- English (UK)

Analysis

Bitcoin Reaches New Highs Since 2021 - New Historical Record on the Way?

This operational dynamic occurs in a context where the approval of a Bitcoin ETF (Exchange-Traded Fund) had previously captured the investment community's attention. Although Bitcoin recorded an unfavorable reaction after approval by US regulators, probably following a dynamic commonly known as "buy the rumor, sell the fact," the long-term outlook for Bitcoin seems promising due to some key factors such as institutional participation and Bitcoin's "Halving."

Institutional Participation

The growing interest from financial institutions in the cryptocurrency market suggests a significant shift towards the legitimization and stabilization of Bitcoin. Additionally, the seal of approval by regulators for cryptocurrency-linked assets adds an extra layer of seriousness to this market, which has earned its formal place on Wall Street.

Among the main benefits of SEC approval are:

- Increased accessibility for investors: Bitcoin ETFs offer a familiar and accessible way for traditional investors, such as pension funds and financial institutions, to gain exposure to Bitcoin without the need to directly purchase or deal with the complexity of its custody. This opens the door to an influx of institutional capital, which could translate into a significant increase in demand for these types of cryptographic assets.

- Legitimacy and trust: The approval of an ETF by a major regulator like the SEC lends a legitimacy seal to the cryptocurrency market, dispelling doubts and concerns from some investors. This could generate greater interest and confidence in Bitcoin from the general public, driving mass adoption.

Although I previously mentioned that the existence of a Bitcoin ETF does not automatically guarantee a massive flow of institutional capital into this market, when combined with the next point, this could create the perfect combination for the leading cryptocurrency to reach a new record high.

Bitcoin "Halving"

For those reading about this phenomenon for the first time, Bitcoin "Halving" is an event that occurs every 210,000 blocks mined (approximately every four years) in which the reward for mining a Bitcoin block is halved. This means BTC miners receive fewer bitcoins for their effort, and this, in turn, reduces the rate of new bitcoins being issued.

As such, the "Halving" is designed to control Bitcoin inflation and ensure that the total amount of Bitcoins mined will be limited. The Bitcoin protocol states that only 21 million bitcoins can be mined, and the "Halving" helps ensure this limit will not be exceeded.

From a historical perspective, "Halving" has proven to be a significant event in the Bitcoin world, coinciding with periods of price increase for the cryptocurrency. This leads many investors to consider "Halving" as a bullish indicator for Bitcoin's price, as it reduces the supply of new bitcoins entering the market.

