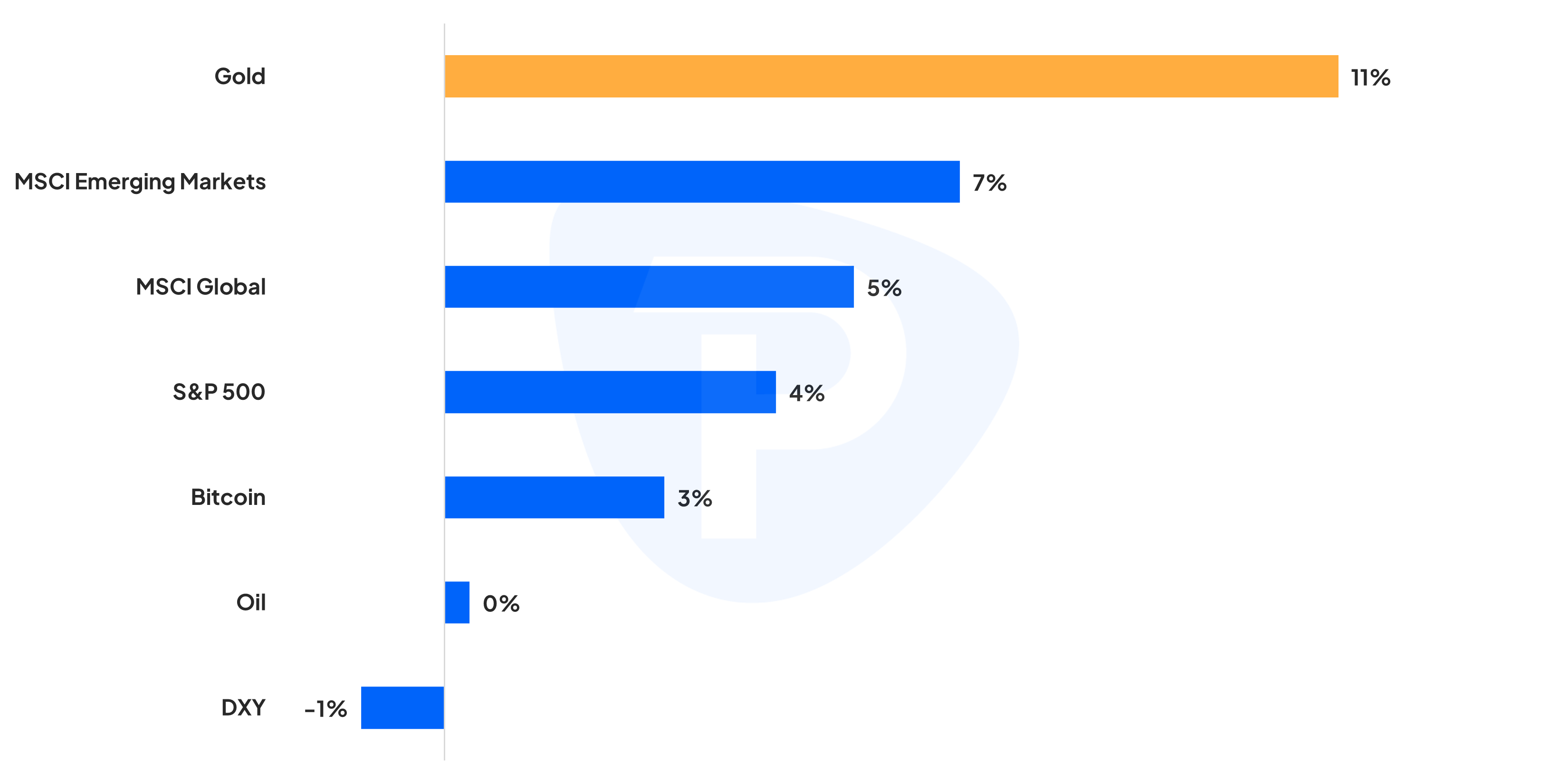

The significance of gold’s surge during the early stages of 2025 becomes even more apparent when compared to other global market benchmarks. While the U.S. dollar index has declined, oil remains stagnant, Bitcoin is advancing marginally, the S&P 500 is up 4%, the MSCI Global index is up 5%, and the MSCI Emerging Markets index is up 7%.

