- Italiano

- English

- Español

- Français

Analisi

USD set-up in focus ahead of the first Presidential debate

It’s a big week for markets, but when is it not? Aside from the various economic data points, notably US consumer confidence, personal spending, ISM manufacturing and non-farm payrolls (consensus 850k jobs, u/e rate 8.2%), the political noise turns up a dial. In the UK we see the final round of Brexit negotiations, so GBP volatility will be a theme. However, the first US Presidential debate in Cleveland will steal the limelight, with proceedings due to kick-off at 9:00pm ET Tuesday (11:00am Wednesday AEST).

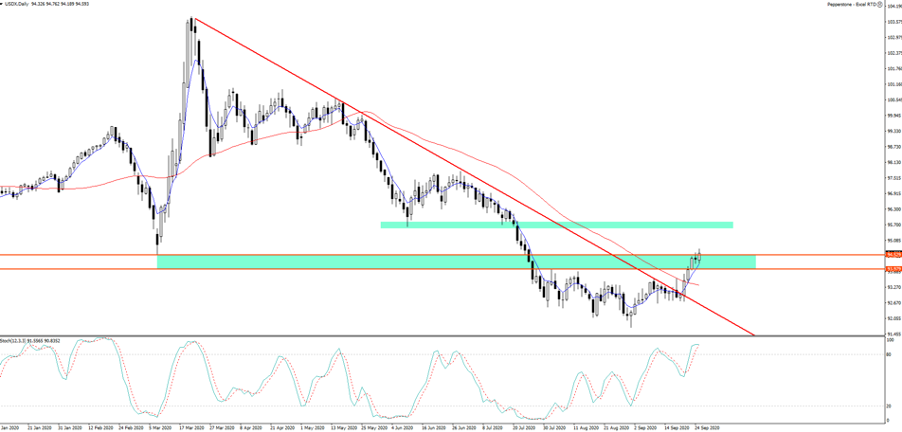

As always the USD will get huge attention, with price having undergone somewhat of a resurgence of late, gaining 1.9% last week and breaking above the March downtrend, 50-day MA, and range high. We sit testing the March lows on the daily, with price holding the 5-Day EMA, which is trending higher. US real yields have given the USD rally backbone, with 5-year rates moving up from -1.46% (1 September) to current sit at-1.20% - if US real rates keep moving higher (less negative) then the USD will only likely go one way, especially against the likes of the AUD, NZD and NOK, with AUDJPY shorts likely working in this environment – you can source real rates on the FRED website here.

It’s really about how inflation expectations track and they seem to have an eye on economic data and another on the debate around the prospect for a near-term US fiscal stimulus. Personally, I’d be very surprised if the current $2.4t deal, which was put on the table late last week, will pass through the Senate. We then need to consider that the employment and small business benefits that were extended under Trump’s executive order in early August expire soon, so there could be a hit to personal income in the period ahead, which could weigh on economics.

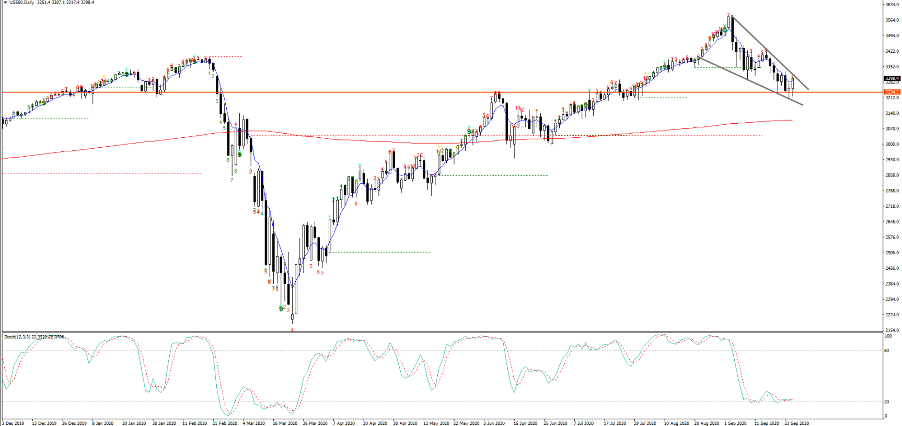

It suggests inflation expectations could fall a touch further and keep the USD bid, although, in equity land the US500 is holding the June former highs at this stage and we see price consolidating in a wedge – the break, whichever way it plays out, should be respected.

US politics is front and centre

The Presidential debate will captivate this week, especially in the wake of Amy Coney Barrett’s nomination for Supreme Court Justice, and now in light of today’s NY Times article on Trump’s tax tribulations.

