- Português

- English

- Español

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- لغة عربية

Macro Trader: Markets Over-Excited About Rate Cuts…Again…

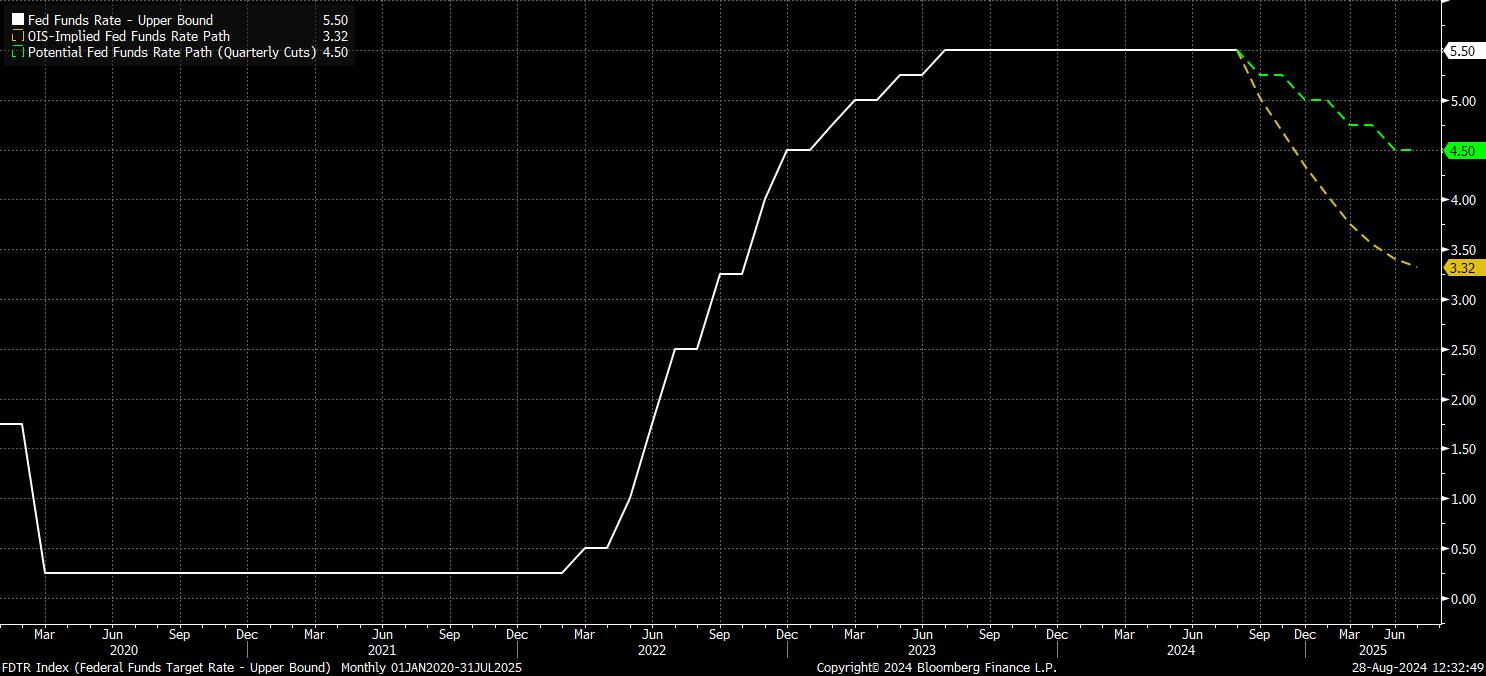

The best place to start, naturally, is with a look at what markets currently price. A 25bp Fed cut in September is seen as a certainty, while a larger 50bp move is seen as a roughly one-in-four chance. Further out, the USD OIS curve discounts just over 100bp of easing by the end of the year; with only three further FOMC meetings in 2024, pricing of this nature implies that at least one of these meetings will see Powell & Co deliver a 50bp cut. Beyond that, markets price a rapid pace of easing into the start of next year, with the curve discounting almost 200bp of cuts by the end of the first half of 2025, effectively judging that rates will be back at their neutral level in less than a year.

