- Italiano

- English

- Español

- Français

Analisi

The Bitcoin halving – a shifting supply v demand dynamic suggests higher volatility

For a more detailed understanding see the ‘Traders need to know’ article.

The halving goes directly to the plumbing in the Bitcoin ecosystem - it is where the magic happens and the platform that leads to all speculation and investment that takes place out in the secondary market, where traders buy and sell freely through crypto exchanges, and OTC through the use of derivatives (such as CFDs).

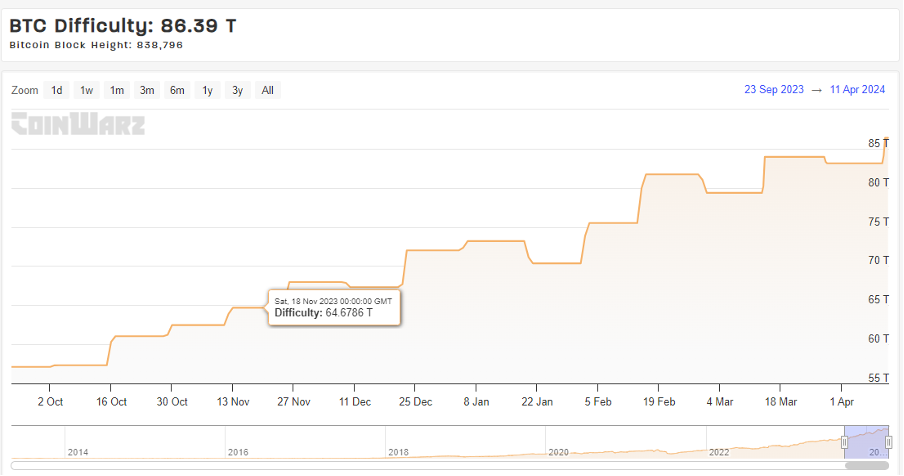

Many close to the Bitcoin ecosystem are keenly watching metrics such as ‘hash rates’ (the number of guesses attempted per second to solve a puzzle) and the mining ‘difficulty’ rating (which measures how hard it is to mine a new block and the greater the computational power and energy needed). As we roll into the halving, data shows that both metrics are rising, which is putting a real strain on the Bitcoin mining community.

(Source: Coinwarz)

When we also consider rising energy costs that are such a critical input for miners to run and cool their supercomputers, the rising difficulty to obtain a reward, married with the reduction in the reward to 3.15 coins, is going to have a big impact on the Bitcoin mining scene going forward.

It will naturally be the smaller and less efficient miners who have a limited ability to reduce costs or have a lower cash balance, who will cease work due to mining no longer being profitable. However, we can look at how the market estimates the impact on the mining scene through listed miner’s equity and the subsequent price action. Marathon Digital (MARA) is the largest listed play, with a market cap of $4.71b, and we can see by the setup that the street is seeing rising headwinds.

Over time these bigger players will capture greater market share which can be a positive for future earnings, but it can also lead to concentration risk – fewer players obtaining more of the rewards – which will impact the hash rate and reduce confidence in the system.

But in the short-term basic economics plays out – that is we will see reduced supply amid a backdrop of strong and rising demand, and in theory that means a higher Bitcoin price.

That doesn’t mean we’re going to see a sudden explosion and impulsive move higher in the Bitcoin price from the moment the halving takes place – in fact, in the three prior halving occurrences (November 2012, July 2016, and 11 May 2020) the Bitcoin price gained just 6% on average in the 10 days after the event. However, from a fundamental perspective, it does support the thesis that higher levels could be seen over the medium-term.

As we look at the daily chart of Bitcoin, we’re seeing compression in the daily high-low price ranges and consolidation in the technical set-up – with ever diminishing daily moves away from the 20-day moving average. The longer this compression in volatility plays out the higher the probability we should see an explosive move in one direction. The levels that guide and where I see higher volatility, or perhaps a trend developing in one direction are seen between 72,000 and 64,500 - so a closing break of either level could be highly meaningful.

Perhaps the halving will be that catalyst to result in the range break and a new trend developing – we shall see, but as traders reacting to the flow of capital is key in our quest to put the odds in our favour.

It is clear the halving will significantly impact the mining ecosystem, and by extension, it alters the supply/demand dynamics, which in turn goes some way to impact future price action. Of course, we could also see a ‘sell on fact’ scenario play out and we can also debate how intently macro forces (risk and sentiment in broad financial markets) influence - but either way, a change is coming next week, and it should be on the radar.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.