- Italiano

- English

- Español

- Français

What does the VWRL ETF invest in?

The VWRL ETF stands for the FTSE all-world Exchange Traded Fund (*ETF). It is an investment fund that acquires securities with the intention of tracking the performance of the FTSE All-world Index.

*An ETF is an Exchange Traded Fund. They look to track the performance of a basket of assets, commodities or, in this case, an index. An ETF is traded like shares on a stock exchange. It is a pooled investment fund. Trading CFD ETFs through Pepperstone is a derivative of the underlying product.

The Objective

The VWRL fund seeks to provide long-term growth of capital by tracking the performance of the index, a market- capitalization weighted index of common stocks of large to mid-cap companies in developed and emerging countries.

Weighted investments

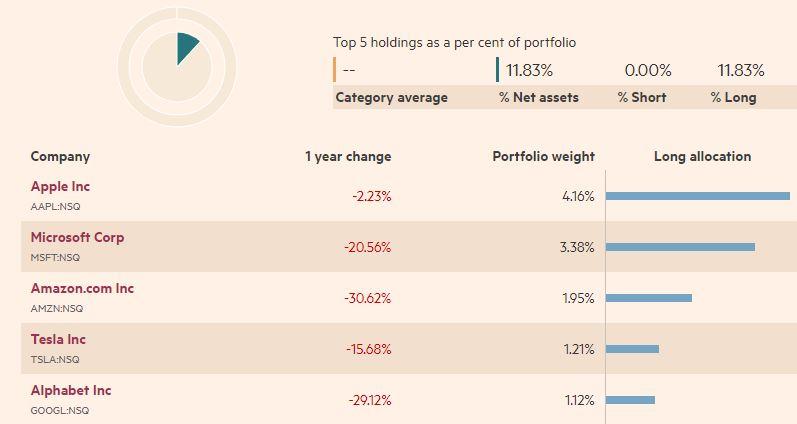

The top 5 holdings within the fund make up 11.83% of overall investments with over a 4% allocation in Apple Inc.

Figure 1 marekts.ft.com 10/10/2022

Invested Sectors

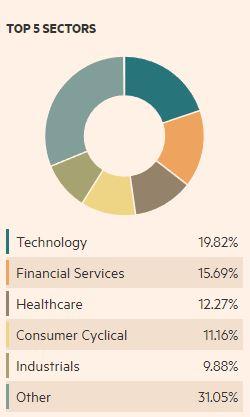

It is plain to see from the single stock allocation that the VWRL is weighted towards the technology sector.

Figure 2 marekts.ft.com 10/10/2022

A look from a technical perspective

Historic price

Since its inception in May 2012, the VWRL ETF witnessed an increase of nearly 200% (from a 31.18 low to a 93.36 high).

Figure 3 TradingView VWRL rally

Although we have seen a correction the downside, we are still holding within a bullish channel formation with trend line support located at 68.50.

Figure 4 TradingView bullish channel

A look from a technical analysis perspective.

VWRL Weekly Chart

The weekly chart offers two possible bullish technical formations for the ETF:

- We look to be holding within an Expanding Wedge formation (dashed black lines). This pattern has an eventual bias to break to the upside.

- The last rally stalled close to the 78.6% Fibonacci level of 90.07 (from 93.36 to 77.90)

Figure 5 TradingView Expanding Wedge and 78.6%

If 77.90 holds (the swing low from the week 13th of June), we could see an extension to the upside to complete a Cypher pattern known as a bearish Butterfly formation.

Figure 6 TradingView possible Butterfly pattern

To learn more about technical analysis, please click here.

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.