Such a path seems wildly over-optimistic. That said, as the below handily shows, we have been here before, with market participants having had a frankly shocking track record of attempting to second-guess the path of monetary policy this year.

There are a couple of reasons why I would argue that current market pricing represents a very high bar for the FOMC to meet, leaving some assets vulnerable to a reversal in recent trends – particularly in the FX space.

The first such reason stems from the labour market. While July’s jobs report undoubtedly showed a further easing in employment conditions, it was far from a disaster. The 3-month average of payrolls gains now stands at +170k, comfortably the lowest in three years, though a similar clip to that seen during the latter stages of the last economic cycle, in 2018 and 2019.

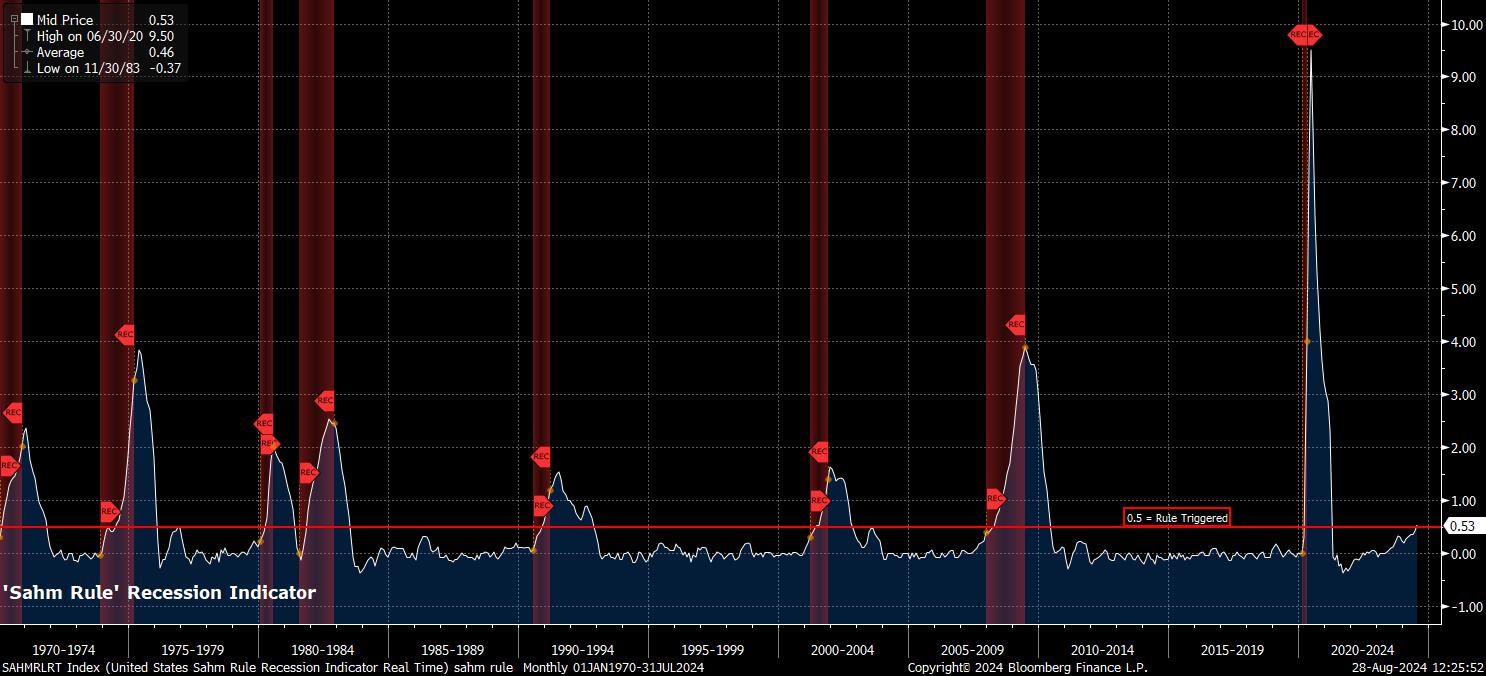

Meanwhile, the unemployment rate has also attracted significant attention, with headline joblessness having risen to 4.3%, its highest level since the fourth quarter of 2021, having triggered the so-called ‘Sahm Rule’ recession indicator in the process. There is more to this than just higher unemployment, though.

