- English

- Italiano

- Español

- Français

Analysis

From a volatility perspective, AUDUSD 1-week (options) implied volatility sits at 11.2% - the 20th percentile of the 12-month range – in essence, the market is not expecting an outsized move through the week, and that makes sense – however, there are still reasons to believe we could see big movement in the AUD, AUS200 and Aussie bank/consumer plays.

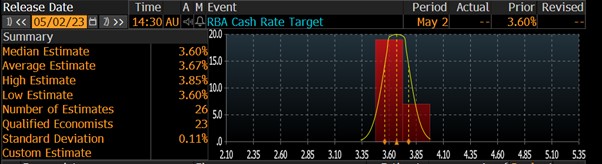

Having just seen the Aus Q1 CPI print – with the trimmed mean CPI measure coming in below expectations at 6.6% - interest rate futures are pricing just 3bp – or a 12% chance - of a hike at the May RBA meeting. Rates traders hold a high conviction that the cash rate will remain at 3.6%. So naturally if we were to see the RBA hike by 25bp it would be a shock, and the AUD would likely spike 50-70 pips off the bat.

It's rare that the market has such a strong view, and the RBA doesn’t ultimately meet the market.

If we look further out the interest rate futures ‘curve’ at forward expectations, we see 13bp of hikes priced by September to reach a peak rate of 3.7%. This feels fair, with the market essentially pricing a premium that if we get a hotter Q1 wage price index (17 May), employment report (18 May) and monthly CPI print (31 May) that the RBA may look at massaging the cash rate higher sometime in Q3. There’s obviously a lot that can happen between that time.

Given this forward rate pricing, if we do see the RBA leave rates at 3.6% at the May meeting, the market will reconcile the tone of the statement to this forward pricing. It seems likely the statement will be largely unchanged, with the RBA offering the flexibility to hike in the future, again making it clear that they are data dependent.

.png)

Economists view on the RBA meeting

The economist community are more upbeat on the prospect of a hike, and while the consensus of economists polled by Bloomberg sees the cash rate on hold, we still see 7/24 (including CBA) calling for a 25bp. This position is in some way at odds with market pricing.

As always when looking at risk we consider positioning – the TFF futures report shows AUD net position held by leveraged traders is modestly short, to the tune of 4092 contracts. Other flow reports from investment banks suggest leveraged funds are long of AUD, while real money funds are holding a sizeable short position.

Pepperstone's client positioning is more reflective of sentiment and trend, and we see the net position is skewed long, with 69% of open positions held to capture a move higher.

So considering positioning, rate expectations and flows, traders need to weigh up where they see the balance of risk and the probability for a big move in price.

I think the RBA pause on rates and offer little new intel in the statement – subsequently, I favour selling rallies on the day in AUD, given any outsized move will be driven by positioning and it should not last long before the AUD takes its variance from USDCNH, the CN50 index and even copper.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.