- English

- 简体中文

- 繁体中文

- ไทย

- Tiếng Việt

- Español

- Português

- لغة عربية

Analysis

One key theme which has legs this week are moves in Chinese markets – notably, China went after short sellers with several targeted measures. We also saw a 50bp cut to banks RRR amid reports of an RMB2t package for offshore SOE to buy Chinese equities – that said, with big inflows into mainland funds, the HK50 and CSI 300 managed an unimpressive 4.2% and 2% weekly gain respectively.

Judging by price action in the HK50 market players seem unsure about building on the move from 15k, and Fridays inside bar needs to be rectified – I would look to trade a break of 16300 (longs) and 15809 (shorts)

While hindsight is a wonderful thing, the equity index to be long on the week was the EU Stoxx 50, which is in beast mode (even when priced in USD). The ECB refraining from pushing back on market pricing has certainly helped, while EU earnings also ramp up. Looking ahead, Thursdays EU CPI could be very important for both the EUR and EU equity, where a weak core CPI print – below 3% - could open the door for the ECB to signal a big change from the collective at the 7 March ECB meeting, although we can gauge an immediate response to the CPI data from ECB members Lane and Centeno, who both speak after the CPI data.

US data last week, for the most part, impressed and should result in the FOMC statement being little changed this week. Nuance and positioning will play a key role in the moves in rates, the USD, gold, and equity. FOMC aside, it’s a big week ahead State Side, with a raft of key labour market reads, growth data points, the US Treasury Quarterly Refunding Announcement (QRA) as well as it being the marquee week of US earnings with Microsoft, Apple, Alphabet and Amazon reporting.

It’s not a shock that longs in NAS100 and US500 have had a collective rethink and thought twice about building on the move into 4900. That said, if we look at the volatility markets there has been no pickup in hedging activity with limited propensity to buy downside puts. In fact, all the talk has been that funds are selling index calls to collect premiums and enhance returns on their underlying equity positions. This is subsequently having a big effect in dampening volatility.

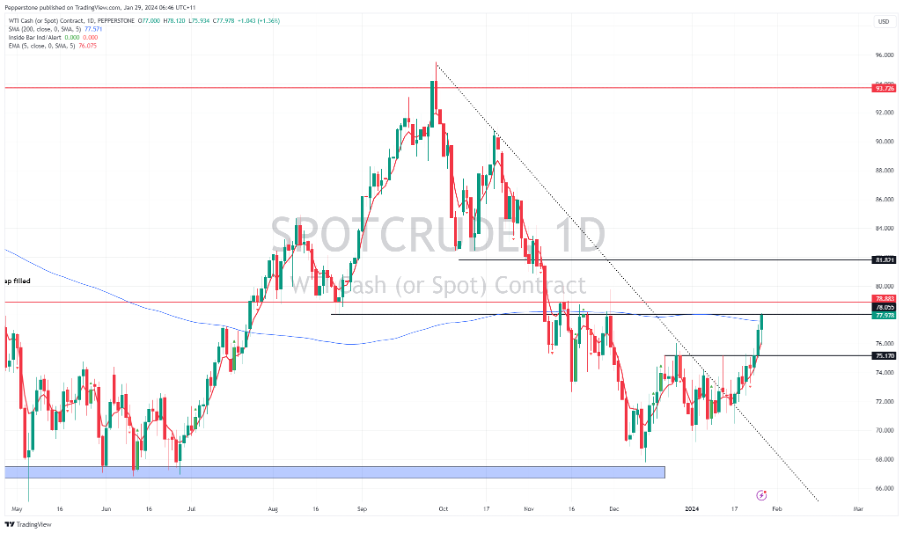

Crude and Nat Gas are where the moves are taking place, and certainly, SpotCrude had a flyer gaining over 6% on the week, trading into the Nov range highs and taking out the 200-day MA. US data has been a factor, but geopolitics is also a growing issue, and we watch headlines roll in. The bulls seem to have control for now, so upside risks remain – a break higher could also become problematic for future headline inflation, although we’re not at levels too concerning yet.

All in, we see a new week littered with key event risks – economic data flow, central bank meetings and corporate earnings. It pays to be aware of the calendar, whether one is day trading and navigating these potential vol events through the day. Or holding positions but not in front of the screens. Consider if the event holds the potential for outsized moves, where the skew of risk resides, and what the means for the stop placement and position sizing.

It’s the week that has it all – good luck.

The marquee event risks for traders to navigate this week:

- End-of-month portfolio flows – Investment bank flow models suggest USD selling to play out to rebalance portfolios, with some sizeable selling in Japanese equities to reweight.

- Aus Q4 CPI (31 Jan – 11:30 AEDT) – Q4 CPI poses an obvious risk to AUD and AUS200 exposures. The market looks for headline Q4 CPI to print 0.8% QoQ / 4.3% YoY (from 5.4%), with the trimmed mean measure also expected to fall to 4.3% YoY. Importantly, the RBA had forecast 4.5% for Dec CPI (on both metrics), so the further below that the more dovish the reaction in the AUD. As it stands, Aussie interest rate futures see no chance at the Feb RBA meeting, with a 1-in-4 chance of a 25bp cut in the May meeting. Given such sanguine pricing, we’d need to see a 3-handle on CPI YoY to bring a cut onto the table near-term and promote a big move in the AUD.

