- English (UK)

Analysis

April 2025 US CPI: Further Cooling Won’t Force Fed’s Hand

Headline CPI rose 2.3% YoY last month, cooler than consensus expectations for an unchanged 2.4% YoY, while core prices rose by 2.8% on an annual basis. So-called ‘supercore’ prices, meanwhile, aka core services inflation less housing, rose 2.7% YoY in April, a fresh low since early-2021, and a notable decline from the prior 2.9% annual rate.

On an MoM basis, meanwhile, price pressures firmed compared to the previous couple of months, largely a result of tariffs beginning to boost prices across the economy, the impacts of which will continue to show up over the next quarter or two, even though the most drastic trade levies have been dramatically pared back since ‘Liberation Day’. Headline CPI rose 0.2% MoM in April, cooler than expected but still the firmest print since January, while prices excluding food and energy also rose 0.2% MoM over the same period.

Annualising this monthly data helps to provide a better idea of the inflationary backdrop, and underlying price trends:

- 3-month annualised CPI: 1.6% (prior 2.6%)

- 6-month annualised CPI: 3.0 % (prior 3.0%)

- 3-month annualised core CPI: 2.1 % (prior 3.0%)

- 6-month annualised core CPI: 3.0 % (prior 3.0%)

Digging a little deeper into the data, the April CPI report pointed to a continuation of recent trends, with goods price pressures continuing to firm, as core goods deflation came to an end for the first time since the start of 2024, even as core services prices continued to ebb.

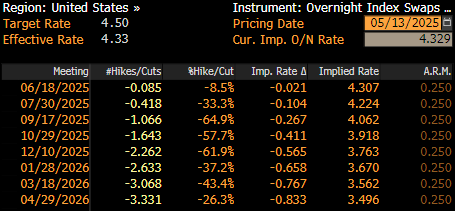

In the aftermath of the data, money markets underwent a modest dovish repricing, though little moves of any significance, with the USD OIS curve continuing to discount two 25bp Fed cuts by year-end, in September and December.

On the whole, the April inflation figures won’t be a game-changer, or anything of the sort, for the FOMC and the near-term policy outlook. Powell & Co. remain firmly in ‘wait and see’ mode for the time being, seeking to sit on the sidelines amid a ‘well positioned’ policy stance, assessing both incoming economic data, as well as changes in trade policy, and digesting how these shifts may alter the balance of risks facing each side of the dual mandate.

Primarily, though, the Committee’s focus remains on ensuring that inflation expectations remain well-anchored as, even in light of the recent reduction in US tariffs on Chinese goods, the substantial rise in the overall average effective tariff rate is near-certain to result in CPI continuing to head higher through the summer.

With these upside inflation risks in mind, as well as the considerable degree of uncertainty that continues to cloud the economic outlook, and the labour market remaining in rude health, the bar to Fed action in the short-term remains a very high one indeed. While the direction of travel for rates remains lower, any cuts before the end of the third quarter seem a very long shot indeed, barring a significant deterioration in labour market conditions and policymakers obtaining sufficient confidence in price pressures remaining contained in the meantime.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.