- English

- Italiano

- Español

- Français

Analysis

Economic Landscape: Mixed Signals, Stalled Recovery

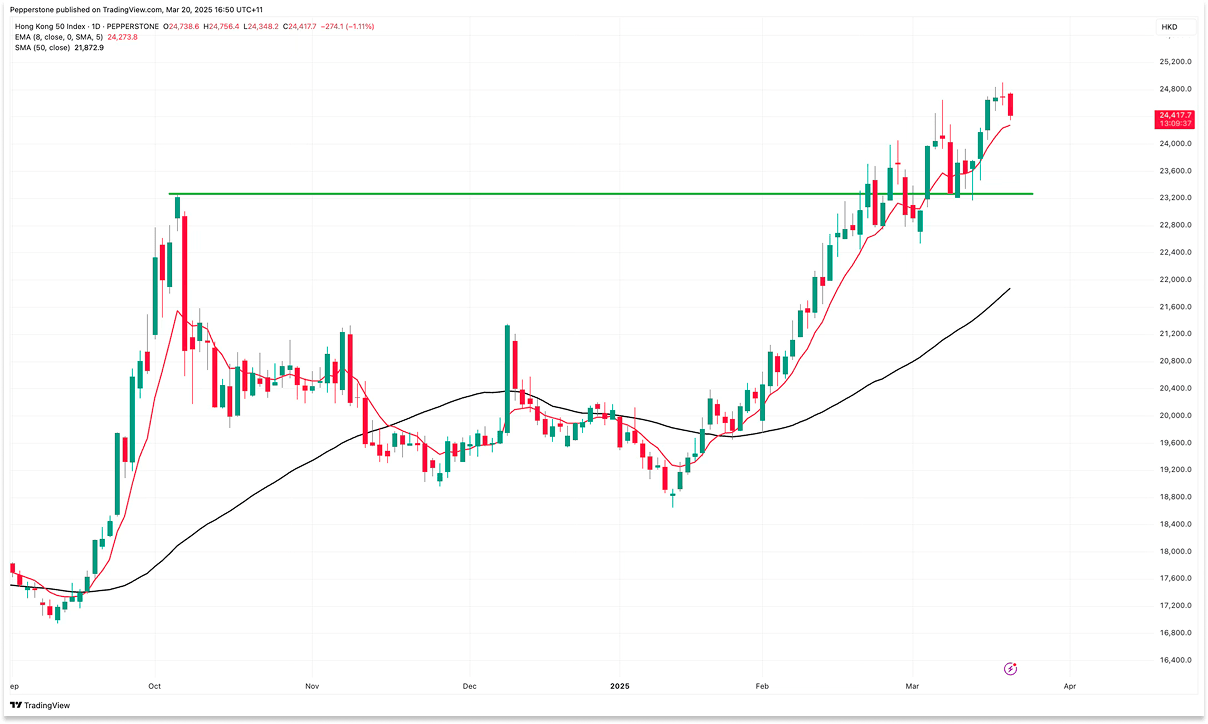

Driven by the strong performance of the tech sector, Hong Kong stocks and other China-related assets have delivered impressive gains. The Hang Seng Index has surged as much as 30% year-to-date, largely pricing in the tailwinds from the rise of AI companies.

However, recent economic data paints a more complex picture, revealing that China is currently in a painful transformation phase, with a full recovery still a long way off.

On one hand, consumer and production data have exceeded market expectations, indicating resilience in some sectors of the economy. Supported by "trade-in" subsidies, retail sales of consumer goods in January-February grew by 4% year-on-year. Meanwhile, export-oriented industries, spurred by a "front-running" effect before the US tariff adjustments, helped industrial production grow by 5.9% over the same period.

On the other hand, structural issues continue to weigh on overall growth momentum, with deflationary pressures becoming increasingly evident. Although the data may be distorted by the timing of the Chinese New Year, the 0.7% year-on-year decline in February's CPI indicates weak domestic demand.