- China Manufacturing and Services PMI (31 Jan – 12:30 AEDT) – the market eyes the manufacturing index at 49.2 (from 49.0) and the services index at 50.6 (50.4) – after some big stimulus last week CN/HK equity index longs will be keenly hoping for the data flow to show signs of improvement, although it’s the property space that is of most interest.

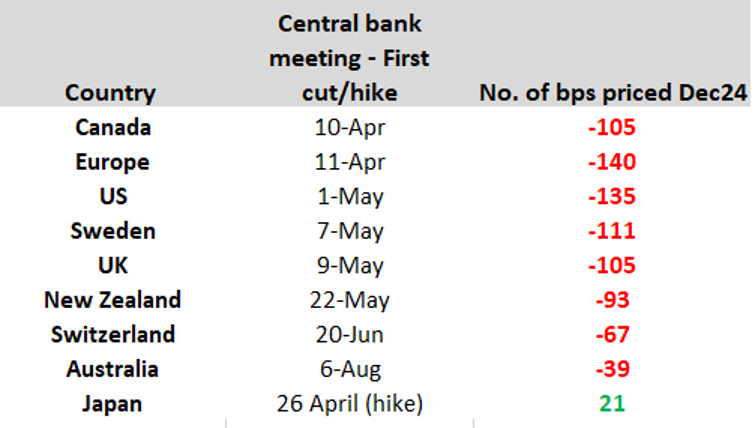

- FOMC meeting (1 Feb 06:00 AEDT) & Chair Powell presser (06:30 AEDT) – it will certainly be hard to match the strong dovish reaction in the Dec FOMC meeting and after the strong Q4 GDP print, and consumption the Fed will be in no mood to declare victory. With the Fed expected to lose its tightening bias, the FOMC statement should read neutral. There will also be a large focus on the timeline for tapering the pace of QT (or balance sheet reduction), notably with Jay Powell’s likely to be heavily probed on this in his press conference – all up, while positioning is always a factor, I see two-way risks for the USD and equity. See our preview here.

- Sweden’s Riksbank meeting – the Riksbank will leave rates at 4% but should open the door to cuts, with the swaps market pricing the first cut in May. Preference for USDSEK upside, adding on a closing break of 10.5000.

- BoE meeting (1 Feb – 23:00 AEDT) – the GBP has found support from resilient UK data flow, with GBPUSD tracking a clean 1.2800 – 1.2600 range. The market will be expecting the bank to retain a hawkish lean and will be looking for changes in the vote split to a 8-1 or even 9-0 vote to hold rates. With the market pricing the first 25bp cut at the May BoE meeting at 50%, and the first cut fully priced in June, I see a two-way risk to the GBP at this meeting. See our preview here.

- US nonfarm payrolls (3 Feb – 00:30 AEDT) – the median estimate is that we see 180k jobs created (the economist range of estimates is set between 285k to 120k), with the unemployment rate expected to tick higher to 3.8%. I think the USD reaction will be more closely linked to the outcome of the U/E rate than net job creation.

- EU CPI (1 Feb) – The CPI print could be pivotal to the ECB and could set the stage for a more dovish narrative from the bank. The market sees headline CPI falling to 2.7% (from 2.9%) and core CPI to 3.2% (3.4%). Chief economist Lane speaks 90 minutes after, so we could get an immediate reaction to the data from one of the ECB’s most influential members. The EU CPI print poses big EUR risk given the implication for ECB rate expectations, so consider EUR exposures over the news.

- US Treasury financing estimate (29 Jan) and Treasury Quarterly Refunding Announcement (QRA - 31 Jan) – the QRA was the trigger for lasting trending conditions in price in both August and November and the implications this time around could be significant. That said, I am leaning towards the idea that the market will not get a surprise this time around, but with T-bills still expected to play a big role in govt funding in the weeks ahead there will be further increased scrutiny on the level of RRP balances and ultimately the funding markets (SOFR-Fed funds). See our preview here.

US earnings in the week ahead

As it stands, we’ve seen 25% of S&P500 companies report, 78% have beaten expectations on EPS (by an average of 6%) and 53% have beaten on sales. Companies have reported 1.6% aggregate EPS decline, and 3.7% sales growth.

In the week ahead we get earnings from just over 40% of the S&P500 market cap, including 4 of the illustrious MAG7 names – as a highlight I expect good interest in:

Tuesday - UPS, Microsoft (implied move -/+ on the day of reporting 4.3%), Alphabet (-/+ 5%)

Wednesday - Boeing (-/+ 3.8%), Mastercard (-/+ 2.9%), QUALCOMM (-/+ 5.6%)

Thursday - Apple (-/+ 3.2%), Meta (-/+ 6.5%), Amazon (-/+ 6.2%)

Friday - Chevron (-/+ 2.3%), and Exxon (-/+ 2.2%).

Other US data points worth considering:

US – Consumer confidence (31 Jan 02:00 AEDT), JOLTS jobs openings (31 Jan 02:00 AEDT), Employment Cost Index (1 Feb 01:00 AEDT), ISM manufacturing (2 Feb 02:00 AEDT).

In LATAM FX

The BCCh (Chile) meet on Wednesday and are expected to ease by 100bp to 7.25%, although there is a chance they go 75bp - USDCLP is seeing positive momentum and I favour it higher near-term but have limited conviction.

The Brazilian CB go on the same day and should cut the selic rate by 50bp to 11.25%.

Columbia also meet on Wednesday, and we see a 50bp cut to 12.50%.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)

.jpg?height=420)