- English (UK)

The Daily Fix: The day the markets priced in negative rates in the US

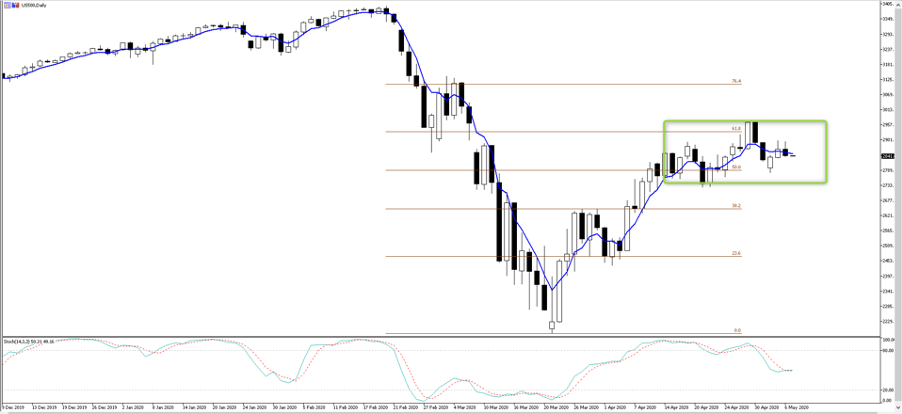

The NAS100 has been a pillar of strength with a gain of 0.6%, However, the S&P500 closed -0.5%, with the Russell 2000 – 0.7%, while EU indices closing broadly lower by just over 1%. Volumes have been ok through the cash markets, although 1.4m contracts traded in S&P 500 futures is lightweight – the 15-day average is 1.61m. Breadth has been poor, with 66% of S&P 500 stocks lower, and consider where the US benchmark would have been if weren’t for the fact that Amazon, Apple and Microsoft put in 5-index points – this is where the concentration risk is seen front and centre.

On the technical front, the set-up on the daily show’s consolidation and a growing pronounced sideways move. One to watch.

Implied vols are largely unchanged across all markets, although the CBoE crude implied vol read is up 18 vols and one to keep an eye on. Certainly, the VIX index remains unchanged at 34%, despite the news flow and implies a 2.13% daily move (higher or lower).

(Source: Bloomberg)

One could argue that the moves across asset classes are a reflection that much of the good news about re-openings are discounted. Maybe the data has taken some of the wind out of the sails too but this seems unlikely given the sell-off in the long-end of the US bond market, with the ADP private payrolls coming in close-to-consensus at 20.236m job losses and reinforcing tomorrows NFP guesstimate of 21.25m jobs losses in April. We can add a brutal India PMI (services came in at 5.4 and the composite at 7.2), while we saw a single-digit construction PMI print UK in the UK.

On the docket today we have Aussie trade data, BoE meeting and US jobless claims (consensus 3m new claims), so not a huge amount of event risk for traders to be concerned with, with Asia equity indices expected to open on a sour tone with Aussie SPI and Nikkei futures lower by 0.9% and 0.8% respectively. Hang Seng futures are -0.8%.

