- English

- Italiano

- Español

- Français

Analysis

The Week That Was – Themes

The US inflationary backdrop was participants main focus last week, with cooler than expected core CPI, and PPI, figures sparking a modest dovish reassessment of FOMC policy expectations, though caution remains advisable.

Core CPI rose 3.2% YoY in December, the slowest such pace since last August, in further evidence of the relatively bumpy and uneven disinflationary process continuing. That said, at the same time, headline prices rose at their fastest rate in six months, climbing 2.9% YoY as 2024 drew to a close.

Clearly, the US economy remains far from being ‘out of the woods’ when it comes to stamping out persistent inflation, particularly with upside inflation risks remaining numerous, including those that may stem from the potential imposition of tariffs under President Trump, as well as continued tightness in the labour market. Furthermore, it is important to recognise that the components of the PPI and CPI releases which feed into the PCE metric, the FOMC’s preferred inflation gauge, were relatively hot, likely giving the Committee continued cause for concern.

Consequently, a ‘skip’ at the January meeting remains the most likely scenario, though participants do now assign around a 3-in-10 chance to the possibility of a cut in March, largely spurred on by comments from influential Fed Governor Waller that the aforementioned data was “very good”, and that cuts in the first half are possible if more data of this ilk were to be released.

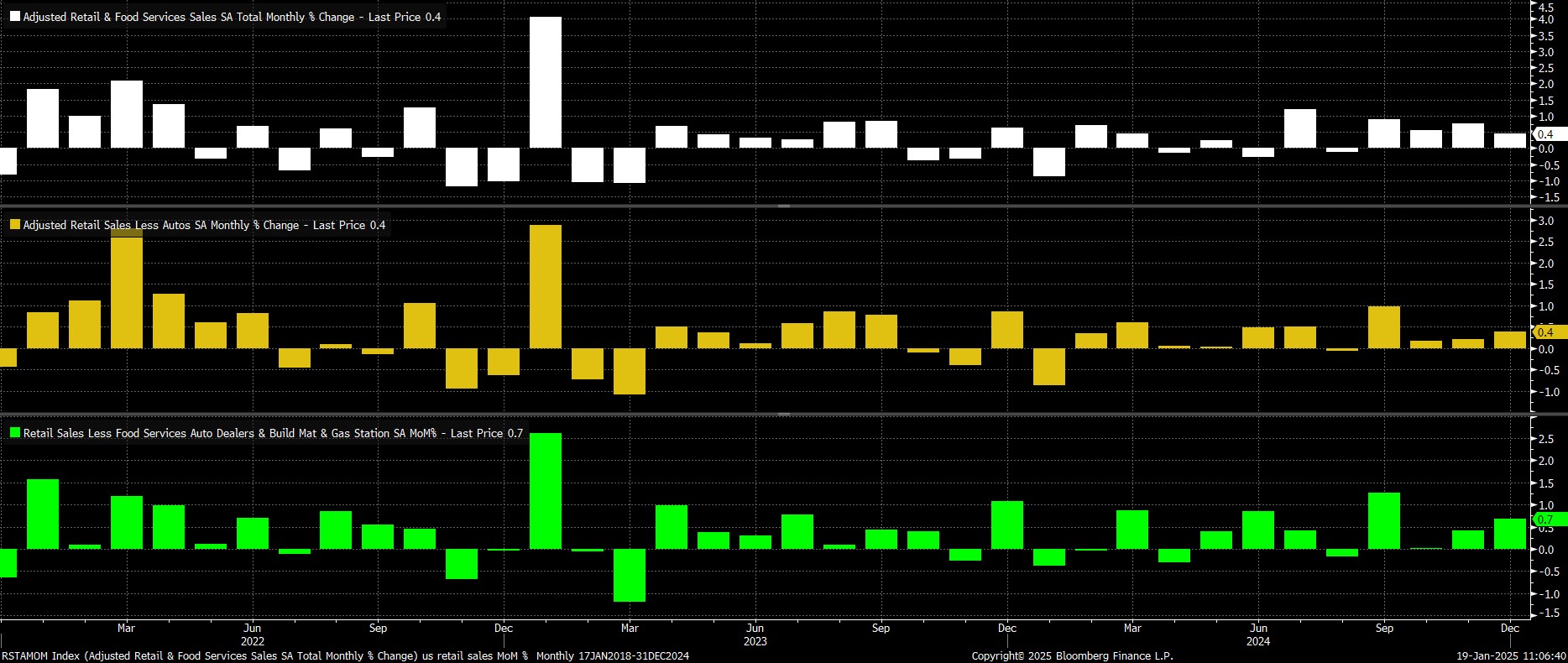

While there is, of course, still a long way to go before the March FOMC, the US economy right now is not one that appears to be screaming out for additional rate cuts, on top of the 100bp of easing that policymakers delivered at the back end of 2024. The December retail sales figures were useful evidence of this, with control group sales (the basket which feeds into the GDP release) having risen 0.7% MoM, even if headline sales, at 0.4% MoM, were a touch softer than expected.

On the whole, incoming President Trump is being handed something of a goldilocks economic inheritance by his predecessor – a labour market that remains tight, adding jobs at a very healthy clip; inflation which continues to move in the right direction, albeit in bumpy fashion; and, a US consumer which remains buoyant, underpinning the broader economic expansion. Not a bad backdrop against which to begin your final four years in the Oval Office.

Sadly, ‘goldilocks’ is not a word that one could reasonably use to describe the state of the UK economy at present. Last week brought something of a data deluge, which once more painted a relatively grim picture of UK Plc.

