- English (UK)

Analysis

2025 Outlook: Eurozone – Questioning When ‘Peak Pessimism’ May Come

Looking ahead, it seems somewhat unlikely that these themes will significantly shift moving into 2025, at least not in the early part of the year.

In terms of economic growth, risks to the eurozone outlook remain firmly tilted to the downside, while also being incredibly numerous in nature. From a geopolitical perspective, tensions in the Middle East, as well as the ongoing war in Ukraine, are both likely to pose relatively stiff headwinds, particularly with a sustainable resolution to either conflict seemingly not on the cards at present.

Meanwhile, the continued lack of a significant economic recovery in China will likely also pose significant headwind to the bloc, with the manufacturing and luxury goods sectors remaining the most exposed. While further Chinese fiscal stimulus is likely in 2025, measures thus far have been focused on providing support to financial markets, as opposed to putting a much-needed floor under the ‘real’ economy.

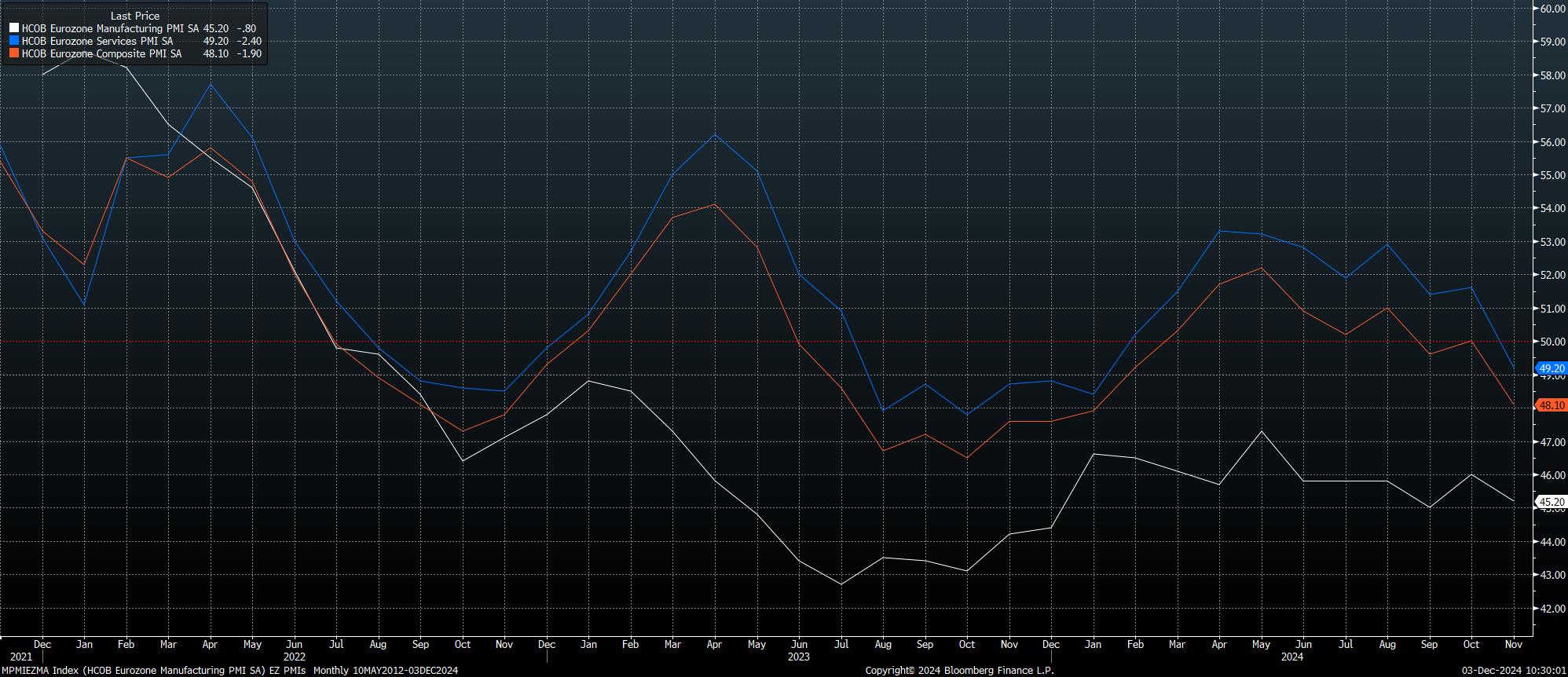

With this in mind, the economic outlook remains a dour one, with all three of the PMI surveys now residing firmly in contractionary territory, in the short term things could get worse before they get better.

Presenting further downside risks is the bloc’s political backdrop, which has soured significantly in recent weeks.

Next year, in February, Germany will head to the polls, after the recent collapse of the current governing coalition. While the SPD are unlikely to be returned as the largest party, there is every chance that they feature once again in a new coalition, likely led by the CDU, particularly if parties see a need to join another multi-party government in order to prevent the far-right AfD from achieving power. Nevertheless, the lead up to, and likely protracted negotiations after, the election will result in effective governmental stasis over the short-term.

