学习交易

Why do investors like trading indices?

Trading Indices has become very popular as it allows the investor to gain exposure to various sectors of an economy. The Pepperstone platform offers all the major indices from around the world.

The Nasdaq Index has big names in the US technology sector such as Apple, Amazon and Tesla.

The DAX40 is an index where 40 of the largest companies in Germany are listed. With the index being the main benchmark for German and European stocks, trading the DAX gives the investor exposure to the European economy.

What are indices and how are they formed?

When a company decides to ‘go public’ it offers its shares to be freely traded on a dedicated exchange. This is known as an IPO or initial public offering.

There are thousands of shares that are traded throughout the globe on various exchanges. They could be traded on the New York Stock Exchange or the Dubai Financial Market.

The share price of a company might fluctuate daily, depending on the supply and demand for their stock.

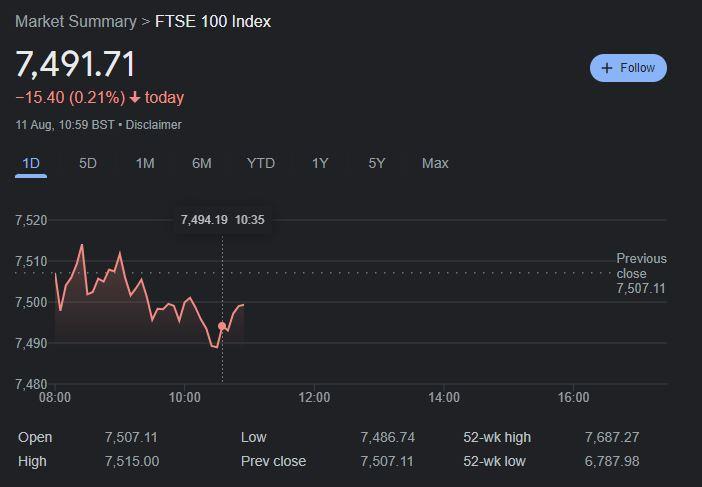

Stock Indices are formed by measuring a basket of stock from different companies. For instance, the FTSE100 is the Financial Times Stock Exchange and measures the value of the top 100 companies listed by their highest market capitalisation.

Other popular indices include the French CAC 40, the Spanish IBEX 35, and the Italian FTSE MIB 40. In Asia, traders enjoy the Japanese Nikkei 225 and Hong Kong’s Hang Seng Index.

Figure 1 FTSE100 11/08/2022

You can trade indices with lower margins

Trading Indices through Pepperstone can lower your margin or deposit requirements.How is this possible?

Indices tend to have lower margin requirements than individual shares. This is because they reflect a combination of companies. If one company within the index has a dramatic move, only the company's capitalised weight within that index will be reflected in the index price.

As a rule, the lower the risk the lower the margin requirements.

For more information of the benefits of trading indices through Pepperstone, click on this link.

Related articles

Pepperstone不保证这里提供的材料准确、最新或完整,因此不应依赖这些信息。这些信息,无论来自第三方与否,不应被视为推荐;或者买卖的要约;或者购买或出售任何证券、金融产品或工具的邀约;或者参与任何特定的交易策略。它不考虑读者的财务状况或投资目标。我们建议阅读此内容的任何读者寻求自己的建议。未经Pepperstone批准,不得转载或重新分发这些信息。