- English

- Italiano

- Español

- Français

Analysis

There isn’t a better time to raise capital through an IPO than when equity markets are at all-time highs, when market volatility is low, and when broad financial conditions are as easy as we see today.

Reddit’s IPO may have been in the pipeline for some time but given market conditions the timing to go public seems admirable. Pricing is always important and while the IPO pricing was set at the top of the range at $34, the underlying demand has been robust – many times oversubscribed - and subsequently the share price spiked to $57.80 on open.

Market conditions and pricing aside, what matters now is the investment case and the ability of management to execute its strategic growth plans. For traders what matters more is liquidity and its typical daily and intraday movement; volatility, its beta to other equities/S&P500, rate of change, and propensity to trend for a lasting duration.

On the trading dynamic, these variables will evolve and become clear as the market explores the company’s fundamentals, it will take time to ascribe a collective fair value. This heightens the near-term risk of price volatility and choppy price action which could greatly appeal to short-term CFD traders who look to scalp or capitalize on two-way (long and short) opportunities.

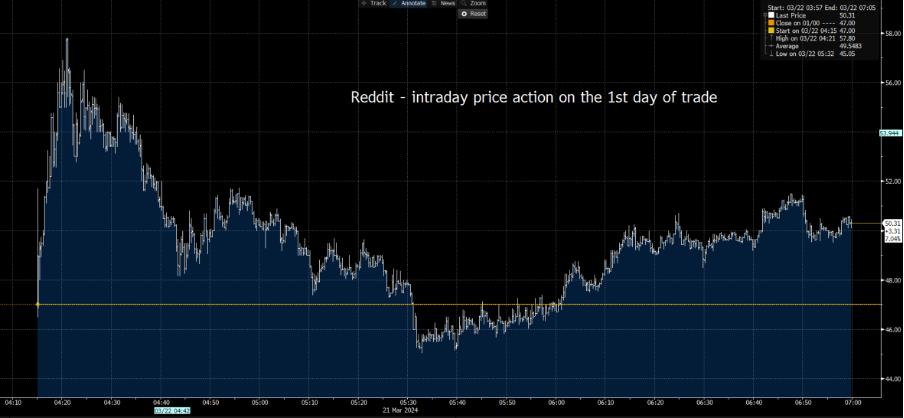

A wild first day’s trade

We saw this in the first day of trade was predictably wild, with shares opening at $47 – a 38% gain from the IPO price, rallying to $57.80 before heading back to the flatline and closing at $50.31 – a first day gain of 7% for those who got the opening tick.

For those who cut their craft reacting to price action, investment and capital flows matters above all else as hedge funds and big investment portfolio managers enter and exit positions, and options dealer flow exacerbate daily movement.

One can also be open-minded that at an $8b valuation, there could be a further push towards $10b and that may even create short-term opportunities for trend traders.

Will Reddit trade with meme characteristics?

There is a debate about whether Reddit become a meme candidate, where fundamentals simply don’t matter and the share price is driven more intently by absolute momentum, underpinned by traders buying short-dated call options and options dealers hedging their exposure as the shares trade higher, by buying the underlying shares.

We can’t rule this out, but the reception to the IPO within Reddit’s community hasn’t been overly positive, while the capital structure isn’t there either, where the amount raised in the IPO equates to a modest 8% of shares outstanding – very low compared to say GameStop, where 58% of shares are outstanding.

With the current capital structure, it seems there could be a limit by which the various social communities can have a lasting influence. The way the deal has been structured we see that a large percentage of shares will be held by insiders (CEO Steve Huffman owns 46% of shares alone) as well as institutional funds, many who have held for years, including from the 2021 raising - through a convertible stock offering – which at the time put them on a $10b valuation.

Assessing the business model

Fundamentals should therefore matter. It’s interesting that management has been keen to emphasize their growing involvement in AI through their data licensing business, where they are positioned to sell user content to the likes of Google, Open AI, Apple, and Meta.

This aspect should provide support for valuations given Reddit’s user base, where a significant percentage of the daily users are unique to Reedit and seldom look at other social media channels.

While Reddit looks to effectively monetize this area of growth, the numbers and guidance currently reported will split investors. On one hand, top-line growth projections for 2024 sit at a solid 20%. However, the bottom line is less compelling with EBITDA guidance that they will break even this year, after recording a loss in 2023 of $69.3m.

Some also point to the average revenue per user (APRA) and see that US APRA fell 7.4% in Q423 yoy, which compares poorly to the likes of Meta and Pinterest.

As the market becomes comfortable with understanding its model and ability to monetize sales opportunities and earnings growth, we will likely see trends develop in the price action. IPO investors would have heard sufficient intel in the IPO roadshow, but for many in the secondary market, there will be keen interest in hearing reported earnings and the outlook from management in the upcoming earnings report.

Reddit is in the spotlight for now, and rightly so – the business model greatly divides public sentiment with many seeing risk that once the initial flows settle Reddit could be a compelling short opportunity. Others see good upside potential and are willing holders.

When the masses disagree, we typically get volatility and that suggests Reddit could be a trading stock to put on the radar.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.