How to trade USD/CHF: Influential factors and essential strategies

USD/CHF represents the exchange rate between the U.S. dollar and Swiss franc. Known as a "safe haven" pair due to CHF’s stability, it offers unique trading opportunities. This guide covers key factors influencing USD/CHF

Factors influencing the USD/CHF currency pair

The USD/CHF pair is highly influenced by a variety of economic, political, and financial factors:

- Monetary Policies: The Federal Reserve (Fed) in the U.S. and the Swiss National Bank (SNB) play major roles. The Fed's decisions on interest rates impact USD, while the SNB, known for intervening to prevent excessive CHF appreciation, also affects the pair.

- Risk Sentiment: The CHF is considered a safe haven during turbulent times due to Switzerland's political neutrality, strong economy, and low-risk financial system, whereas the USD is more sensitive to global economic and geopolitical shifts.

- Global Economic Indicators: Data from the U.S. and Switzerland (GDP, inflation, employment figures) provide evidence on each country's economic health, thus impacting USD/CHF.

When is the best time of day to trade USD/CHF?

The best times to trade USD/CHF align with high periods of high liquidity:

European Session: 07:00-16:00 UTC, when Swiss economic data is released, and CHF is actively traded.

U.S. Session: 13:00-21:00 UTC, when U.S. economic reports are released, and USD is most active.

Overlap of Sessions: The overlap between the European and U.S. sessions (13:00-16:00 UTC) provides increased liquidity and tighter spreads.

How do I analyse USD/CHF price movements?

Here's a 5-step process to help analyse USD/CHF price movements:

1. Check Economic and Geopolitical Events

Monitor U.S. and Swiss economic indicators, especially interest rate decisions, inflation data, and GDP. Be vigilant of geopolitical factors affecting Switzerland's safe-haven status, such as European or global financial instability.

2. Observe USD and CHF Strength Separately

Review the strength of the U.S. dollar by analysing the U.S. Dollar Index (DXY) and general economic conditions in the U.S.. Assess the Swiss franc’s position, especially in relation to its safe-haven demand. When global risks rise, CHF more broadly often appreciates due to its safe-haven appeal.

3. Identify Support and Resistance Levels

Identify key support and resistance levels on the USD/CHF chart. Look for areas where price has historically reversed or consolidated. Use longer time frames like daily and weekly charts to confirm significant price zones.

4. Use Technical Indicators for Momentum

Apply momentum indicators like Moving Averages to identify trends and potential trend reversals. Use RSI and MACD to gauge overbought or oversold conditions, which may signal reversals within the pair’s range.

5. Watch for SNB Intervention or Announcements

Track any SNB communications or policies, as the SNB has historically intervened in the currency markets to keep the Swiss franc from appreciating too much. Any hints of intervention can impact USD/CHF, as these moves tend to weaken CHF to support the Swiss economy.

How does the Swiss National Bank (SNB) policy affect USD/CHF?

The SNB has historically intervened in the USD/CHF and EUR/CHF currency pairs to manage the Swiss franc's strength, primarily because a strong franc can impact Swiss exports by making them more expensive. The SNB likely chose a floor instead of a peg to allow some flexibility in the EUR/CHF exchange rate. This gave the SNB room to adjust to market conditions without constantly defending a fixed rate, reducing the overall cost of intervention. There is no fixed floor for USD/CHF as there is for EUR/CHF. Any intervention is usually discretionary and based on broader economic and currency market conditions rather than a preset exchange rate target.

In addition to these direct interventions in the FX market, the SNB has diversified its foreign currency reserves, notably investing in foreign stocks such as Apple, Amazon, and Microsoft. This portfolio adjustment serves as another method of managing currency strength and diversifying reserve assets.

Technical Indicators to consider when trading USD/CHF

When trading the USD/CHF there are several technical indicators that traders should consider using to guide their decision-making process. Combining indicators gives a better understanding of market trends, momentum, and potential reversal points:

Type: Trend-following indicator

Why it’s useful: Moving averages smooth out price data to identify the underlying trend. They are especially effective in trending markets, providing a clear signal of whether the market is in an uptrend or downtrend.

How to use: An uptrend is identified when the shorter moving average (e.g., 10-day) is above the longer moving average (e.g., 50-day), and both are sloping upward, indicating bullish momentum. A downtrend occurs when the shorter moving average is below the longer moving average, with both sloping downward, reflecting bearish momentum.

Type: Momentum oscillator

Why it’s useful: The RSI measures the speed and change of price movements. It oscillates between 0 and 100, helping traders identify overbought and oversold conditions. Overbought (above 70) and oversold (below 30) conditions may indicate potential reversals, especially when combined with price action.

