Choosing the best MT4 broker for your trading

Choosing an MT4 broker doesn’t have to be complicated—this guide breaks down all the essentials, from platform stability to trading tools, to help you make a confident decision. With options like Pepperstone's low-latency, transparent fees, and advanced resources, you're set to kick off a seamless MT4 trading experience.

Why trade with MT4?

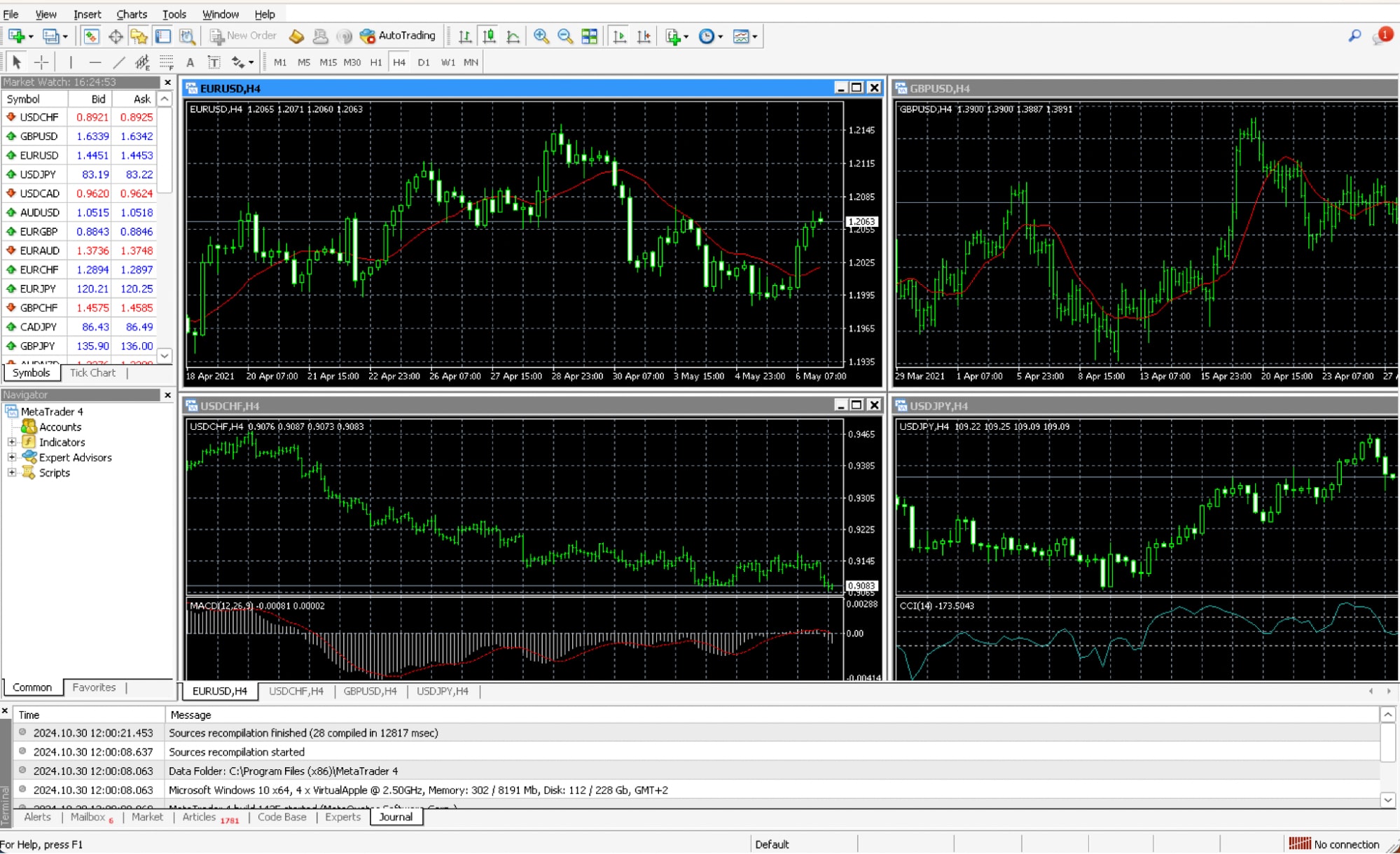

MT4 (MetaTrader 4) has earned its reputation as a leading trading platform, providing traders with flexibility, speed, and tools that are hard to beat. Its user-friendly interface, combined with powerful analysis tools, makes it ideal for beginners and experts alike.

