Analysis

September 2024 ECB Review: A Cut Without Commitments

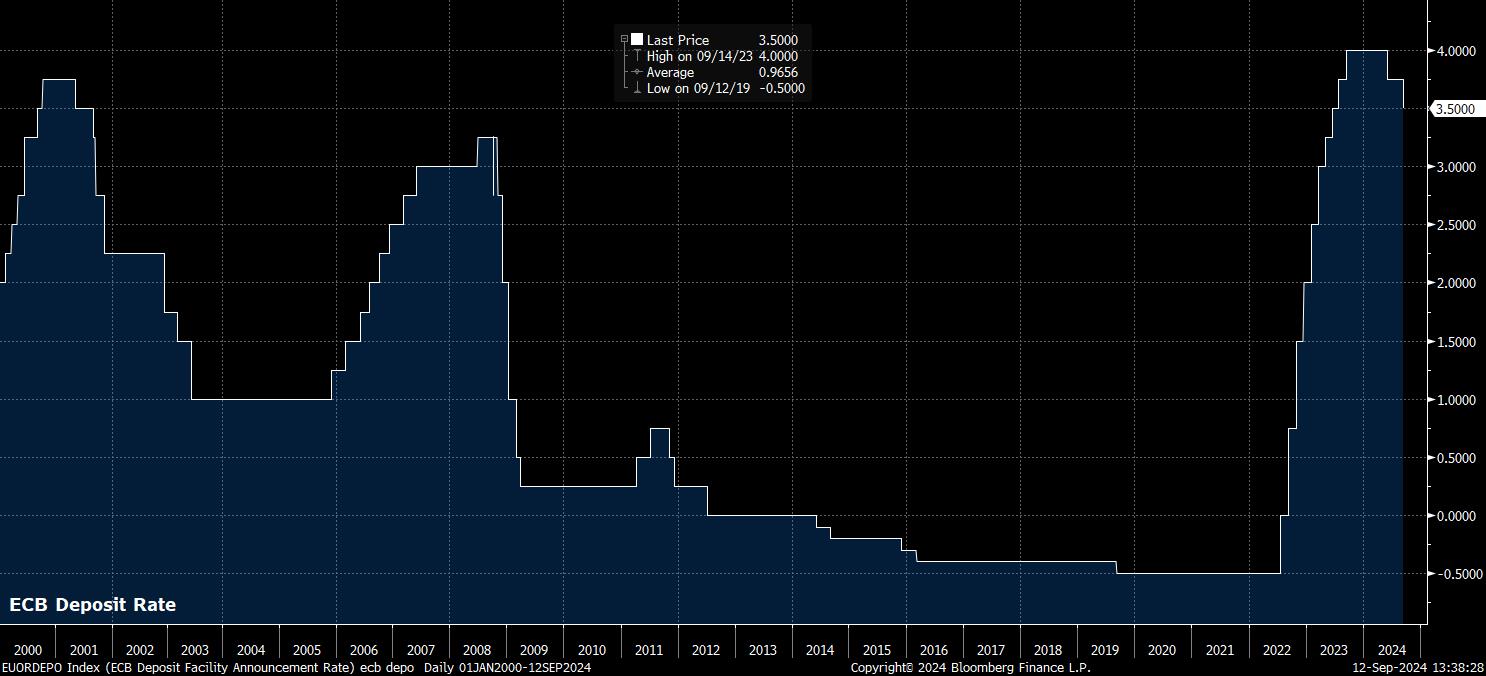

As was fully expected, and discounted by financial markets, the ECB’s Governing Council delivered a 25bp at the conclusion of the September policy meeting. Such a cut is the 2nd that the ECB have made this cycle, with the deposit rate now standing at 3.50%, its lowest level since last July, as policymakers continue to gradually move towards a less restrictive policy stance.

Furthermore, as had been outlined in the ECB’s framework review back in March, today saw the spread between the main refinancing rate, and the deposit rate, reduced to 15bp, from the prior 50bp. This is a purely technical change, designed to increase the ECB’s control over short-term market rates, and as part of the ECB’s broader shift from a supply-driven to a demand-driven system.

Accompanying the decision to cut rates, the Governing Council largely reiterated the guidance issued after the July meeting. Once again, policymakers committed to take a data-dependent, meeting-by-meeting approach to future rate decisions, while re-affirming that they are not ‘pre-committing’ to a particular rate path. As has been the case since this cycle’s first cut, there remain three factors which will determine how policy evolves, namely – the ECB’s assessment of the inflation outlook; the dynamics of underlying inflation; and, the strength of policy transmission.

