- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

With just under a month left until Germany’s key elections, the political environment is becoming very interesting. Recent polling data shows the left of centre SPD, under the steady hands of the current Finance Minister Scholz (long track record of experience in German politics), making substantial gains at the expense of the CDU/CSU and Greens. The SPD has risen by around 8% points over the last month or so and are now polling ahead of the CDU/CSU. Prior to this, the Greens looked primed for silver in this race, but have now drifted lower in the wake of the SPD’s resurgence. This could see Mutte Merkel’s party kicked off the throne for the first time since 2005. Many within the CDU/CSU are blaming the lack of popularity for Laschet and are disgruntled that he was chosen ahead of Markus Söder. Small shifts in public opinion now could have huge implications for domestic policy and for Europe’s largest economy. The largest party will take charge of the chancellery. Based on current polling numbers, it now also looks like a coalition of 3 parties will be needed to form a majority, each with their own ideology of how they want Germany to be run. This raises the possibility for long and drawn out coalition talks.

Source: Politico

After the first tv debate this weekend a snap poll showed further danger for the incumbent party, the CDU/CSU. The results showed that 36% believe Scholz won, with the Green’s candidate Baerbock at 30% and a meagre 25% for Laschet. The next televised debates are pencilled in for the 12 September and 19 September, which will be Laschet’s last chance to stage a comeback.

A potential coalition partner which is being thrown around a lot lately is the FDP - a pro-business and slightly conservative leaning party. They could be described as fiscal hawks and are against making the EU recovery fund a permanent tool. In terms of potential coalition scenarios, I see the following permutations:

1) CDU, SPD and the FDP

2) SPD, FDP and the Greens, however, this one seems less likely given the different policy views on economics and climate

3) SPD, Greens and the Left Party

4) CDU, SPD and the Greens. For financial market stability the most positive coalition option would be CDU, SPD and the FDP.

A 3 party coalition could make negotiations during crises within the EU more difficult. Brussels in the past has relied on Germany to be the anchor of stability.

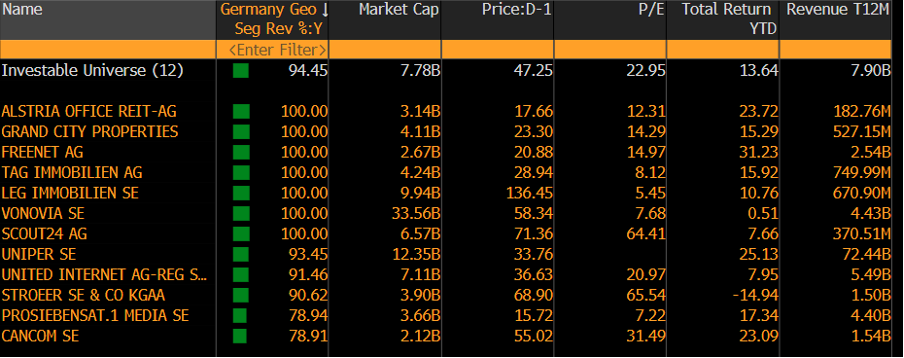

In terms of economic policy, the left leaning parties (Greens and SPD) are pro higher taxes, more government spending and increased regulation on topics like minimum wage. The right of centre parties (CDU/CSU and FDP) are more fiscally conservative and will want to be more prudent with their spending. Pepperstone’s Head of Research Chris Weston sourced this nice chart showing our universe of German stocks which make over 75% of sales in Germany. These would receive a tailwind if the fiscal taps were opened more aggressively.

Source: Bloomberg

DAX:

The DAX's volatility has slumped to around 138 points of late, however, we’re likely to see an expansion in volatility as we get closer to the election and post the election in the DAX. The DAX could get back up to around 250-300 points moves easily. Price has been running into sellers as the 16k mark. The 21-day EMA, trend line and 50-day SMA has been providing support to price dips. Price is now right on the 21-day EMA and the 15.8k former range resistance level. The RSI is having a go at the overhead 65 zone, which has marked previous stalls in price rallies. On the upside, my target would be the previous high on the 13 August at 16k. On the downside 15.435k range support. Below there 15k would come into play.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)