- English

- Italiano

- Español

- Français

Analysis

February 2024 CPI Recap: Reinforcing The Fed’s Patience To Deliver Cuts

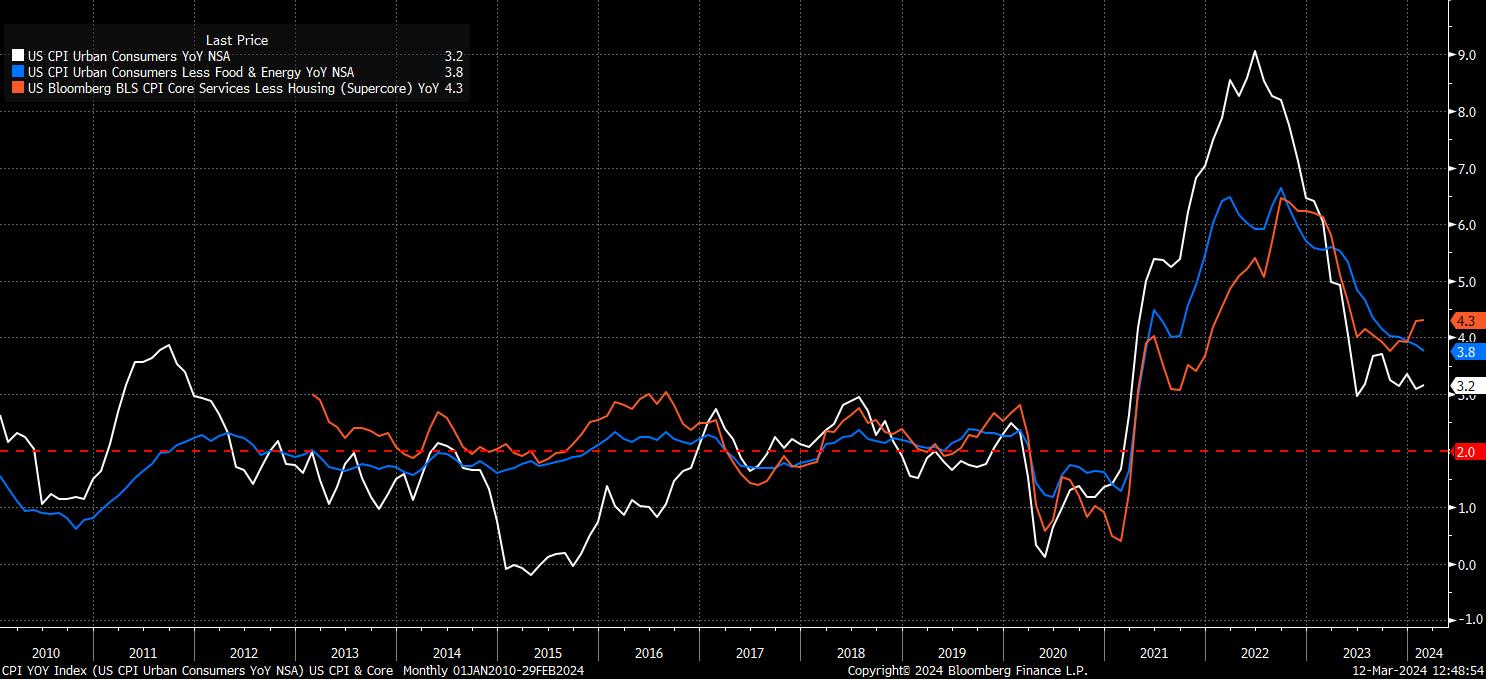

Headline CPI rose by 3.2% YoY last month, a surprising rise from the 3.1% pace seen in January, and 0.1pp above consensus expectations. Core CPI, meanwhile, slowed just a touch to 3.8% YoY, from 3.9% YoY in January, while the ‘supercore’ inflation measure (aka – core services, ex. housing) remained unchanged at 4.3% YoY for the second month running, a relatively worrying sign in terms of the potential stickiness of price pressures.

Increasingly, however, the YoY figures are not the most effective way of analysing incoming inflation figures, largely owing to distorting base effects, and the difficulty of gauging underlying inflationary pressures from the annual figures. Hence, the monthly data has taken on increasing importance, particularly as FOMC policymakers place increasing emphasis on 3- and 6-month annualised MoM CPI metrics.

On this note, headline CPI rose 0.4% MoM, a modest quickening from the 0.3% pace seen in January, while core prices also rose 0.4%% on the month, unchanged from a month prior. In turn, this saw the all-important annualised MoM core CPI prints rise to 4.2% on a 3-month basis, and 3.9% on a 6-month basis, the latter being the highest such level since last July.

Digging into the data a little further, and the inflation report does not appear quite as ugly as the headline measures would suggest. Principally, taking some of the edge off the hotter-than-expected report, is that around two-thirds of the MoM rise in headline inflation came from the shelter (which may still be skewed by OER) and gasoline components – both of which are relatively volatile, and likely to be looked-through by FOMC policymakers.

Nevertheless, there remains a significant divergence between core goods and core services prices, with the goods side of the economy remaining in deflation, as prices fell 0.3% YoY, while services inflation continues to run hot, remaining north of the 5% handle, as it has in every month since May 2022.

All in all, the February CPI report pointed to a continuation of the relatively bumpy disinflationary path back towards the Fed’s 2% target. While the MoM metrics, and their annualised compatriots, did show a surprising rise, the core disinflationary trend remains intact, with YoY core CPI extending its run of having fallen in every month since last March.

As such, the inflation figures are likely to have a relatively muted impact on the policy path that the FOMC are set to take. USD OIS continues to imply a strong likelihood that the first 25bp cut of the cycle will come in June, while also continuing to price around 90bp of easing over the year as a whole, both being broadly unchanged from pre-release levels.

Importantly, there are a further three CPI reports due before the Fed are anticipated to deliver the first cut, while one must also remember that the impact of shelter inflation is significantly lower in the PCE metric that the FOMC prefer, than in CPI – with around half the component weight. These two factors together help to explain the lack of any significant repricing, though the report does perhaps – at the margin – dent the already-slim chances of a more explicit dovish turn from the FOMC at the March meeting, next week.

In terms of broader market reaction, conditions were choppy, but ultimately produced significantly more by way of noise, than they did of signal. An initial knee-jerk hawkish move (stronger USD, Treasuries sold, equities pressured) faded almost as quickly as it occurred, to be followed by markets rapidly returning to pre-release levels, though with the greenback just a touch softer than prior to the data dropping.

As with the lack of changes to the policy outlook, the February CPI report will do little to change the broader cross-asset market outlook – ongoing ‘US exceptionalism’ should help to keep the dollar underpinned vs. most G10 peers, while the continued expectation of rate cuts, and looser monetary policy, later in the year should provide a firm backstop to equities, and keep the path of least resistance leading to the upside.

_D_2024-03-12_12-49-57.jpg)

It seems likely that said path of least resistance is what markets will take for the time being, at least until we hear from Powell & Co. in the middle of next week. Once more, that FOMC meeting should stress policymakers continuing to seek “confidence” that inflation is on its way back to target. The February inflation report reinforces the rationale behind this prudent, patient stance, which seems highly unlikely to change for the time being.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.