Analysis

S&P 500 & Nasdaq rise as The Fed’s big week arrives

Market Thoughts – Monday 16th September

Where We Stand – Markets ended last week on a strong footing on Friday, with both the S&P 500 and Nasdaq 100 gaining around 0.5%, as both of the major indices capped their best weeks of the year so far. Weekend news of a second assassination attempt on former President Trump has had next-to-no impact on sentiment though may, at the margin, see a renewed bout of interest in the so-called ‘Trump Trade’, were a subsequent bounce in the polls to follow.

Clearly, participants appear to have reconciled themselves with the idea that the FOMC may not, in the short-run at least, deliver the magnitude of easing that some desire. That said, the ‘Fed put’ remains forceful, with 200bp of room to cut before getting to neutral, and 500bp of room to ease before the zero lower bound is reached. Of course, this is without considering the balance sheet, with it becoming increasingly likely that quantitative tightening ends before the end of the year to avoid the balance sheet, and the fed funds rate, pulling in opposite directions.

In any case, with the Fed looming large on Wednesday, participants are likely to sit on their hands for now, with risk management the priority, and conviction lacking until Powell & Co’s actions are known.

Read my full thoughts on this week’s FOMC meeting here.

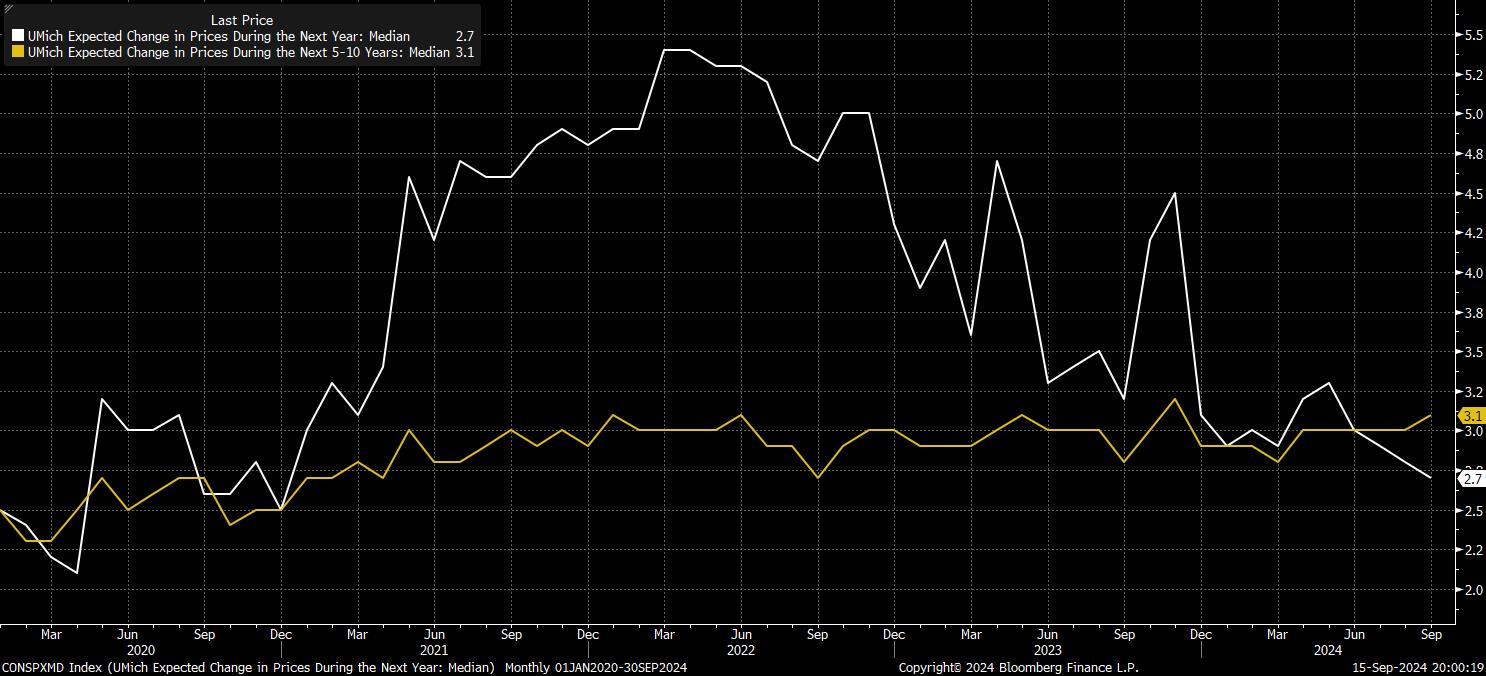

Friday, though, did bring some further positive news for policymakers, as the 1-year inflation expectations component of the UMich consumer survey fell to 2.7%, it’s lowest level since the tail end of 2020. However, a rise in long-run expectations, to their highest level since last November, serves as a handy reminder that the scourge of inflation is not yet fully defeated, and that the Fed would be well-served by plotting a careful course in moving rates back to a neutral level.

Elsewhere, on Friday, Treasuries rallied across the curve, led by the front-end, as 2s fell 6bp amid a dovish repricing of Fed expectations. The USD OIS curve currently prices Wednesday as approx 65% chance of a 25bp cut vs. approx 35% chance of a 50bp cut.

These odds seem far too delicately poised for the FOMC’s liking. Policymakers have shown a distinct desire to minimise volatility over policy decisions this cycle, and said desire seems unlikely to change now, at the most delicate point in the cycle thus far. A ‘sources’ story before Wednesday’s announcement shouldn’t be ruled out, as an attempt to further massage market expectations, one way or the other. My base case remains for a 25bp cut.

The Treasury rally saw some marginal USD softness creep into the G10 FX space though, in keeping with the remainder of last week, price action was relatively contained. This, of course, excludes the JPY, which notched a fourth straight daily gain to close the week, as USD/JPY sunk to its lowest levels of the year, amid ever-stronger signals that the early-August market turmoil shan’t deter the BoJ from further tightening this year. The JPY has further built on these gains this morning, as USDJPY slips under the 140 handle for the first time since last year.

Meanwhile, the EUR traded flat on Friday, despite a frankly ridiculous slate of eleven different ECB speakers - including Luxembourg central bank Governor Reinesch speaking for the first time since 2015. It’s a tough life for some!! Predictably, all GC members stuck to the ‘data dependent, meeting-by-meeting’ script, with an October cut seemingly not under serious consideration.

In the commodities space, gold continued its recent ascent, as the yellow metal notched fresh all-time highs in the spot market. While the rally appears to lack an obvious catalyst, long gold appears to have become a momentum trade once more, in a similar fashion to the price action seen earlier in the year. Though the fundamentals do not appear to align with the move, it is one that feels tough to fade, at least while spot remains north of the prior $2,530/oz range highs.

Look Ahead – A quiet day likely awaits, with the economic docket lacking top-tier releases, and participants likely loath to do anything too significant or sizeable, ahead of Wednesday’s FOMC decision. Twiddling our thumbs might well be how most investors spend the day.

In terms of planned events, this afternoon’s US NY Empire Manufacturing Index may be of some interest, as a useful leading indicator for the broader ISM manufacturing gauge, and ahead of some of the other regional Fed manufacturing surveys due later in the month. It’s tough to imagine the data being market-moving, however.

The same could also be said of today’s scheduled ECB speakers, including Chief Economist Lane, Deputy Governor de Guindos, and Exec. Board member Panetta. Any deviations from the recent script by these three ‘big-hitters’ would be incredibly surprising, and is also highly unlikely.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_sp_2024-09-15_20-00-22.jpg)