- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

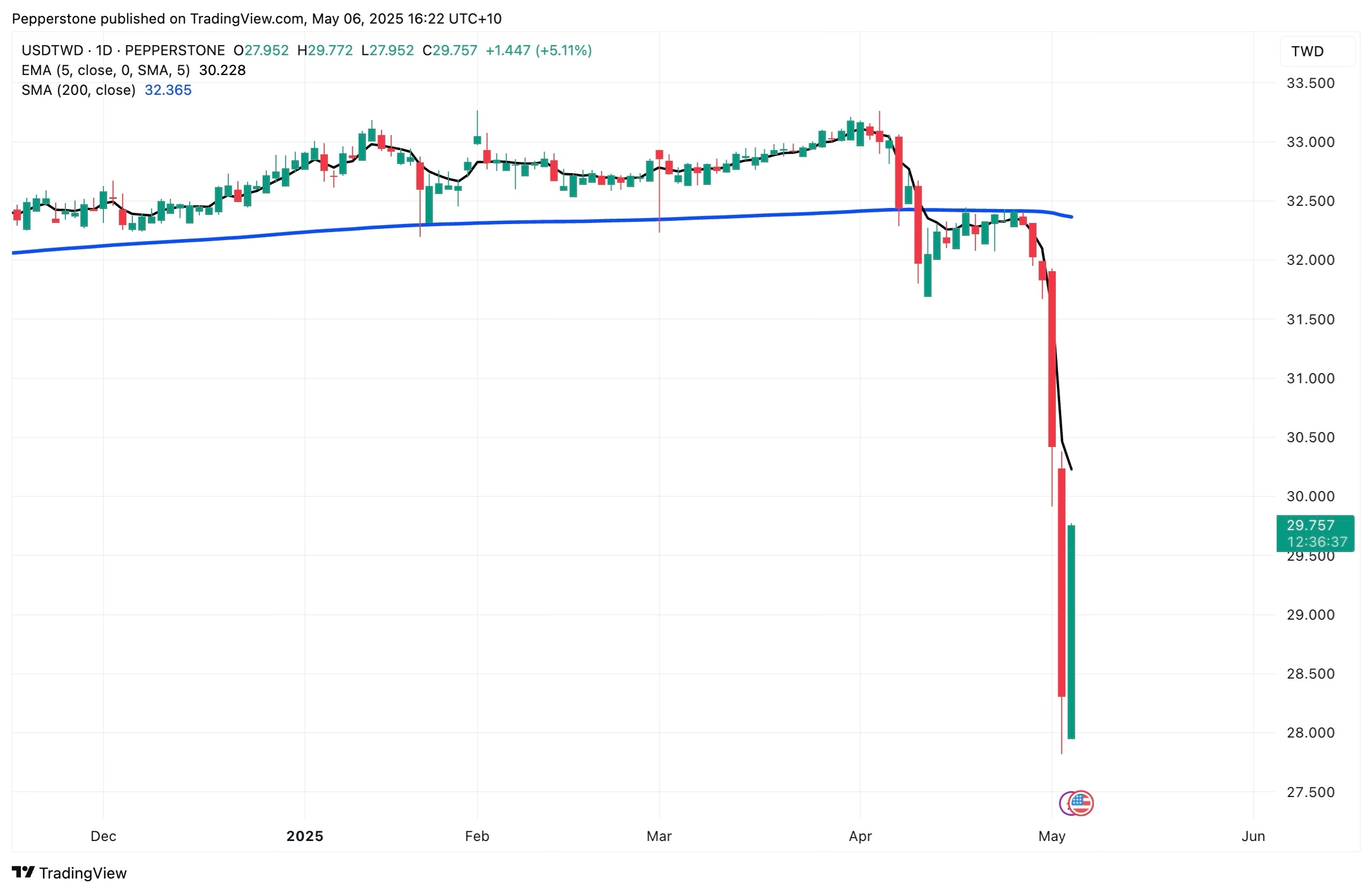

In recent sessions, the TWD posted a single-day gain of more than 4%. Unlike previous episodes—such as the brief rebound following the global market turmoil of the late 1980s—this time, capital appeared far more committed to the idea that the TWD strength would continue.

As a “weaker” currency subject to strict controls, the appreciation of the Taiwanese dollar and the Taiwanese authorities’ tacit approval have led traders to speculate about the underlying causes.

From tariff overtures to carry trade unwind

In recent years, Taiwan’s relatively low interest rates and open financial markets have made the New Taiwan Dollar a “low-cost financing currency,” significantly boosting forex derivatives trading. Similar to the yen carry trade, investors borrow TWD to buy high-yield assets, profiting as long as the exchange rate remains stable or fluctuates moderately.