Additionally, the trade data is disappointing, with imports falling by 8% in February, well below the expected 1% decrease. More concerning is the fact that, despite some businesses accelerating shipments to avoid potential tariff hikes, cumulative export growth for January-February was only 2.3%, significantly below the market consensus of 5%. This suggests that external demand is not stable, and after the policy front-running, exports may face more significant downside risks in the second quarter.

Moreover, the real estate market remains sluggish, with declining new home sales, falling property prices in major cities, and a drop in real estate investment. This has led to a sharp decline in new household loans to the lowest level in 20 years, further dampening consumer and investment confidence.

Overall, while some economic data shows resilience, there are still doubts about whether the current growth drivers can sustain momentum. Deep-seated structural issues clearly require more robust policy support to drive a genuine economic recovery and sustain the stock market’s upward momentum.

Increased Stimulus to Tackle Domestic and External Pressures

In response to the challenges of domestic recovery and external pressure from US tariff policies, the Chinese government outlined its policy direction during the National People’s Congress in early March. While maintaining the GDP growth target of 5% for the year, authorities lowered the 2025 CPI inflation target to 2% (down from 3%) and raised the fiscal deficit-to-GDP ratio from 3% to 4% to strengthen policy support and release more liquidity.

As anticipated by the market, the government has introduced a series of economic stimulus measures, including the issuance of 4.4 trillion yuan in special local government bonds for infrastructure investment, land acquisitions, and real estate project purchases, as well as debt swaps for local governments. Additionally, 1.8 trillion yuan in special government bonds will be injected into the banking system and used for consumption subsidies to enhance credit expansion and boost economic momentum.

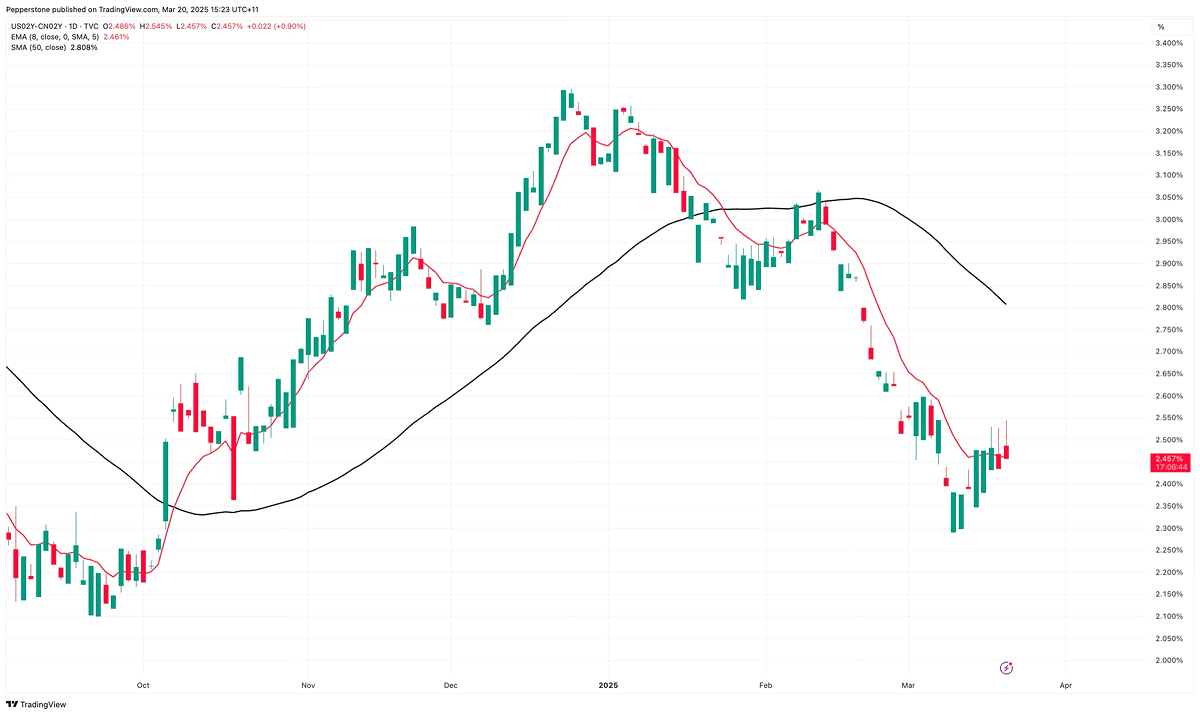

Beyond fiscal stimulus, the People’s Bank of China has also signaled monetary easing. PBoC Governor Pan reiterated that in 2025, China will consider reducing reserve requirements and interest rates. Previously, fluctuations in the RMB exchange rate had been a major constraint on the central bank's easing policies, especially as market expectations grew that China might devalue the yuan to offset export pressures amid escalating US trade barriers.

