- English

- Italiano

- Español

- Français

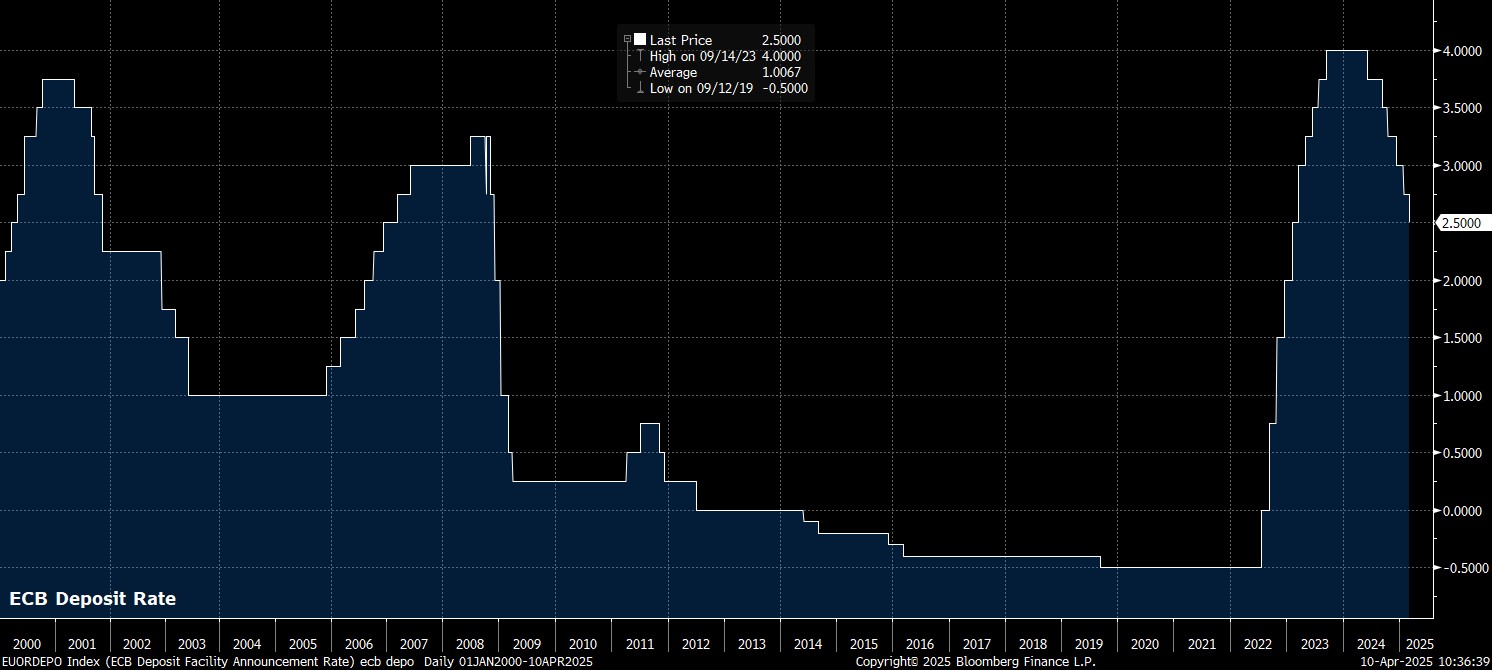

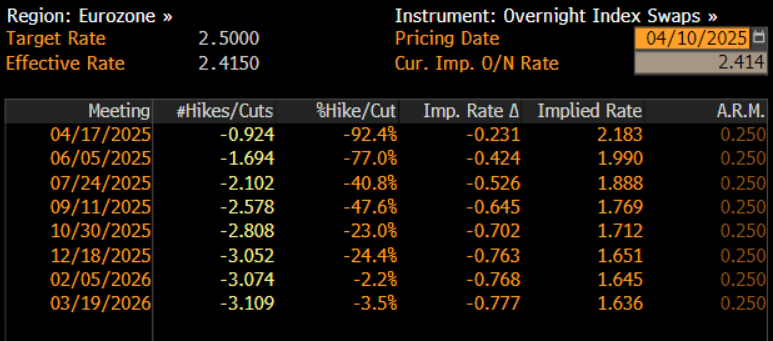

As noted, the Governing Council seem near-certain to deliver a 25bp cut at the conclusion of the April meeting, lowering the deposit rate to 2.25%, a move which would be this year’s third, and this cycle’s seventh rate reduction. Money markets, per the EUR OIS curve, discount around a 90% chance of such a move, while pricing a further two 25bp cuts by year-end.

It seems, however, that the decision to deliver such a rate cut is unlikely to be a unanimous one, even though the ECB continue not to publish a formal voting record. Austrian representative Holzmann has been a notable hawk of late, rubbishing the need for further rate cuts, though he abstained, as opposed to voting against additional easing, last time out.

Despite that, the Governing Council’s policy guidance is likely to be largely unchanged from last time out. As such, policymakers should reiterate that a ‘data-dependent’ and ‘meeting-by-meeting’ approach to future decisions will continue to be taken, with policy not on a ‘pre-set’ course. Furthermore, the statement should also repeat the language tweak made last time out, that the policy stance is “becoming meaningfully less restrictive”.

While that change had, last time out, been taken to be an implicit nod towards a slower pace of policy easing going forwards, it goes without saying that the macroeconomic backdrop has significantly shifted in the intervening period.