Biden has the benefit that expectations surrounding his performance are low, so if he takes it hard to Trump then it won’t be difficult to impress. The debate is moderated by Chris Wallace (Fox News anchor), and as detailed last week gives us renewed insight into the candidate's ability to ‘be presidential’, as well as further views on the economy, the integrity of the election itself, COVID-19, and aspects like race and violence.

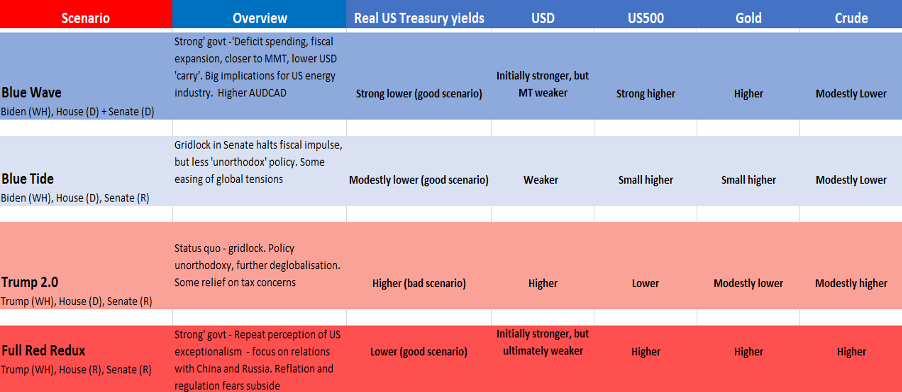

At this point, a quick focus on political forecasting models shows the prospect of a Democrat clean sweep is the higher probability outcome. I know everyone is cynical about political models these days given how wildly inaccurate they were in 2016. However, the logic remains, and they, along with betting markets, are still our primary vehicle for pricing risk.

Let’s assume the House is a near given, where the DEM’s only need to win four of the 31 seats considered ‘toss-ups’ to claim victory. The Senate is wide open though, with the FiveThirtyEight model average outcome (run off 40,000 simulations) having the DEM’s getting 50.7 seats. RealClear Politics (RCP) in their own ‘no toss-up’ model have the DEM’s getting 51 seats - in the case of a 50:50 split, the VP gets the deciding vote.

As it stands, the bookies have Biden winning the election, with Predicit at 57% vs 47% for Trump. Betfair has Biden at 56.1%. In terms of political models, The Cook Report has Trump getting 290 Electoral College seats, which is 20 more than is needed, while RCP gives Biden 222 seats and Trump 125, but this includes 191 ‘toss-up EC seats. On RCP’s ‘no toss-up’ model they give Biden a massive 353 seats. FiveThirtyEight gives Biden a 77% chance of taking the WH.

So, at this stage, the bookies and political models suggest a ‘Blue Wave’ as the most likely scenario.

That said, we have to consider when we actually get the final outcome. With mail-in votes there is still the risk we get wild swings in the expected victor from the moment exit polls are released.

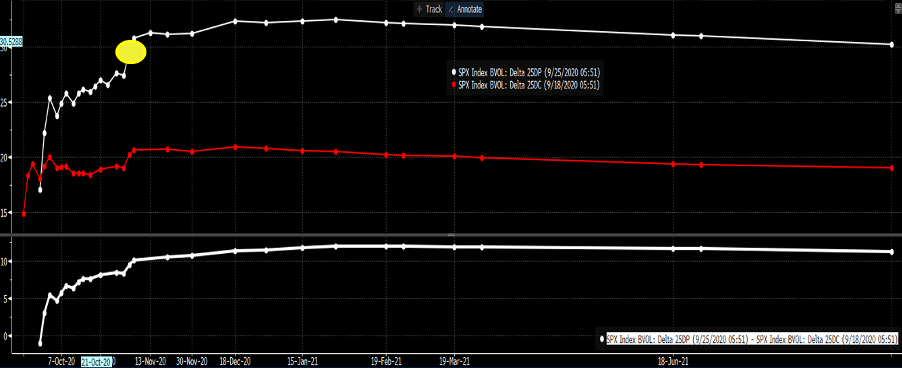

We also need to consider what is priced. One aspect that I’ll touch on tomorrow is the options market and the message we hear here. Whether I look at FX vols or the S&P 500 term structure, the market has hedged itself in such a substantial way through optionality and I can argue has priced a contested outcome - so any outcome that avoids contested and the potential for taking this to the Supreme Court would be a relief for markets.

Top pane – S&P 500 term structure

White - 25-delta S&P 500 put volatility

Red - 25-delta S&P 500 call volatility

Iniziamo a fare trading?

Iniziare è facile e veloce. Con la nostra semplice procedura di apertura conto, bastano pochi minuti.

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.