- English

- Italiano

- Español

- Français

Analysis

WHERE WE STAND – Friday’s blowout US labour market report saw markets end the week on a risk-averse note, as expectations grew that the Fed’s anticipated January ‘skip’ could instead turn into a prolonged ‘pause’.

Headline nonfarm payrolls rose +256k in December, topping the forecast range, and marking the biggest one-month jump in employment since last March. Meanwhile, unemployment unexpectedly declined to 4.1%, erasing November’s surprise increase, even as participation held steady at 62.5%. Earnings, lastly, rose 0.3% MoM, and by 3.9% YoY, reinforcing policymakers’ longstanding view that the labour market is not a source of inflationary pressures at the current juncture.

While, undeniably, good news, and a report that pointed to the continued resilience of the US labour market, the report was probably too good for equities, given that the figures somewhat raise the chances of the FOMC sitting on the sidelines for longer, plotting an even more careful course when it comes to taking further steps back towards a more neutral policy setting.

Furthermore, the jobs figures come against a backdrop where the FOMC’s hawks already held the upper hand, amid the plethora of upside inflation risks that the year ahead seems likely to bring, and taking into account the potential for further risks stemming from President-elect Trump’s initial policy moves.

One must also consider that the jobs figures came at a time when bond bears are in the driving seat across DM, with the hot slate of employment data serving only to further strengthen their position. This was evident not only in the Treasury complex, where yields rose across the curve into Friday’s close, but also here in the UK, where Gilts remain on incredibly shaky ground.

While UK benchmarks performed broadly in line with peers on Friday, the GBP continues to move in the opposite direction, with cable probing the 1.22 handle to the downside, all while the Chancellor has jetted off on a jolly-up to China. Clearly, confidence in UK Plc among international investors remains low, ahead of a busy upcoming week, including 10- and 20-year auctions, as well as the latest inflation figures.

In fact, confidence among market participants more broadly remains relatively low, with conviction seemingly somewhat lacking. The default position for most, ahead of Trump’s inauguration in a week’s time, remains flat risk, short fixed income, and long USD.

There seems to be little that is likely to change those biases in the short-term, at least not until clarity on Trump’s initial policy moves is obtained. Consequently, I still favour buying any USD dips, and over the short term at least, fading strength in the equity space.

My longer-run belief in the path of least resistance leading to the upside remains. However, near-term catalysts tilt towards a more cautious stance, with Q4 earnings season soon to get underway, presenting a high bar for upside surprises given lofty expectations, and with participants likely to take the prudent step of trimming positions into Inauguration Day next Monday.

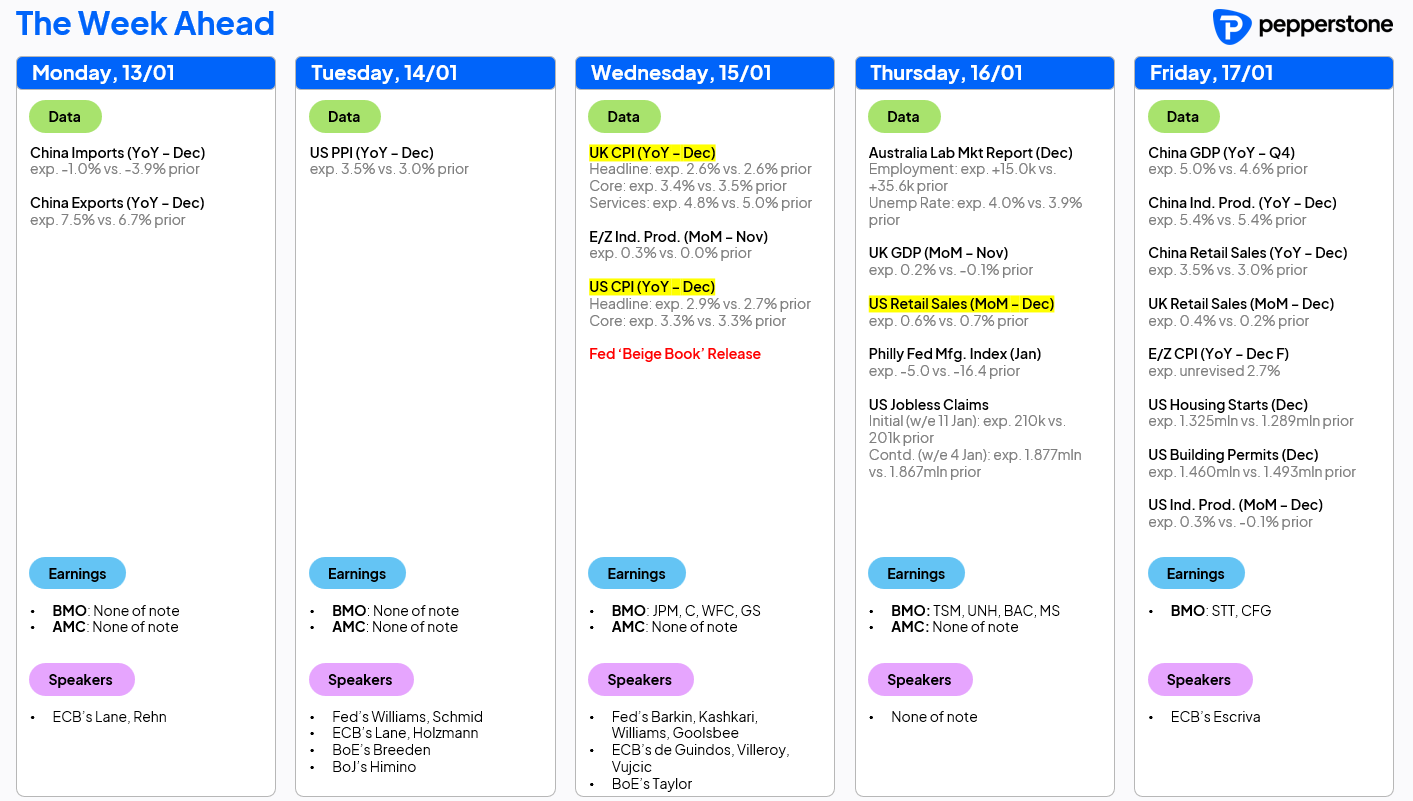

LOOK AHEAD – Another busy week lies ahead, with the full calendar shown below.

Wednesday’s US CPI print stands as the most significant risk event for participants to navigate, particularly after the hawkish repricing seen in the aftermath of Friday’s jobs report, though the December retail sales report will also be worth a close look, especially given how integral solid consumer spending is to underpinning the ongoing solid pace of US economic growth.

Here in the UK, a busy docket lies ahead, with the mid-week inflation figures likely of most interest. The GBP OIS curve discounts around a 3-in-4 chance of a 25bp BoE cut at the start of next month, though a further lack of disinflationary progress on underlying inflationary metrics could threaten the chances of further loosening. Naturally, a hot print would also be bad news for the fragile Gilt market, where 10- and 20-year supply is due this week.

Besides that, as mentioned earlier, the start of Q4 earnings season brings another narrative for markets to watch, with banks in the limelight this week, before focus moves to ‘big tech’ in a couple of weeks’ time.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.