Plus, with its global popularity, MT4 brokers like Pepperstone are equipped to offer stable, reliable experiences tailored to any trading style. Whether you're into fast-paced scalping or longer-term strategies, MT4’s charting capabilities and customisable tools, like automated trading and add-ons, make it the go-to choice for anyone serious about trading.

All you need to know about picking an MT4 broker

Picking the right MT4 broker begins with evaluating the essentials. Here’s a breakdown of what matters most:

- Platform Stability: A stable platform is non-negotiable. You want to trust that your MT4 broker can handle high traffic, market peaks, and unexpected shifts without crashing or freezing. Top brokers like Pepperstone have systems designed to handle large volumes, ensuring stability even during intense market activity.

Hint: You are a fundamental news trader and you're watching the markets reacting to major economic news like a central bank decision. A stable platform lets you respond instantly rather than missing the opportunity.

- Execution Speed and Low Latency: Fast execution isn’t just a perk; it’s essential for reducing slippage, especially for high-frequency traders. Slippage—when a trade executes at a different price than intended—can chip away at profits. Choosing a broker with servers close to trading hubs like London or New York minimises delays.

Hint: Scalpers who aim to profit from quick, small price movements benefit from ultra-low latency. A slight delay could mean a loss rather than a gain on each trade.

- Security and Regulation: Only trust brokers regulated by well-established authorities. A regulated broker provides safeguards for your funds, adheres to ethical standards, and has a track record of compliance.

Why choose Pepperstone as your MT4 Broker?

- Rock-Solid Platform Stability: Pepperstone’s platform is designed to handle the busiest trading days with ease, so you can trade confidently—even during wild market moves.

- Fast Execution for Fast Thinkers: With ultra-low latency servers, trades are executed lightning-fast, helping you avoid slippage. Ideal if you’re a high-frequency trader or just value quick response times.

- Transparent, No-Nonsense Pricing: Whether you’re on a Razor or Standard account, Pepperstone keeps costs low and clear, so there are no surprises.

- Trusted Regulation and Security: Regulated by the FCA, BaFin, SCA, CMA, ASIC, and CySEC, Pepperstone prioritises your safety and trust, so you can trade with peace of mind.

- Advanced Tools to Stay Ahead: Get access to Autochartist, Smart Trader Tools, and more—giving you valuable insights right when you need them.