Although the results of the first round of trade negotiations between Taiwan and the US on May 1 have not been disclosed, some traders speculate that Taiwan is using its currency to send a friendly signal to President Trump, given Taiwan's unique geopolitical and economic position. As an export-driven economy, the appreciation of the Taiwanese dollar would also help reduce Taiwan’s trade surplus with the US during negotiations.

Speculation about a possible "Taiwan version of the Plaza Accord" lit the fuse, triggering a reversal of carry trades on the TWD. A surge in short covering, initiated by exporters concentrating their foreign exchange settlements, quickly escalated. Considering Taiwan’s previous $100 billion investment offer to the US, a statement from the Taiwanese central bank seemed insufficient compared to an aggressive “money printing” approach.

Limited USD hedging triggers insurance-sector repositioning

In addition to the reversal of carry trades by international capital and retail investors, another key reason for the TWD's appreciation is the collective “panic” among Taiwan's life insurance companies. These insurers had previously absorbed savings in New Taiwan Dollars and heavily invested in US assets. As of the end of January, Taiwanese life insurers controlled at least $700 billion in US dollar-denominated financial assets, with only about 65% of these assets hedged, a historic low.

As the creditworthiness of the US dollar declined and concerns about the US economy mounted, the huge number of US dollar-denominated assets held by Taiwanese insurers rapidly depreciated. In the process of fleeing from dollar assets and reallocating to New Taiwan Dollar assets, the limited hedging positions triggered a series of currency mismatches. This led to a feedback loop where the faster the TWD appreciated, the more aggressively investors bought, pushing the TWD higher against the USD.

Export headwinds mount, recession bets rise

In a weak dollar environment, Taiwan’s tariff gestures to the US, the concentration of foreign exchange settlements by exporters, and the urgent hedging by life insurers could keep the TWD elevated for some time. This raises concerns among traders about the long-term effects of the Taiwanese dollar's appreciation.

For Taiwan’s export-dependent economy, the TWD’s appreciation is undoubtedly a significant blow. According to estimates, for every 1% appreciation of the TWD, Taiwan Semiconductor Manufacturing Company’s (TSMC) profit margin declines by 0.4%. Other export-driven sectors like machinery, chemicals, and textiles are similarly pressured, collectively dragging down Taiwan’s stock market performance.

If Taiwanese authorities continue to allow the TWD to appreciate, the negative effects of currency overvaluation, such as shrinking exports, economic slowdown, and asset bubbles, may become more pronounced. While history doesn’t repeat itself exactly, it often rhymes. After the Plaza Accord, Japan’s economy, despite the initial joy of a stronger yen, entered a prolonged stagnation period known as the "Lost Decade."

"FX for Tariffs": A shift in competitive dynamics

Beyond Taiwan, there are no winners in this storm sweeping through Asia. Currencies like the South Korean Won and Singapore Dollar also appreciated, while the offshore Chinese Yuan breached the important 7.2 mark. Hong Kong was forced to sell large amounts of its currency to defend the peg, repeatedly setting records for the largest single-day sell-offs.

Every movement of the TWD ripples through neighboring countries’ capital flows—banks and funds in the region have been hedging between currencies, concentrating risks that should have been diversified.

From a strategic tariff negotiation perspective, Taiwan’s compromise on its exchange rate sends a clear and insightful message: In trade relations with the US, if a country chooses to adjust its export advantage through currency appreciation to ease the US’s trade deficit pressure, this gesture is likely to be seen as “cooperative intent” by Washington, potentially securing concessions or tacit approval in other negotiation areas. In other words, this is an implicit “currency for tariffs” trade logic.

A policy dilemma for Taipei—and the specter of US exceptionalism

Taipei's policymakers now face a tough decision: Should they intervene decisively in the forex market and sell off large amounts of TWD? While this would help ease the forex pressure on export-oriented businesses and insurance funds in the short term, it also carries the risk of being labeled as “currency manipulation,” potentially sparking friction with major trade partners. Conversely, if they choose to stay hands-off and let the market adjust, it could demonstrate the independence and maturity of their monetary policy, but it may exacerbate the pressures already facing the real economy and financial system. The authorities’ stance will be crucial in determining the next movement of the TWD.

Additionally, we should also watch for statements from the White House. Taiwan's actions could set a precedent for external pressure, prompting other major trading partners (such as Japan, South Korea, and even China) to follow suit, creating conditions for the establishment of a multilateral currency coordination mechanism, akin to a “Plaza Accord 2.0.”

If this process begins, the US dollar could face significant devaluation pressure, and capital markets may once again embrace the narrative of “American exceptionalism,” where, as other countries are forced to appreciate their currencies at the cost of competitiveness, the US achieves economic growth and asset appreciation through its currency devaluation and trade structure optimization—a "win-win" scenario.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)