- English

- Italiano

- Español

- Français

Analysis

May 2025 FOMC Review: Powell Plays With A Straight Bat

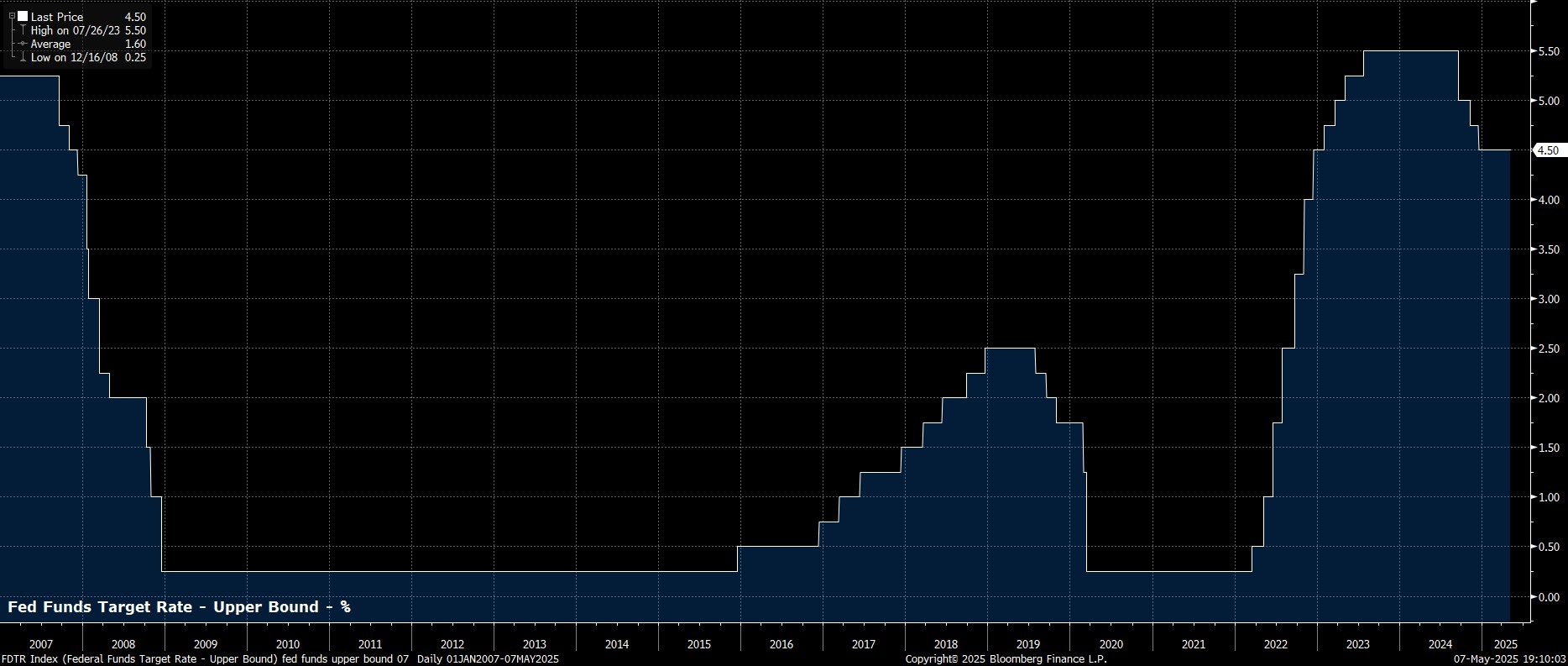

As expected, and had been fully discounted by money markets, the FOMC held the target range for the fed funds rate steady at 4.25% - 4.50% at the conclusion of the May meeting, continuing the pause in the cycle of policy normalisation which begun at the January meeting. The decision to stand pat was a unanimous vote among policymakers, though Minneapolis Fed President Kashkari voted in place of Kansas City President Schmid, due to the recent death of his wife.

This ‘wait and see’ approach to policymaking allows Committee members not only to continue taking stock of the lagged impacts of last year’s policy easing, but also to digest the impacts of the Trump Administration’s trade policies, and associated uncertainty, on each side of the dual mandate.

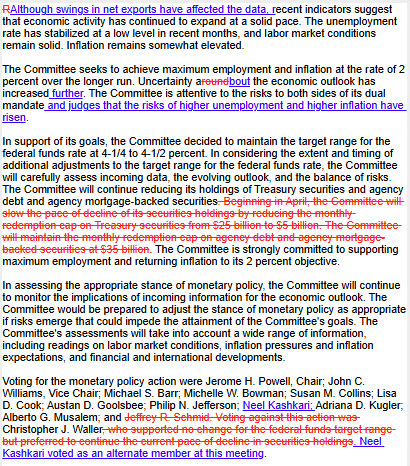

Accompanying the decision to hold rates steady, was the Committee’s updated policy statement.

In the statement, the FOMC acknowledged the mounting danger of ‘stagflation’ within the US economy, by flagging that the risks of higher unemployment, and of higher inflation, have both risen, while also noting that economic uncertainty has further increased. Besides these changes, though, the remainder of the statement was largely unchanged from that seen last time out, with policymakers using net exports to explain away a weak Q1 GDP print, describing the labour market as “solid”, and inflation as “somewhat elevated”.

Along with the policy statement, Chair Powell’s post-decision press conference was also in focus, as participants continue to assess how policymakers may deal with risks to each side of the dual mandate coming into conflict.

Here, Powell well and truly stuck to his recent script, stressing that the current policy stance is ‘well positioned’ to respond to economic developments in a ‘timely’ manner, and that such a stance enables the FOMC to wait for greater clarity, before making any policy adjustments. Furthermore, Powell reiterated that if each of the dual mandate goals were to come into tension, the Committee would consider how far each goal was from being achieved, and the horizon over which achievement would be obtained, before determining the appropriate policy response.

These lines were reiterated all throughout the press conference, with the Committee clearly in no rush to deliver further rate cuts, with the costs of waiting seen as being “fairly low”, but policymakers reserving the right to “move quickly as appropriate” when the economy develops. Perhaps, a prolonged hold, then a few 50bp cuts, is a scenario to consider.

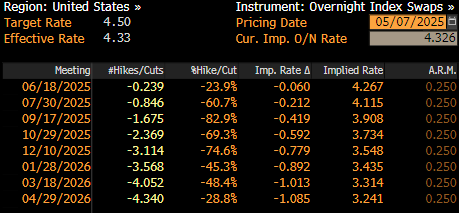

As all of the above was digested, money markets repriced marginally in a dovish direction, with the next 25bp cut now fully priced for September, compared to July pre-meeting. By year-end, the USD OIS curve now discounts around 76bp of easing, compared to just shy of 80bp before Powell took to the stage.

On the whole, the May FOMC confab will largely go down as a placeholder meeting for Powell & Co, with the Committee continuing to sit on the sidelines for the time being, awaiting greater clarity on the economic outlook, and how the balance of risks to the dual mandate is evolving, before taking further steps to remove policy restriction.

While the direction of travel for rates clearly remains to the downside, increased ‘stagflation’ risks will likely lead policymakers to continue to sit on their hands for the time being, seeking to ensure that inflation expectations remain anchored, and that the ‘hump’ in inflation as a result of tariffs does indeed prove to be temporary in nature. Hence, any further rate reductions before the summer is out remain a very long shot indeed.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.