- English

- Italiano

- Español

- Français

Analysis

May 2025 BoE Review: The Doves Remain Caged (For Now)

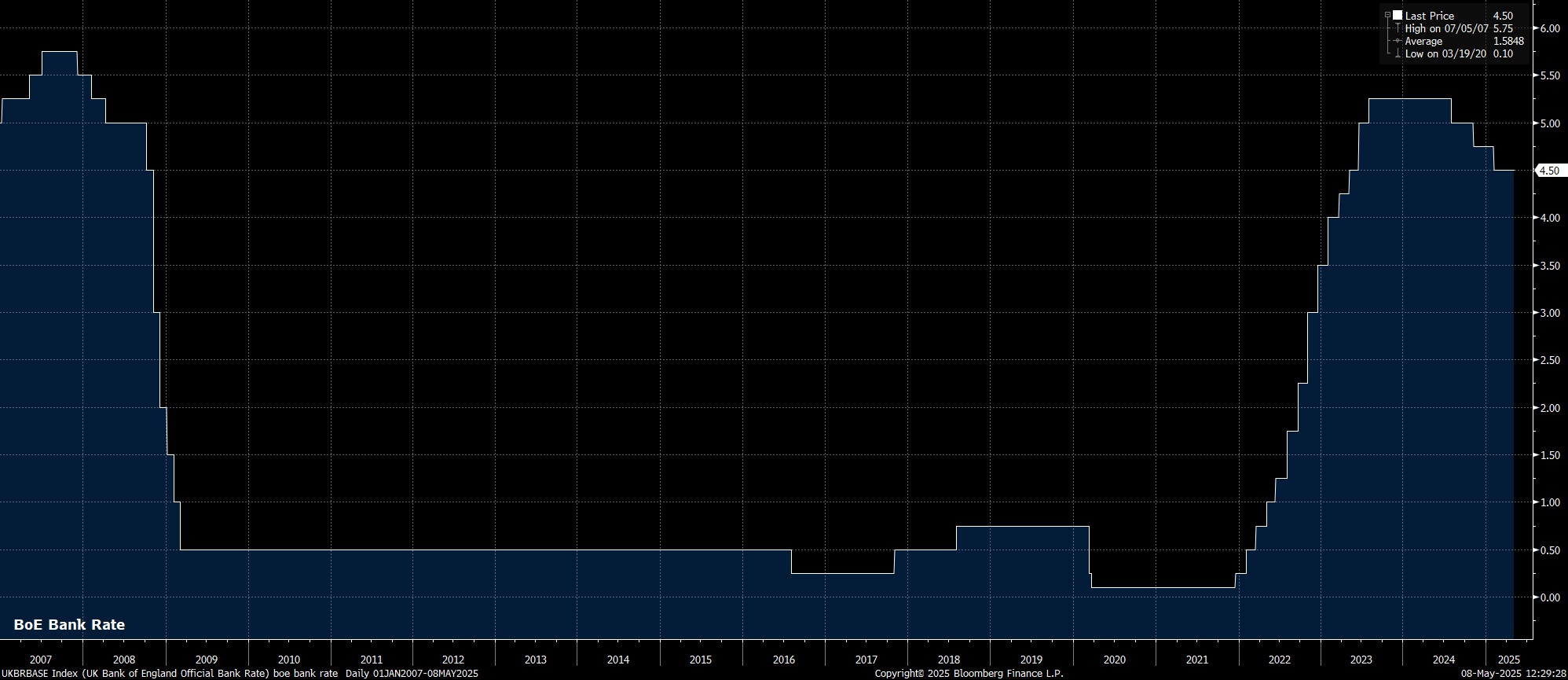

The Bank of England’s Monetary Policy Committee delivered their fourth rate cut of the cycle at the conclusion of the May meeting, lowering Bank Rate by 25bp, to 4.25%, as the ‘Old Lady’ continues to remove policy restriction.

That is, however, by far and a way the most straightforward part of the May decision, as the MPC find themselves in something of a pickle.

Among the nine members of the Committee, only seven voted in favour of any form of rate cut, with external member Mann, and Chief Economist Pill instead preferring to hold rates steady. Not only was this very much out of line with consensus, it is also surprising to see an ‘internal’ member dissent.

As if that wasn’t enough of a mixed message, among the seven policymakers who were in favour of a rate reduction, two – external members Dhingra and Taylor – also dissented, in favour of a larger 50bp rate cut. The remaining five MPC members all favoured the 25bp cut that was ultimately delivered.

Along with the vote split, participants’ attention also fell on the MPC’s updated policy statement. Here, however, there were none of the dovish changes that many, including I, had been expecting. Instead, the MPC reiterated that a ‘gradual and careful’ approach to policy easing remains appropriate, and that policy will still need to remain ‘restrictive for sufficiently long’ in order to reduce the risks of persistent price pressures becoming embedded within the UK economy.

With the May meeting being a ‘Super Thursday’, the Bank also unveiled their latest Monetary Policy Report, including an updated round of economic forecasts.