Meanwhile, in France, the political backdrop is similarly tumultuous. PM Barnier’s decision to force through a Budget encompassing €60bln of spending cuts and tax hikes has led to a no confidence motion being tabled, which is near certain to pass. The likely toppling of the government, however, shan’t immediately trigger fresh elections, which can’t be legally held for another 12 months. Hence, further legislative logjam is likely, as the budget deficit continues on a path towards a whopping 6% of GDP, double the EU’s ostensible limit.

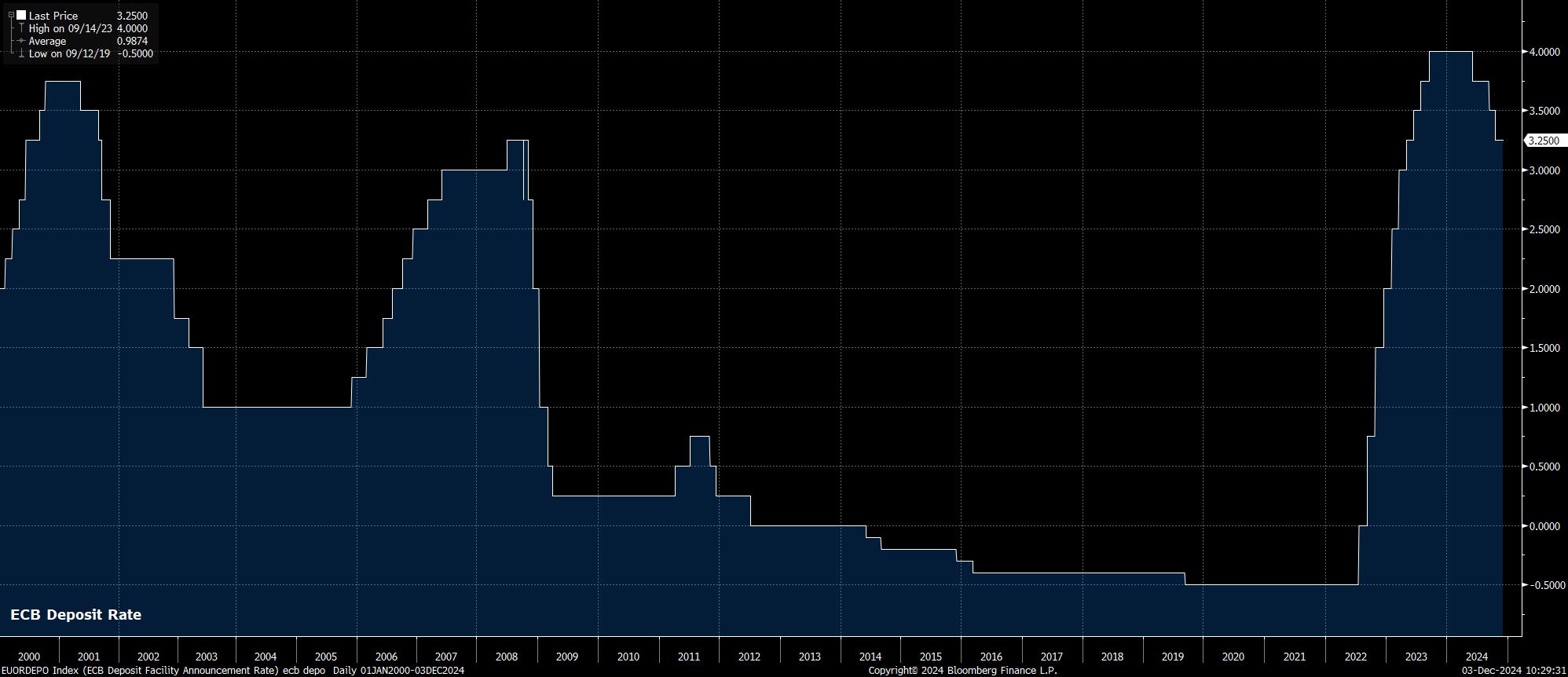

The dismal growth, and uncertain political, backdrops create something of a headache for ECB policymakers, who continue to lower rates in relatively predictable fashion, back towards neutral.

As is always the case, precisely estimating the neutral rate is a near-impossible task, though said rate is likely around 2% in the eurozone. With policymakers so far showing little desire to deviate from the current path of cutting by 25bp at every meeting, neutral is likely to be achieved next April. Consequently, debate among policymakers and market participants alike is set to turn to whether the ECB need lower rates below neutral, into outright ‘loose’ territory.

Such a scenario seems likely at present, not only in an attempt to prop up growth, and to somewhat insulate the bloc from political uncertainties, but also due to faster than expected disinflation, as price pressures return towards the ECB’s 2% target.

Though headline CPI ticked higher to 2.3% YoY in November, per the ‘flash’ reading, said increase was largely due to an increase in wholesale and consumer energy prices, which policymakers should look through. Instead, Lagarde & Co will continue focusing on core CPI, which rose 2.7% YoY over the same period, its joint lowest level since February 2022.