Meanwhile, the September meeting also saw the release of the ECB’s quarterly staff macroeconomic projections.

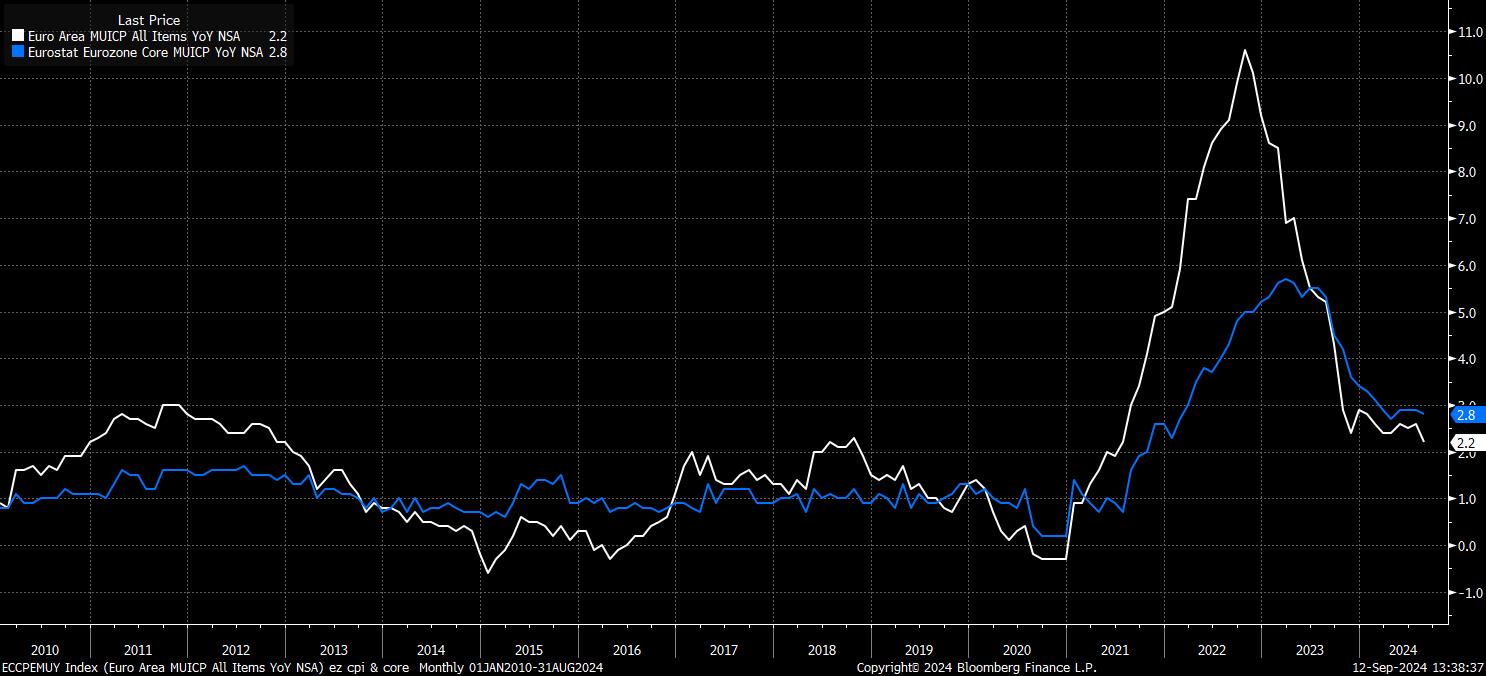

On inflation, forecasts remained unchanged throughout the 3-year projection horizon, at 2.5% this year, 2.2% next year, and 1.9% in 2026. Policymakers also continue to expect a ‘rapid’ decline in core inflation, despite the 2024 and 2025 core HICP projections being revised higher by 0.1pp apiece.