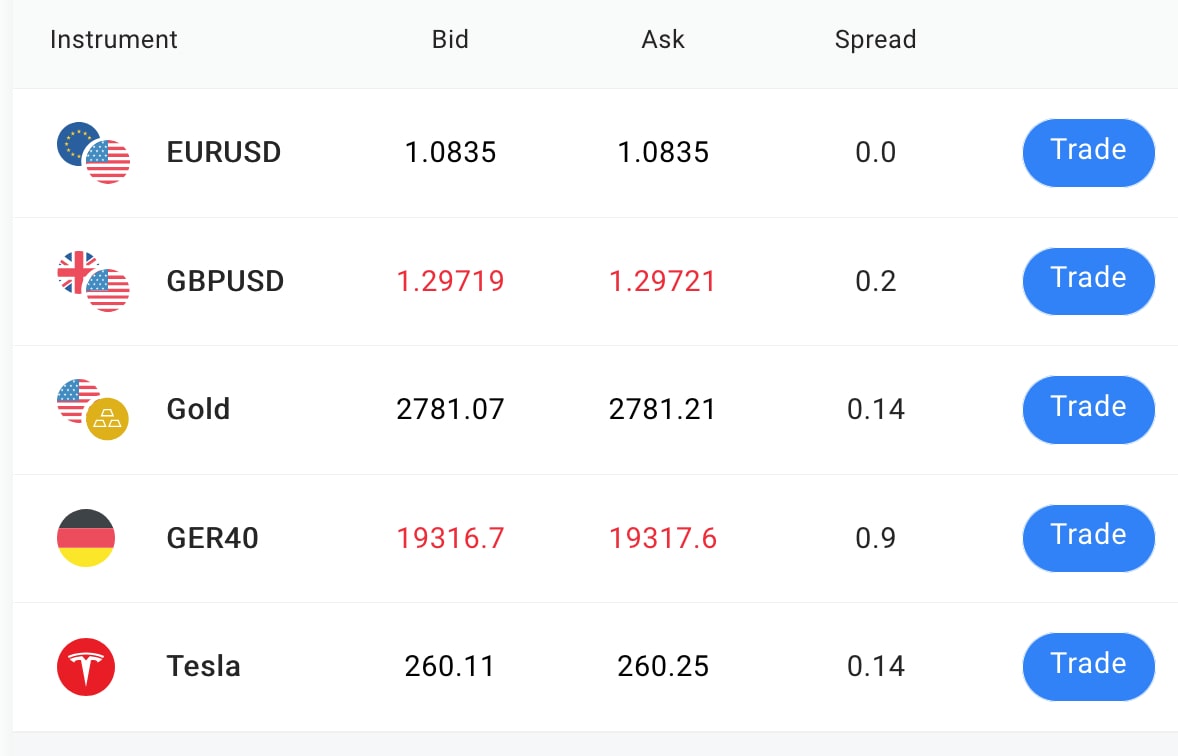

- A World of Assets to Trade: Choose from a wide range of assets, from forex, indices, and commodities to shares, crypto, and ETFs. With this variety, you’ve got options to fit every strategy and market trend.

- Education That Empowers: Whether you’re new to trading or looking to level up, Pepperstone’s webinars, tutorials, and guides are here to help you make informed moves.

- 24/5 Support from Real Experts: When you need guidance, Pepperstone’s team is ready to help with quick, reliable support for all things MT4.

Selecting the right MT4 broker: A complete guide

Beyond the basics, there are additional elements to look for that can enhance your trading experience. Let’s dive into the specifics:

- Account Types & Fee Transparency: Brokers offer various account types to cater to diverse trading strategies. Look for transparent pricing structures and options that fit your frequency and style. Pepperstone offers Razor and Standard accounts, with Razor featuring low spreads, making it ideal for high-frequency traders and those with a keen eye on costs.

Hint: A high-frequency trader might benefit from Pepperstone’s Razor account with lower spreads, whereas a casual trader may prefer the Standard account.

| Razor | Standard | |

| Trading Platform | cTrader, TradingView, MetaTrader 4&5 | cTrader/MetaTrader 4&5 |