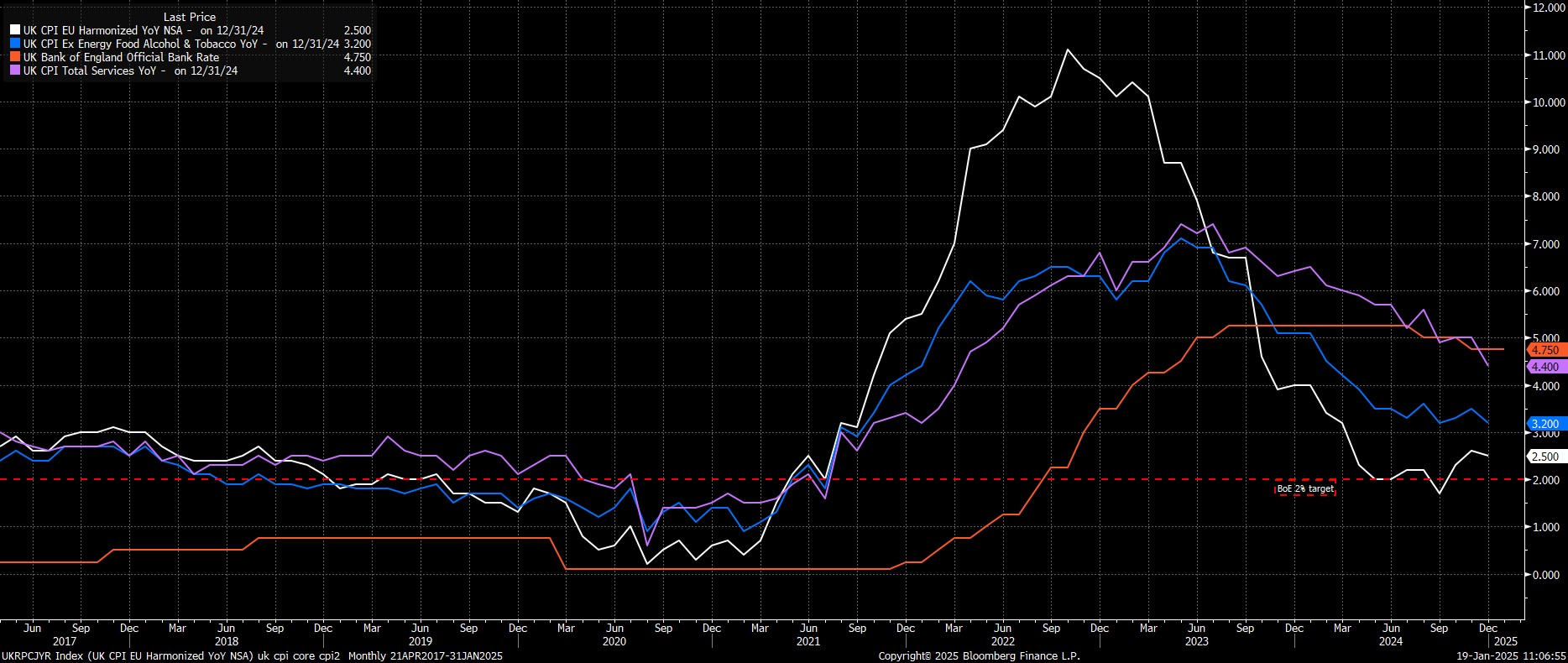

To start with the good news, headline inflation slowed 0.1pp to 2.5% YoY in December, modestly below market expectations, albeit in line with the BoE’s own forecasts. Likely of more interest to policymakers, though, were the falls in core and services inflation, to 3.2% YoY and 4.4% YoY respectively, which will have been particularly pleasing given the MPC’s continued focus on eradicating persistent underlying price pressures from the UK economy. The GBP OIS curve, incidentally, now implies around a 92% chance of a 25bp cut in February, while also discounting 65bp of easing by the end of the year.

That, though, is where the optimism ends.

Firstly, the faster than expected pace of disinflation in the aforementioned CPI figures was largely due to statistical quirks, particularly the early December survey date used by the ONS, as well as the choice by the statistics agency to measure airfares on Christmas Eve, and New Years Eve, which together cut around 0.2pp from the headline inflation metric. There is likely to be a payback from this in the form of higher inflation come the January reading, mid next-month.

Meanwhile, the latest GDP figures were rather grim. The economy grew just 0.1% MoM in November which, while snapping a run of back-to-back monthly contractions, is not something that is particularly worth celebrating, especially considering that the economy stagnated over a rolling 3 month period from September to November. Once again, we see in ‘hard’ data the impacts of both the Government ‘talking down’ the economy since their election, as well as the potential early impacts of October’s tax-hiking Budget. With sentiment surveys, among both businesses and consumers, having remained pessimistic since, there appears to be little sign of reprieve on the horizon any time soon.