Firstly, unemployment has risen in recent months at the same time as labour force participation has increased, implying that at least some of the rise owes not to increasing numbers of workers losing their jobs, but instead to the size of the labour force having increased. In effect, this is a positive, as more people are entering the labour market, to look for work.

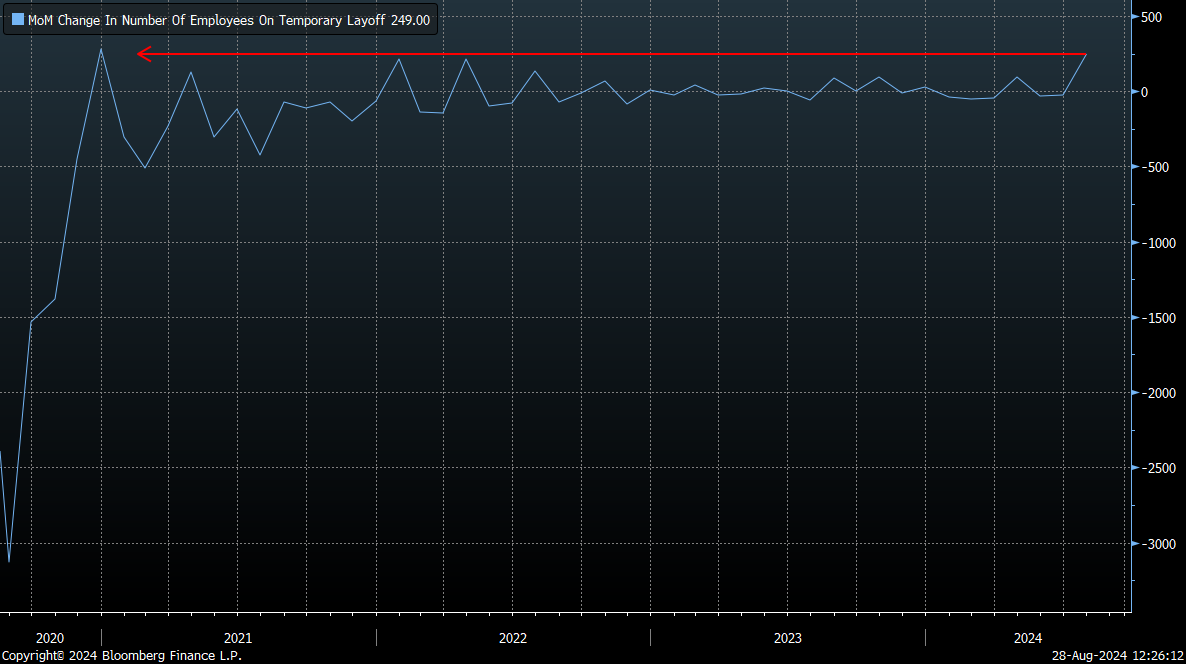

Secondly, the July rise in unemployment increasingly looks anomalous. A significant degree of the rise in headline unemployment was driven by a surge in temporary layoffs, which rose +249k last month, in the biggest MoM increase since the tail end of 2020. This is almost entirely due to the impacts of Hurricane Beryl, which struck during the survey week, with many having been prevented from working during the inclement weather. Furthermore, both initial and continuing jobless claims have trended lower in recent weeks, adding additional support to the notion that much, if not all, of July’s unemployment rate rise will reverse when the August jobs report is released on 6th September.

