- Português

- English

- Español

- 简体中文

- 繁体中文

- Tiếng Việt

- ไทย

- لغة عربية

Análises

Dollar’s Bull Run Shows Few Signs Of Slowing

As noted, there are a handful of distinct catalysts behind the recent move higher in the USD. Hence, there is value in distilling these developments into as simple a form as possible, both to determine what the key drivers among these catalysts are, and to formulate an outlook for how the current trend may evolve.

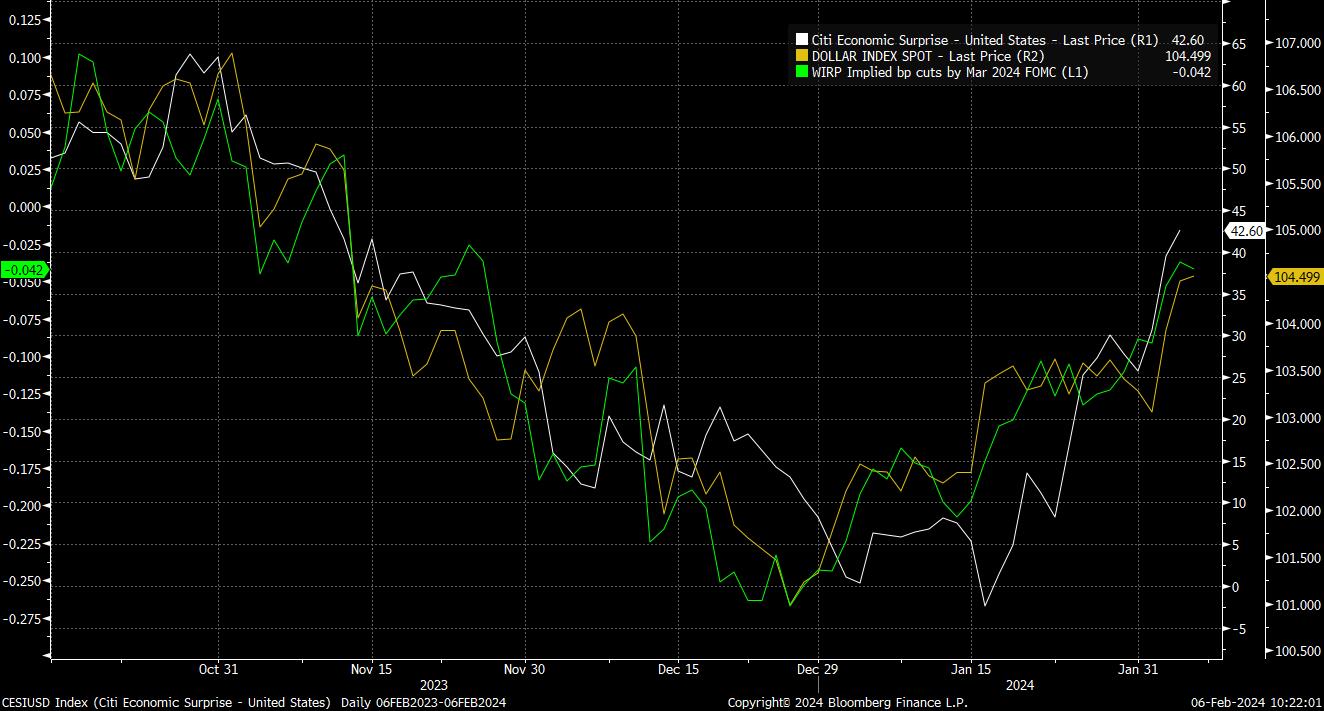

The greenback’s recent rally is, perhaps, one of the simplest FX trends to explain in some time, as the below chart – which some may, uncharitably, call a ‘chart crime’ – nicely illustrates.

The three closely correlated series on the above chart show Citi’s US economic surprise index, the spot value of the dollar index (DXY), and the bp of cuts that USD OIS prices for the March FOMC meeting.

Put simply, since the turn of the year, the equation has been as follows – incoming economic data has consistently surprised to the upside compared to consensus, thus (along with pushback from Chair Powell) sparking a hawkish repricing of rate expectations, thereby igniting demand for the greenback against most, if not all, G10 peers. Put even more simply, this is ‘US exceptionalism’ at work.

It is worth noting, though, that a decomposition of those recent upside economic surprises shows that the bulk of said upswing has come due to above-consensus reports pertaining to inflation – most obviously Friday’s sizzling hot average hourly earnings prints – as opposed to any growth impulse. This further reinforces the message from Fed Chair Powell that March will be too soon for the FOMC to have the required ‘confidence’ to fire the starting gun on the easing cycle at that juncture.

For those of a technical analysis disposition, the manner in which these broad-based gains have seen the DXY slice above both the 200-, then the 100-day moving averages with ease will be pleasing signs of upside momentum likely being able to continue, though 104.50 appears to mark something of a stubborn level for now.

_2024-02-06_10-21-32.jpg)

Perhaps the most interesting thing about all this, though, comes not in spot, but by looking at derivatives.

Taking, for simplicity, just the GBP and the EUR, where we see both the 1-week and the 1-month 25-delta risk reversals trading to their most negative levels since mid-December; incidentally, the time around which the FOMC begun the dovish pivot which continued last week.