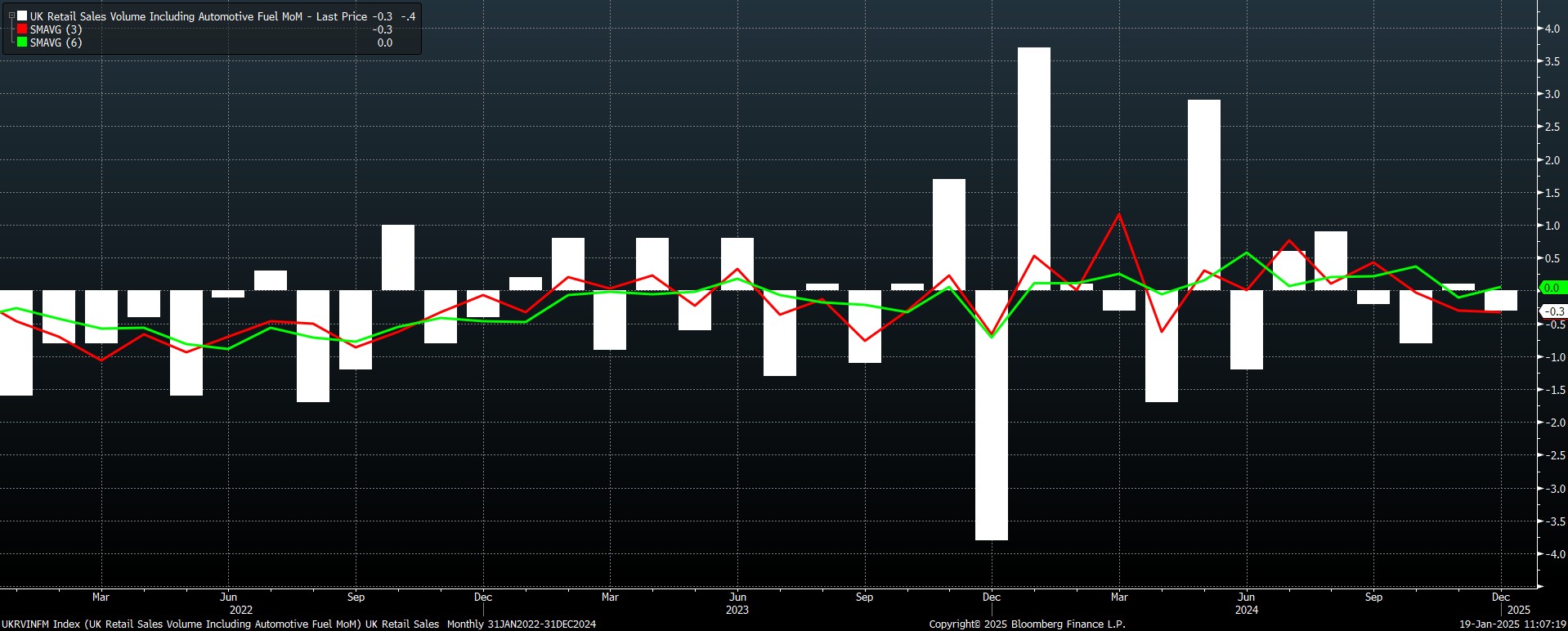

In any case, if GDP was grim, December’s retail sales report was nothing short of ugly. Headline sales fell 0.3% MoM in the final month of the year while, excluding fuel, sales fell by a chunky 0.6% MoM.

These declines are of particular concern when one considers that December is typically a strong month for consumer spending, while the figures also mean that sales volumes did not grow at all in 2024. Clearly, the UK consumer remains rather cautious, with the data also raising the chances that the UK economy at large contracted in the final three months of last year.

Perhaps counter-intuitively, the figures did actually provide something by way of reprieve for beleaguered Chancellor Rachel Reeves. Heightened growth concerns saw benchmark 10- and 30-year Gilt yields fall around 20bp apiece last week, soothing some concerns about the UK’s perilous fiscal backdrop. The FTSE 100 also ended the week at a fresh record high, though this had more to do with the continued slide in the value of the GBP, than any particular surge in economic optimism. As the old adage goes, the stock market is not the economy.

