分析

March 2024 FOMC Review: Continuing The Countdown To Confidence

As expected, and had been fully priced by markets, the FOMC voted unanimously to maintain the target range for the fed funds rate at 5.25% - 5.50% at the conclusion of the March policy meeting, marking the 6th straight meeting at which the Committee have stood pat on policy. This now marks just over seven months since the fed funds rate reached its terminal level, though the Committee continue to seek “greater confidence” that inflation is moving back toward target before firing the starting gun on the easing cycle.

This line on ‘confidence’ was one of many statement additions that were made at the January FOMC that were carried over into the March policy statement, which was, by and large, a ‘copy and paste’ of that delivered at the previous meeting. This lack of a further dovish pivot reinforces that the May meeting is not ‘live’ in terms of a potential rate cut; barring a ‘black swan’ or unexpected financial accident necessitating immediate policy easing.

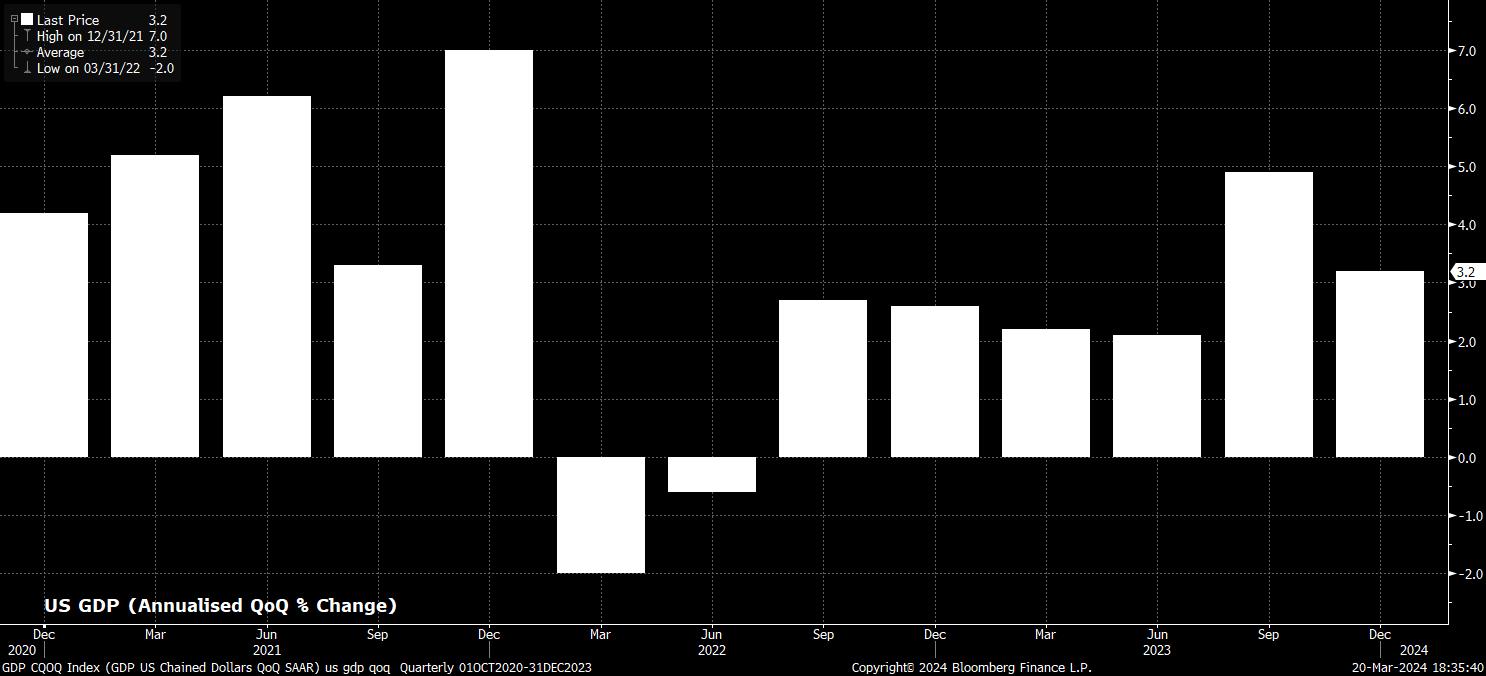

Once again, economic activity was described as expanding at a “solid pace”, inflation as remaining “elevated” and job gains as “strong”. Importantly, overall, the Committee continue to judge that both sides of the dual mandate are coming into “better balance”, a prerequisite before any policy easing can be delivered.

A largely unchanged policy statement had been fully expected, given that the economy has continued to evolve in line with the Committee’s expectations, albeit with CPI and PPI printing marginally hotter-than-expected, the core PCE deflator – the FOMC’s preferred inflation gauge – has continued to decline on a YoY basis in each of the last twelve consecutive months, as price pressures continue to be squeezed out of the economy.

