- Français

- English

- Español

- Italiano

Analyse

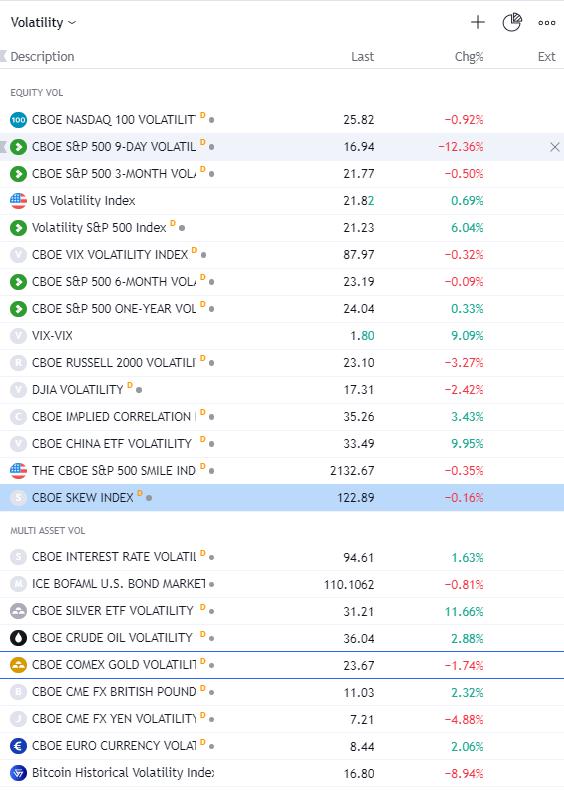

A number of traders have raised the notion that volatility (vol) has been fairly subdued of late – we see that in levels of ATR, ADR (average daily range), or measures of statistical measures – implied or realised volatility. I have put together a watchlist on TradingView of various volatility measures (see below). For me what is most important is where these sit within their own range – percentile rank is important here, as comparing the VIX index and rates volatility are very different - they take their feed from completely different options pricing – so we look at one measure of vol relative to itself.

Two measures I am looking at over others are the MOVE index and SRVIX index – the MOVE index looks at implied measures of volatility in US Treasuries, while the SRVIX measures interest rate swap vol (see the link for a more thorough explanation - https://cdn.cboe.com/resources/indices/srvix-white-paper.pdf).

Both are now moving higher and should be the leading light for higher vol in FX and equity markets – the repricing in the US rates markets has been consistent throughout February, where the peak Fed rate expectation has been moving higher and now sits at 5.32% - this has seen the US 2yr Treasury push up another 5bp on the day – rate cuts priced for 2H23 are being priced out, and we now see 24bp of cuts priced this year – on 1 Feb this was 60bp of cuts.

If we’re seeing higher implied vol in interest rates – as options trader’s price higher degrees of movement - then that should spill over into higher vol in the USD and equity markets too.

For me, this is the biggest risk to the markets we’re facing now. While some will focus on US/China relations and point to upcoming meetings between the Chinese and Russians this week, the repricing and push higher in interest rate expectations will eventually open up the downside in equity markets.

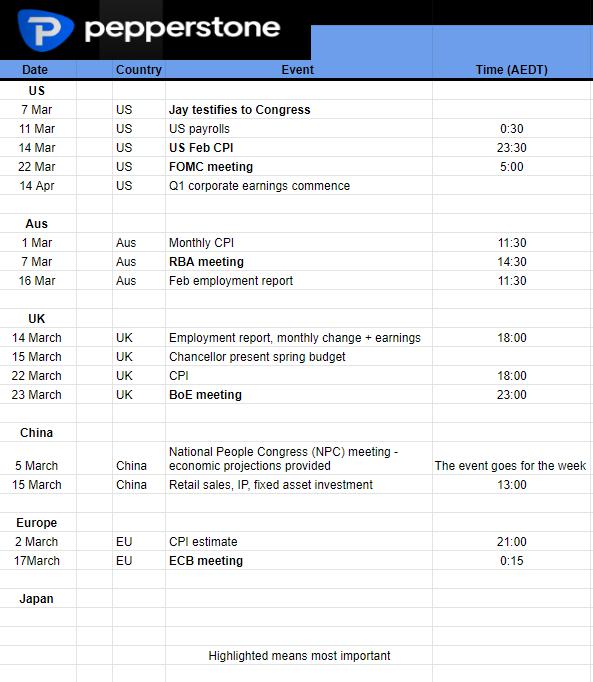

As suggested in the morning video, there are event risks in play this week (Fed FOMC minutes, personal income, Core PCE), but it’s really the March period where things get real – I’ve put this loose calendar together to highlight some of the absolute marquee event risks to look ahead to – the 22 FOMC meeting is key, but the US CPI print will set off expectations ahead of that – in the lead-up we watch to see if the market continues to push up rates in the near term – we ask, where is the point where risk breaks?

Related articles

Le matériel fourni ici n'a pas été préparé conformément aux exigences légales visant à promouvoir l'indépendance de la recherche en investissement et est donc considéré comme une communication marketing. Bien qu'il ne soit pas soumis à une interdiction de traiter avant la diffusion de la recherche en investissement, nous ne chercherons pas à tirer parti de cela avant de le fournir à nos clients. Pepperstone ne garantit pas que le matériel fourni ici est exact, actuel ou complet, et ne doit donc pas être utilisé comme tel. Les informations, qu'elles proviennent d'un tiers ou non, ne doivent pas être considérées comme une recommandation; ou une offre d'achat ou de vente; ou la sollicitation d'une offre d'achat ou de vente de toute sécurité, produit financier ou instrument; ou de participer à une stratégie de trading particulière. Cela ne tient pas compte de la situation financière des lecteurs ou de leurs objectifs d'investissement. Nous conseillons à tous les lecteurs de ce contenu de demander leur propre conseil. Sans l'approbation de Pepperstone, la reproduction ou la redistribution de ces informations n'est pas autorisée.