Chiefly, this concerns the issue of trade, with President Trump having thrown tariffs around all over the place since the ECB last decided policy. While the “reciprocal” tariff of 20% announced on 2nd April has since been halved to a 10% levy, there remains a 25% tariff on imports of steel and aluminium, as well as a 25% tariff on automobiles. In addition, the aforementioned 20% “reciprocal” tariff hasn’t been shelved entirely, only paused for 90 days, until 8th July.

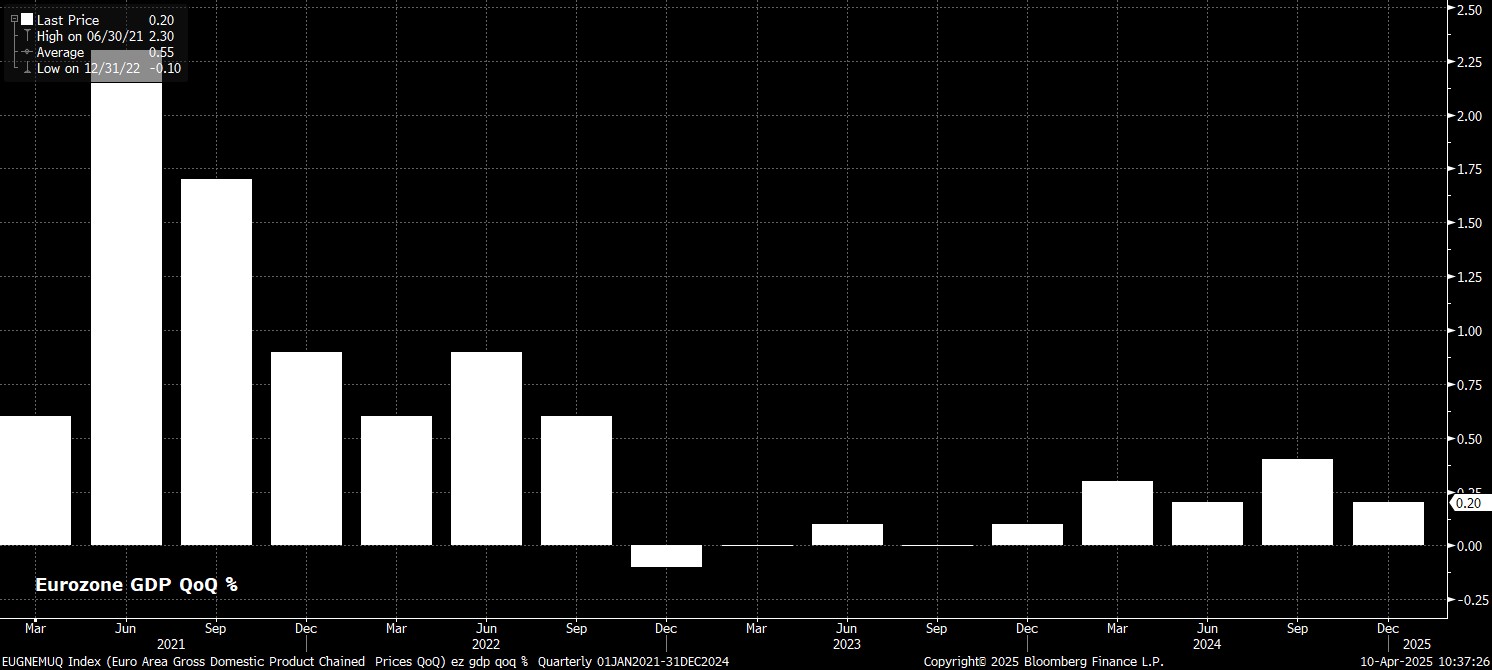

This pause is important as, while EU-US negotiations will continue during this period, the degree of uncertainty clouding the economic outlook will remain incredibly elevated. With the threat of a 20% tariff still looming large, it’s difficult to envisage businesses being able to make firm investment plans, or consumers feeling any sense of relief. As well as this, even a 10% tariff on EU imports is likely to cause a significant drop in demand for eurozone goods, in turn presenting significant downside growth and inflation risks for the bloc. This growth hit, per some rudimentary ‘back of the envelope’ maths, could be as much as 1ppt off GDP this year.

With this in mind, even though a ‘worst case’ scenario on the tariff front has seemingly been avoided, at least for now, it remains likely that the ECB will need to cut deeper, and cut quicker, than had previously been foreseen, in order to somewhat cushion the blow that those protectionist trade measures will cause.

Given the elevated degree of uncertainty, and that an updated round of staff macroeconomic projections to quantify the impact of recent developments is not due until June, President Lagarde is unlikely to make waves at the post-meeting press conference.

Instead, while near-certain to stress that risks to economic growth continue to tilt to the downside, Lagarde will probably stick largely to her familiar script, stressing that policy is not on a pre-determined path, and that policymakers will provide the support required to ensure that inflation remains sustainably at the 2% objective, especially with risks of a prolonged undershoot growing.

Taking a step back, while the ECB may not be prepared to make a more dovish pivot in terms of their tone just yet, mounting risks of inflation undershooting target for a prolonged period of time, and the economic damage caused by Trump’s tariffs, will likely necessitate that the easing cycle continues for some time to come. Consequently, the base case is that a 25bp cut will be delivered at every meeting from now, until the autumn, with a move below the bottom of the range of neutral rate estimates, at 1.75%, seemingly nailed on.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.