Given the lack of policy or statement changes, attention naturally fell on the latest iteration of the FOMC’s ‘dot plot’.

During the last forecast round, in December, the median expectation from the dots pointed to 75bp of cuts to the fed funds rate this year, followed by a further 100bp next year, and an additional 75bp of easing in 2026, implying a gradual path of easing to a target range of 2.75% - 3.0%. At the same time, the ‘longer-run’ rate, a useful proxy for the FOMC’s estimation of the neutral rate, remained at 2.5%, largely unchanged since mid-2019.

The March dots continued to point to a median expectation of three 25bp rate cuts this year, though the median did move marginally higher further along the forecast horizon, with the Committee now steering towards a median expectation of a 3.875% rate in 2025, and a 3.125% rate in 2026, 25bp and 50bp higher (respectively) than the prior iteration. The longer-run fed funds rate estimate also nudged higher, to 2.562%, likely the start of a trend as the Committee continue to revise higher their estimate of the neutral fed funds rate.

The broadly unchanged dot plot came amid a marginally hotter growth and inflation outlook in the latest SEP.

On inflation, the FOMC now see core PCE ending the year at 2.6%, 0.2pp higher than in the prior forecast round, before price pressures moderate to 2.0% in 2026, in line with the prior forecast. As shown by the dots, however, this marginally hotter than previously seen inflation path has had little impact on the near-term policy outlook.

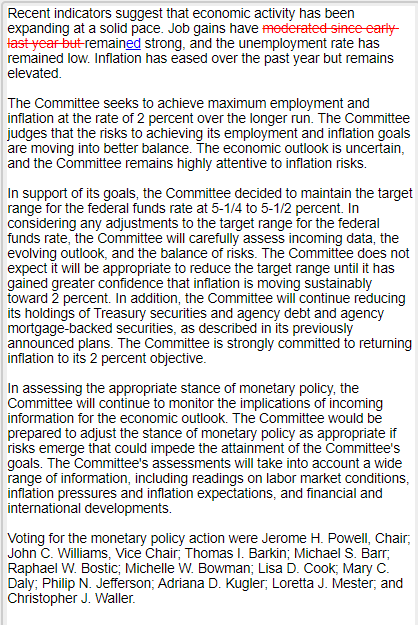

Meanwhile, in terms of economic growth, recent resilience sparked an upward revision to GDP expectations throughout the forecast horizon, with policymakers now expecting growth of at, or above, 2% in each year out to 2026.

Finally, on the SEP, continued labour market tightness saw the unemployment projection remain largely unchanged, albeit with the 2024 forecast nudged 0.1pp lower to 4.0%, despite a surprising uptick in joblessness in the February labour market report.

All in all, however, the forecasts continue to point to a ‘soft landing’ for the US economy, and remain as near as makes no difference unchanged from those issued after the December decision.

With this in mind, it was perhaps of no surprise that Chair Powell’s post-meeting press conference also offered, largely, a reiteration of recent remarks, with Powell having last spoken on Capitol Hill just two weeks ago, offering very little by way of fresh information, albeit while noting that it will likely be “appropriate” to slow the pace of balance sheet runoff “fairly soon”.

Markets, by and large, took all of this in their stride, which was perhaps unsurprising given the lack of significant policy shifts. The knee-jerk move lower in the USD presumably owed to some position squaring as a result of the failure to revise higher the 2024 median dot, as some may have expected, though the greenback remains likely to outperform G10 peers on both a yield and a growth basis over the medium-term.

_2024-03-20_18-44-51.jpg)

Overall, the March FOMC decision should be seen as little more than a placeholder. Clearly, the Committee are close to, but not yet at, the point where they are comfortable in delivering the first rate cut of the cycle, continuing to seek additional data to confirm that the disinflationary process will take price metrics back to the 2% target. Nevertheless, the broader policy outlook remains unchanged, with rate cuts, and an end to QT, still on the horizon around mid-year, a backdrop that should continue to limit equity vol, and keep the path of least resistance for risk leading to the upside.

Related articles

此处提供的材料并未按照旨在促进投资研究独立性的法律要求进行准备,因此被视为营销沟通。虽然它并不受到在投资研究传播之前进行交易的任何禁令,但我们不会在向客户提供信息之前谋求任何优势。

Pepperstone并不保证此处提供的材料准确、及时或完整,因此不应依赖于此。无论是来自第三方还是其他来源的信息,都不应被视为建议;或者购买或出售的要约;或是购买或出售任何证券、金融产品或工具的征求;或是参与任何特定交易策略。它并未考虑读者的财务状况或投资目标。我们建议此内容的读者寻求自己的建议。未经Pepperstone批准,不得复制或重新分发此信息。