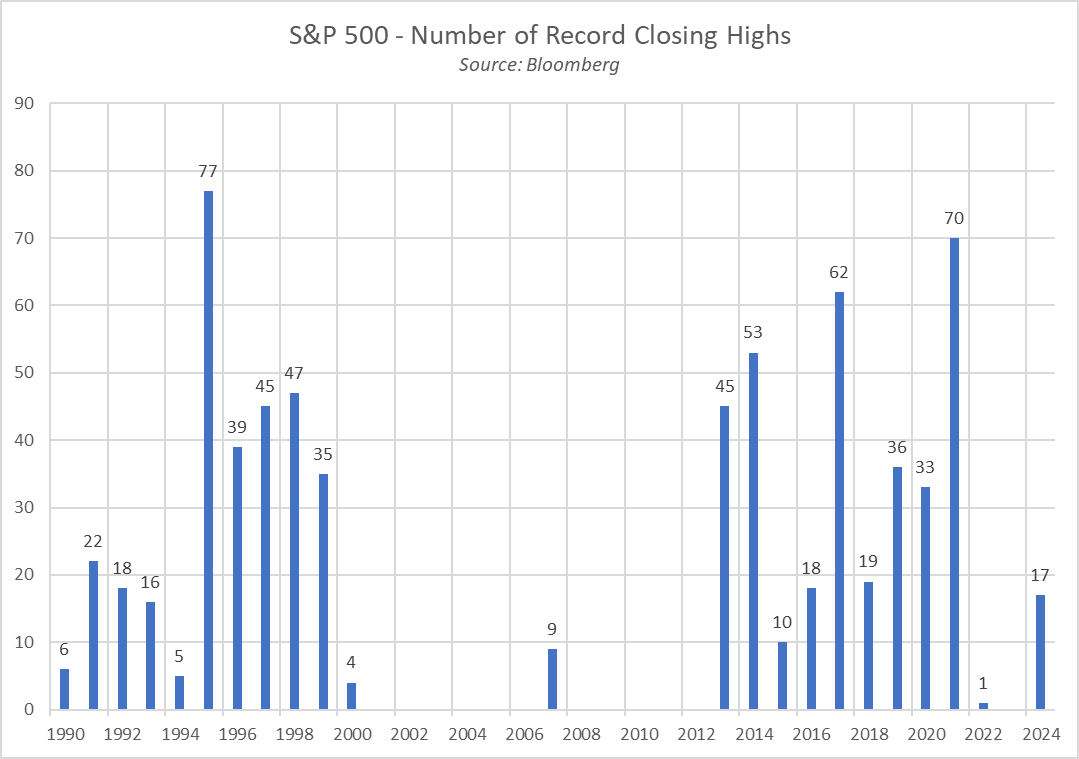

Just how strong has this performance been? 17 record highs in the S&P 500 already since the beginning of January, to be precise, a total of 44 trading days. That represents the benchmark US equity index having notched a new all-time closing high on 38% of all trading days thus far, while having already notched the most record highs in a year since 2021.

As has often been noted in these pages, there are few more bullish signs for any asset than said asset setting new all-time highs on a regular basis.

Looking under the surface, further bullish signs, pointing towards potential greater upside, begin to emerge.

For instance, the rally shows increasing signs of broadening out, with the gains not just being a tech/AI story as we’ve seen during much of the cycle so far. At a sector level, 9 of the 11 S&P 500 sectors currently trade in the green on a YTD basis, with only utilities and real estate marginally in the red.

This proportion is up from 8 sectors around a month ago, and from just 5 sectors having traded in positive territory at the end of January, with such an improvement in breadth also coming amid rising volumes, likely a sign of increasing conviction in the ongoing rally.

Digging deeper still, to a constituent level, we see 335 of the 503 S&P 500 constituents, approx. two-thirds of the index, now trading in positive territory on the year. In a similar manner to what’s been seen at a sector level, this figure has improved from 54% of constituents a month ago, and a rather pitiful 44% at the end of January. Once again, increasing participation in equity upside tends to be a strong bullish indicator.

Remaining at a single-stock level, this increased participation has also resulted in a greater proportion of index members now trading above key medium- and long-run momentum gauges, again implying further upside could well be on the cards.

As an example, the proportion of S&P constituents now trading above their 100-day moving average now stands north of 85%, its highest level this year, and close to the highest since 2021 – as mentioned, the last time the market was setting record highs with such regularity.

Scaling out to the 200-day moving average, a key input in many institutional trend-following strategies, and a similar picture is evident. Just over 80% of S&P 500 members now trade above said level, the highest since mid-2021, with breaks above the 200-day MA having a strong tendency to entice fresh longs to enter the market.

Of course, while both of these are signs of upside momentum continuing to mount, neither can or indeed should be taken in isolation.

That said, it is not only strong internals that are helping to propel the market higher at the present time.

Although recent inflation data has surprised to the upside, with the last three CPI prints proving hotter than market expectations, the core disinflationary trend within the US economy remains intact. In turn, this should still allow the Fed to begin policy normalisation later this year, most likely in June, with both rate cuts, and the end of quantitative tightening likely to result in improved liquidity, providing a favourable tailwind for risk.

In addition, with the inflationary beast almost slain, policymakers have a significant degree of optionality on the policy path that they wish to take, being able to ease more rapidly, to a greater magnitude, or reintroduce targeted liquidity injections were they to be required. In other words, the central bank ‘put’ has returned alive and well.

Furthermore, one must consider that the economic backdrop remains relatively resilient – the services sector continues to expand at a solid clip, output in the manufacturing side of the economy appears to have bottomed, and the labour market remains tight, which should continue to underpin consumer spending.

Of course, this is not to say that near-term downside is off the cards, nor that a pullback or even a deeper correction won’t happen, particularly if the Fed were to make a renewed hawkish pivot, or the economic backdrop were to sour in a significant manner. However, for now, and likely for some time to come, the balance of risks points to further upside, with the path of least resistance likely continuing to lead higher, and with any dips set to be bought rapidly, and aggressively.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。