However, recent changes in the market environment have shifted the narrative. The “American exceptionalism” narrative has come to an end, coupled with the uncertainty surrounding Trump’s policies, which has led to a continued decline in U.S. Treasury yields and a weakening of the dollar. Meanwhile, the strong performance of China’s tech sector has boosted market confidence, with Chinese bond market yields rising, the China-U.S. interest rate gap narrowing significantly, and the exchange rate showing signs of recovery.

Against this backdrop, external constraints on China’s monetary policy have eased substantially, and the risk of RMB depreciation is no longer an obstacle to cutting reserve requirements or interest rates.

Compared to the current combination of fiscal tightening and monetary easing in many developed markets like the UK and the US, China's policy mix not only helps alleviate downward economic pressure but also offers clearer growth expectations, guiding China’s economy toward a more stable recovery track.

“Sci-tech board” in bond market: Strong Support for Tech Startups Financing

As Chinese tech companies continue to enhance their competitiveness, they are emerging as new economic growth drivers. The "AI+" strategy and the concept of "Sci-tech board" in bond market have become key topics of discussion.

Since most tech companies require capital-intensive research and development processes before they become profitable, financial support is crucial. Generally, companies can obtain funding in two ways: credit financing or bond financing. However, startup tech companies often lack collateral and formal credit ratings, making it difficult to meet the rigid requirements of traditional financing models.

As a result, founding teams often have to give up significant equity to attract venture capital in exchange for funding. This inevitably poses risks to company management and long-term development.

The "Sci-tech board" proposal discussed at the meeting could significantly improve this situation. Under this framework, financial institutions, tech companies in growth and mature stages, and private equity investors can issue bonds on specialized financing platforms targeting institutional and individual investors (indirect holders). These bonds, which are high-risk, may benefit from policy guarantees, credit backing, and risk-sharing mechanisms to enhance their credit standing.

For innovative tech companies, the implementation of this policy provides funding support at every stage, from early development to expansion. The 5-10 year repayment cycle for these bonds also helps stabilize cash flow and facilitate the transformation of results.

For China’s economy, the tech bond initiative will promote the establishment of a credit rating system for tech innovation enterprises and channel more funds into sectors like AI, biopharmaceuticals, and new materials. Government measures to enhance the credit of municipal bonds will also increase market acceptance of high-risk bonds, driving China's technology innovation strategy and industrial upgrading.

Tariff Developments and Policy Strength Are Key

Overall, some economic data in China shows signs of recovery, and the strong performance of the tech sector, along with stimulus measures introduced by the National People’s Congress, underscores the government’s determination to stabilize growth. However, structural economic challenges remain, and the effectiveness of policy execution is still to be observed.

While the government has proposed a series of measures to boost consumption, such as establishing childcare subsidies and optimizing wage adjustment mechanisms, the specific implementation steps and quantitative targets have not yet been clarified. The measurability and transparency of these policies are crucial for strengthening market confidence and ensuring the sustainability of the economic recovery.

On the external front, Beijing's response to Trump’s 20% tariffs has been relatively mild, announcing countermeasures of 10-15%. With the US trade policy review still pending, the details of potential retaliatory tariffs remain unclear. Chinese policymakers will need to assess the further evolution of tariff friction and may seek to negotiate a new trade agreement.

Looking ahead, China will release its GDP data for Q1 2025 on April 16, and a high-level meeting at the end of April will discuss economic policy. By then, the government's assessment of the economic situation and the impact of tariffs will become clearer. If domestic growth slows and external trade tensions escalate, policymakers may further ramp up stimulus measures to offset potential shocks.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg)