- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Noteworthy Finnish, Irish, and Portuguese Equities

Finland

We begin in Finland, and with the Nordic region’s largest bank by assets, Nordea, who are both headquartered, and have a primary listing in, Helsinki. Interestingly, the headquarters location leads to Nordea being supervised directly by the ECB, being denoted as a “Significant Institution” by the ECB’s banking supervision arm, albeit not designated a G-SIB by the Basel Committee.

In any case, Nordea’s share price has enjoyed a strong run of late, trading at roughly its best levels in a year, largely reaping the benefit seen by other financial institutions as a result of benchmark rate hikes helping to widen net interest margins.

_2024-01-16_14-02-10.jpg)

However, also in keeping with other banking institutions, there remain question marks over the ability of consumers and corporations alike to weather the impact of higher rates as refinancing takes place throughout the course of the year ahead. This, coupled with the potential for policy loosening from central banks and the likelihood of economic momentum continuing to wane, may intensify the headwinds already being faced by the financial sector.

Elsewhere, the energy sector is a significant feature of the new Finnish listings, including oil refiner Neste (around one-third owned by the Finnish PM’s office), as well as state-owned energy firm Fortum. In addition, the industrial sector is represented by elevator engineering firm Kone, whose shares received a lift in the final quarter of 2023 despite pressure from an ongoing construction slowdown, while telecoms and tech firm Nokia are also a noteworthy addition.

Republic of Ireland

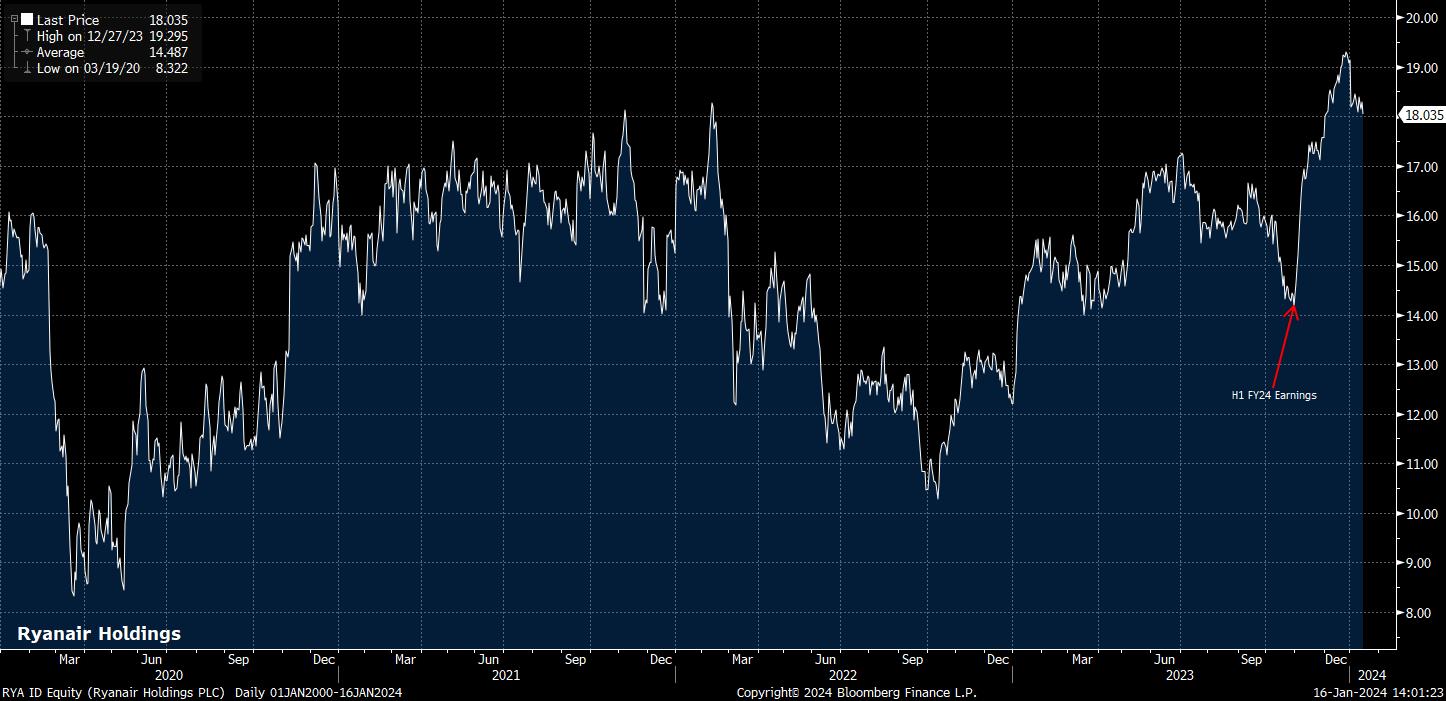

Meanwhile, in the Emerald Isle, Europe’s largest airline by passengers flown – Ryanair – stands out as one of the most well-known names in the index. The company’s stock took off towards the tail end of 2023, after substantially better than expected H1 FY24 results pointed to a 72% rise in profits, largely due to higher fares, along with record traffic during the European summer holiday season.

The stock’s near-term outlook remains somewhat uncertain, with the airline themselves forecasting a modest loss over the slack winter season, and future growth prospects somewhat cloudy, given ongoing and well-documented issues with the manufacture of Boeing 737MAX aircraft, which make up the majority of Ryanair’s future order book.

Other names that standout include professional services firm Accenture, who have been on a significant M&A spree of late, in addition to medical device manufacturer Medtronic, and betting giant Flutter Entertainment, now operating globally having been initially formed via the merger of Paddy Power and Betfair.

Three of the ‘big four’ Irish banks also feature – with Ulster Bank being a wholly owned subsidiary of NatWest – namely, AIB, Bank of Ireland, and Permanent TSB; all of whom received significant government bailouts during the GFC a decade and a half ago, and which largely remain in majority state ownership.

Portugal

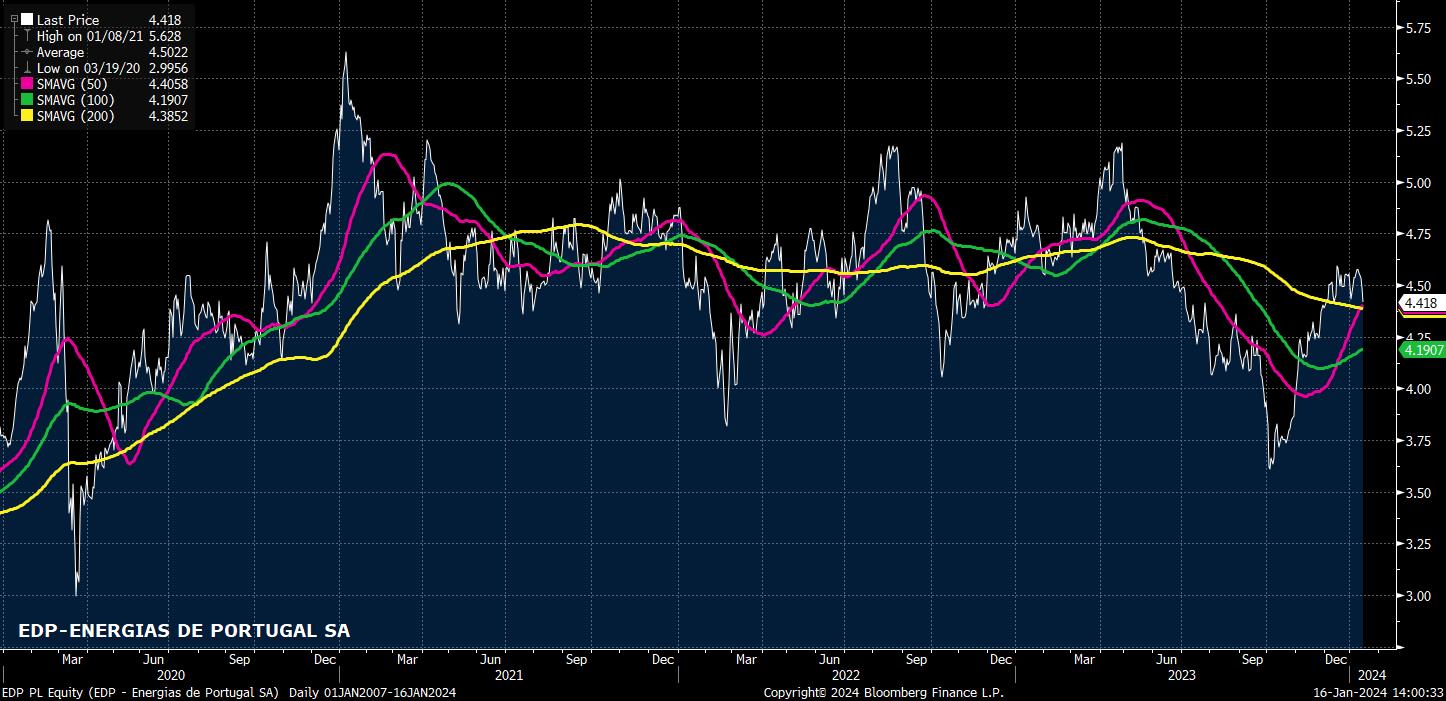

Finally, moving to Southern Europe, and Portugal. Utility firm Energias de Portugal stand out as the largest name, by market cap, among those having been recently made available to trade, with the firm having – in recent times – headed off a hostile takeover attempt from largest shareholder China Three Gorges Corporation, while having also begun to expand its operations further into the Spanish power market.

Other intriguing listings include food distribution group Jerónimo Martins, paper manufacturer The Navigator Company, whose stock was beaten into a pulp during the pandemic period, but has since recovered strongly, as well as Portugal’s largest private bank, Banco Comercial Português.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.