- Español

- English

- Italiano

- Français

Trader Insights - A US CPI-inspired volatility rips through markets

Breaking down the CPI print

US core CPI came at a far hotter 0.39% MoM and while we saw a -0.32% mom decline in core goods, core services increased 0.66% with all components increasing – ‘sticky’ is the buzzword of the day, and economists clearly underestimated the effects of January start-of-the-year pricing. Owners’ Equivalent rent category was perhaps the big surprise gaining 0.56% MoM.

What we’ve seen is a market caught offside with limited hedges in place and a max long position in risk. Today’s US core services print, notably when married with the recent rise in consumer confidence and solid labour market readings has some even questioning if rate cuts come in 2024 at all. Further, when the two big macro worries are resurging inflation and a future recession, the fears of the former concern have hit a sour note for markets, although as we know it's core PCE that the Fed set policy to (PCE inflation is due 29 Feb).

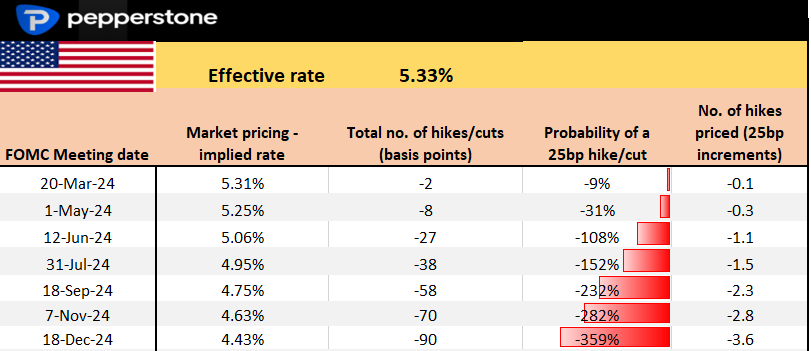

The US swaps market pushes back the default start date for cuts from May to the June FOMC meeting, and we see just over three 25bp cuts this year – importantly, the rates/swaps markets and the Fed's dot plot projection (which had called for 3 cuts this year) are now aligned, which is incredible when only recently the market had seven 25bp cuts pencilled in this year.

Assessing the market reaction

In Treasuries, the losses were led in the front-end with US 2’s +18bp to 4.65% with the US yield curve bear flattening. US 10-year real rates pushed up 9bp and settled above 2%, where the structure suggests yields could be headed towards 2.2%, which could further negatively impact sentiment.

The USD has found form in this backdrop of higher US bond yields, where the gains have been broad-based and most pronounced vs the SEK, NOK, CHF, and AUD. We also see that Gold trades at $1993, where the one-two punch of a stronger USD and higher real rates would have pleased clients who were skewed short of the yellow metal going into the CPI print. $1980 is the big level to target on the downside, and one where the scalpers will be keen to hit.

EURUSD has printed a new cycle low through 1.0723 support which puts the skew of risk favouring the downside – that said, our client flow is countering this move, and we see 65% of open positions in EURUSD set long.

USDCHF was an idea I liked yesterday, and we’ve seen spot take out the 200-day MA with the set-up offering a probability of 0.9000 coming into play. USDJPY – a clear rates play – takes out the 150-handle and eyes the Nov highs of 151.20 and we’ll no doubt run into BoJ/MoF currency fighting rhetoric soon enough – I’m sure the market will be too concerned by JPY intervention headlines just yet.