In short, the US labour market is not nearly as soft as the last jobs report would imply.

It is not, however, solely the jobs market which indicates that markets are rather over-aggressive in their pricing for the Fed policy outlook.

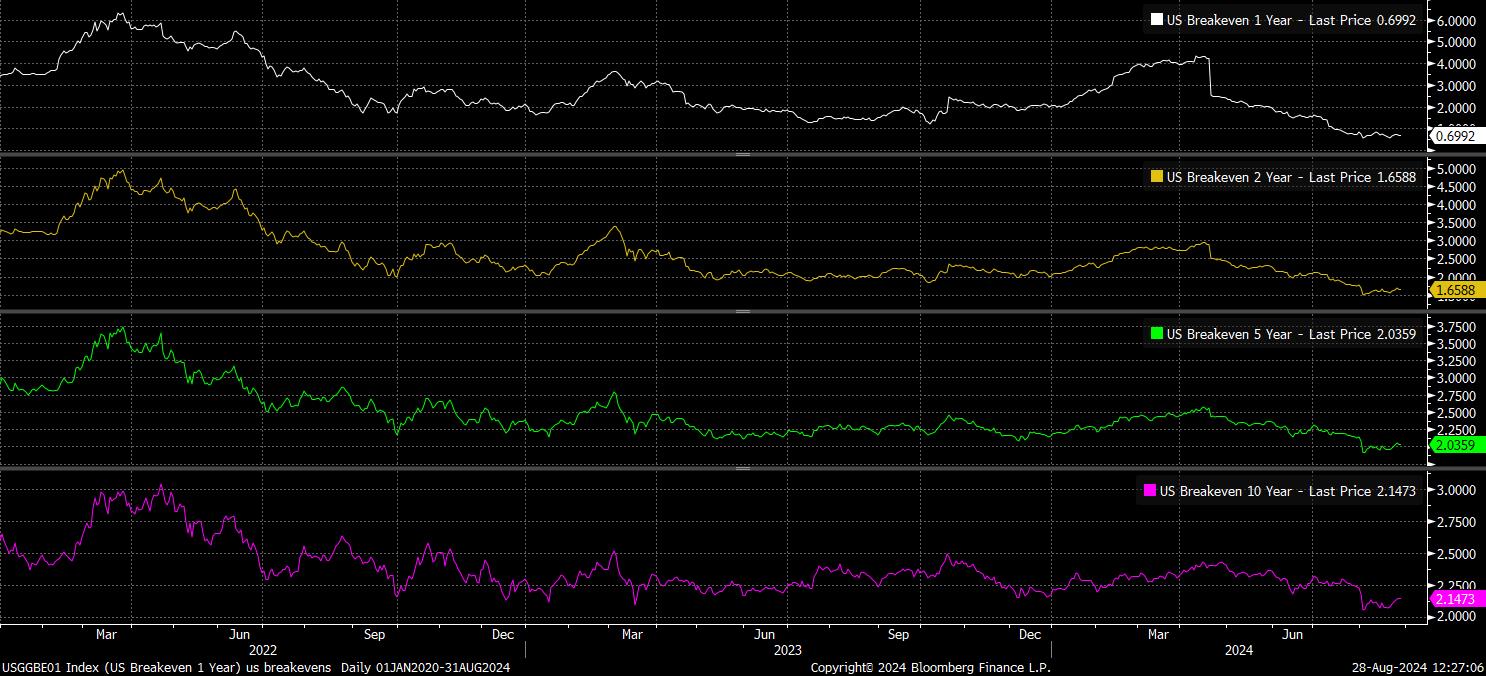

The inflationary backdrop also suggests a degree of caution remains warranted, even if Chair Powell confirmed at Jackson Hole that policymakers have now, at long last, obtained sufficient confidence that headline inflation is on a path back towards 2%.