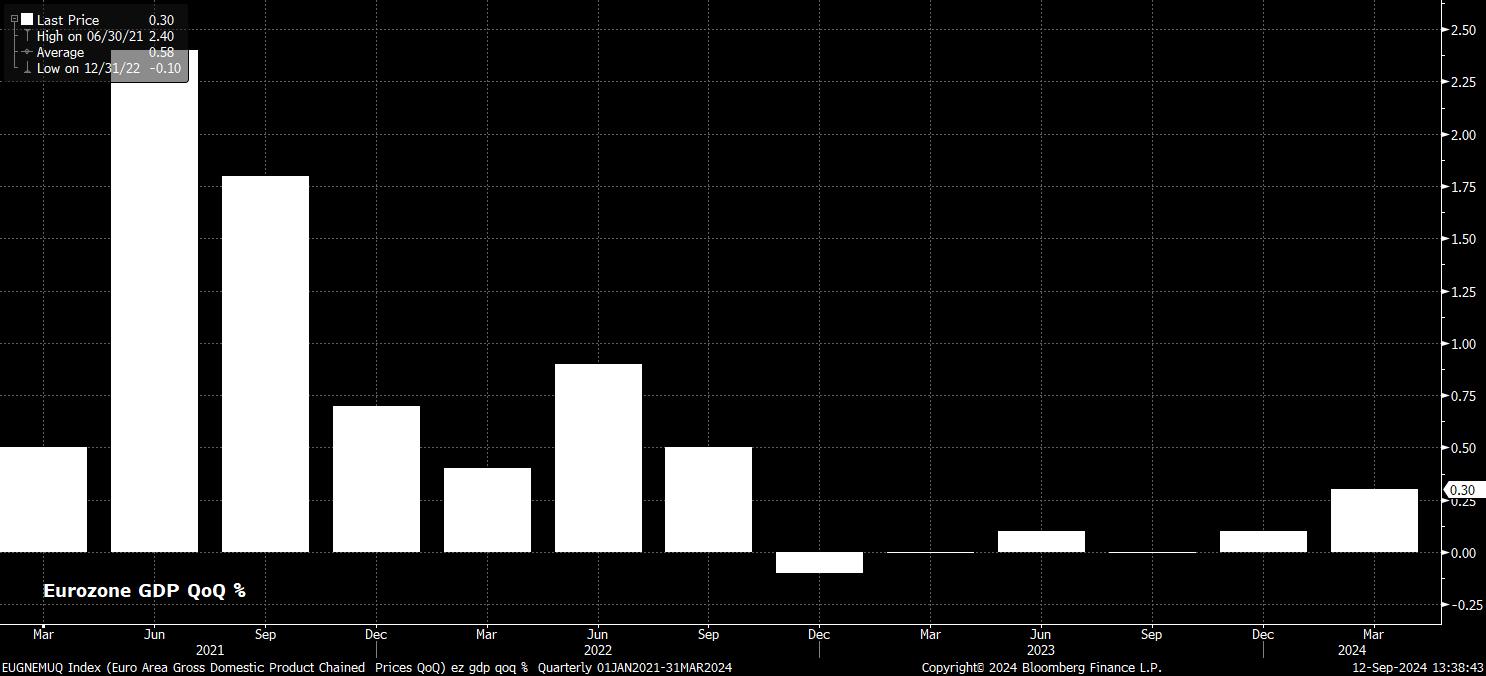

Turning to GDP growth, the projections pointed to a marginally more pessimistic outlook than that expected in June. The eurozone economy is now seen growing by 0.8% this year, 1.3% next, and 1.5% the year after, with all three of those projections 0.1pp below the growth rates expected three months ago.

Naturally, President Lagarde’s post-meeting press conference was also closely watched for clues on the policy outlook.

Here, Lagarde reiterated that policymakers are not pre-committing to a particular path, while also repeating comments from July that eurozone growth risks remain tilted to the downside. Lagarde also noted that today’s decision was “unanimous”, and that the ECB are not “fixated” on a specific data-point, with trends in incoming data of much greater importance. Furthermore, there was "no commitment whatsoever” given on the October meeting, as expected, which is just five weeks away, and where policy settings will probably remain on hold.

Financial markets, broadly speaking, were largely unchanged over the ECB decision itself, and the post-meeting press conference. The EUR was as near as makes no difference flat, with all announcements having been bang in line with expectations, while both the 2-year Schatz and 10-year Bund also saw little by way of notable volatility. Equities, however, did see some downside, with the DAX paring gains to trade back to flat on the day, though such a fall was in sympathy with selling seen on Wall Street after marginally hotter-than-expected US PPI figures, as opposed to any ECB-related catalysts.

On the whole, the September decision is unlikely to prove a game-changer for ECB policy, or for the EUR. That said, the EUR OIS curve still appears a little over-priced, with a further 44bp of easing discounted by year-end, and policymakers instead likely to plot a more deliberate course of removing restriction, probably cutting the deposit rate just once more this year, in December. Were the FOMC to strike a relatively dovish note next Wednesday, this divergence could help to underpin EUR/USD over the medium-term.

Beyond the end of the year, once the deposit rate has reached a more neutral level, disagreement among Governing Council members seems likely to grow, as policymakers debate how loose policy can safely become to support the economy in the face of significant downside growth risks, while continuing to combat the threat of a resurgence in inflationary pressures.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_e_z_intra_2024-09-12_14-29-02.jpg)