Crypto CFDs - the perfect short-term trading instrument?

It’s not to say these players don’t continue scanning for opportunity in FX, commodity, or equity index markets, especially when they can use leverage to great effect.

But for these traders who are directionally agnostic and trade price action long or short, in a holding period typically less than 24 hours, Crypto CFDs can be one of the best vehicles to capture short-term and potentially explosive price moves.

However, with some 2000-3000 point moves in short spaces of time, whether you're long or short, at the current levels in Bitcoin, you do need to be cognisant of liquidation periods and the potential impact on open positions.

The importance of expected returns for Crypto

The obvious drawcard is clearly the expected returns that can be derived from movement – and while Crypto carries heightened risk, there's no asset class that comes close when we assess the ability to get 3:1 or 4:1 (RR - reward to risk) on a short-term trade. Crypto takes movement to a whole new level and in finance expected returns matter.

Liquidity is the obvious point of difference between asset classes and while liquidity in the Centralised Exchanges – the dominant venue for transacting Crypto - is improving, the ability to get in and out of exposures in size at the top of book quote is still poor relative to say major FX. This poses portfolio drag for higher volume traders.

For many retail traders the relative lack of liquidity, especially in the newer coins actually improves the attraction of the coin. When the market detects strong buy flow, the sellers will more readily pull offers from the order book, which can result in explosive range expansion.

In the institutional world, an asset’s expected return is an essential input for portfolio diversification purposes and money managers will look at these returns on a risk-adjusted basis. Most see the store of value proposition of Bitcoin et al and like Gold will look at holding a small weighting as a percentage of the fund’s total capital.

Unlike Gold though, Crypto isn’t treated as an anti-bond – i.e. if real (inflation-adjusted) US Treasury yields go higher then gold typically goes lower. In fact, the correlation between Crypto and other markets is low. So, if you’re a fund and desire an asset with low correlation qualities then Crypto can really help increase diversification.

In the retail world, the expected return is also critically important, but rather than use for diversification purposes, many see the ability to generate 4x to 5x one’s money in a short duration. Where Crypto can move 10% in a matter of hours, some even in minutes.

30 Minute Chart of Ethereum

(Source: Tradingview - Past performance is not indicative of future performance)

It’s a story of pure supply and demand

Perhaps just as important as the expected return is that while you can look down a rabbit warren and get into some incredibly complex places – too many, crypto is actually very simple to understand and fundamentals often matter little. When you’re biggest risk for a material move are infrequent headlines around regulation or whether Musk is accepting Bitcoin for payment for Tesla vehicles, traders do not need to be as active in managing known event risk like US non-farm payrolls, or an ECB meeting - such as we do in FX, Commodity, or Equity markets.

There is also no universally agreed valuation measure, as the debate as to what Crypto actually is makes this hard to answer.

- Do we take a view that Crypto is a store of value?

- Is Crypto a means of transaction and a payment solution, with a focus on the stock of money?

- Do we value the likes of Bitcoin by the marginal cost of producing Bitcoin?

- Do we look at Crypto relative to the outstanding coins in circulation?

The answer is not immediately clear, but to many retail traders it really doesn’t matter. The lack of obvious fundamentals simply adds to the attraction.

Crypto is simply a price driven by the purest of trading factors – flow and changes in supply and demand - without the noise. Momentum just increases interest, with FOMO often playing a significant role. But, when your greatest focus is price action and you frequently see large impulsive moves (up or down) it makes the trading environment highly attractive. Specifically, for traders on lower timeframes of 30 minutes or less.

Tactically, we so often see consolidation after a trend, where the longer the consolidation typically the more powerful the move when price does breakout. It’s here we see the rate of change pick up and the percentage moves can be incredible if you can catch it.

A stop loss will help manage the downside and understand your risk, which in turn will help achieve correct position size – the idea being to capture 3x or 4x the risk.

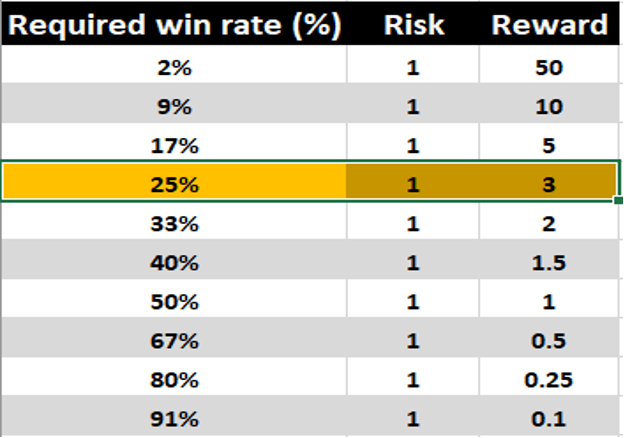

As the chart shows below - assuming I either hit my target or my stop (i.e. I don’t close early) and if I aim for 3:1 RR, I could have a win rate of 25% and still make money over time.

(Source: Pepperstone - Past performance is not indicative of future performance)

So, if we’re talking pure percentage moves nothing really comes close to Crypto, and with the flexibility to go long or short and profit from an impulsive move in either direction, CFD’s offer a flexible alternative to trading these powerful price moves.

(Source: Pepperstone - Past performance is not indicative of future performance)

To capture the growing interest from clients to trade crypto CFDs, we're rolling out new coins, on industry-leading average spreads. With the ability to trade crypto CFDs throughout the weekend and a unique range of tools to manage your risk and entry with real control (on any timeframe) – it’s not hard to see why short-term traders are seeing opportunity in this high volatility asset.

Related articles

Pepperstone không đại diện cho việc tài liệu được cung cấp ở đây là chính xác, hiện tại hoặc đầy đủ, và do đó không nên dựa vào nó. Thông tin, có phải từ bên thứ ba hay không, không được coi là một khuyến nghị; hoặc một đề nghị mua bán; hoặc một lời mời mua bán bất kỳ chứng khoán, sản phẩm tài chính hoặc công cụ nào; hoặc tham gia vào bất kỳ chiến lược giao dịch cụ thể nào. Nó không tính đến tình hình tài chính hoặc mục tiêu đầu tư của độc giả. Chúng tôi khuyên bất kỳ độc giả nào của nội dung này nên tìm kiếm lời khuyên của riêng mình. Mà không có sự chấp thuận của Pepperstone, việc sao chép hoặc phân phối lại thông tin này không được phép.