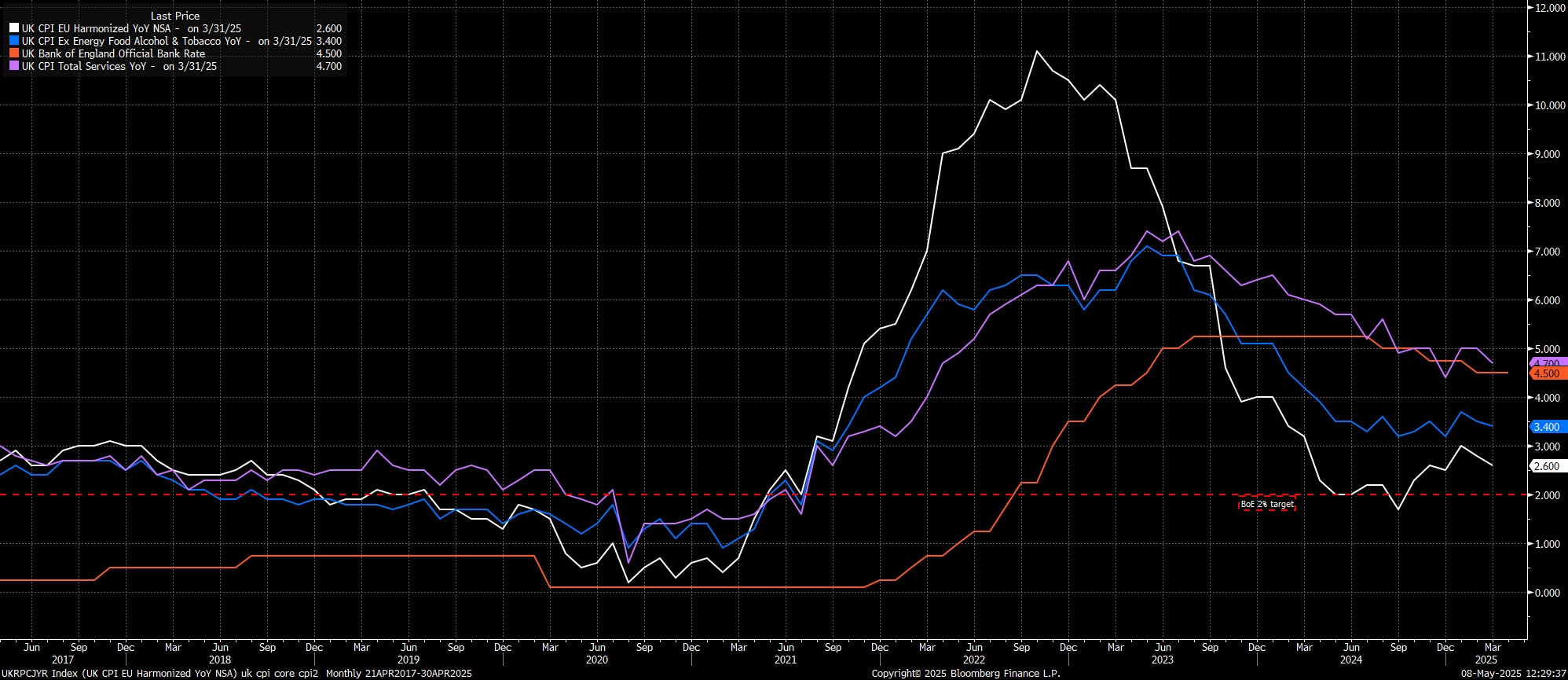

On inflation, the Bank now see a lower CPI profile throughout the forecast horizon, having nudged down the expected inflation peak by 0.2pp, to 3.5% in the third quarter of this year. Furthermore, the latest forecasts also project a sooner return to the 2% price target, with said objective now seen as being achieved in the first quarter of 2027, compared to the fourth quarter of that year in the prior forecast round.

Meanwhile, in terms of the updated growth outlook, near-term growth expectations were nudged a touch higher, with the Bank now expecting growth of 0.8% this year, likely a result of a better than expected outturn in Q1, and a potential boost from rising export demand amid tariff front-running. The remainder of the growth forecast, though, was a rounding error away from being unchanged from that issued last time out.

At the post-meeting press conference, reflecting on the above, Governor Bailey stressed that interest rates are not on “autopilot”, and that policymakers don’t expect the near-term rise in headline inflation to persist, begging the question of why that can’t be looked through, and more rapid cuts delivered. Bailey also noted that a “small” margin of slack has emerged, and that said margin is expected to widen over the next couple of years, again leaving me scratching my head over the ‘status quo’ guidance that the MPC issued.

Taking a step back, the May meeting leaves the MPC in a bit of a mess, with no clear consensus on the direction of travel for rates, nor on the clip sizes that rates should be moved in. It is also surprising that policymakers have failed to open the door to a more rapid pace of normalisation, particularly given mounting downside growth risks, a lower growth projection, higher unemployment forecast, and a substantially shallower inflation profile.

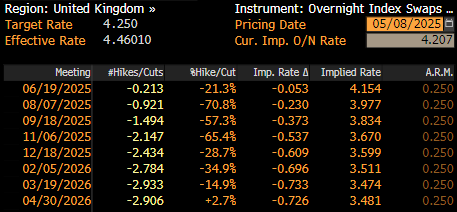

Frankly, it would appear that the ‘gradual and careful’ guidance on rates is now on borrowed time, particularly with an additional two CPI figures (for April & May) due before the June policy decision. Assuming that those prints evolve in line with, or cooler than, the Bank’s forecasts, policymakers may well have obtained sufficient confidence to embark on a more overt dovish pivot towards the middle of next month.

For the time being, at least, while the potential remains for consecutive rate cuts through to the end of summer, such an outcome is now a slimmer probability than before, especially given the bitterly divided nature of the MPC. Taking this, and the huge degree of economic uncertainty into account, it is plausible that policymakers may instead seek to hold fire until August, and the next forecast round, before pulling the trigger on another Bank Rate cut. By that point, though, more sizeable rate moves may well be needed, given the stiff headwinds that the UK economy continues to face.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.