- Français

- English

- Español

- Italiano

What is driving gold? Momentum and geopolitics reign supreme

As with any strong momentum rally, there is obviously an attraction(s) that causes a wave of capital to push price higher and higher. Buyers are willing to pay higher prices and sellers will naturally be content with selling to them at ever higher levels. Order book dynamics greatly influence and what is on offer at the ‘top of the order book’ thins out and it becomes even easier for the buyers to push price higher.

We can add CTAs (systematic trend followers), who buy when the price is going up (their rules dictate as such) and we also see options market makers – who have sold call options to traders - buying gold futures to hedge their exposures as the price moves above the fixed strikes. Again, this just exacerbates the move higher in price.

Positioning is also a factor, where notably short positions have been heavily reduced (managed money short gold futures are the lowest since May 2020), with shorts either stopped out or traders simply managing their risk and buying back to close.

Short positions held by managed money – weekly CFTC report

It all becomes a flow show and this dynamic can create strong one-way moves that don’t always make sense when we try and explain the move by gold's traditional drivers and relationships.

As is the way with many markets, fundamentalists often try and explain why something is moving retrospectively and will cherry-pick a narrative that best fits the news flow and underlying theme.

Gold is perhaps the king of markets here, and the reasoning as to why price is moving is often the subject of great debate. Many will pick the direction, but their initial thesis for taking a position is often wholly incorrect.

Some of the reasons behind gold's recent rise that I’ve heard include:

- A hedge against the potential for a sustained rebound in inflation.

- A hedge against a US fiscal debt blowout, where government debt now stands at $34.6 trillion and increasing at a rapid clip.

- A hedge against geopolitics – notably, concerns that the recent strike on the Iranian Consulate in Syria, and the potential response, could bring other nations into the conflict.

- US political concerns – fears a Trump presidency could lead to a rise in nationalistic and protectionist policies.

- A hedge against future economic fragility (from higher for longer rates setting) and potential changes in Fed policy.

- Chinese retail buying of various forms of physical gold.

- Central banks (notably those in emerging market nations) increasing the allocation of gold reserves and diversifying away from USD holdings.

- A broad-based rally in commodities that is taking gold higher in appreciation.

- A belief that US real rates (i.e. US Treasuries adjusted for expected inflation) will head lower throughout 2024, boosting the relative appeal of gold.

In the art of trying to find the most likely reason for the move and to understand the preeminent driver of gold we can use statistical analysis, through regressions or correlation analysis. However, a simple overlap of two variables on TradingView can do the job fairly well.

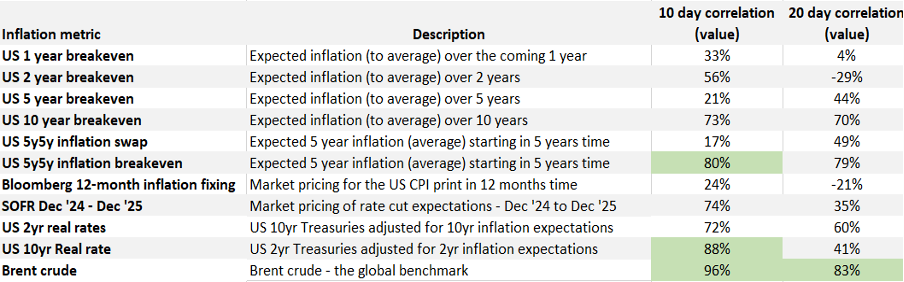

Currently, if I run a short-term correction analysis between XAUUSD and market measures of expected future inflation, US real rates and crude I see the strongest positive relationship is with crude and with US real rates. There has also been some uplift in inflation expectations, but the relationship is less pronounced.

This is interesting as historically gold would face strong downside risks in a rising US real rates environment, especially if the move in US bonds resulted in a stronger USD. Currently, the opposite is true.

The fact that gold is completely overlooking the hawkish repricing in US rate expectations (i.e. Fed rate cut expectations have been reduced) and is following the moves in crude speaks to the broad rally in commodities, and market players hedging resurfacing geopolitical risk from both the Middle East and Russia/Ukraine.

For the fundamental traders this suggests keeping a close eye on moves in Brent crude, where gold longs would ideally want to see a break of $100 to keep the momentum in check.

How long the relationship with crude lasts though is always tough to predict, and I note that a hot US core CPI print on Wednesday (consensus 0.3% m/m and 3.7% y/y) would see Fed rate cut expectations further repriced and see US bond yields rising, which may see the inverse relationship between gold and US bond yields reestablish itself.

The fact that the prominent driver of gold changes so frequently, and it is not always clear what that is anyhow throws weight to the idea of looking less at the ‘why’ and keeping life simple – be a slave to the aggregated flow of capital and to price action.

Price discounts all known news and is the aggregator of all behaviours, hedging activity and speculative flows. Reacting to price moves within the strategy can make trading far more efficient.

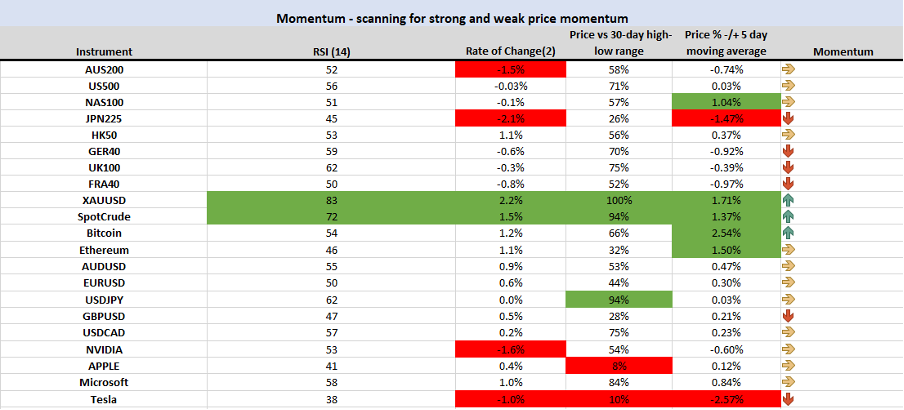

As we see from this simple 4-factor momentum model, gold is perhaps the strongest market in this universe of Pepperstone’s most frequently traded markets. One could argue gold is overbought which makes chasing the upside tough, but it is strong for a reason, and we haven’t yet seen any pickup in inflows into gold ETFs.

Taking short positions in such a hot market have been a tough trade on the 4-hour or daily timeframes. Subsequently, it feels like pullbacks will be shallow and could offer an opportunity to initiate new longs.

Judging by the correlations I’m seeing the risk to longs are a simmering of geopolitical concerns and a decline in the crude price. However, I am also cognizant that if US real rates do push high this may start to matter once again – price, however, will tell us all we need to know.

Related articles

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.