BTC/USD

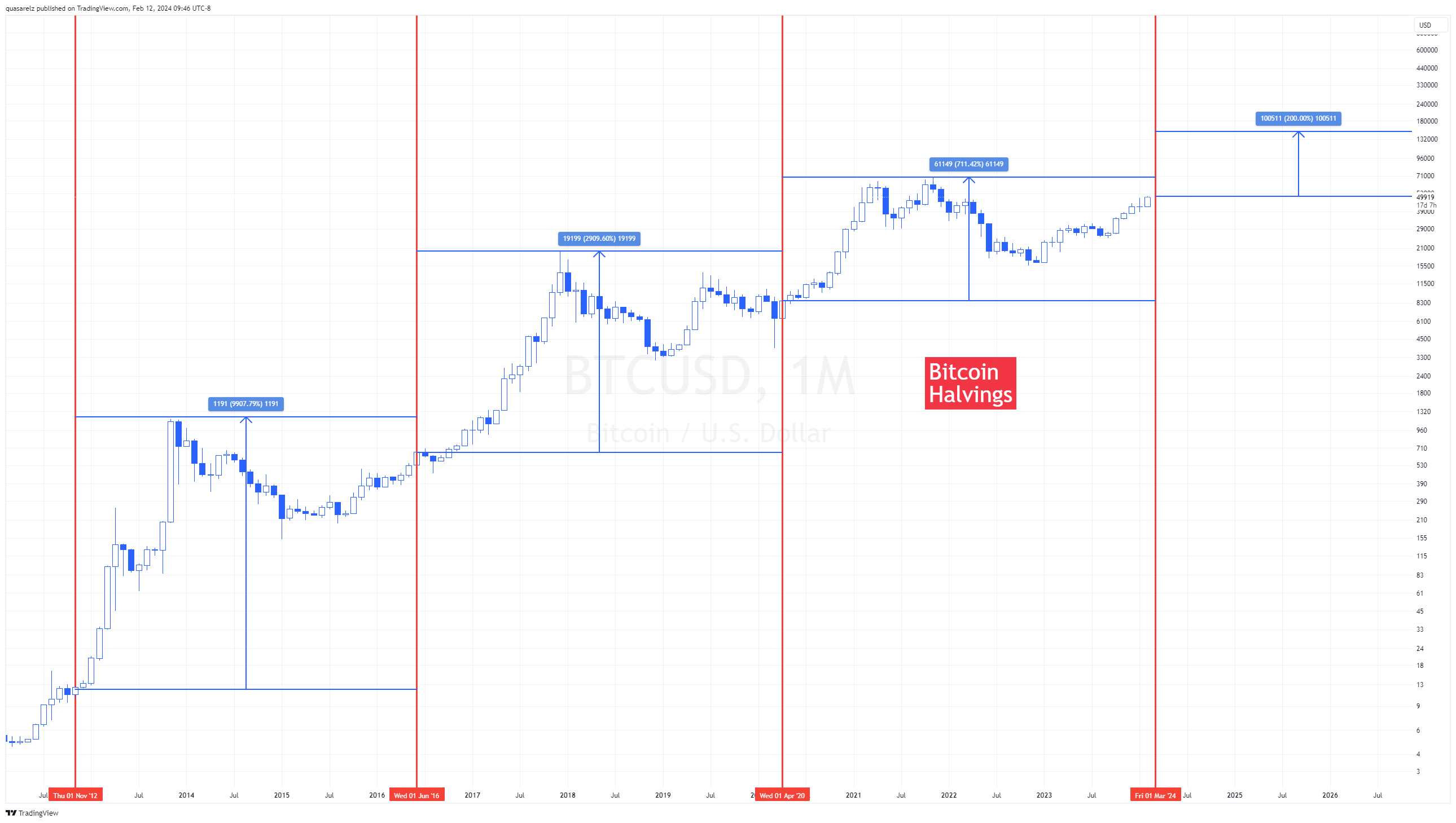

As we can observe in the monthly logarithmic chart of BTC/USD, in its three previous occurrences, since 2012, when this phenomenon has happened, BTC has registered considerable upward movements during the approximately two years following.

For those with an economic perspective, putting together the two previously presented factors, the accessibility of the institutional front (higher demand) in conjunction with the "Halving" (lower supply) this could be seen as a playing field with conditions ideal for, those knowledgeable in economics will not let me lie, an increase in prices.

An argument against this might quickly arise: Why would the institutional front be interested in exposing themselves to this market? Personally, I believe there are two reasons that could lead to a greater incursion by the institutional front. In the first instance, we have the equity market, where, as we remember, the S&P 500 has recently been setting new record highs. This indicates a considerable appetite for risk-taking by investors. Additionally, so far in 2024, BTC has recorded gains close to 20%. This can quickly become, as BTC advances further, a dynamic where investors seek exposure to assets that are performing the best and not miss out on the potential "benefits." To put it simply and concretely, "FOMO" (Fear of Missing Out).

Having laid out this hypothesis, the next question that arises is: Where are we headed?

Bitcoin Potential

Firstly, we need to observe what happened previously during the "Halvings," considering the date from when the reduction took place and the peak reached during that cycle.

- 2012: ~+10,000%

- 2016: ~+2,900%

- 2020: ~+700%

For those interested in patterns, something becomes clear. While Bitcoin has indeed advanced following these phenomena, the subsequent advance has been lesser with each "Halving." The 2016 "Halving" saw a rally approximately 3.5 times less than that of 2012. Comparing the 2020 rally to that of 2016, the advances were about 4 times smaller. Although we would definitely need many more samples to categorize this as a definitive rule, we might be facing a dynamic to consider for Bitcoin.

Considering a midpoint and extrapolating an advance 3.5 times less than that of the “Halving” of 2020, Bitcoin theoretically has an additional growth potential of approximately 200% from the upcoming "Halving" in April.

Based on a current level of ~$50k, additional advances of such magnitude would theoretically set Bitcoin on course to register a new record high and break through the $100,000 per token barrier in the process.

BTC/USD Weekly

Based on technical analysis, considering advances from the 2019 low, the 2021 high, and the 2022 correction, the Fibonacci expansion level of 161.80% of such structure might be a potential candidate to consider as a target level. It is worth mentioning that this level is below the theoretical 200% derived from previous "Halvings." Additionally, it is important to emphasize that metrics are considered from the moment of the "Halving," which has not yet occurred, so these levels could change.

BTC/USD 4H

For those interested in exposure after breaking through $48k and in search of Bitcoin's theoretical bullish potential, while on other occasions I might have suggested, under the effect of polarity, using the Fibonacci retracement of 61.80% as an invalidation level, given the much more volatile nature of this market, the recommendation is to use Bollinger Bands instead, as this considers the asset's recent volatility to some extent.

To conclude, it is important to remember that Bitcoin and cryptocurrencies remain high-risk assets. Therefore, it is recommended not to invest capital that one cannot afford to lose.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.