Analysis

Presidential Election Day Arrives

WHERE WE STAND – I’ll keep this brief, given the long election preview below. Markets were for the most part subdued on Monday, with stocks treading water, and the dollar losing some modest ground, as attention remains firmly on the presidential election.

On that note, there was a further clearing up of positioning ahead of the ‘big day’, with some of the recent ‘Trump trade’ unwinding, partly as polls and betting odds continued to narrow, and partly as those that had been running said positions took profit ahead of the election itself. This dynamic was most evident in the Treasury complex, where yields from 7-30 years slipped over 10bp on the day, erasing the entirety of Friday’s late-day sell-off.

Still, there’s not really much value to be sought from a messy day of pre-election trade, so let’s turn to what awaits in the next 24-48 hours.

LOOK AHEAD – Election Day is finally upon us – here’s some thoughts on how the next day or so could well unfold.

I, and the remainder of the Pepperstone research desk, will be available throughout, including overnight; please don’t hesitate to reach out if there’s anything we can assist with.

First, a look at the current backdrop.

Uncertainty ahead of the election has seen the vast majority of market participants move to a more neutral stance over the last couple of weeks, helping to explain the back-to-back weekly declines in the S&P 500, and position squaring seen elsewhere. Conviction, understandably, has also been lacking of late, with few seeking to risk their YTD PnL over what is an incredibly finely balanced election, as risk management has become the priority, and should remain so.

Speaking of which, nationwide opinion polling, per the RealClearPolitics average, has Trump and Harris neck-and-neck on 48.5% and 48.4% respectively – well within the margin of error. Given the mechanics of the Electoral College, the election will likely be decided by the seven swing states (Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin). Here, the two candidates are also well within the margin of error according to almost all polls.

Betting odds, which have become an increasingly useful barometer of expectations, point to a slight advantage for Trump. Polymarket sees the race as 59% vs. 41%, while Kalshi (a site limited to US residents), has the race tighter, though still in Trump’s favour, at 57% vs. 43%. Whichever one metric chooses to use, the race seems too close to call with a high degree of conviction.

Let’s turn to election night itself.

Polls will begin to close from 7pm ET (midnight Wednesday morning in London), at which point news agencies, and TV networks, will begin to ‘call’ the race in each state. These calls are what markets will pay most attention to as the night progresses, with those in the aforementioned swing states being of most importance.

At least at the beginning of election night, when a final result is likely to be known will probably be of more importance than who the election winner might be. The longer that the process drags on, the more uncertainty increases, and the more that risk sentiment is consequently likely to deteriorate.

In terms of specific timings, the 2020 race was not officially called until the Saturday after election day, though the pandemic did complicate proceedings. In 2016, the election result was called around 2:30am ET/7:30am GMT on the Wednesday.

As already noted, swing states are key (electoral college votes in brackets):

- Arizona (11 votes): polls close 9pm ET/2am GMT, counting begins an hour later; in 2020, the state was called at 2:50am ET/7:50am GMT

- Georgia (16 votes): polls close at 7pm ET/midnight GMT, counting begins immediately with mail-in ballots and early votes first; in 2020, the race was too close to call before the overall election result was announced

- Michigan (15 votes): polls close at 9pm ET/2am GMT, with the count likely to be completed by 12pm ET/5pm GMT on Wednesday; in 2020, the race was called at 6pm ET/11pm GMT on the day after election day

- Nevada (6 votes): polls close at 10pm ET/3am GMT, counting does not begin until polls close; in 2020, the state was not called until Saturday

- North Carolina (16 votes): polls close at 7:30pm ET/12:30am GMT, counting has already begun, though the impact of Hurricane Helene may delay some mail-in ballots; in 2020, the state was too close to call before the overall election result was announced

- Pennsylvania (19 votes): polls close at 8pm ET/1am GMT, with no ballots processed or counted until election day itself; in 2020, the state was called on Saturday, and tipped Biden over the 270 Electoral College votes needed to secure the presidency

- Wisconsin (10 votes): polls close at 9pm ET/2am GMT, with the count likely to conclude by 12pm ET/5pm GMT on Wednesday; in 2020, the state was called at 2pm ET/7pm GMT on Wednesday

Let’s now break down the potential market impact of each potential presidential election winner.

A TRUMP victory would likely see markets focus on a theme of reflation, with tax cuts likely to provide a fillip to growth, and the imposition of tariffs giving rise to a potential resurgence in inflationary pressures. In terms of initial market reactions, one would expect:

- USD upside, particularly against those currencies which could find themselves subject to tariffs, such as the MXN, CNH and EUR

- Treasury downside, most notably at the long-end of the curve, as growth and inflation expectations rerate higher

- Upside for equities, broadly speaking, amid expectations for a lower regulatory burden, with the Energy and Defence sectors likely to outperform

Meanwhile, a HARRIS victory would represent a theme of continuity. In terms of initial market reactions, one would likely see:

- USD weakness, as Trump-linked hedges are unwound, and trade-sensitive currencies breathe a sigh of relief

- Treasury downside, albeit not to the same degree as in a Trump win, on bets that fiscal policy will become more expansionary

- Knee-jerk equity downside, on concerns over potential for tighter regulation, though any dips are likely to be bought in short order, while sectors such as Clean Energy and Technology could outperform

Of course, a significant degree of the above scenarios will also hinge on the makeup of Congress. Here, all 435 seats in the House of Representatives, as well as 34 Senate seats, are up for election. While also incredibly tight, state-level polling points to the Democrats flipping control of the House, and the Republicans (GOP) flipping control of the Senate.

