- English

- Italiano

- Español

- Français

Analysis

March 2025 BoE Review: The Old Lady Is In No Rush

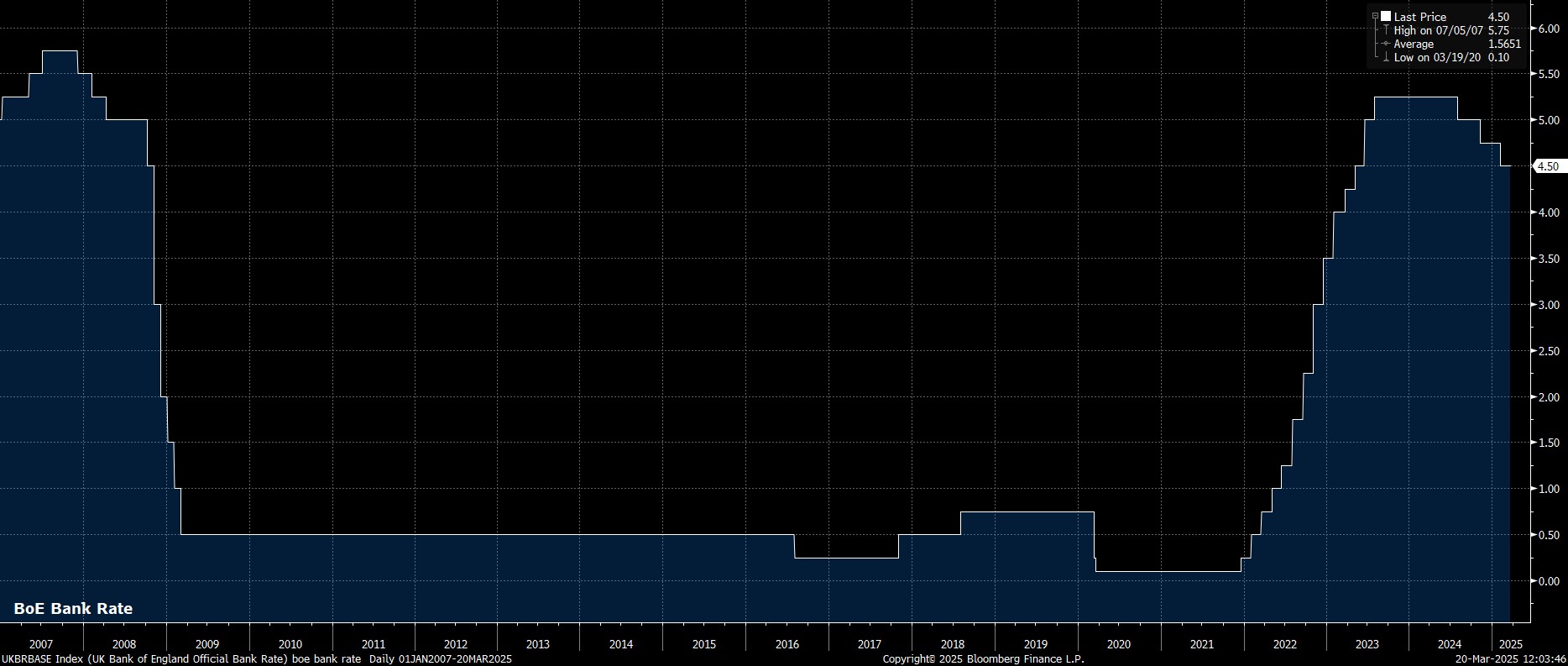

As expected, and fully discounted by money markets, the Bank of England’s Monetary Policy Committee stood pat on policy at the March meeting, holding Bank Rate steady at 4.50%, having delivered a 25bp cut at the prior meeting last month.

Though that decision brought nothing by way of surprises, the MPC’s vote split was again of particular interest, with the 9-member Committee clearly divided over the course that policy should take.

The decision to hold Bank Rate steady came by virtue of an 8-1 split. External member Dhingra was the only dissenter, favouring another 25bp cut, cementing her place as the MPC’s most dovish participant.

Meanwhile, the MPC’s updated policy statement was – by and large – a reiteration of that issued after the February meeting. As a result, the Committee reiterated that a “gradual and careful” approach to removing monetary policy restriction remains appropriate, and that policy must remain “restrictive for sufficiently long” in order to bear down on the risks of stubborn price pressures becoming embedded within the UK economy.

In any case, the MPC repeated that a ‘data-dependent’ and ‘meeting-by-meeting’ approach will continue to be followed when making future policy decisions.

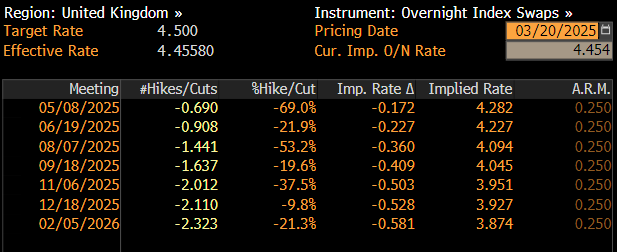

In reaction, the GBP OIS curve was pretty much unchanged, with participants still discounting around a 90% chance of the next 25bp cut coming by the June meeting, with around 54bp of cuts in the curve by year-end.

On the whole, the March MPC meeting will likely be seen as a placeholder one, as policymakers continue to bide their time, plotting a slow and deliberate course back to a more neutral policy stance. This caution is warranted, given not only that CPI remains considerably above the 2% target, and underlying price metrics continue to show worrying signs of persistence, but also with headline inflation expected to climb back towards 4% by the summer.

Consequently, my base case remains that the MPC will continue with their ‘slow and steady’ approach, delivering one 25bp cut per quarter, in conjunction with the release of updated economic forecasts. Risks, though, to this scenario do tilt in a dovish direction, especially if the labour market were to weaken significantly, in turn exerting substantial downward pressure on sticky services prices.

For now, though, the MPC are likely to continue to err on the side of caution, with elevated inflation, and substantial risks of persistence, preventing any kind of imminent dovish pivot in an attempt to prop up the ailing and stagnant UK economy.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.