| Commission (FX Only) | 2.60 EUR (per lot, per side) | No commission |

| Spreads | Raw (from 0) | Variable |

| Max Leverage for Retail Clients | 1:30 | 1:30 |

| Account currencies | USD, EUR, GBP, CHF | USD, EUR, GBP, CHF |

| Instrument Offered | 1200+ | 1200+ |

| Stop Out Level (Retail) | 50% | 50% |

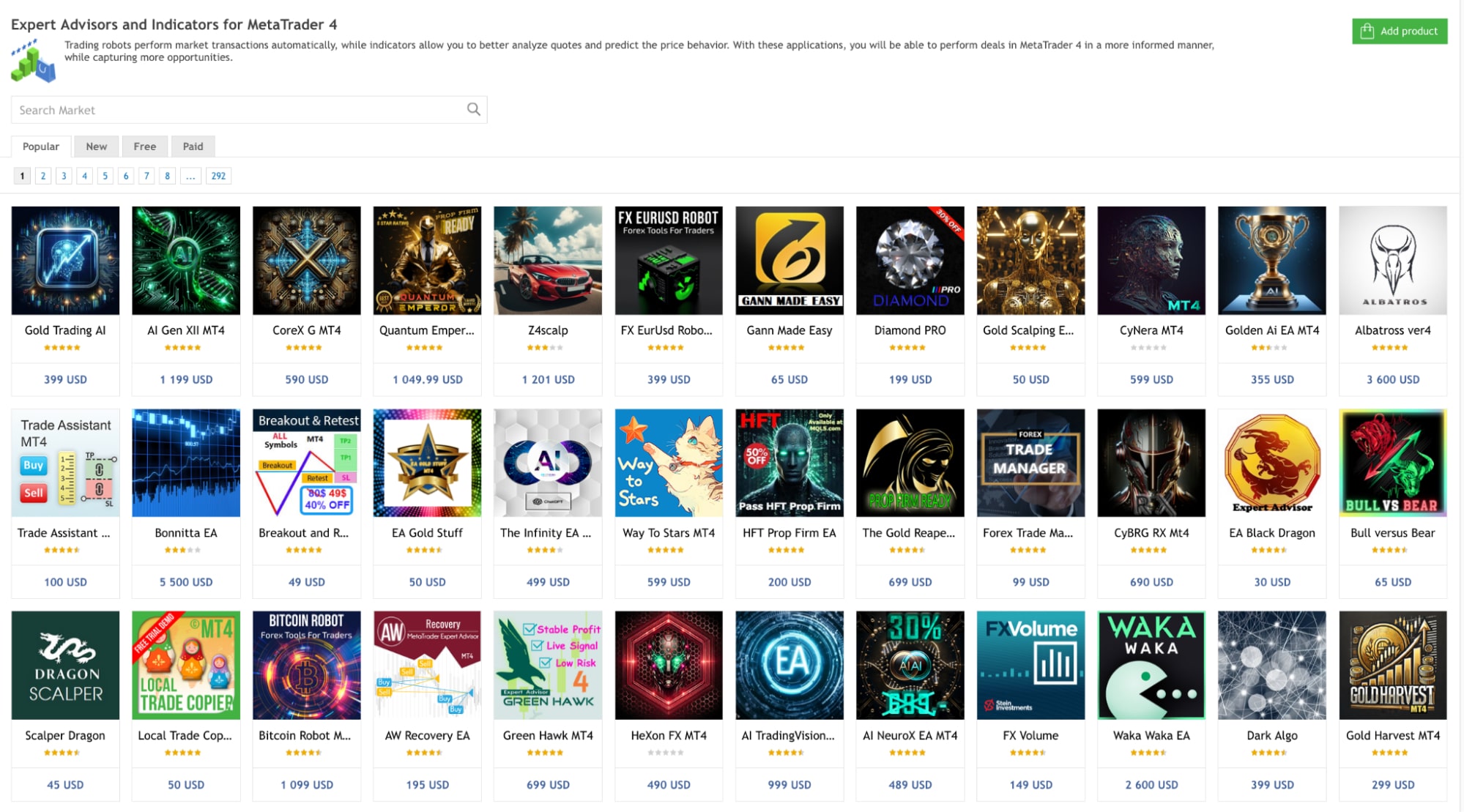

Advanced Trading Tools and Add-Ons: The best MT4 brokers offer tools that give you an edge. Look for additions like Autochartist for pattern recognition, Smart Trader Tools for custom indicators and alarms, and economic calendars that keep you informed. These are essential if you want real-time insights and tools to maximise your MT4 experience.

Hint: If you use technical analysis heavily, Autochartist can help you identify profitable chart patterns quickly, saving you time and boosting your efficiency.

Educational Resources: Look for brokers who support your learning journey with webinars, tutorials, and resources geared towards all experience levels. Pepperstone’s webinars and in-depth guides are designed to help you stay on top of trends, whether you’re a novice or a seasoned trader.

What should I look for when comparing brokers?

Use this checklist to find the best match for you:

☐ Pricing and Spreads:

Transparent pricing is key, especially if you’re trading frequently. Take a look at spreads and commission rates, and check if the broker offers fixed or variable spreads. Pepperstone’s Razor account, for example, has low, variable spreads that can make a big difference for cost-conscious traders.

Hint: For traders who make dozens of trades daily, even a small difference in spreads can significantly impact the bottom line.

☐ Execution Speed and Reliability:

Fast, reliable execution can make a huge difference—especially in a fast-moving market. The best brokers have infrastructure that keeps your trades smooth and avoids slippage, even when volatility spikes.

☐ Support and Assistance:

When you need answers, you want a team that’s quick, helpful, and knows MT4 inside and out. Look for brokers that offer 24/5 support with experts who can help you get the most out of MT4’s tools.

