- English

- Italiano

- Español

- Français

Analysis

It is for this reason that the continued bear steepening of the curve – where long-end yields rise faster than their counterparts at the front-end – should be attracting more attention than it currently appears to be getting.

While that view of the curve in its entirety shows the bear steepening in question, zooming in to a segment of it makes things clearer still. Take, for instance, the 3m10y spread below.

Of course, the most important thing among all this is what the bear steepening may actually mean, and its potential implications. On this note, we must dive down into the rabbit hole that is financial plumbing, and liquidity.

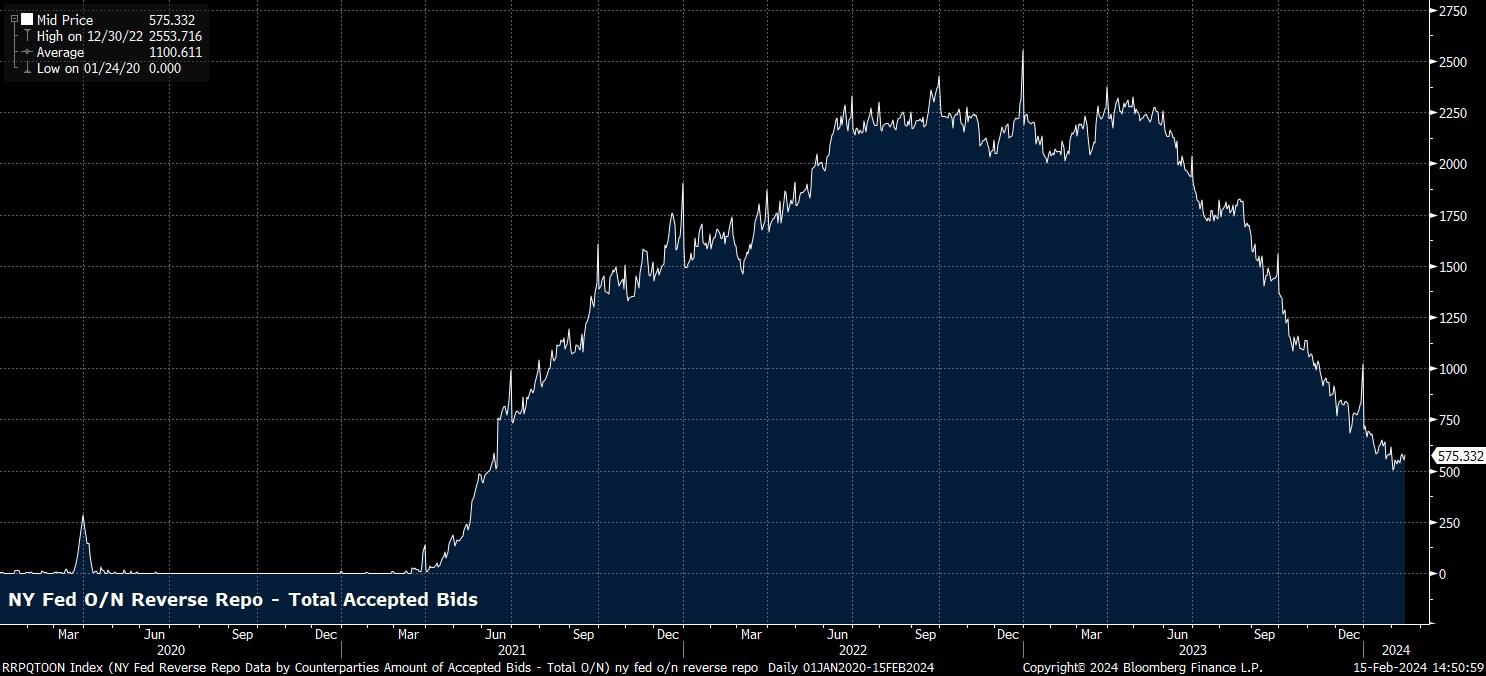

In layman’s terms, were the bear steepening to continue, as one may expect with front-end rates anchored by the Fed’s policy stance, and rate cuts unlikely until the spring, this should continue to increase the relative attractiveness of short-term debt (e.g. bills), particularly for money market funds, in turn likely resulting in a faster rundown of the Fed’s overnight reverse repo facility, usage of which has already fallen to a quarter of its peak level.

This, overall, amounts to liquidity being drained from the market. This reduction in liquidity leads to two conclusions – firstly, an increase in the chances of potential financial instability, particularly as the impact of prior hikes this cycle continues to be felt; and, secondly, being a potential headwind for riskier assets to battle, with the link between equity performance and liquidity remaining a close one, as the below chart shows.

However, while these near-term considerations are important, there are some longer-run factors that should also be borne in mind, particularly with the FOMC set to begin more formal discussions over the process of balance sheet rundown, and quantitative tightening (QT), at the March meeting.

The focus for policymakers remains ensuring that reserves remain above what has been termed the “LCLoR” – the lowest comfortable level of reserves, in plain English. While such a level is hard, perhaps impossible, to measure, it’s important to note that a more rapid pace of RRP rundown is likely to result in a higher level of bank reserves. In turn, this may lead to the Fed enacting QT for longer, allowing the current weaker liquidity backdrop to continue, and potentially posing a headwind to risk as a result.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.