- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

March 2025 BoE Preview: Gradual & Careful Remains The Way

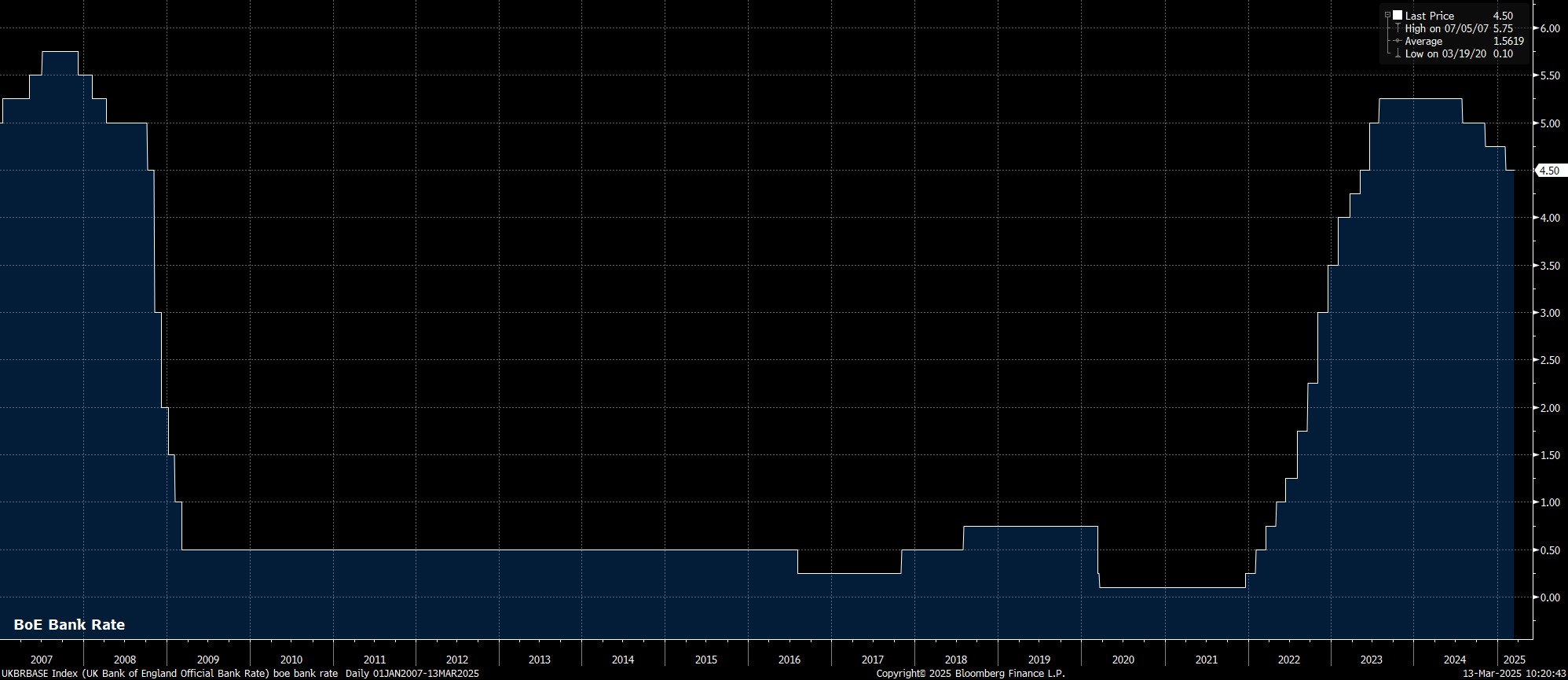

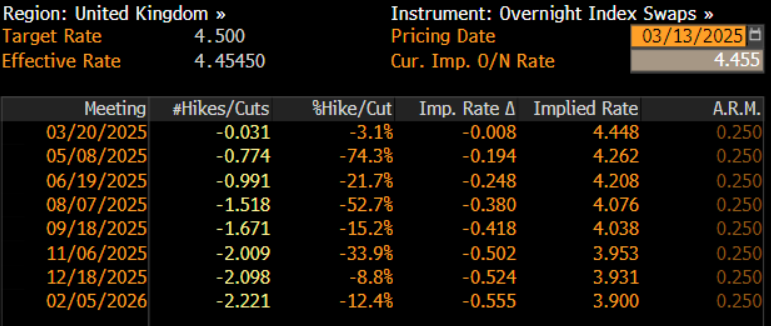

As mentioned, Bank Rate is almost certain to remain unchanged at 4.50% at the March meeting, with money markets pricing next-to-no chance of any rate changes, and guidance from MPC members since the prior meeting suggesting there being little rush to deliver further policy easing.

