- English

- Italiano

- Español

- Français

Analysis

June 2025 BoE Preview: The Old Lady’s Burying Her Head In The Sand

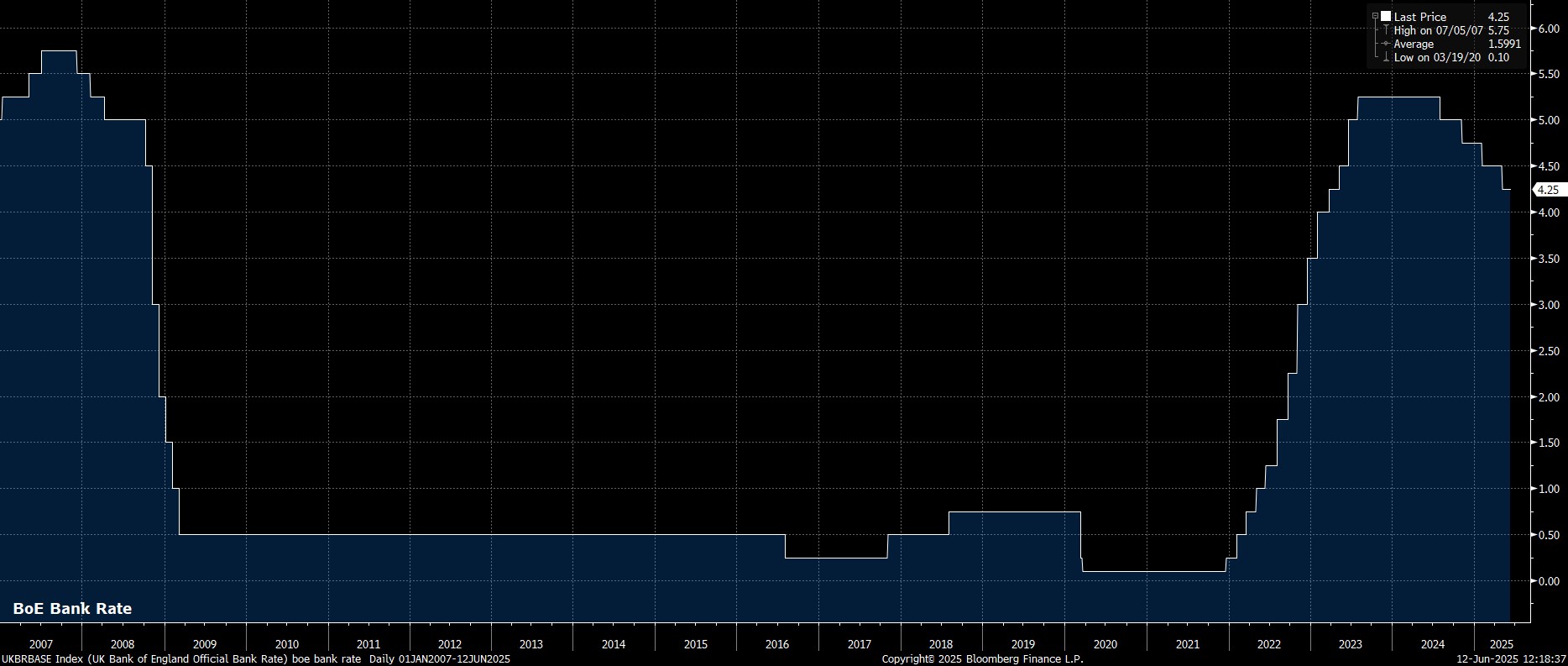

As noted, the MPC are set to hold Bank Rate steady at 4.25% at the conclusion of the June meeting, keeping policy settings unchanged, having delivered this cycle’s fourth 25bp cut last time out.

Once again, though, the June confab is likely to lay bare the deep degree of disagreement among policymakers over the appropriate path of policy, and speed of interest rate cuts that should be delivered.

The May meeting culminated with a three-way split among MPC members – Mann and Pill preferring rates to be held steady, Dhingra and Taylor dissenting in favour of a larger 50bp reduction, and the remaining members, including Governor Bailey, plumping for the 25bp cut that was indeed delivered.

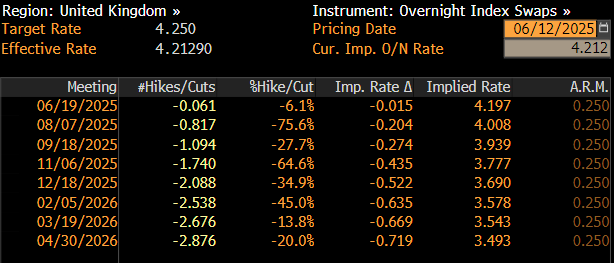

Things are likely to be somewhat more straightforward this time around, even if a split MPC remains the base case. External members Dhingra and Taylor will likely dissent once more, though probably only for a ‘run of the mill’ 25bp reduction. This leaves the base case as a 7-2 vote in favour of a 25bp cut, however there is the potential for another dovish dissenter to emerge given the recent soft run of economic data – Deputy Governor Ramsden is a prime candidate here.