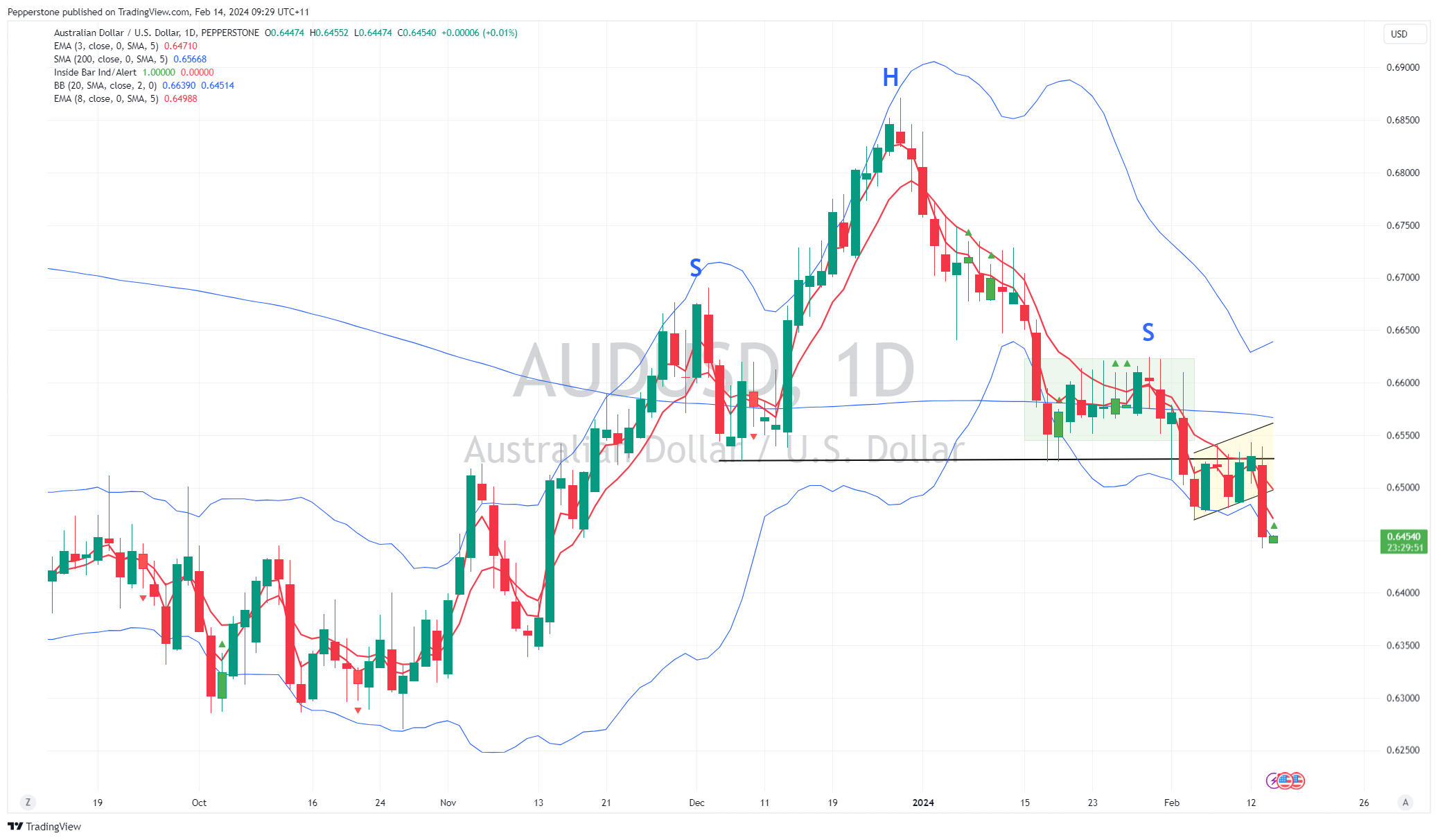

The AUDUSD daily gets focus with a sharp rejection of the former H&S neckline and bear flag, which puts the Oct lows in play as a target.

Equity longs exposed

The reaction in equity land has been pronounced, where noticeably funds have beefed up hedging activity, where we see the VIX index into 16%, having been as high as 17.9%, with S&P500 1-month put (options) volatility rising 2.19 vols to 14.5%. The sell-down was broad-based with 90% of stocks (within the S&P500) lower on the day.

Junk equity (high leverage, poor balance sheets) and US small caps have been smacked with the US2000 -4%, high short interest baskets -5.5% and US regional banks (KRE ETF) -4.2%. The S&P500 cash closed -1.4% at 4953, although a late session rally saw the index close 0.7% off the lows, which is a small silver lining for the risk bulls.

It’s worth pointing out that sell-offs like this have been incredibly frustrating for those short risk, as there has been limited follow-through – let's see if this gets legs.

Our calls for Asia equity are heavy, with the ASX200 called down 1.3% and JPN225 -0.6%. CBA has reported 1H24 earnings, with solid cash earnings, inline costs, a low impairment charge and an interim dividend that should please investors. After a strong move in the share price of late the numbers need to blow the lights out – well see, but the business looks in fine shape.

A cautious outlook from CEO Matt Comyn, who talked up the view that downside risks are building may get headlines – one for the radar, and the fortunes of CBA will resonate through the broad index pricing.

After a period of consolidation in the AUS200 today's breakdown won’t have gone unnoticed by the bears, but let's see if calmer heads prevail when the ASX200 cash market unwinds – it could tell us a lot about the psychology of the market, and whether traders will buy into this opening weakness or conversely liquidate positions.

Good luck to all.

Related articles

Pepperstone no garantiza que el material proporcionado aquí sea preciso, actual o completo, por lo tanto, no debe confiarse en él como tal. La información, ya sea de un tercero o no, no debe considerarse como una recomendación; o una oferta de compra o venta; o la solicitud de una oferta de compra o venta de cualquier valor, producto financiero o instrumento; o para participar en una estrategia de negociación en particular. No tiene en cuenta la situación financiera u objetivos de inversión de los lectores. Recomendamos a los lectores de este contenido que busquen su propio asesoramiento. Sin la aprobación de Pepperstone, no está permitida la reproducción o redistribución de esta información.