☐ Regulation and Security:

Your peace of mind matters. Top brokers are regulated by reputable authorities, which means they’re held to strict standards. Look for brokers regulated by the FCA, ASIC, CySEC, or similar bodies for added security.

☐ Extra Features:

A little extra goes a long way! Some brokers offer added perks like copy trading, VPS hosting (for running your EAs smoothly), or social trading, so you can follow and learn from top traders. These extras can make trading easier and more interesting.

☐ Educational Resources and Market Insights:

Learning never stops in trading. Quality brokers offer solid educational resources—think webinars, trading guides, and market insights—to keep you informed and help you hone your skills. Look for those that go the extra mile to offer real-time market updates too.

☐ Customisation Options:

MT4 is all about flexibility, so a good broker should let you really make it your own. Check if they offer access to an MT4 library where you can find scripts, indicators, and EAs to tweak and customise your trading setup.

☐ Account Types and Leverage Options:

Different trading styles call for different account types and leverage options. Whether you’re after standard, ECN, or other specialised accounts, make sure your broker has the flexibility you need. And remember, leverage is powerful but comes with risk—choose a broker that lets you set your leverage level to match your comfort zone.

Getting started with MT4: The basics

Whether you’re a beginner or transitioning from another platform, setting up MT4 with a broker should be straightforward. Here’s what to expect:

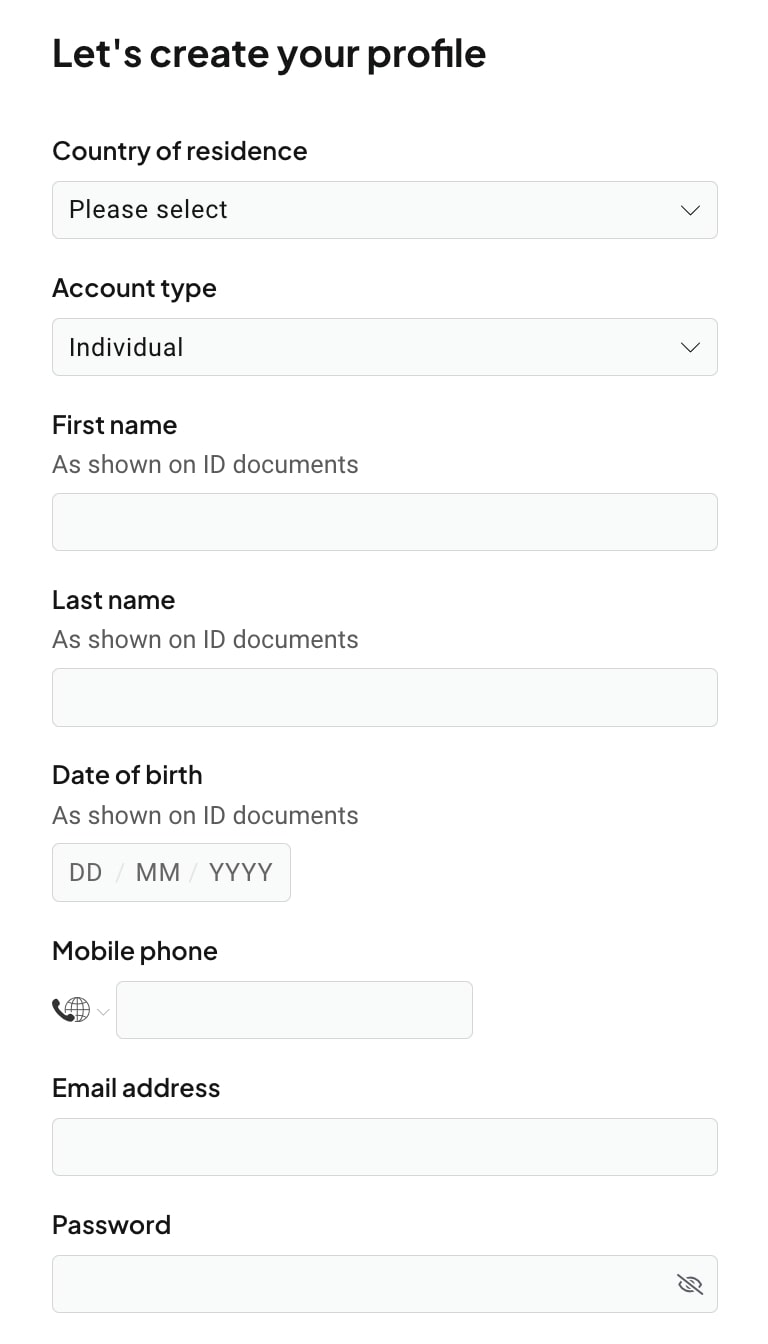

Step 1: Open a Pepperstone Account

Begin by opening a trading account.

