- Italiano

- English

- Español

- Français

Analisi

A traders’ week ahead playbook - Energy markets to drive sentiment

We start the week with a clear focus on the energy markets, with the OPEC+ meeting holding the potential for solid two-way risk in crude. Russia’s response to the G7’s plan to apply price caps on Russian oil imports was to shut off the Nord Stream 1 (NS1) pipeline and we’re at the point where lots of questions are being asked by the market on how this escalates and right now there is minimal clarity.

We have crude futures opening first up, and amid a shortened session - due to US Labor Day - lower liquidity may exacerbate moves – EU Nat gas resumes trade at 4pm AEST and markets will be watching the open closely for a spike higher.

With European index futures tailing off 3% on Friday on the NS1 news and the NAS100 lower in sympathy, it feels like the probability of this negative price action resuming in Asia is high. The GER40 July lows beckon.

US payrolls modestly reduces the probability of a 75bp hike in Sept

The US payrolls report was solid enough but the rise in the participation rate (to 62.4%) made for a 20bp upside surprise in the unemployment rate. This saw a slight repricing of Fed rate expectations, and USD selling, where the FX move reversed once we saw equity markets being carved up on the NS1 news. Hard to bet too heavily against the USD and we’ll be watching for commentary from Powell and Brainard this week to guide. USDCNH could be central to the USD move, and a break above 6.93 suggests a real risk that we can talk 7.000 and this will likely impact EURUSD and AUDUSD.

The ECB meeting will get good attention and we could see some vol in the EUR, not that we need a central bank meeting to promote that when we have the energy markets to do that for us. The GBP gets attention as the trend is strongly lower and the pair has fallen for 6 straight days, losing 6.3% since 10 Aug. A spike in energy this week is really the last thing the UK needs when they are facing 20% inflation in Q123, so it seems we could be on for 1.1400 sooner.

Aside from the looming QT ramp-up, it’s another big week next ahead – global equities are in a tough spot right now and rallies are being sold in earnest – we’re going to need to see a far weaker US CPI print to promote some relief, but that is not out until next week – it feels like the path of least resistance is lower, with funds increasing portfolio hedging and buying volatility. A break of the 61.8% fibo of the June/Aug rally in the US500 will increase the talk of revisiting the June lows.

By way of known event risks, here are seven key focal points for the week ahead:

- ECB meeting (Thursday 22:15 AEST) – The market places a 64% chance of a 75bp hike, with the economist’s consensus call also for 75bp. At this meeting, we also get ECB staff projections on inflation and growth, so it will be interesting to see how drastically they take down growth expectations. EURUSD 1-week (options) implied vol has pushed higher, but this is also a function of NS1 remaining closed. A 50bp hike obviously can’t be ruled out and if this plays out then expect EURUSD to test 0.9900

- BoC meeting (Thursday 00:00 AEST) – A 75bp hike seems likely from the BoC, taking the lending rate to 3.25% - although there are risks of a 50bp. Short GBPCAD has been the trade here, and the trend seems to be a continued friend.

- RBA meeting (Tues 14:30 AEST) – the market is pricing a 50bp hike, and from here resuming to a more conventional 25bp rise from the October meeting. AUD 1-week implied vol sits at 11.9%, subsequently pricing a 93-pip move (up or down) from Friday’s close – not overly high, but last week's low of 0.6771 may come into play fairly soon.

- Fed vice chair Brainardand chair Powell speak (Thursday 02:35 & 23:10 AEST respectively) – the USD, gold, NAS100 could be very lively as they explain how the NF payrolls report affects their view on policy. With the market pricing a 54% of a 75bp hike in Sept FOMC, we’re going to need to see the US CPI (13 Sept) to decide the fate of the next hike – 75bp or 50bp – Rates aside, I remain of the view that QT holds big headwinds for risky assets.