Furthermore, there remains huge uncertainty over the increasingly erratic nature of external member Mann’s vote, having dissented in favour of holding Bank Rate steady last month, despite a dovish dissent for a 50bp reduction back in February. Mann seems likely to prefer holding rates steady this time out, though it is impossible to have a high degree of conviction around this call.

Thankfully, projecting the MPC’s policy guidance is a somewhat easier task. Put simply, the policy statement is likely to be a ‘carbon copy’ of that issued last time out, with the MPC reiterating that a ‘gradual and careful’ approach to rate reductions remains appropriate, that policy must remain ‘restrictive for sufficiently long’ in order to bear down on the risks of persistent price pressures, and that policy will be determined on a ‘meeting-by-meeting’ basis.

Importantly, at least judging by recent remarks, policymakers appear to have little-to-no inclination to adopt a more dovish position at this juncture, despite a considerable softening in economic data of late, which suggests that such a pivot may be warranted.

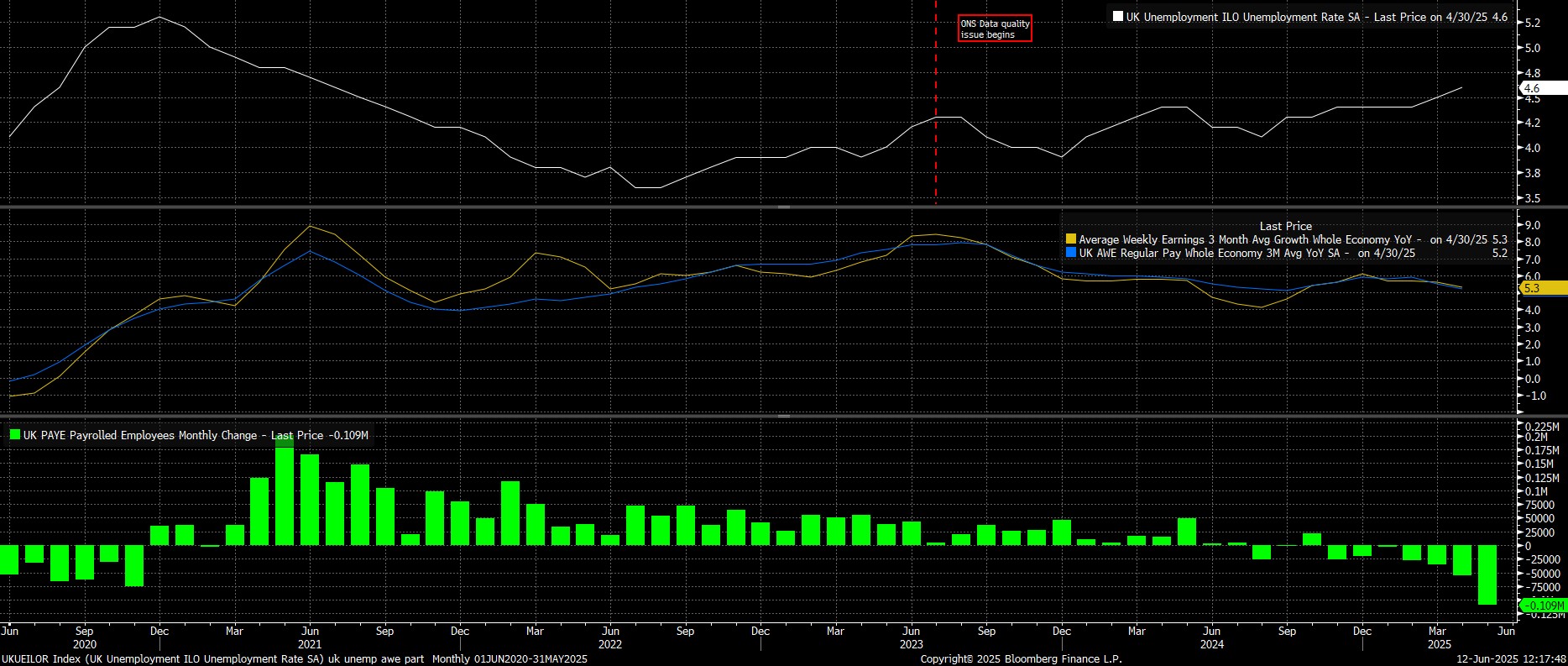

The labour market is the most obvious area where economic weakness is developing at a worrying rate. Unemployment, in the three months to April, rose to 4.6%, a fresh 4-year high, while overall earnings growth cooled to 5.3% YoY – still too hot to be compatible with the 2% inflation target, but nonetheless moving in the right direction. Of more concern, given the unreliable nature of the ONS’s Labour Force Survey, is the more timely HMRC payrolls indicator, which indicated employment having fallen by 109k in May, bringing the total job losses since the October Budget to a whopping 276k. A significant margin of slack is opening up here, at a very rapid pace indeed.

