- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

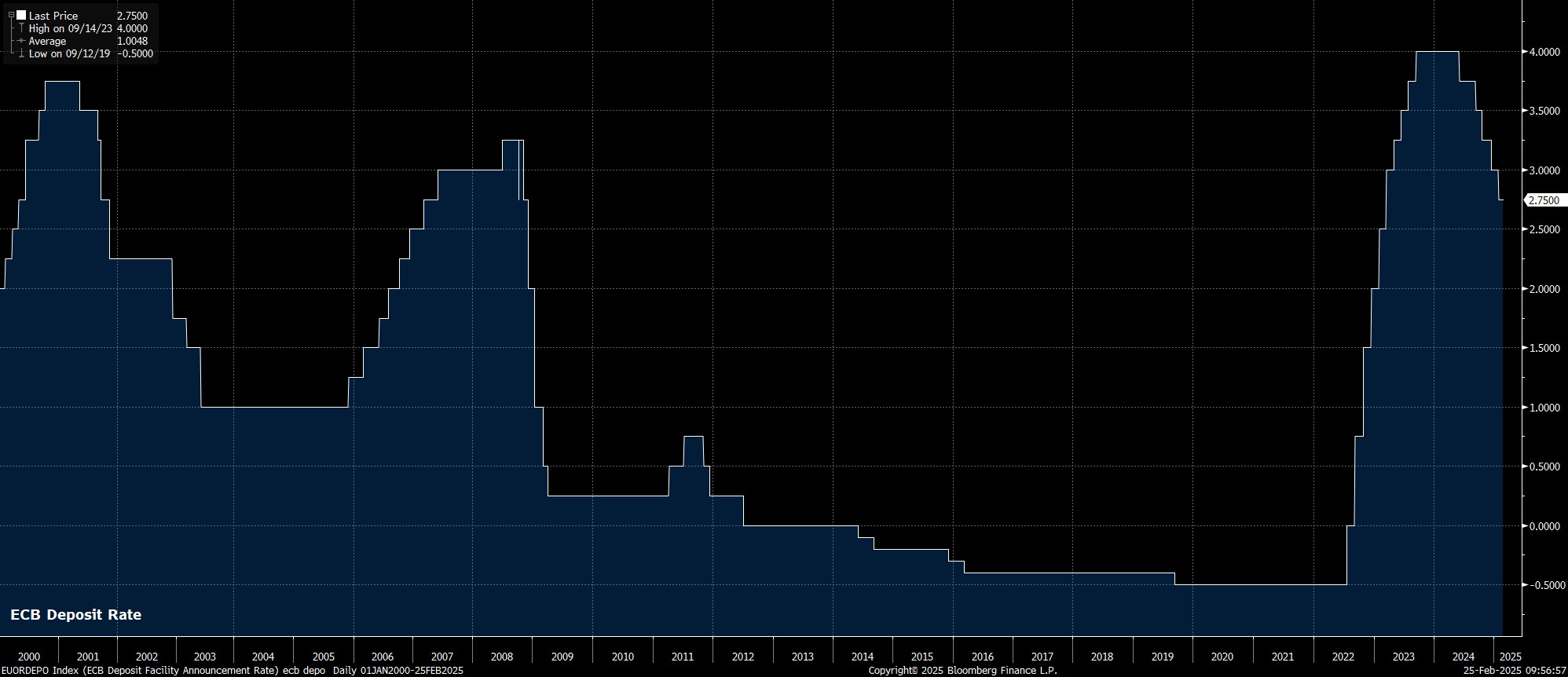

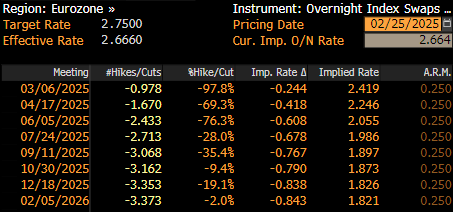

As noted, the Governing Council will almost certainly deliver another 25bp cut at the conclusion of the March policy meeting, reducing the deposit rate to 2.50%, in a move that will be this cycle’s sixth rate cut. Money markets, per the EUR OIS curve, fully discount such a cut, though don’t fully price another such 25bp cut until June.

The decision to deliver another 25bp cut is likely to be a unanimous one among policymakers, even if a formal voting record isn’t published. Though the ECB’s hawks have grown somewhat more vocal in recent weeks, their concern has typically focused on the potential for further cuts beyond the March meeting, and whether policy remains restrictive, as opposed to debating the need for a March cut itself.

Executive Board member Schnabel’s commentary is of most interest in this regard, given her view that policymakers should discuss whether the label that policy is “restrictive” should be dropped at this meeting. In many respects, however, remarks of this ilk shouldn’t be too surprising, particularly as the deposit rate inches ever closer to a more neutral level, with ECB staff pencilling in neutral as sitting between 1.75% and 2.25%.

It seems unlikely that the policy statement will drop that “restrictive” label just yet, in order to avoid sending any unintentionally hawkish policy signals. However, a discussion on this topic is highly likely to have taken place, with post-meeting ‘sources’ reports likely to provide further colour as to when this description could well be ditched.

In any case, broader guidance within the policy statement is likely to be little changed from that issued at the January meeting. Consequently, the GC will re-affirm that a “data-dependent and meeting-by-meeting approach” will continue to be followed in determining future monetary policy decisions, with no ‘pre-commitment’ being made to a particular rate path.

Though policymakers are still seeking to preserve a degree of optionality in terms of future policy moves, the trajectory that rates will follow remains a downwards one, with the principal question being how quickly further rate cuts are delivered from Q2 onwards.

Recent eurozone economic data reinforces the case for policymakers to continue to reduce the degree of policy restriction.

On inflation, despite headline CPI having risen for three months in a row, touching 2.5% YoY in January, metrics of underlying inflationary pressures prompt little cause for concern, with the rise in headline inflation driven primarily by a substantial increase in energy prices, and an unfavourable base effect from 2024. Core CPI, excluding food and energy, remains at 2.7% YoY, while services inflation has slipped under 4%. On the whole, the balance of risks continues to point towards a greater probability of inflation undershooting the 2% target, as opposed to overshooting it.

That said, the ECB’s latest staff macroeconomic projections are unlikely to be significantly revised from those issued a quarter ago, continuing to project inflation falling back to the 2% target from the second quarter onwards, along with a modest undershoot of the target in 2026.

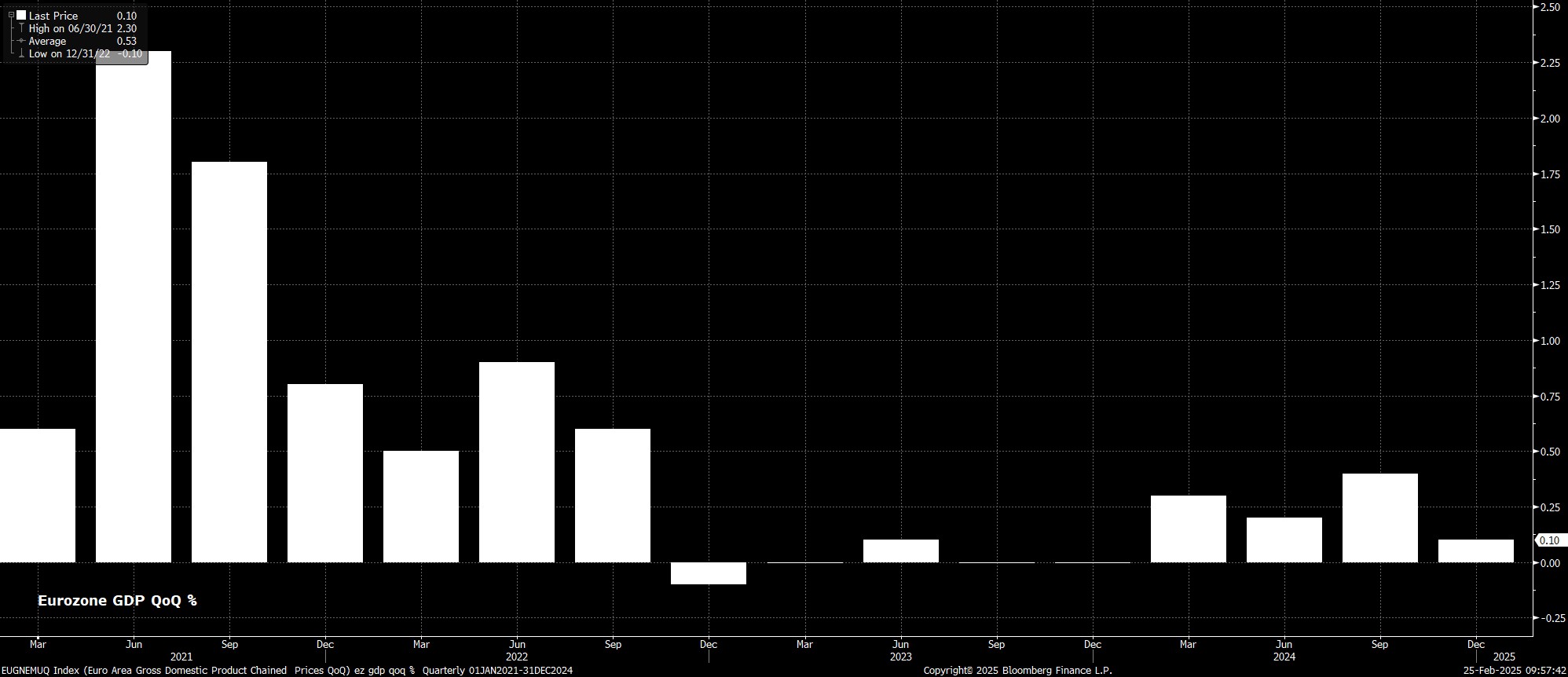

Meanwhile, on growth, the eurozone economy has continued to lose momentum in recent months, with the services sector in particular facing notable headwinds, as evidenced by the ‘flash’ February PMI figure falling to a 3-month low at 50.7.

More broadly, the composite PMI remains just above the breakeven mark, at 50.2, while economic momentum was waning as 2024 drew to a close, with GDP having grown by a meagre 0.1% QoQ in the final three months of last year.

Looking forward, risks to the outlook remain firmly tilted to the downside, even if a degree of political uncertainty has now been alleviated after German federal elections produced a likely ‘Grand Coalition’. Nevertheless, political uncertainty continues to linger in France, and at a bloc-wide level, where leadership remains rudderless.

Numerous other risks also remain on the horizon, particularly in the geopolitical realm, even if a Ukraine peace deal is soon agreed, a subsequent increase in defence spending is likely to put further pressure on the bloc’s already perilous fiscal backdrop. Furthermore, Chinese growth remains lacklustre, while the spectre of a broad, tit-for-tat, EU-US trade war remains, amid Trump’s threat of reciprocal tariffs, though the precise impacts of this are impossible to measure at this stage.

Taking all of the above into account, growth forecasts may be nudged a touch lower, with 1.1% real GDP growth in 2025 seeming ambitious, at beast.

Turning to the post-meeting press conference, President Lagarde is likely to stick resolutely to her recent script, re-emphasising the data-dependent approach to future policy shifts, and drumming home the message that rates are not on a pre-set course. For market participants, focus at the presser will likely fall on Lagarde’s comments as to the degree of unanimity around the decision, as well as potential guidance as to the ECB’s approach to dealing with the fallout from potential tariffs and associated upside inflation risks.

Taking a step back, while a 25bp cut is baked in for the March meeting, the policy outlook into the second quarter is somewhat more uncertain. While further rate cuts remain likely, the pace of said cuts could slow, if inflation progress were to stall, or reverse course. Furthermore, as rates approach a more neutral level, which of course is an imperfect science in itself, the degree of dissent among Governing Council members is likely to increase, as the hawks seek a greater magnitude of policy restriction to be maintained.

The deposit rate remains on track to fall to 2% by the middle of the year, though further cuts below such a level seem somewhat hard to come by for now, likely requiring a substantial loss of economic momentum, or significant decline in headline inflation, in order to convince a majority of policymakers that such a move would prove necessary.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.