- Español

- English

- Italiano

- Français

What is a Forex calendar?

The Forex calendar, or economic calendar as it is more commonly known, highlights the schedule of economic events and data releases. They vary from growth figures to inflation or interest rate decisions and employment.

Depending on how ‘high impact’ the data release is, and how far the result deviates from the consensus, they can have a dramatic impact on the Forex markets.

How do I interpret the data from the Forex calendar?

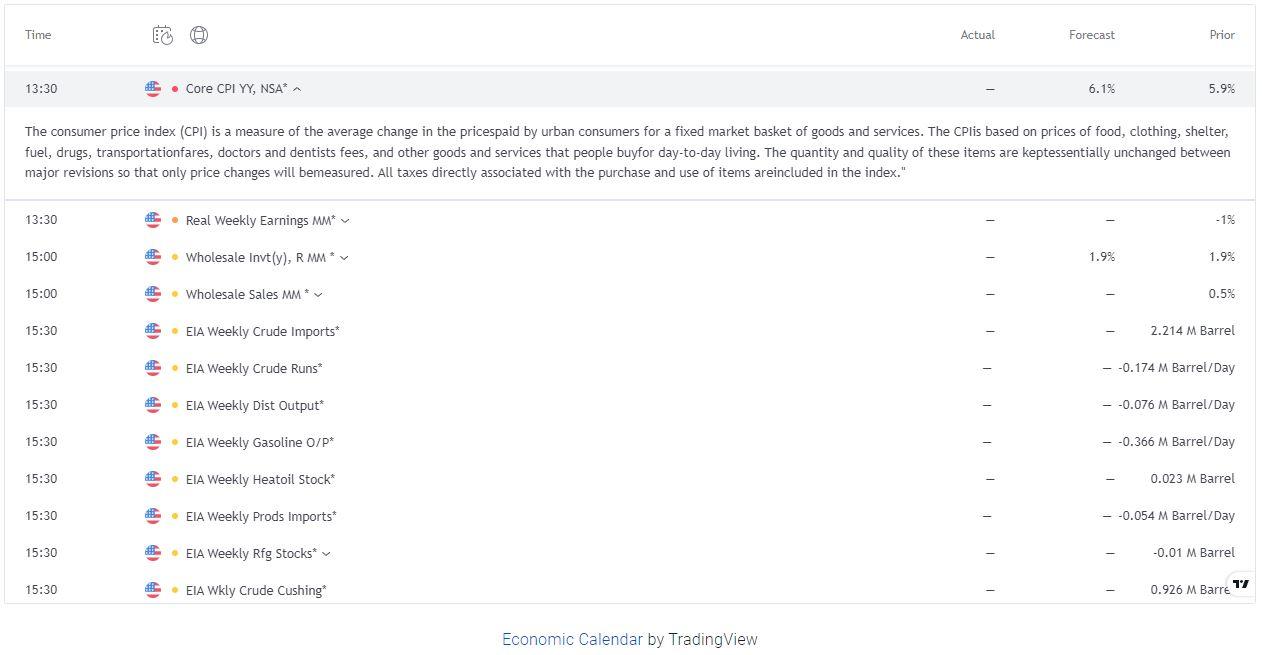

An economic release will have a scheduled time, the country of origin, what data is due, and an explanation of that data being released. On the right-hand side of the calendar, you will see the data points.

Prior is the figure from the last data release. Forecast is what the consensus is for this data release and actual is updated when the data is published.

Looking at the prior and the forecast you may be able to decipher if the trend is getting better or worse. For example, the US CPI (consumer price index) is an inflation indicator. The prior figure was 5.9% with the expected 6.1%. The trend seems to be getting higher.

Figure 1 forex calendar CPI

If the actual figure deviates greatly from the consensus, then traders can, and do react by buying or selling currencies.

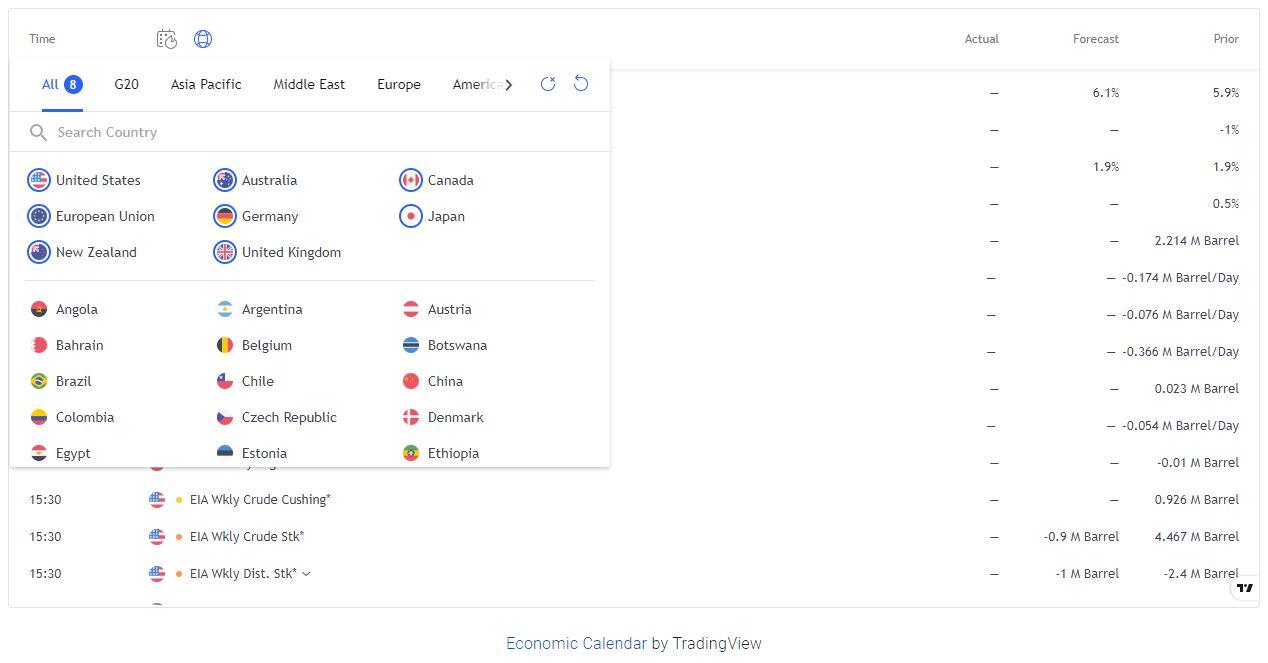

How do I place filters on the Forex calendar?

There are two filters at the top. Highlight the first TAB and you receive only high impact data releases. Click on the globe and you can filter data for only those countries that you are interested in.

What are the high impact events I should be aware of?

- Employment figures. The most widely watched is the Non-farm Payroll figures from the USA.

- Interest rate decisions and National Bank speakers.

- Growth figures such as GDP (Gross Domestic Product).

- Inflation, retail sales and manufacturing.

To access the Pepperstone Forex calendar click on this link.

Pepperstone no garantiza que el material proporcionado aquí sea preciso, actual o completo, por lo tanto, no debe confiarse en él como tal. La información, ya sea de un tercero o no, no debe considerarse como una recomendación; o una oferta de compra o venta; o la solicitud de una oferta de compra o venta de cualquier valor, producto financiero o instrumento; o para participar en una estrategia de negociación en particular. No tiene en cuenta la situación financiera u objetivos de inversión de los lectores. Recomendamos a los lectores de este contenido que busquen su propio asesoramiento. Sin la aprobación de Pepperstone, no está permitida la reproducción o redistribución de esta información.