- Complete the registration form, providing the required details such as name, email, and contact information.

- Verify your identity: In order to process transactions, we will require proof of address and identity documents. Follow the on-screen instructions to upload the necessary documents.

- Once registered, check your email inbox for a confirmation message from Pepperstone containing your login credentials and further setup instructions.

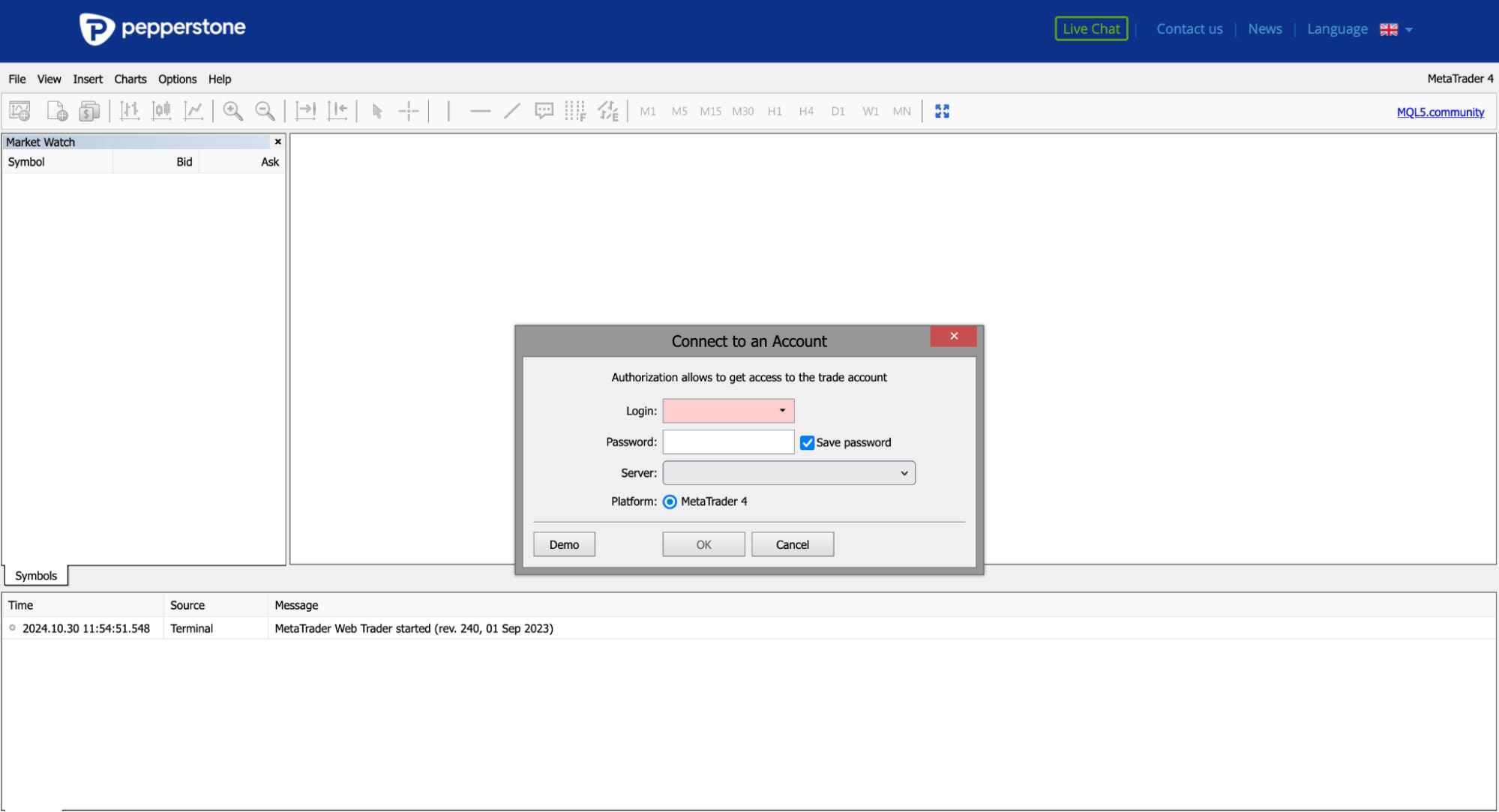

Step 2: Download and install the MT4:

