will “keep under review” how long Bank Rate should now remain at the current level.

On that note, it seems that the MPC are relatively comfortable with the current market rate path, which sees just shy of three 25bp cuts this year. There has been no explicit pushback on this pricing in recent remarks, while the February inflation forecasts – when based upon a constant 5% Bank Rate – pointed to a substantial undershoot of the 2% target over the medium-term, an implicit signal that rate cuts will be needed during the forecast horizon.

At the time of writing, the February inflation figures are yet to be published, with the data due on 20th March, the day of the MPC meeting, and a day prior to the policy announcement – as, following usual procedure, the MPC’s vote takes place the night before the decision is released to the general public.

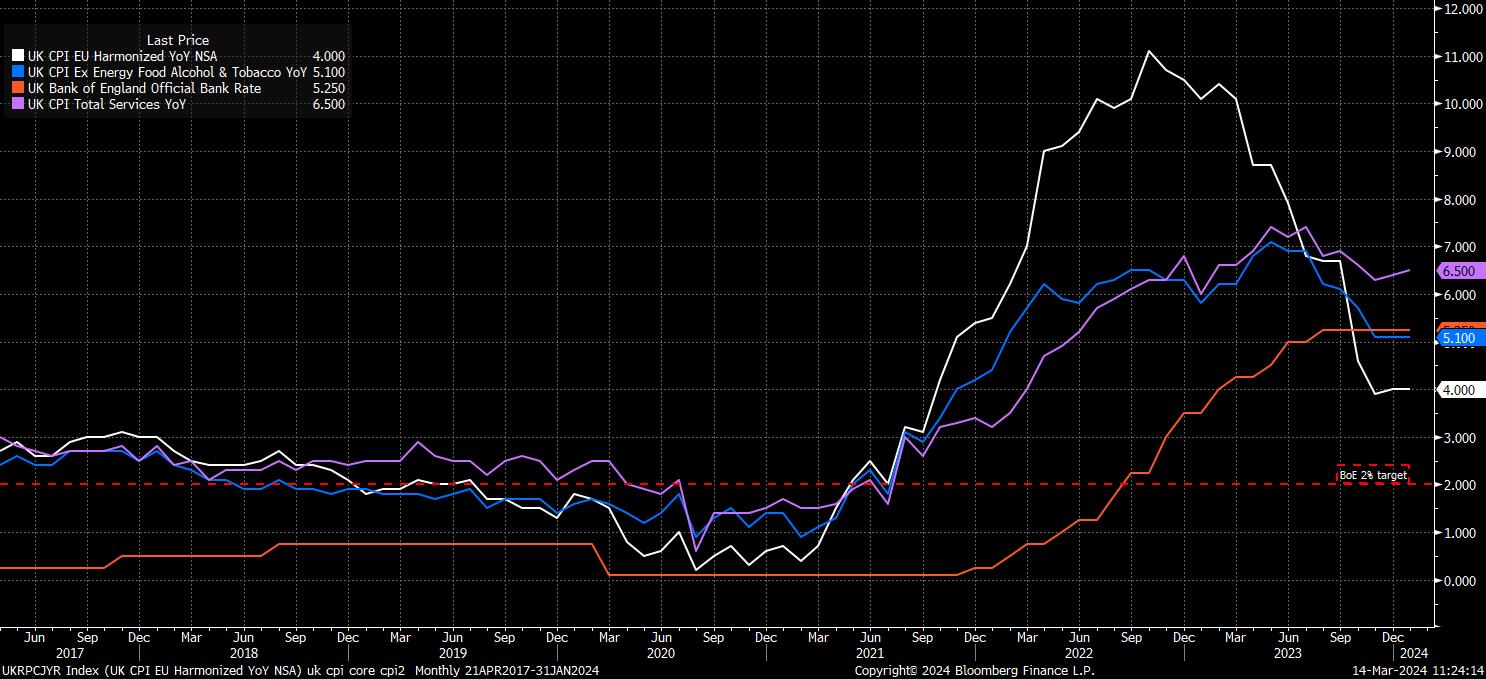

Nevertheless, while headline and core inflation are both likely to continue to slow in February, both gauges are set to remain considerably above the BoE’s 2% price target. Policymakers will primarily be paying attention to the services inflation gauge, which continues to run north of 6%, and is showing worrying signs of stickiness. That said, the 2% inflation target is highly likely to be achieved in the spring, probably in time for the June MPC meeting, primarily due to a sizeable fall in the energy price cap, in addition to frozen fuel and alcohol duties in the March budget knocking around 0.2pp off headline inflation for the remainder of the year.

Despite this, achievement of the 2% target is likely to be relatively brief, with a reacceleration in price pressures, partly owing to base effects, likely in the second half of the year. Furthermore, the MPC’s statement will likely again flag how risks to the inflation outlook remain tilted to the upside, owing to both ongoing global geopolitical risks, in addition to elevated earnings pressures.