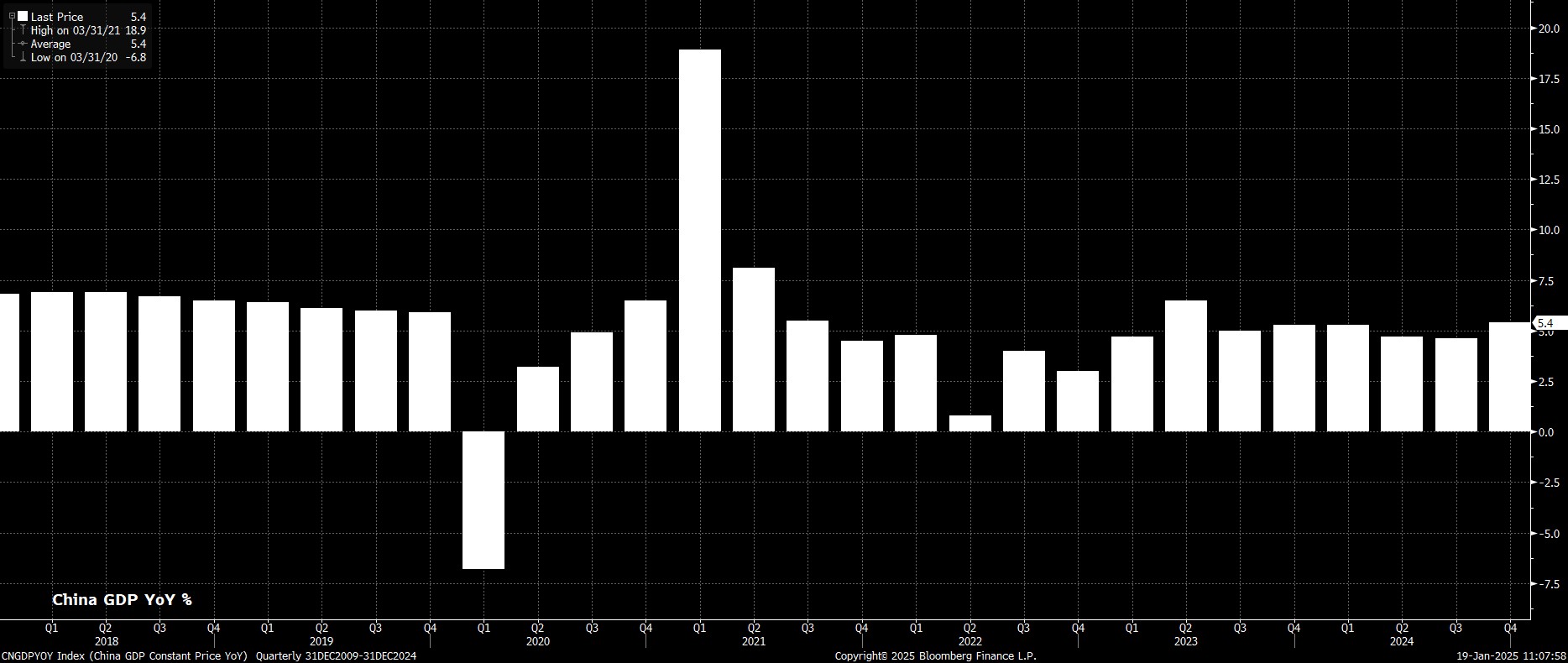

On the subject of growth, though, it’s worth noting that Chinese data surprised to the upside last week, with the economy growing 5.4% YoY in the final quarter of 2024, and achieving the Government’s 5% annual GDP growth target. Naturally, the veracity of these figures is highly questionable, as usual; in other words, a target is rather easy to hit when one simply makes up the numbers in order to achieve it.

Moving to numbers that aren’t being made up, Q4 US earnings season has started on a strong note, with the biggest Wall Street banks reporting a stellar set of figures. Together, the US’ six largest banks generated a $142bln in profit in 2024, a 20% rise on collective profits made in 2023, and the second best year for bank profitability since the GFC, as a rebound in M&A activity, coupled with continued high interest rates, represented a boon for the sector. Naturally, these solid earnings beats will have heightened expectations for the rest of corporate earnings season, which continues for the next few weeks.

That strong pace of M&A, meanwhile, looks set to continue into the new year, with reports last week indicating that Rio Tinto had undertaken discussions with Glencore over a potential merger. If such a merger were to come to fruition, it would be the largest ever in the mining sector, though it is unclear whether talks are still underway. In any case, the rally in Glencore shares after those reports broke was one of the factors helping the FTSE 100 to a new record, though the cynic in me wonders whether, if a merger were to take place, the new combined entity would consolidate its listing on the ASX, and de-list from London – let’s hope not.

Lastly, on the fundamental side of proceedings, last week saw the race to be the next Canadian Prime Minister heat up, with former Finance Minister Chrystia Freeland set to face off against former BoC and BoE Governor Mark Carney to replace Justin Trudeau. Carney’s comments did amuse me, given his stated desire to be “completely focused on the economy” were he to get the top job. Quite ironic, given that when his job was to focus on the economy, he continuously dabbled in politics, now his job could be in politics, he wants instead to dabble in the economy. Ever the unreliable boyfriend!

The Week That Was – Markets

Despite the significant number of fundamental catalysts last week, focus for market participants fell on one thing – the US inflation figures.

Once more, we see the dependency of participants on a more dovish policy outlook, with equities in particular seeming to be increasingly driven by shifts in policy expectations, as opposed to the strong underlying economic growth that the US economy continues to demonstrate.