2025 Comparison

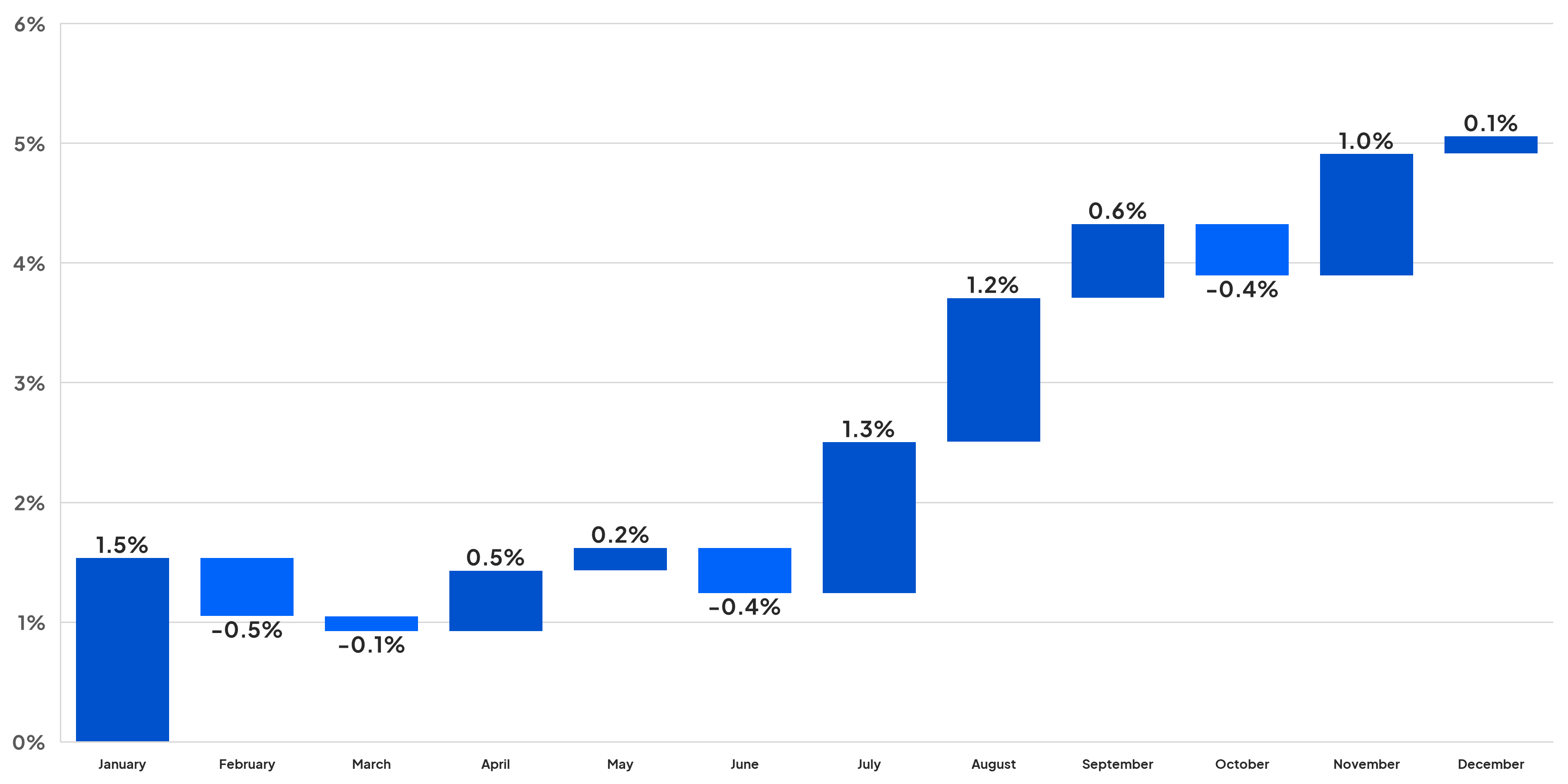

Against all these, gold shines with its double-digit growth. What is most striking is that this is happening during a traditionally modest period for the yellow metal. Since the 1980s, the historical average for January-February has been around just a 1% increase. In other words, this 11% gain is well above the typical seasonal pattern.

Gold Seasonality

Extraordinary Performance in 2024

To illustrate, gold’s momentum during 2024 was driven by several key factors:

- A less restrictive monetary policy, with central banks such as the Federal Reserve, the Bank of England, and the European Central Bank cutting rates.

