Analysis

FX Trends To Watch Into Year-End

While much of 2024 saw a relatively subdued G10 FX market, marked by tight trading ranges, and incredibly low levels of both implied, and realised, vol, things came alive during the summer. First, participants were forced to digest a more hawkish than expected Bank of Japan decision, which acted as a spark to kick-off a wide-ranging carry trade unwind. Then, a soft July US jobs report, coupled with Fed Chair Powell’s more dovish than expected remarks at Jackson Hole, all-but-confirming a September rate cut, sent the greenback to its weakest levels of the year.

This tees up an interesting backdrop as markets return to more normal levels of activity, as summer draws to an end.

- Two key drivers appear likely to influence the FX space between now, and the end of the year. Namely, the evolution of monetary policy, as normalisation continues across most of G10, and with the prospect of further BoJ hikes remaining on the table; and, the upcoming US presidential election, as the race for the White House heats up, though down-ballot races will also be in focus

- Monetary policy dynamics are likely to influence markets in a handful of ways. Firstly, there is the matter of who does, and who doesn’t, live up to market pricing of rate cuts. The Fed, for instance, have set an incredibly high bar to meet the approx. 100bp of easing that the USD OIS curve currently discounts by year-end, which seems fanciful barring a significant external shock. Upside USD risks present themselves as a result. While rate pricing is ambitious across the board, the GBP (40bp cuts by year-end), SEK (75bp cuts by year-end), and CHF (49bp cuts by year-end) all seem more fairly priced, and could hence find themselves on fragile ground

- Secondly, there is the question of how long those central banks which have not yet delivered a rate cut – namely, the RBA and the Norges Bank – maintain these ‘higher for longer’ stances. Taking recent rhetoric at face value, a 2024 cut from either seems a long shot at present, though it remains somewhat questionable whether such a stance can prevail once Powell & Co begin to cut the fed funds rate. If it does, then the AUD and the NOK standout as the obvious longs in the G10 FX space, likely benefitting most significantly against the lower-yielders, providing that risk sentiment continues to hold up

- Lastly, there is the wildcard that is the BoJ. Having delivered a more hawkish than expected message in July, with a 15bp hike and plans to trim JGB purchases, Governor Ueda has left the door open to further tightening, while also noting that 0.5% is not a ‘ceiling’ for rates. The JPY OIS curve prices just 11bp of further tightening by year-end, which seems a touch underdone, leaving the door open for further JPY appreciation, as the JP-RoW rate spread continues to tighten, even if the carry unwind does seem largely done & dusted at this stage

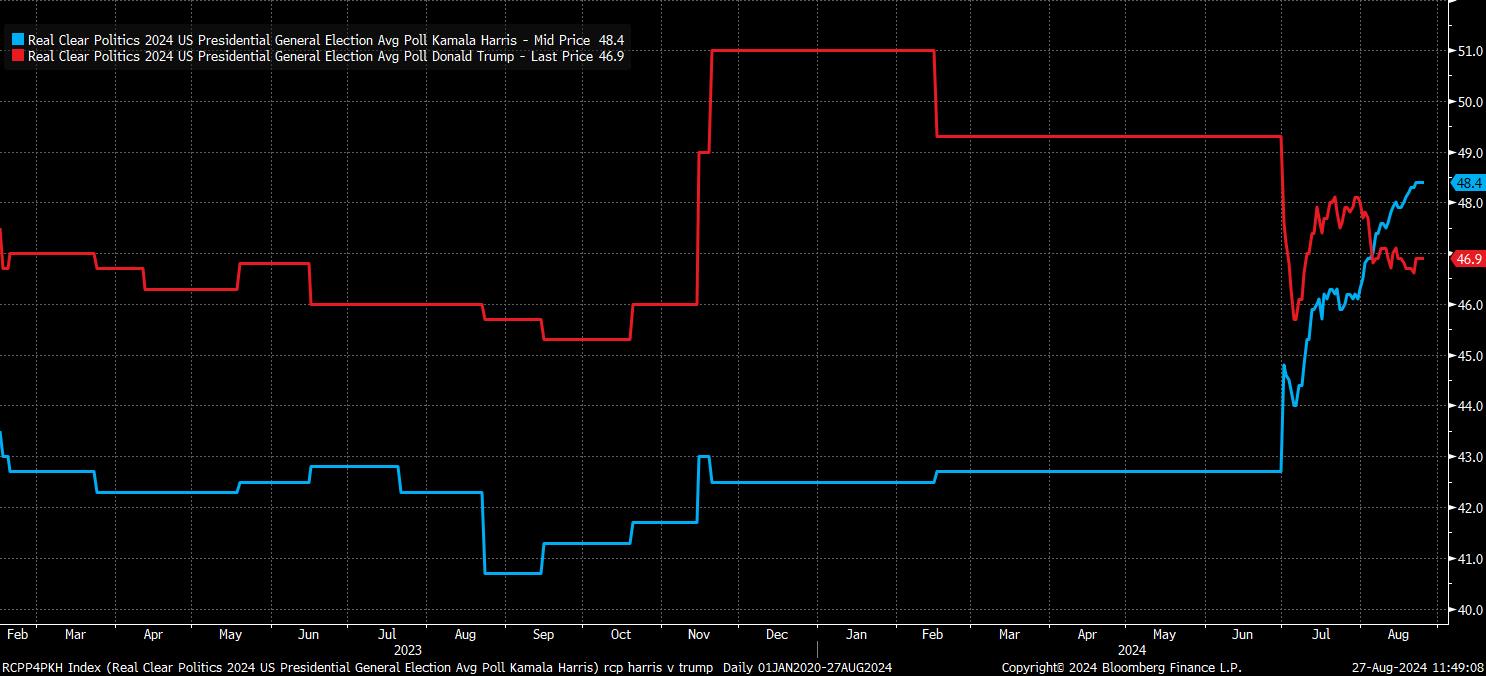

- Away from policy, there is the small matter of the US election for markets to grapple with. In policy areas that are of importance to financial markets – e.g., fiscal policy – both Trump and Harris display a remarkable similarity; principally, that neither display particular concern for higher government spending, the rising deficit, or surging government borrowing. The most significant policy differences come in the realm of regulation – Trump favouring deregulation, Harris broadly favouring tighter rules on US corporates – though the market impact of said differences will principally be on display in the equity space, rather than in FX

- In the FX space, one would expect a Trump win to be a knee-jerk positive for the USD, if only in a mechanical manner due to the significant weakness likely to be seen in the MXN and the CNY/H on the back of said result. Nevertheless, the FX market typically tends to care more about political stability, than the particular allegiances of a government, meaning that a divided government scenario – whereby the party who wins the White House doesn’t have overall control of Congress – is likely the most significant short-term negative USD outcome

- Overall, though, as has been the case ‘since God was a boy’, markets are notoriously poor at accurately pricing political risk. Consequently, both implied and realised vol is likely to rise substantially into polling day in November, while haven FX demand could also accelerate, as traders seek to hedge politically-exposed positions elsewhere

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.