In any case, the S&P 500 gained almost 3% last week, the best one-week advance since November, with the index reclaiming the 50- and 100-day moving averages in the process. My base case remains that the path of least resistance leads to the upside for equities, albeit with that path likely to be a relatively bumpy one, as participants continue to grapple with a greater degree of fiscal policy uncertainty, and adapt to the comfort blanket of a ‘Fed put’ having been removed amid renewed hawkish risks to the policy outlook, which were not present in 2024.

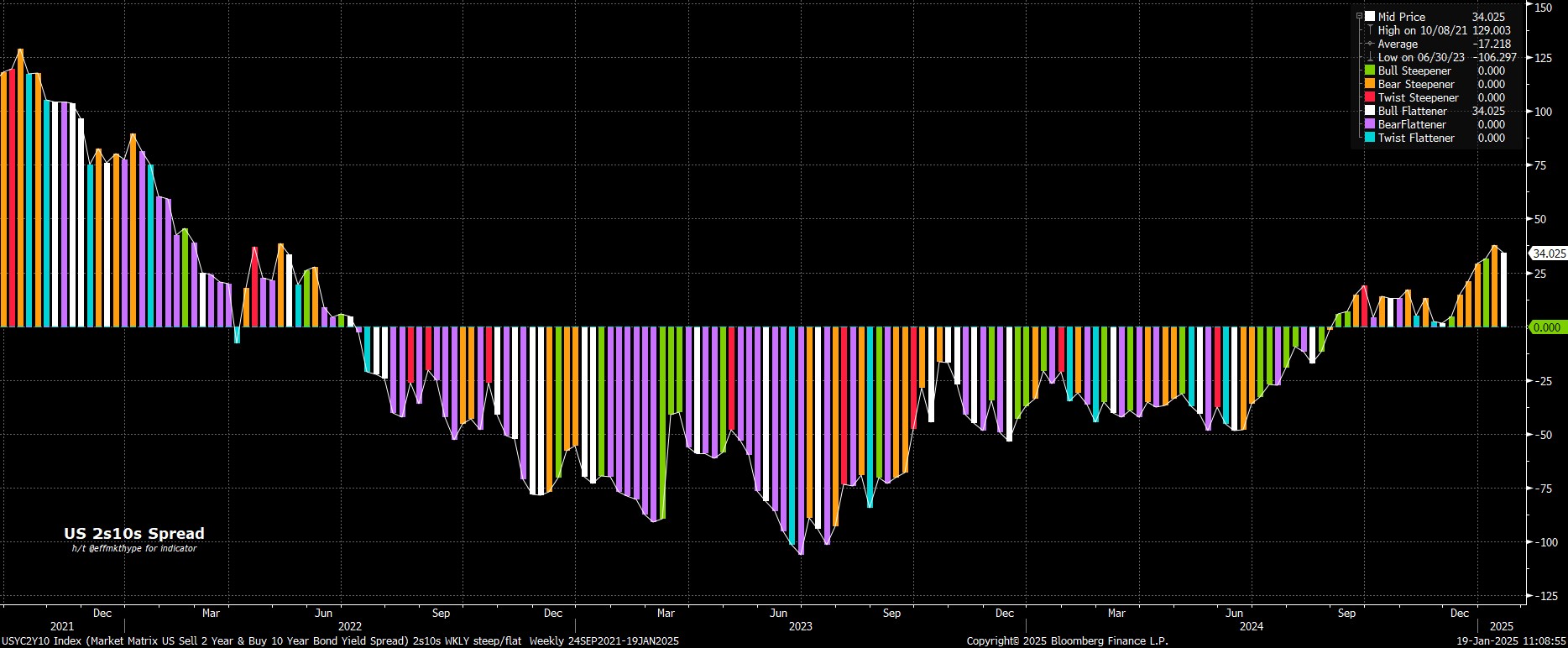

Treasuries, meanwhile, rallied across the curve, which bull flattened, as the 2s10s tightened to +34bp. In fact, the long-end of the curve enjoyed its best week since last December, with 10-year yields retreating back towards 4.60%, and 30year yields briefly dipping back beneath 4.80%.

Of course, yields at this levels are likely to be attractive to buyers, with longs seeming a decent risk/reward proposition at this juncture. However, I’d expect conviction to be somewhat lacking until greater clarity on President Trump’s tariff plans, and their potential macroeconomic impact, is obtained, which could keep a lid on further gains for the time being.