However, “towards” 2% does not mean that the 2% target has been achieved, nor does it guarantee that the target will be sustainable achieved over the medium-term, as the Fed’s dual mandate requires it to be. Services prices remain stubbornly high, having risen by just shy of 5% YoY in July, while inflationary risks also present themselves from a couple of other sources.

Average hourly earnings growth has continued to cool, though at 3.6% YoY in July, still represents a healthy-enough clip of real earnings growth. Were a renewed labour market tightening to occur, and earnings pressures to re-emerge, this could threaten sustainable achievement of the inflation aim. At the same time, geopolitical risk continues to linger, with the situation in the Middle East remaining unstable, potentially posing the threat of a surge in crude prices were the temperature to further increase. While policymakers would likely look-through such a temporary increase, it would likely still skew both consumer, and market-based, inflation expectations to the upside.

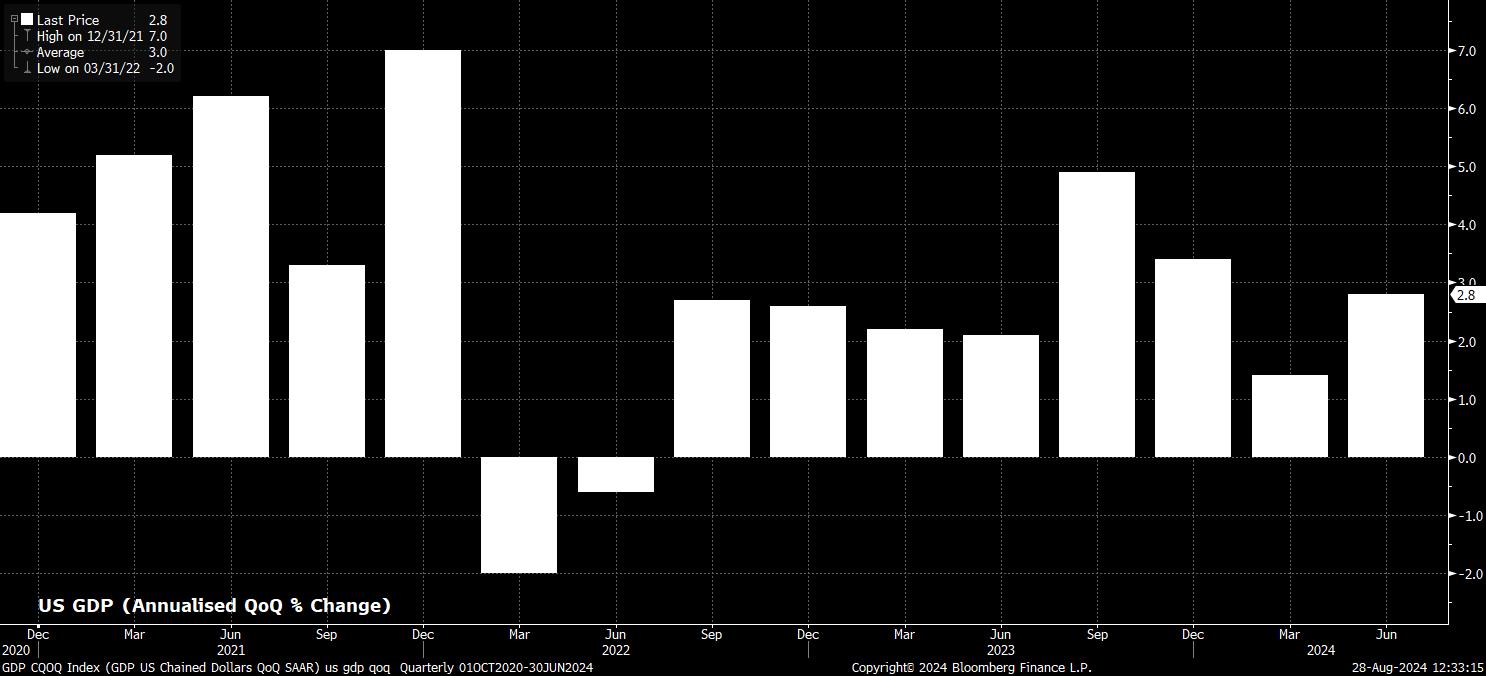

Lastly, there is the argument that the economy is simply not in need of a rate cut right now.