The implication of this is that the implied volatility of puts (contracts offering the holder the right but not the obligation to sell at a specified strike) is trading at its greatest premium over the implied volatility of calls (contracts offering the holder the right but not the obligation to buy at a specified strike) in around 8 weeks.

Since there is a direct (positive) correlation between the implied vol of a contract, its price, and demand for said contract from market participants, we can therefore extrapolate that participants in the derivatives space are becoming substantially more bullish on the greenback, with demand for downside bets having risen to a near 2-month high.

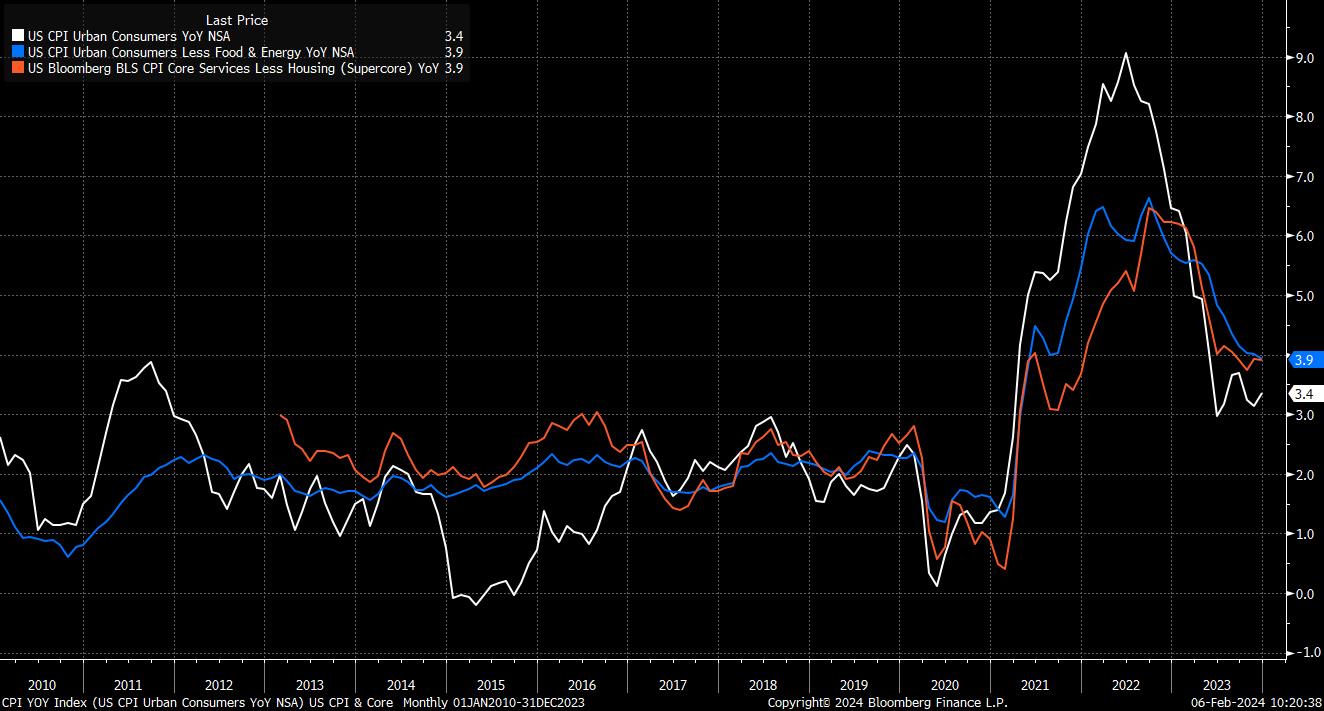

Of course, it’s important to recall that the 1-week tenor mentioned above also covers the January US CPI report, due 13th February, which stands as the next major risk event for financial markets.

While it is, clearly, too early for any forecasts to have been submitted just yet, participants will look for disinflation to have continued, particularly in the currently sticky services prices component, with a hotter-than-expected print likely to see the residual 4bp of easing still priced for the March FOMC priced out, further strengthening the USD.

On the whole, the ‘buy dollars, wear diamonds’ theme that many participants have subscribed to since the start of the year shows little sign of abating any time soon, as the path of least resistance continues to lead higher, with any dips likely to be bought into.

O material fornecido aqui não foi preparado de acordo com os requisitos legais destinados a promover a independência da pesquisa de investimento e, como tal, é considerado uma comunicação de marketing. Embora não esteja sujeito a nenhuma proibição de negociação antes da divulgação da pesquisa de investimento, não buscaremos obter qualquer vantagem antes de fornecê-la aos nossos clientes. A Pepperstone não representa que o material fornecido aqui é preciso, atual ou completo e, portanto, não deve ser confiável como tal. As informações, quer sejam de terceiros ou não, não devem ser consideradas uma recomendação; ou uma oferta de compra ou venda; ou a solicitação de uma oferta para comprar ou vender qualquer título, produto financeiro ou instrumento; ou participar de uma estratégia de negociação específica. Não leva em consideração a situação financeira ou objetivos de investimento dos leitores. Aconselhamos aos leitores deste conteúdo que busquem seu próprio conselho. Sem a aprovação da Pepperstone, a reprodução ou redistribuição desta informação não é permitida.