Risks, however, on the inflation front, appear firmly tilted towards a potential undershoot of the inflation aim, particularly as the economy continues to lose momentum, with recent weakness in the manufacturing sector now also becoming increasingly evident in the all-important services sector too.

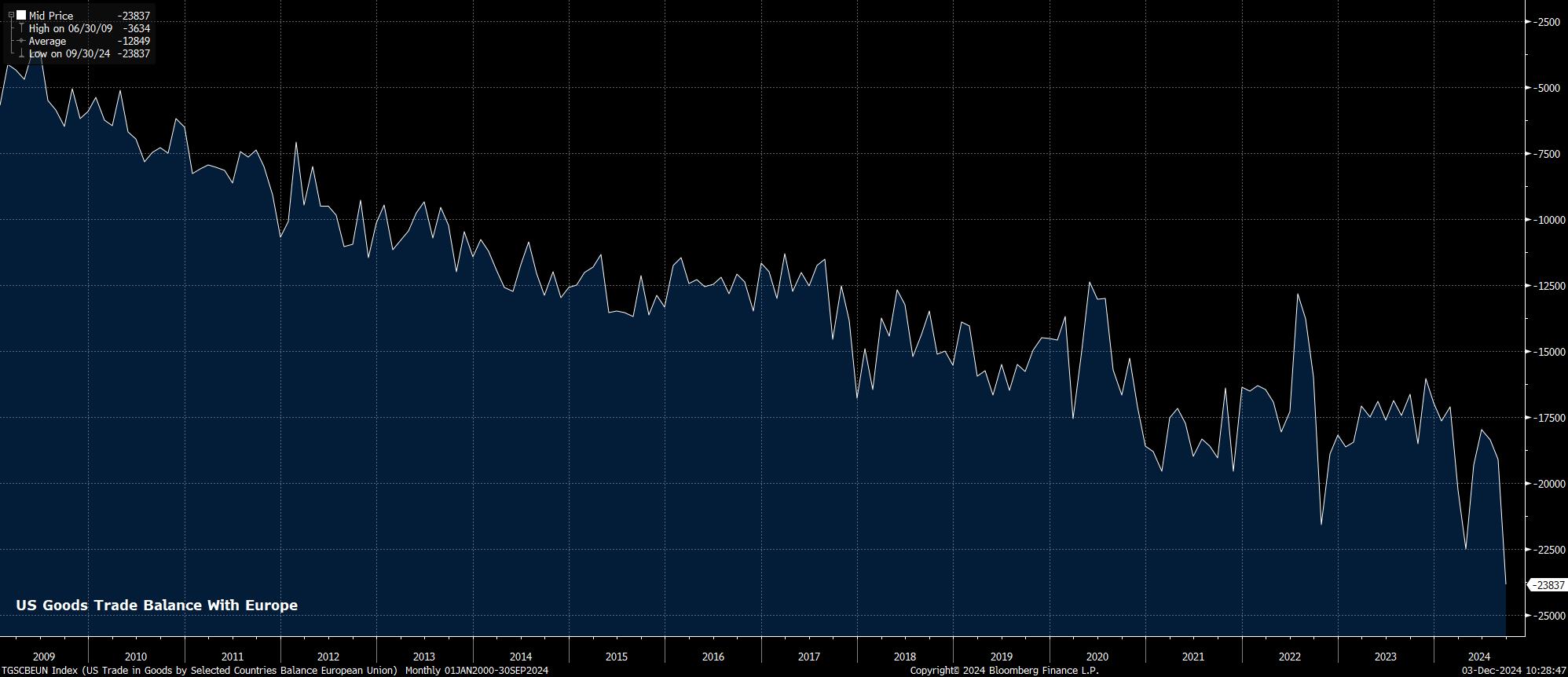

Perhaps the biggest risk to the inflation, and growth, outlooks comes from the potential for another tit-for-tat trade war with the US. Incoming President Trump’s preference to impose tariffs apparently on a whim in order to bring trading partners to the negotiating table is well known, with China, Canada, and Mexico having already faced Trump’s ire, well before inauguration day.

It would be logical to expect that the EU become Trump’s next target, likely posing a further headwind to growth, but also bringing with it the possibility for a resurgence in price pressures, thus leaving ECB policymakers to grapple with a potentially stagflation-esque macro backdrop, particularly when the EU’s political leadership vacuum means any potential trade war is set to be prolonged.

At face value, none of this is particularly positive for eurozone assets. However, the key question with which market participants must grapple next year is one of when sentiment surrounding the bloc reaches a point of ‘peak pessimism’. A tell-tale sign of such a scenario would be stretched short positioning, and a blow-off bottom in the EUR/USD.

Were such a scenario to come to pass, it would evidence a market that has priced an adequate degree of risk and negative catalysts, and one that would no longer be as sensitive to incoming pessimistic news flow as seen in 2024. One would expect that such a ‘peak pessimism’ point is reached before EUR/USD falls to parity, at which point the aforementioned crowded positioning would likely spark a rebound as shorts unwind. A potential scenario under which this could occur may come as a result of more substantial ECB easing being seen to underpin economic growth, and/or as a potential trade war fails to escalate to as significant a degree as markets currently expect.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.