On that note, it remains difficult to glean a clear picture of labour market developments. While average weekly earnings growth has continued to cool, with the ex-bonus measure slipping to 6.1% YoY in January, a 15-month low, such a pace remains incompatible with a return to the inflation target, while also representing real earnings growth north of 2%.

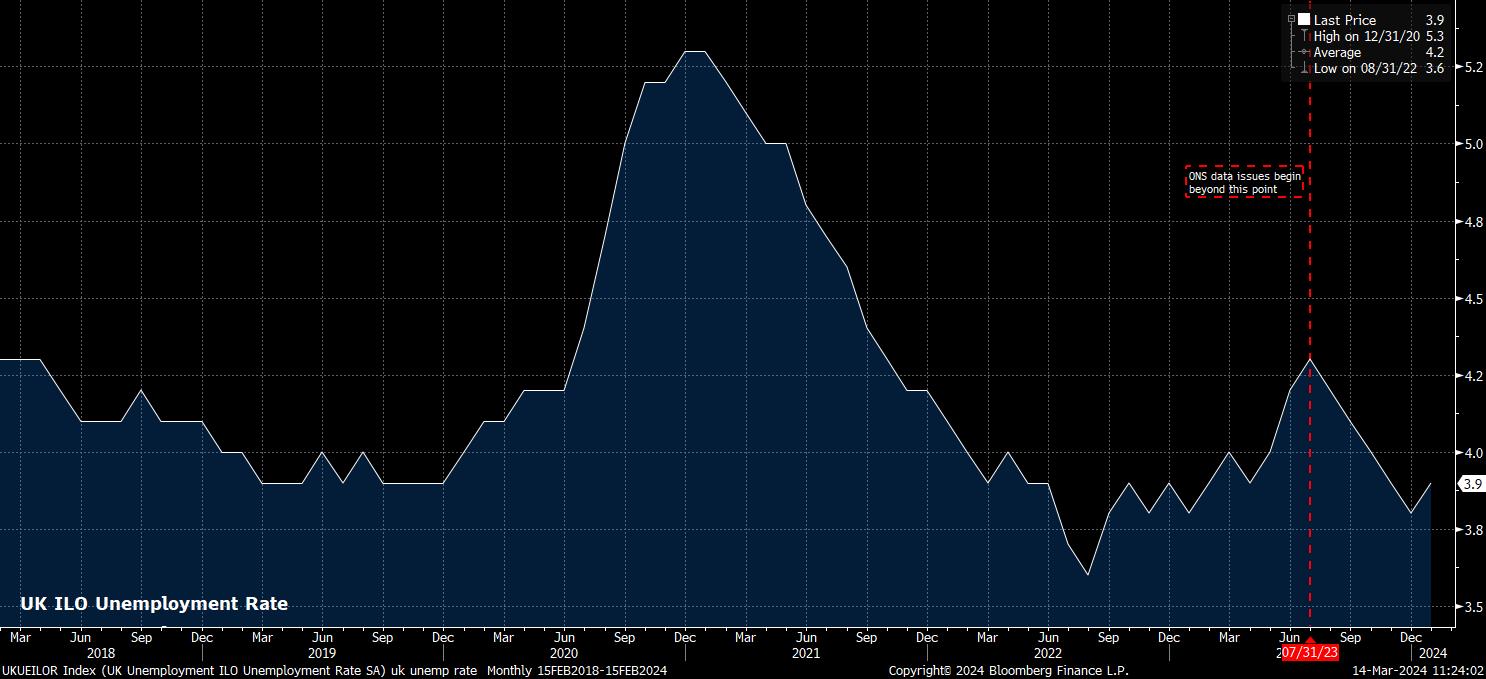

Meanwhile, on unemployment, ongoing data quality issues continue to plague the official ONS data, with the redesigned Labour Force Survey not likely to be finalised until the third quarter of this year. This leaves both the BoE, and market participants, ‘flying blind’ in attempting to gauge the degree of slack in the labour market. While official figures pointed to unemployment rising 0.1pp to 3.9% in January, said data also implied that unemployment fell by 0.5pp during the technical recession experienced in the final two quarters of last year, and hence should be taken with a healthy pinch of salt.

Said recession is, almost certainly, already over.