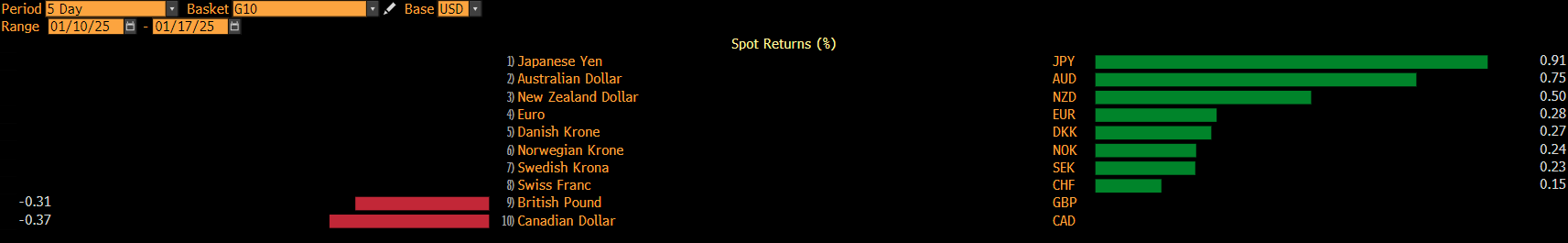

Naturally, this rally in Treasuries, and dovish repricing of Fed policy expectations, and rally across the Treasury curve, posed something of a headwind to the dollar, seeing the DXY snap a 6-week winning streak. Still, the weekly loss was only a modest 0.3%, with the move one that had more hallmarks of the recent uptrend taking a pause for breath, as opposed to one that heralds the beginning of a change in the greenback’s longer-run trend. Certainly, I remain a believer in the USD bull case, with the combination of a hawkish FOMC, and continued economic outperformance, likely enough to propel the buck higher for now.

Across the G10 FX space, it was no surprise to see the GBP and the CAD languishing close to the bottom of the weekly leaderboard, owing to the aforementioned growth worries, and political uncertainty, respectively. Meanwhile, the JPY gained ground on hawkish BoJ sources reports, more on which below, while the Aussie and Kiwi both received a helping hand from better than expected Chinese activity figures.

The Week Ahead

Turning to the week ahead, another intriguing few days lies in wait, with participants again having plenty to get their teeth into.