How to use: In an uptrend, an RSI reading dipping below 30 and subsequently moving higher can indicate strengthening momentum. In a downtrend, an RSI moving above 70 and then reversing lower may signal weakening momentum in the prevailing direction.

Type: Volatility indicator

Why it’s useful: The ATR measures market volatility by calculating the average of true ranges over a set period (usually 14 days). It helps traders gauge the risk or potential reward by understanding the price range in which the currency pair typically trades.

How to use: Higher ATR values suggest more volatility, which may be suitable for traders looking for larger price movements or wider stop-loss orders. Lower ATR values indicate a quieter market, where tighter stop-losses may be appropriate.

Volume

Type: Confirmation indicator

Why it’s useful: Volume is a critical indicator because it confirms the strength of a price move. Higher volume indicates more interest in the price move, suggesting that it may continue.

How to use: In an uptrend, increasing volume suggests the trend is strong. Conversely, in a downtrend, increasing volume confirms the bearish sentiment.

What trading strategies work best for USD/CHF?

Range Trading

USD/CHF often oscillates within identifiable support and resistance levels, making range-bound strategies useful. Traders usually buy at support levels (see chart below) and sell at resistance levels, especially when the market is less volatile.

Trend Following

During times of strong USD or CHF sentiment changes (often triggered by risk events or central bank actions), USD/CHF can trend significantly. Identify trends using indicators like Moving Averages. For example, a 10-day moving average crossing above the 20-day moving average (bullish crossover) indicates a potential upward trend, while crossing below (bearish crossover) signals a potential downward trend. In range-bound conditions, shorter time frames like 10- and 20-day MAs react faster to price changes, helping identify smaller, frequent reversals typical in a constrained market.

A breakout strategy aims to capitalise on significant price movements that occur when the USD/CHF pair breaches key support or resistance levels, often after a period of consolidation. These breakouts can signal the start of a new trend, offering trading opportunities.

The example above highlights the importance of identifying key levels and patiently waiting for a breakout. By combining technical patterns with a clear risk-reward setup, traders can effectively navigate USD/CHF price movements.

Is USD/CHF more volatile than other currency pairs?

USD/CHF is generally less volatile than pairs involving more economically diverse nations, such as USD/JPY or EUR/USD. However, during times of economic uncertainty or SNB intervention, volatility can spike. For range-bound traders, the pair offers relatively stable trading opportunities, but they should still be cautious of sudden movements driven by geopolitical risks or SNB actions.

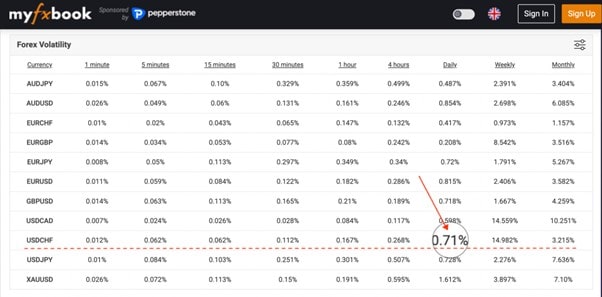

Volatility measures the degree of variation in trading prices over time. A higher number indicates greater market volatility, while a lower number signifies lower volatility. For example, if USD/CHF moves from 0.9100 to 0.9150, this represents a volatility of 50 pips or 0.55%. Similarly, if USD/JPY moves from 109.00 to 110.00, the volatility is 100 pips or 0.92%. In the example above USD/CHF showed a daily volatility of 0.71%, which is lower than pairs like AUD/USD (0.854%) and XAU/USD (gold, 1.612%). Its weekly and monthly volatility also tends to be moderate, with weekly volatility at 1.667% and monthly at 4.259%. In contrast, pairs like USD/CAD and EUR/GBP show higher short-term volatility, particularly on the weekly and monthly scales.

How do I gauge sentiment in USD/CHF?

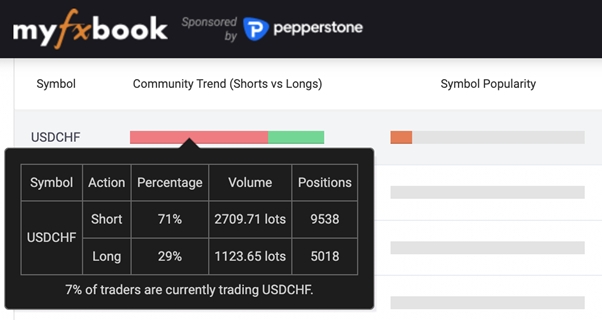

Many brokers and platforms offer sentiment indicators (see below) that show the percentage of retail traders in long versus short positions. For example, if a large majority of retail traders are short on a currency pair, it might indicate bearish sentiment, and vice versa.