Thought of the day

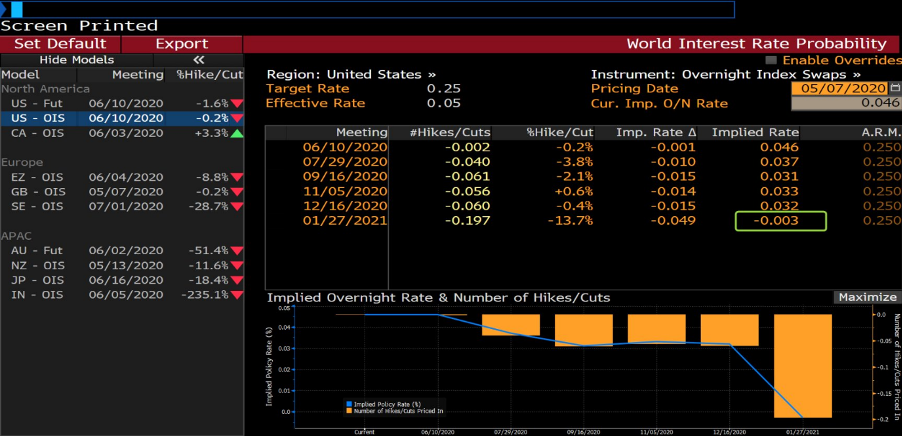

I thought I would highlight this development as it could be a major talking point in markets in the months ahead. This being that traders are betting on a negative fed funds rate in 2021. This is certainly not straight forward and would require a change to the Fed Act, while almost certainly seeing the US banking system mount a costly legal challenge. However, negative rates open a whole new backdrop for markets.

On the FX side, the USD is +0.5% and we’re seeing high beta FX under pressure, with good selling in the MXN, BRL and ZAR. The BRL is likely to head further lower given the central bank cut rates by 75bp, 25 more than expected.

The JPY is working well here, and again feeding into the view that the bears will take a small victory in this session. USDJPY has been at the heart of our flow, with spot dropping through the I-cloud and looking like it wants to head through the 106-handle. Keep an eye on this pair as there will come a point, perhaps when we see a move into 105, that the BoJ starts to ramp up the easing dialogue, although, the market is far less sensitive to BoJ chatter these days.

A 4- and 6-bp move higher in UST 10s and 30s has given some love to the USD, although USDJPY traders would disagree - maybe that is a reflection of the insane amounts of funding the Treasury Department have to get away in the weeks ahead. Reports that China may retaliate by dumping Treasuries is not new, but clearly not what Mnuchin et al want to hear before embarking on the biggest funding operation ever.

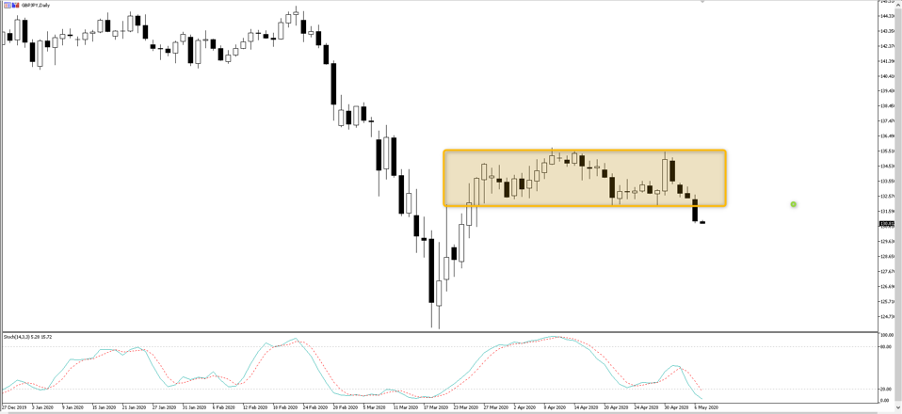

GBPJPY was a set-up I looked at yesterday on the Telegram channel (sign up here) and broke out of its recent range and looks ripe for further losses ahead of today's (16:00 AEST) BoE meeting, which is an idiosyncratic event risk for GBP traders. Consider that few expect a change in the GBP645b asset purchase program, although the risks are somewhat skewed for an increase, so it's not hard to see why traders are selling GBP into this meeting, and we will likely see traders massage exposures through Asia. At the very least we get a firm commitment to do more if needed and will monitor conditions.

(GBPJPY daily)

EURJPY and EURNOK were also trades I looked at and both seem to be working quite well at this stage, with EURJPY breaking down and I would be adding to that on any strength. Happy to hold until price closes (on the daily) back above the 5-day EMA.

The risk-off tone has pushed into the crude complex - Certainly, the fact we’re seeing selling in WTI and Brent crude is interesting as the crude inventory report was largely positive, with the crude build of 4.5m/d half what is expected, with a solid 3.1m barrel draw in gasoline. We also saw crude implied demand head higher, yet price has rolled over a touch.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.