- English

- Italiano

- Español

- Français

Analysis

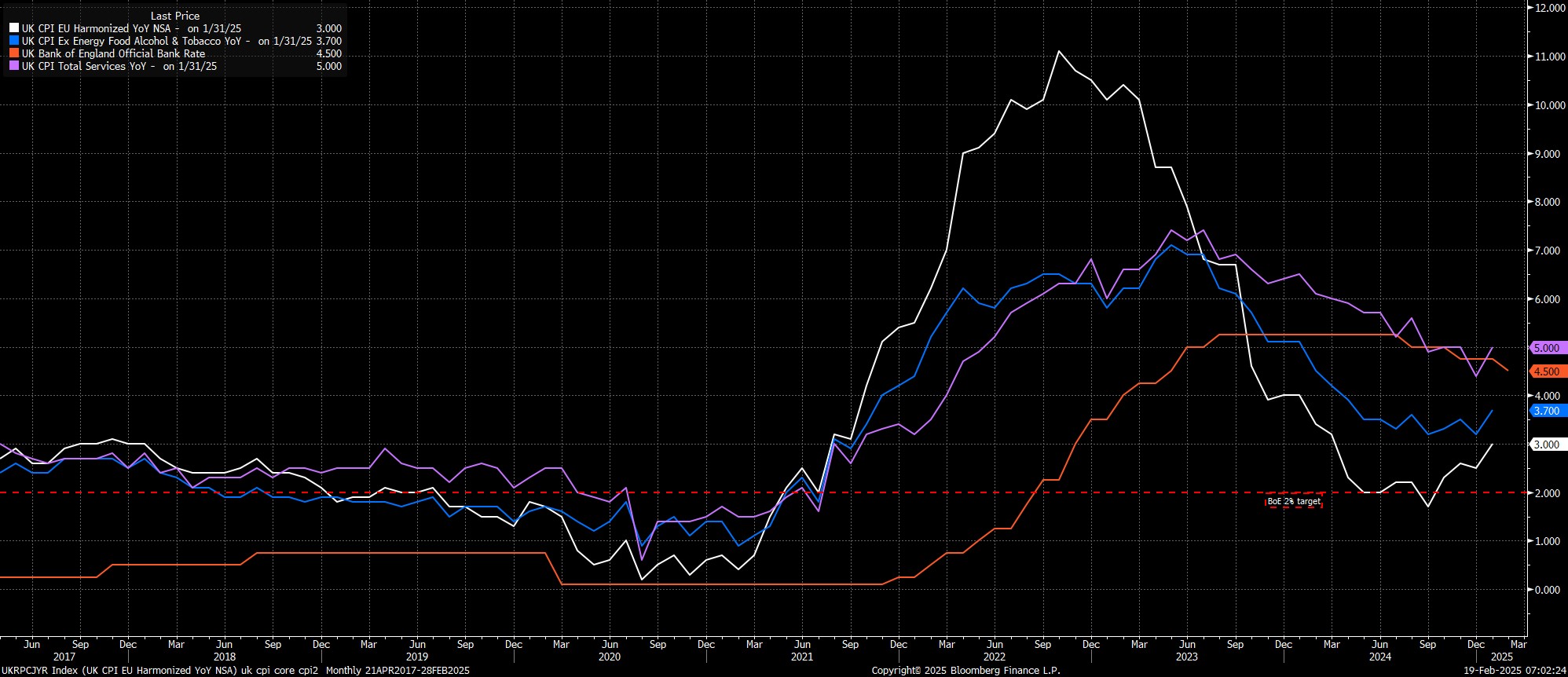

January 2025 UK CPI: Price Pressures Intensify Once More

Headline inflation rose 3.0% YoY in January, well above the BoE's 2.8% forecast, and the fastest such pace since March 2024, while core prices - excluding food and energy - rose by 3.7% YoY in the same period. Meanwhile, the closely-watched services CPI metric jumped 5.0% YoY at the start of the year, somewhat below the Bank's 5.1% forecast, and perhaps a very, very small silver lining within the release.

Amid these figures, it is important to recall that there were numerous factors that would always have pushed the January inflation figures higher, including VAT now being charge on private education, a rise in the bus fares cap, a higher Ofgem energy price cap, and a reversal of the December inflation decline due to the ONS' choice of survey dates. January, also, represents the annual change in the CPI basket.

In any case, figures of this ilk simply do not permit the Bank of England to adopt a more dovish stance at present, with the risk of inflation persistence, and stubborn price pressures becoming embedded within the economy, still elevated. Furthermore, headline inflation is set to continue to rise throughout at least the first half of the year, likely peaking just shy of 4% in the summer.

Consequently, the current "gradual and careful" pace of policy easing, interpreted as one 25bp cut per quarter, looks set to continue for the foreseeable future, with my base case being for the next such cut to come in May, and for Bank Rate to end the year at 3.75%. While risks to this view do tilt towards a more dovish outturn, and the possibility of more rapid rate cuts in H2 amid stalling economic momentum, stubbornly high inflation, and a distinct lack of substantial disinflationary progress, simply shan't permit the 'Old Lady' to reduce rates more quickly for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.