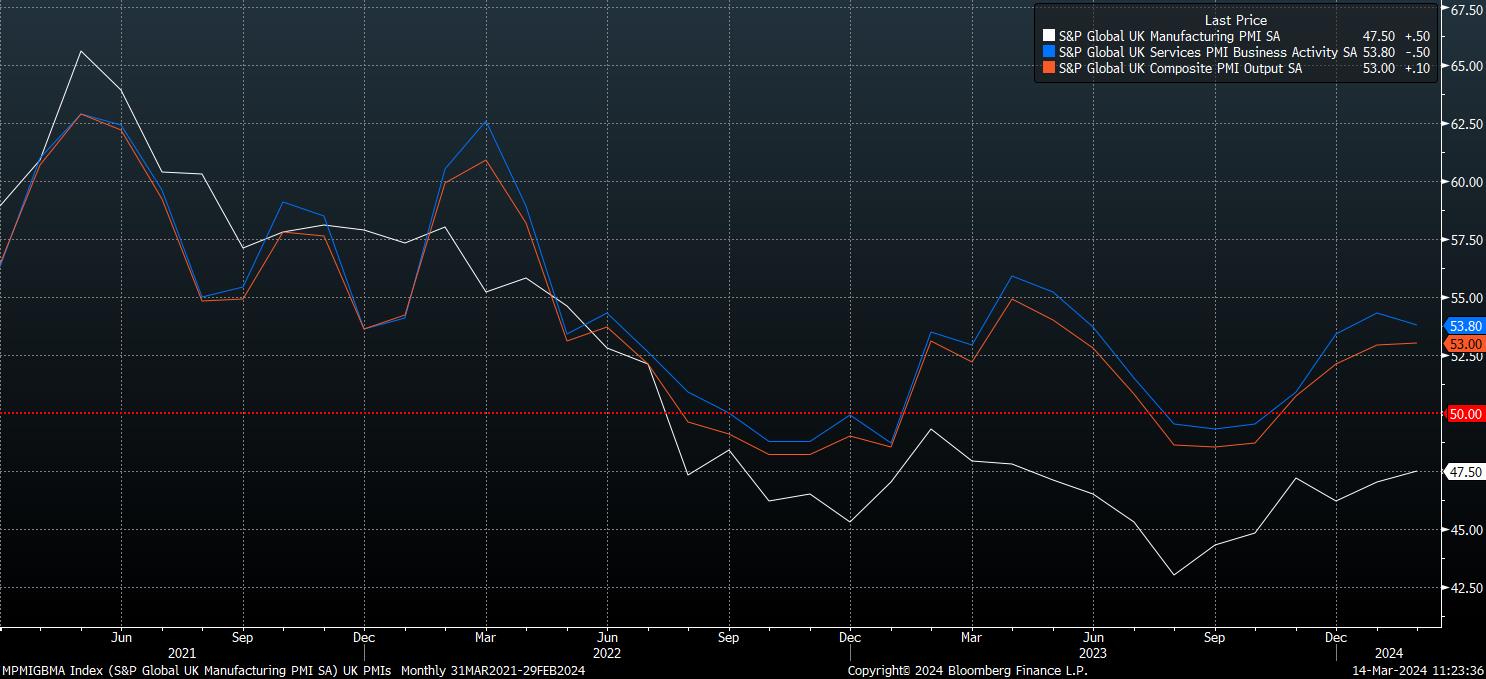

Despite having notched two consecutive quarterly GDP contractions at the end of 2023, the UK economy has begun 2024 with much improved momentum. Monthly GDP rose 0.2% in January, while more up-to-date leading indicators also continue to signal an improvement in the growth backdrop, with the services PMI having remained just shy of a 7-month high last month, as activity in the manufacturing sector shows further signs of having already bottomed-out.

Altogether, while the economic outlook is brightening a touch, inflation remains far too high for the BoE’s liking, leaving policymakers in a data-dependent ‘wait and see’ mode as, in line with G10 peers, MPC members continue to seek confidence that inflation is on its way back towards target in a durable manner before delivering the first rate cut, which is likely to be delivered in the spring.

With said confidence still elusive, any material changes to the MPC’s stance seem unlikely at the conclusion of the March meeting, while those hoping for fresh hints on the policy outlook are also likely to be disappointed, particularly with no post-meeting press conference scheduled.

As such, and given the ‘placeholder’ nature of the meeting, any game-changing developments for UK assets are a long shot. The pound, consequently, seems set to remain driven chiefly by external developments, most significantly the degree to which the G10 FX market continues to hold faith in the ‘US exceptionalism’ narrative that has underpinned the greenback for much of the year so far.

_2024-03-14_11-23-16.jpg)

Related articles

Pepperstone不代表這裡提供的材料是準確、及時或完整的,因此不應依賴於此。這些資訊,無論來自第三方與否,不應被視為建議;或者買賣的提議;或者購買或出售任何證券、金融產品或工具的招攬;或參與任何特定的交易策略。它不考慮讀者的財務狀況或投資目標。我們建議閱讀此內容的讀者尋求自己的建議。未經Pepperstone的批准,不允許複製或重新分發此信息。