Personally, I would rank the possible electoral outcomes, from most to least likely, as follows:

- Trump Presidency, Divided Congress – ‘Divided Red Government’

- Harris Presidency, Divided Congress – ‘Divided Blue Government’

- Trump Presidency, GOP Congress – ‘Red Wave’

- Harris Presidency, Democrat Congress – ‘Blue Wave’

Importantly, any of the ‘Divided Congress’ outcomes are likely to severely limit potential downside in the Treasury complex, given the constraint that a split congress would apply to either presidential candidate seeking a significant degree of fiscal loosening.

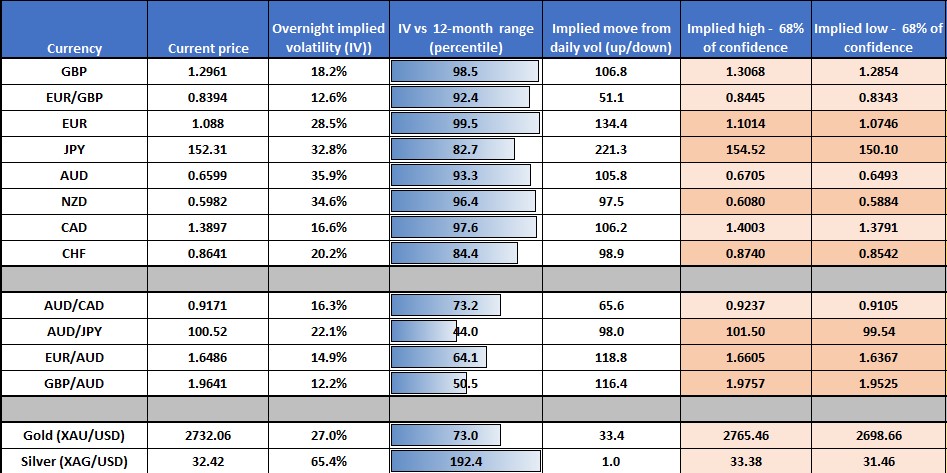

As a guide to what markets currently price in terms of likely trading ranges, we can use overnight implied volatility:

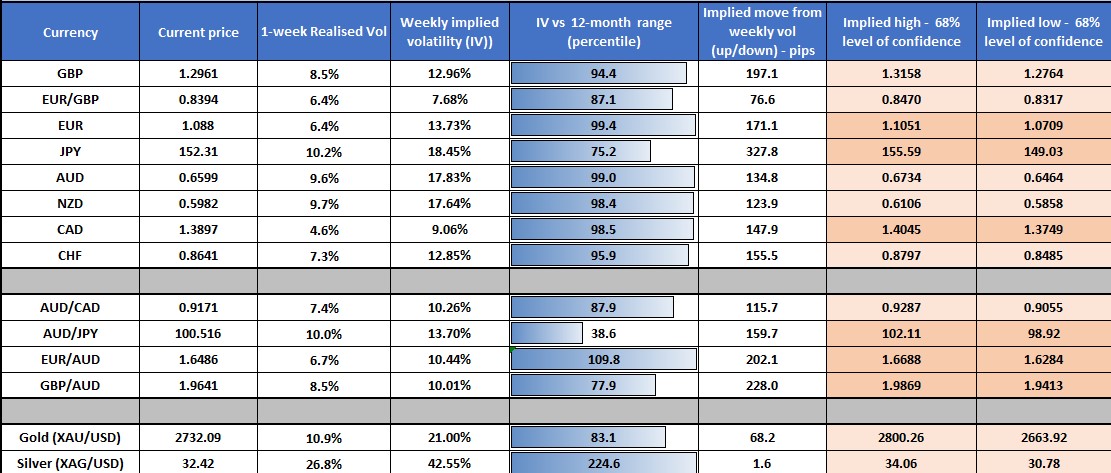

We can also zoom out, and use 1-week vols, as a guide for potential post-election moves, though this of course also covers Thursday’s FOMC decision:

Taking a step back, does the election change the longer-run macro, or market, outlook?

Here, I’d argue the answer is a resounding ‘no’. Certainly, in the case of equities, the three pillars of my longstanding bull case – solid earnings growth, strong economic growth, and the forceful ‘Fed put’ – should remain in place regardless of the party political allegiances of whoever occupies the White House.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.