Choose your platform and follow the instructions to download or access the platform:

Step 3: Login and Access MT4

Use your login details to log into MT4. This includes your Trading Account number and Password. You’ll also be able to see your base currency and leverage details inside the email.

Step 4: Customisation

Begin tailoring MT4 to suit your trading style. Adjust charts, set timeframes, and add indicators that align with your strategy. Head to the MT4 library to explore scripts and Expert Advisors (EAs) that automate parts of your trading process, adding even more flexibility to your workspace. MT4’s adaptability lets you create a setup that feels just right for you.

Step 5: Demo Accounts

Set up a demo account to practise in a risk-free environment. A demo account mimics real market conditions, allowing you to test your strategy without risking capital. Open a Pepperstone demo account for an authentic experience with simulated market trades.

Step 6: Placing Your First Trade

Practise placing trades on MT4 using your demo account. Familiarise yourself with different order types, like market, limit, and stop orders. Once confident, you can proceed to live trades with your chosen strategy.

Ready to Choose your MT4 broker?

Get Started with Pepperstone and Trade CFDs with Confidence

Frequently Asked Questions (FAQs) about MT4

What features make an MT4 broker reliable?

When it comes to reliability, you’re really looking at the full package: trustworthiness, reputation, and features that support a smooth trading experience. Think regulation, support, platform stability, and tech that minimises glitches. Pepperstone, for example, backs its MT4 offering with industry-leading security, 24/5 support, and a reputation built on being a top-tier, user-centred broker.Look for brokers that offer low-latency servers, especially those close to financial hubs, and add-ons like Smart Trader Tools or Autochartist to help with analysis.

How important is low latency and fast execution for MT4 trading?

Quick answer? Essential. Latency and execution speed are the backbone of MT4 trading. Lower latency means you’re seeing the freshest data, and faster execution reduces the chances of slippage. This is particularly useful for anyone trading in fast-moving markets like forex, where every millisecond counts. So, a broker with a strong, low-latency network like Pepperstone is a major asset.

What benefits do Smart Trader Tools provide for MT4 users?

The Smart Trader Tools add a whole new dimension to MT4. They’re like a powerful toolkit, with features that range from automated alerts to in-depth charting and market insights—ideal if you want to dig deeper or automate parts of your strategy. These tools can give you a leg up, helping you to trade smarter, not harder.

How does having no dealing desk intervention impact trading?

No dealing desk intervention means trades go straight through to the market without broker interference. This usually translates to better pricing, fewer conflicts of interest, and, generally, a more transparent trading experience. For anyone serious about trading, it’s a no-brainer.

Are there significant differences between MT4 demo and real accounts?

In a word, yes. A demo account lets you practise with virtual money, so it’s low risk. But when you switch to a real account, you’re working with actual market conditions, real emotions, and live pricing. While MT4 demo accounts are incredibly valuable for practice, real accounts reflect the true ebb and flow of the market, complete with slippage and real-time execution.

How many CFD instruments should a good MT4 broker offer?

A solid MT4 broker should offer a wide range of instruments. The broader the selection, the more opportunities you’ll have to diversify your portfolio. Look for brokers offering CFDs across forex, indices, commodities, and shares – the essentials for a full range of trading options.

What differentiates MT4 brokers from others?

MT4 brokers stand out due to the platform itself—it’s intuitive, reliable, and packed with customisable features, making it a trader favourite. Add to that things like access to Smart Trader Tools, tight spreads, reliable customer support, and no dealing desk execution, and you’ve got the cream of the crop.

^Figure based on 600,000+ registered account holders as at August 2024The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.