That decision to stand pat, however, is unlikely to be a unanimous decision among MPC members, with an 8-1 vote split the base case. That lone dissenter should be external member Dhingra, who remains the uber-dove among the 9-member Committee, and continues to favour a more rapid return to neutral, hence is likely to prefer a 25bp cut at this meeting.

Intriguingly, despite dissenting in favour of a ‘jumbo’ 50bp cut last time around, external member Mann seems likely to fall back in line with the remainder of the MPC this time, voting for Bank Rate to be held steady. While this may seem somewhat peculiar, Mann’s dissent in February was primarily to send a signal regarding the need for monetary policy to be transmitted forcefully, as opposed to being an outline of Mann’s preferred future policy path. Considering this, and her frequent rejection of a ‘gradualist’ approach to rate cuts, a vote in favour of holding Bank Rate steady seems plausible this time out.

In any case, along with the vote split, market participants will also pay close attention to the MPC’s latest policy statement.

By and large, the statement seems likely to be a ‘copy and paste’ of that issued after the February meeting, primarily seeing the MPC reiterate the “gradual and careful” approach to removing further policy restriction. Meanwhile, the statement should reiterate that policy must “remain restrictive for sufficiently long” in order to reduce the risks of persistent inflationary pressures, while reaffirming that the MPC will continue to take a meeting-by-meeting approach to future policy decisions.

Overall, the MPC are likely to be relatively content with the current position of the GBP OIS curve, which discounts just over 2x 25bp cuts (in June and November) by the end of 2025.

Such a path is broadly in keeping with the MPC’s policy guidance, and reflective of the gradual approach that the core of the Committee have advocated. Recent economic data has reinforced this view, though no new economic projections are due from the Bank until the May meeting.

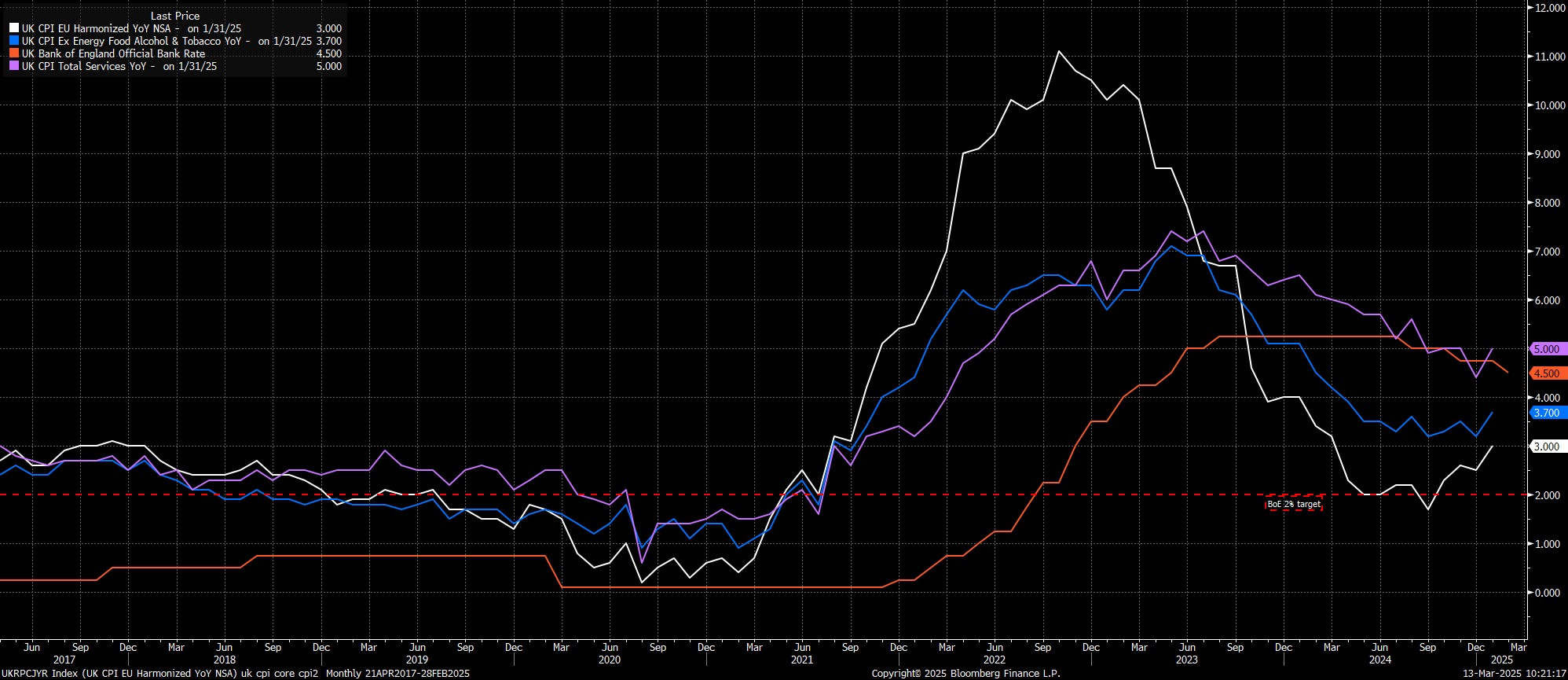

Nevertheless, January’s inflation data will have come as a disappointment to policymakers, with headline CPI having risen by 3.0% YoY – not only the fastest pace since March 2024, but also 0.2pp above the Bank’s February forecast. While services CPI, at 5.0% YoY, was 0.2pp below those same forecasts, such a print can hardly be celebrated, and implies that underlying price pressures remain relatively intense.

Meanwhile, the UK labour market remains a mixed bag, albeit one where the precise picture is almost impossible to discern, given ongoing data quality issues which the ONS have, still, been unable to resolve.

In any case, despite headline unemployment having held steady at 4.4% in the three months to December, other labour market surveys indicate a further weakening in employment conditions, particularly the February PMI prints, where the employment balance tumbled to a dismal 43.5. In addition, ahead of the April National Insurance changes, businesses continue to dramatically pare back hiring plans.

Meanwhile, earnings growth remains at a pace that is clearly incompatible with a sustainable return to the 2% inflation target over the medium-term, with regular pay having risen 6.0% YoY in the final three months of last year. The Bank will, obviously, be seeking a considerable cooling here before becoming confident in the risks of inflation persistence having subsided.

The most significant shift in the economic outlook since the February meeting is the increase in protectionist rhetoric from the Oval Office, and the Trump Administration’s tariff plans. Thus far, from a UK perspective, these tariffs have been imposed only on exports of steel and aluminium, though the broader plan for ‘reciprocal’ tariffs shan’t be unveiled until the beginning of next month.

That said, given the services-centric nature of the UK economy, the impact of potential tariffs is likely to be considerably less significant than that seen in DM peers, for example the eurozone, though does naturally still represent another downside growth risks that policymakers must consider. The uncertainty with which US trade policy continues to be made also isn’t helping on this front, and may well be alluded to in the updated MPC statement, even if a full impact assessment of these measures will have to wait until the May MPR.

With no MPR due this time around, there is also no press conference scheduled, though some form of media appearance from Governor Bailey remains likely. Comments, though, are likely to broadly mirror the statement, and Bailey’s recent messaging, that further rate cuts can be expected, albeit at a pace in line with the “gradual and careful” approach with which participants are now familiar.

On the whole, this approach should result in three further 25bp Bank Rate cuts being delivered over the remainder of the year, taking rates to 3.75% at the end of 2025, with those cuts likely to be delivered in conjunction with the release of updated economic forecasts. Risks, though, to that base case, arguably tilt in a dovish direction, particularly if the labour market were to weaken significantly, and dent demand to such an extend that the pace of underlying disinflation in the services sector markedly quickens.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.