A quick glance at the growth backdrop is all that’s need to support such a view, with GDP having grown by more than 2% on an annualised quarter-on-quarter basis in seven of the last eight quarters, a solid clip in anyone’s book. Concurrently, leading indicators point to this resilience continuing – headline retail sales rose 1.0% MoM in July, while the ISM services PMI remains comfortably in expansionary territory.

To my mind, the anomalous nature of July’s labour market softening, continued risks to the inflation outlook, and still-solid economic growth, all point to the market’s rate cut pricing being over-ambitious, by a significant margin. This, of course, should also be coupled with the FOMC’s inherent nature to tread carefully, and to avoid causing unnecessary uncertainty or panic, which also points to – at least at first – policymakers plotting a relatively gradual course back towards a more neutral policy stance.

This, likely, will take the form of quarterly 25bp cuts, at least this year.

All of this begs the question as to what the impact of the present overly-aggressive market pricing, and potential repricing, could be:

- For the greenback, a hawkish repricing of Fed policy expectations, perhaps spurred on by a better-than-expected August jobs report, would likely aid the USD in rebounding from the YTD lows printed in the aftermath of Chair Powell’s Jackson Hole remarks. Risks for the USD, across all of G10, are biased to the upside, given the high bar for a further dovish repricing, and the 'buy growth' theme which has driven the market for much of the year, and which naturally favours the buck over peers

- In the FI space, front-end Treasuries remain vulnerable to a reversal, despite signs that this week’s supply will be relatively easily-digested, in turn likely posing a further upside risk to the USD. The long-end, however, seems well-priced around current levels, particularly with the lingering risk that inflation takes longer than desired to return to the 2% target

- A renewed sell-off in the Treasury space could also threaten gold, with the yellow metal’s recent rise having stalled out just shy of a fresh record high. Nevertheless, gold has hardly displayed a close relationship with its ‘traditional’ fundamental drivers this year, with supportive EM central bank flows providing a helpful tailwind

- In the equity space, lastly, a hawkish Fed repricing shouldn’t be a significant negative catalyst. As with the remainder of 2024, the key influence driving stocks is not what the Fed will do, but what the Fed can do. This is the very nature of the ‘Fed put’ – if conditions worsen, the Fed have the ability to cut more significantly, or more rapidly, or both, in order to provide the necessary support. Knowledge that Powell & Co ‘have their backs’, and have ample room to cut if required, should see participants remain comfortable to stay further out the risk curve, keeping equity weakness short-lived, and dips as buying opportunities

Related articles

O material fornecido aqui não foi preparado de acordo com os requisitos legais destinados a promover a independência da pesquisa de investimento e, como tal, é considerado uma comunicação de marketing. Embora não esteja sujeito a nenhuma proibição de negociação antes da divulgação da pesquisa de investimento, não buscaremos obter qualquer vantagem antes de fornecê-la aos nossos clientes. A Pepperstone não representa que o material fornecido aqui é preciso, atual ou completo e, portanto, não deve ser confiável como tal. As informações, quer sejam de terceiros ou não, não devem ser consideradas uma recomendação; ou uma oferta de compra ou venda; ou a solicitação de uma oferta para comprar ou vender qualquer título, produto financeiro ou instrumento; ou participar de uma estratégia de negociação específica. Não leva em consideração a situação financeira ou objetivos de investimento dos leitores. Aconselhamos aos leitores deste conteúdo que busquem seu próprio conselho. Sem a aprovação da Pepperstone, a reprodução ou redistribuição desta informação não é permitida.

.jpg?height=420)