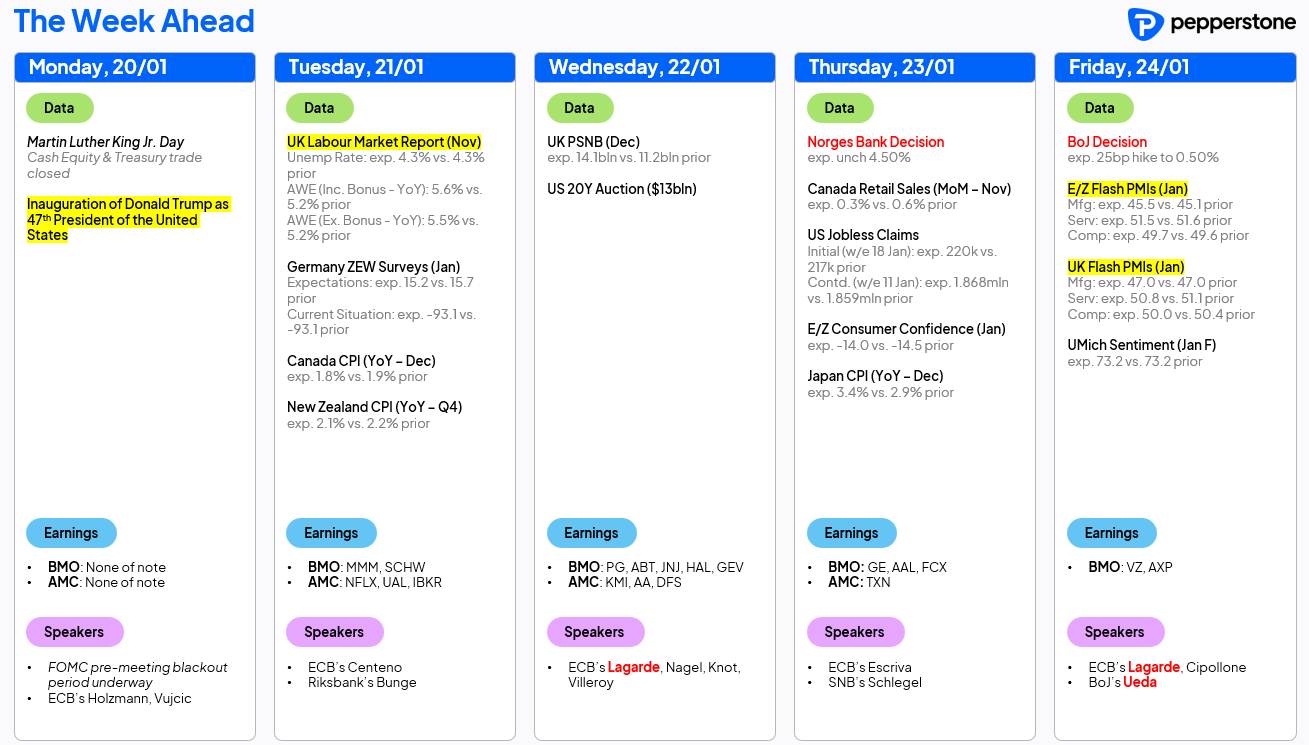

Obviously, most attention will fall on Monday’s presidential inauguration, as Donald Trump becomes the 47th President of the United States. Market attention will focus not only on the inaugural address, for any hints on the fiscal policies that the Administration may seek to implement, but also on the executive orders that Trump signs during the early days of his second term in office.

Chiefly, focus in this realm will fall on tariffs, and whether claims made during the campaign trail, that a 10-20% ‘universal’ tariff would be implemented, actually come to fruition. Reporting on this front has been highly uncertain, with various sources indicating that said tariffs could be limited to ‘critical imports’, or could be phased in over a period of months. There is also the significant matter of specific countries that may be singled out, and the extent of tariffs that are imposed on Chinese, Canadian, and Mexican goods.

Of course, focus will also fall on the response to said tariff impositions, and whether said responses indicate the opening salvos in what could prove to be another tit-for-tat trade conflict of the like seen in 2018-19. I find it tough to argue that markets have priced a ‘worst case scenario’ when it comes to tariffs – say, a 20% universal tariff, with additional levies on goods from the US neighbours’, and from China. In such a scenario, buying vol, selling the CAD and the MXN, and selling the long-end, seem the most plausible market reactions. On the other hand, if Trump’s bark were to prove worse than his bite, and actual tariff impositions fall short of that scenario, risk assets and those trade sensitive currencies would likely rip to the upside.

Away from Trump, this week’s BoJ meeting is probably the most interesting major macro event. Policymakers are almost nailed-on to deliver a 25bp hike, doubling the target rate to 0.50%, though with the caveat that such a hike will be off the table in the event of major market turmoil upon Trump taking office. In many ways, recent strong US data, and the FOMC’s January ‘skip’, have pushed open the window for BoJ hikes once again, though the chances of a prolonged tightening cycle remain relatively slim.

Elsewhere, the latest ‘flash’ PMIs should largely reinforce what we already know – that the eurozone economy is stagnating, the UK economy is stuck in stagflation, and that the US economy continues to outperform. Other notable releases include November’s UK jobs report, January’s ZEW sentiment surveys from Germany, and the weekly US jobless claims figures, where the initial claims print coincides with the survey week for the January nonfarm payrolls report.

Finally, the ‘great and the good’ gather in Davos this week for a good old chinwag, which will produce plenty of remarks from various ECB speakers, including President Lagarde, though mercifully the FOMC have now begun the pre-meeting ‘blackout’ period. Earnings season also continues this week, with 43 of the S&P 500 due to report, highlighted by Netflix after the close on Tuesday.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.