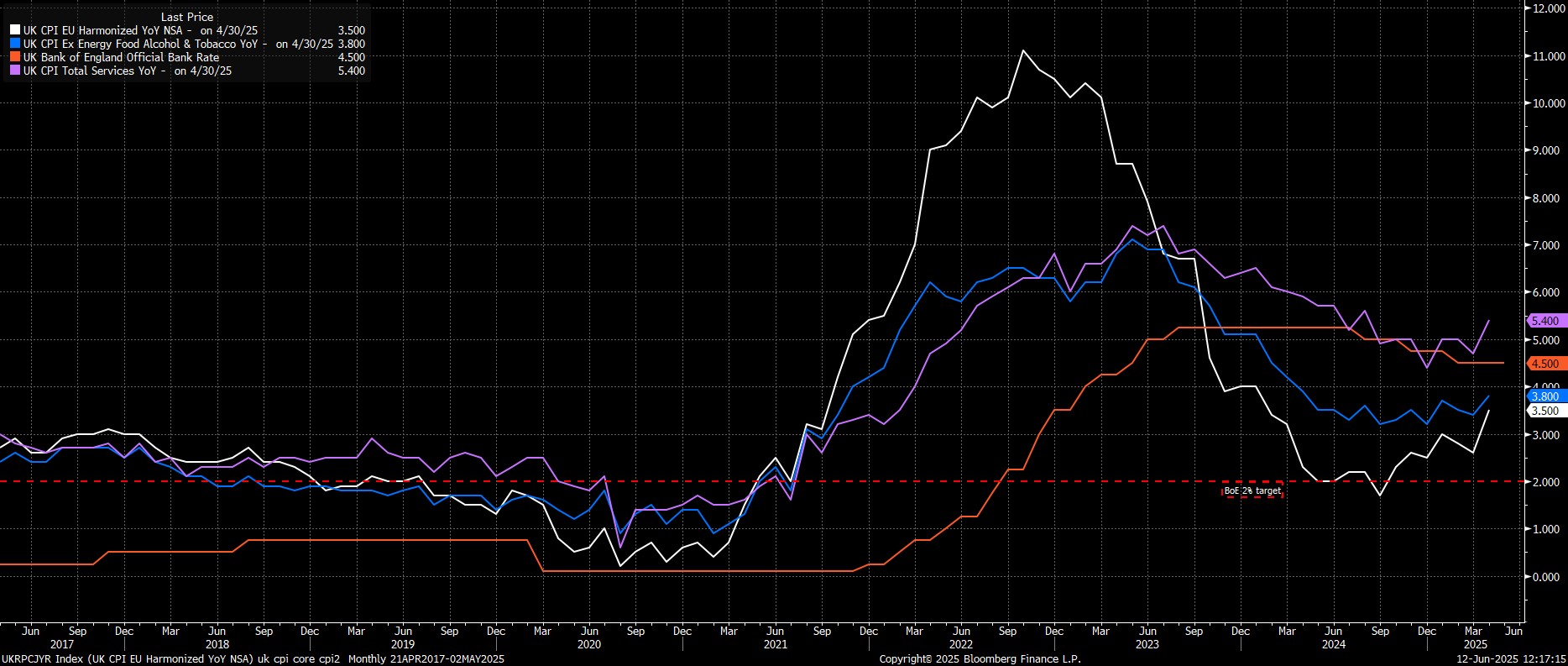

This slack should give the MPC little cause for concern over the potential of price pressures embedding themselves within the economy. Despite headline CPI having risen to 3.5% YoY in April (technically, 3.4% due to another ONS error), it seems unlikely that inflation will sustain itself at this rate for particularly long, owing to both the one-off nature of factors which pushed the aforementioned figure higher, as well as the inability for firms to pass cost increases on in the form of higher prices, given the quickly softening labour market. The May CPI figures are due a day before the BoE announcement, though the MPC will have advance sight of the data on Monday.

The growth outlook for the UK economy also appears rather dour. While output in Q1 was supported by efforts to ‘front-run’ the US’ imposition of tariffs, as well as the pulling forward of activity ahead of a host of tax changes in April, reality is now beginning to bite. April saw GDP contract by 0.3% MoM, though this is a particularly volatile series, while leading indicators such as the most recent PMI surveys indicate that risks to the outlook remain firmly tilted to the downside. This owes not only to ongoing trade uncertainty, but also as the fiscal backdrop remains incredibly fragile, leading to an incredibly high probability of further punitive tax increases being delivered in the autumn Budget.

Against this rather glum economic backdrop, the MPC’s resolute approach to stick with a ‘gradual and careful’ approach to removing policy restriction increasingly looks like policymakers burying their heads in the sand, hoping that the problem will go away by itself.

Clearly, hope is not a strategy, at least not an effective one, even if it is the one that the MPC have chosen to adopt for the time being. Given the likely decision to hold rates this time out, the next 25bp Bank Rate cut is set to be delivered at the August meeting, in conjunction with an update to the BoE’s economic forecasts. Taking into account the dour backdrop, which will likely have worsened further by the end of summer, at which point the ‘hump’ in prices is also likely to have faded, the potential for faster easing in the final few months of the year remains high.

The Old Lady’s slow and steady approach will be maintained in June, but is on borrowed time beyond that point.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.