- Liz Truss likely gets the gig as Tory leader/new UK PM (Mon 5 Sept) – GBP in play, although the outcome of Liz Truss as the new PM is fully expected, and clarity on emergency budgets might not be called straight away – there will some focus on Truss’s cabinet appointments, notably the choice of Chancellor. A big political headline event, but seemingly unlikely to spur much vol in the GBP.

- OPEC+ meeting (Monday 5 Sept) – the meeting starts at 9 pm AEST/12:00 BST, so we can expect headlines shortly after. The consensus position is for no change in group output levels, but recent comments from the Saudis, that they could cut production, suggest a cut to output can’t be dismissed – should we get a surprise cut, the magnitude of output cuts will determine the spike higher in crude. Risky markets can absorb a spike higher in crude, if it is driven by better demand dynamics, I am not sure they’ll be so receptive to higher crude on supply factors. A break of $86.41 and I’d look for $80.00/50.

- EU energy ministers meeting (Friday) – After Friday’s moves from the G7 moves to implement a price cap on purchases of Russian natural gas, the market is keen to explore the price of the cap– this should be discussed at length in the EU energy ministers meeting. Given the Russian response so far, one suspects the Europeans will need to talk about rationing too.

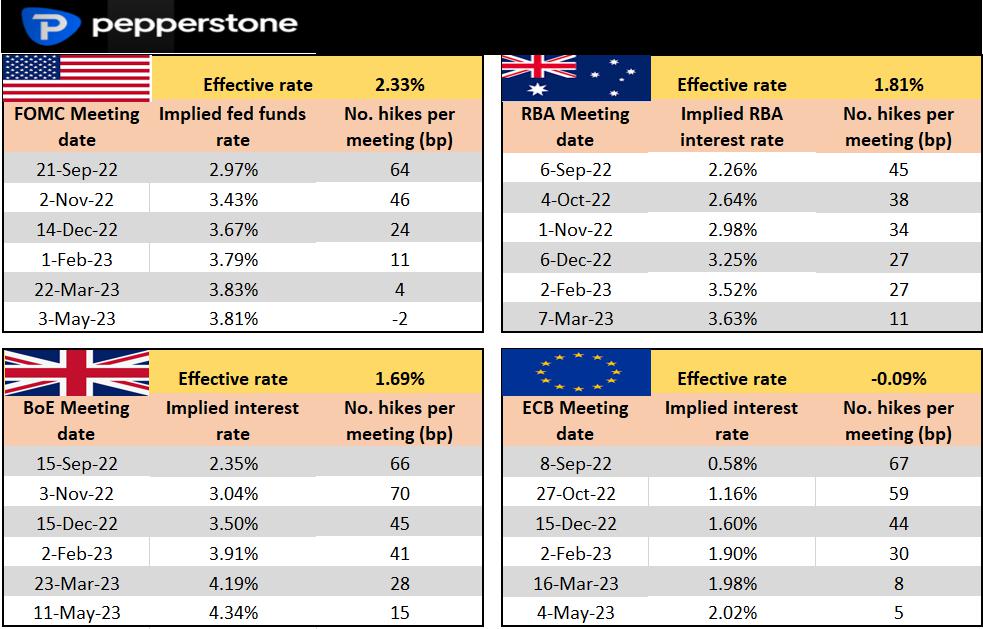

Rates Review – see what’s priced for the upcoming central bank meeting and the step up (in basis points) to the following meetings.

Related articles

Pepperstone non dichiara che il materiale qui fornito sia accurato, attuale o completo e pertanto non dovrebbe essere considerato tale. Le informazioni, sia da terze parti o meno, non devono essere considerate come una raccomandazione, un'offerta di acquisto o vendita, la sollecitazione di un'offerta di acquisto o vendita di qualsiasi titolo, prodotto finanziario o strumento, o per partecipare a una particolare strategia di trading. Non tiene conto della situazione finanziaria o degli obiettivi di investimento dei lettori. Consigliamo a tutti i lettori di questo contenuto di cercare il proprio parere. Senza l'approvazione di Pepperstone, la riproduzione o la ridistribuzione di queste informazioni non è consentita.