Sentiment data for USD/CHF shows that, in this example 71% of traders were short. This indicated a strong bearish bias, as traders expected the Swiss Franc to appreciate against the U.S. Dollar. *Retail sentiment data, such as the proportion of traders long or short USD/CHF, can often act as a contrarian indicator, particularly if sentiment becomes extreme. For instance, if a large majority of retail traders are short USD/CHF like in the example above, it can sometimes signal a possible exhaustion of bearish momentum, hinting at a potential reversal upward if any positive news supports the USD.

How to manage risk when trading USD/CHF

Here are key steps to help effectively manage risk when trading USD/CHF:

Set Stop-Loss and Take-Profit Levels

- Stop-Loss: Place a stop-loss to cap potential losses on a trade. For example, if buying USD/CHF at 0.8900, a stop-loss might be set a bit lower, limiting any potential loss.

- Take-Profit: Use take-profit orders to secure gains when the price reaches a predetermined target. For instance, if the profit target is 50 pips, set take-profit at 0.8950.

- Why: Stops and limits enforce discipline, protects capital, and prevent emotional decision-making.

Manage Position Sizing

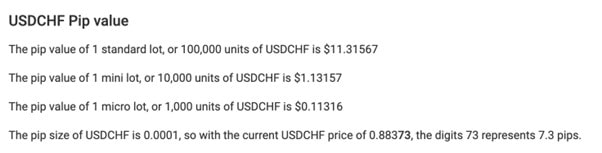

- Calculate the amount to risk per trade as a percentage of an account balance (commonly 1-2%).

- Example: If an account is £10,000 and 1% is risked, this equals to £100 per trade. Adjust position size accordingly, e.g., trading 1 mini lot (0.1 lots) if each pip equals £1 and stop-loss would be 50 pips.

- Why: Position sizing ensures not too much capital is risked on any single trade.

Source: USDCHF Pip value calculated

Monitor Volatility with ATR

- Use the Average True Range (ATR) to adjust stop-loss based on market volatility.

- Example: If USD/CHF’s ATR is 20 pips, use a stop-loss that accommodates the typical daily fluctuation (e.g. 1.5x ATR = 30 pips).

- Why: Volatility-based stops can help prevent premature exits during normal price swings.

Watch Economic Events

- Monitor events like Federal Reserve interest rate decisions or Swiss National Bank policy announcements, which heavily impact USD/CHF.

- Example: Avoid trading during major announcements or use reduced position sizes to mitigate unpredictable spikes.

- Why: Economic events often lead to sudden volatility, which can amplify risks.

Use Risk-to-Reward Ratios

- Aim for a fixed risk-to-reward ratio depending on your risk appetite

- Why: A favourable risk-to-reward ratio ensures that even with a 50% win rate, it is possible to remain profitable over the long term.

Leverage Management

- Use low leverage (e.g., 10:1 or less) to avoid magnifying losses.

- Example: With £1,000 in an account, limit trades to a maximum size of 1 standard lot (£10,000 notional value) to control exposure.

- Why: High leverage increases the risk of margin calls and significant losses.

Evaluate Market Conditions

- Identify whether USD/CHF is trending, or range bound and adapt the strategy.

- Example: In a range bound market, use tighter stop-losses and shorter profit targets, while in trending markets, allow trades more room to develop.

- Why: Adapting to market conditions ensures risk management approach aligns with the current environment.

Advantages and Disadvantages of Trading USD/CHF for Beginners

Advantages

- Lower Volatility: Compared to some other pairs, USD/CHF is often more predictable and range-bound, making it suitable for range trading.

- Safe-Haven Status: CHF’s role as a safe-haven currency provides unique trading opportunities, especially during times of global turmoil.

- SNB Transparency: For the most part the SNB communicates its policies clearly, giving traders clues about potential interventions.

Disadvantages

- Unexpected SNB Intervention: The SNB’s actions can lead to sudden price movements, which might be challenging for beginners to anticipate.

- Global Risk Sensitivity: USD/CHF’s safe-haven nature means that unexpected global events can influence its value dramatically.

- Limited Profit Potential: Due to its lower volatility compared to pairs like GBP/USD, USD/CHF might offer fewer profit opportunities for active traders.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.