- Continued geopolitical uncertainties, especially in the Middle East—where, on multiple occasions throughout 2024, a possible escalation involving Iran and Israel loomed—and in the Russia-Ukraine conflict, which saw extreme moments such as Ukrainian forces entering Russian territory.

- Strong physical gold demand from central banks, translating into record purchases for the third consecutive year (exceeding 1,000 metric tons annually), consistently supporting gold prices.

Continued Gains in 2025

Additional Rate Cuts, Though Potentially More Moderate

As 2025 begins, market participants continue to assess the support that rate cuts could provide. However, the outlook has become somewhat more measured:

- Federal Reserve (Fed): A -25 bp cut is expected by year-end. Inflation progress has slowed, reducing the room for further cuts.

- Bank of England (BoE): -75 bp.

- European Central Bank (ECB): -125 bp.

- Swiss National Bank (SNB): -25 bp.

- Bank of Canada (BoC): -25 bp.

It is important to highlight that this additional normalization, though more moderate—except in the ECB’s case—does not appear to be the main driver of gold’s rally. The market has largely priced in reduced normalization and assumes that central banks, especially the Fed, are acting more cautiously given the risk of persistent inflation. Additionally, there is potential for President Trump’s trade policies to reignite inflationary pressures.

Central Bank Physical Demand: A Constant Ally

Another element that has been, and continues to be, crucial for gold is central bank demand. Although it is expected to be slightly lower in 2025 (around 900 metric tons compared to over 1,000 in the last three years), it remains at a historically high level. The primary reason lies in the need to diversify assets linked to the USD and Western-aligned policies, as well as the search for safe-haven assets amid high-uncertainty scenarios such as trade wars, which sustain a strong appetite for gold bullion.

Gold Demand Chart

Trump’s New Era and the Return of Trade Wars

If there is one factor making headlines while simultaneously sowing uncertainty, it is Donald Trump’s renewed protectionism, as he began his second presidential term on January 20, 2025. The sequence of tariffs announced in the first few weeks of his administration has been relentless:

- January 21: A 10% tariff is imposed on all Chinese imports and 25% on imports from Mexico and Canada (the latter effective February 1).

- February 1: Trump signs executive orders to formalize the 25% tariff on Mexico and Canada and reaffirms the 10% tariff on China. Additionally, a reduced 10% tariff is established for Canada’s energy resources.

- February 3: A one-month “pause” on tariffs for Mexico and Canada is announced following an agreement to strengthen anti-drug trafficking efforts.

- February 10: Tariffs on steel and aluminum are increased to 25%, effective March 12.

- February 13: An executive order is issued to evaluate the implementation of reciprocal tariffs on a global scale.

- February 18: A 25% additional tariff is proposed on imports in the pharmaceutical, automotive, and semiconductor sectors, effective April 2.

This series of actions has reignited concerns about a potential trade conflict that could disrupt supply chains and global economic stability. When uncertainty rises and markets struggle to quantify the damage, gold regains its historical role as a safe haven.

Investors once again find themselves at the mercy of uncertainty patterns similar to those of Trump’s first presidency when tariffs were used as a primary negotiation and pressure tool. This prompts many to seek shelter in assets like gold, which tends to benefit during periods of uncertainty.

Towards $3,000 per Ounce or Beyond?

The convergence of all these factors—a still-normalizing monetary policy, persistent central bank demand, and trade tensions—has led various institutions to forecast that gold could climb to $3,000 per ounce in the coming months. Some investment banks, such as Goldman Sachs, have even updated their projections to $3,100, surpassing the key psychological level.

Alternative Scenario

It is important to mention an alternative scenario, one to which I adhered until recently, suggesting that a tightening trade environment could generate inflationary pressures that would force the Fed to halt any rate-cut plans or, in an extreme case, even consider new hikes. Although this is no longer the base case—mainly because the administration, despite generating significant uncertainty, has opted for a more methodical approach in implementing tariffs—it remains a risk.

Before Trump’s inauguration, the fear was that much broader, more aggressive, and widespread measures would be enacted. However, Trump’s strategy appears more calculated. Still, it cannot be ruled out that an escalation of tariffs could eventually stoke inflation. If that happens, the Fed may be forced to adopt a tighter stance, altering gold’s upward trajectory.

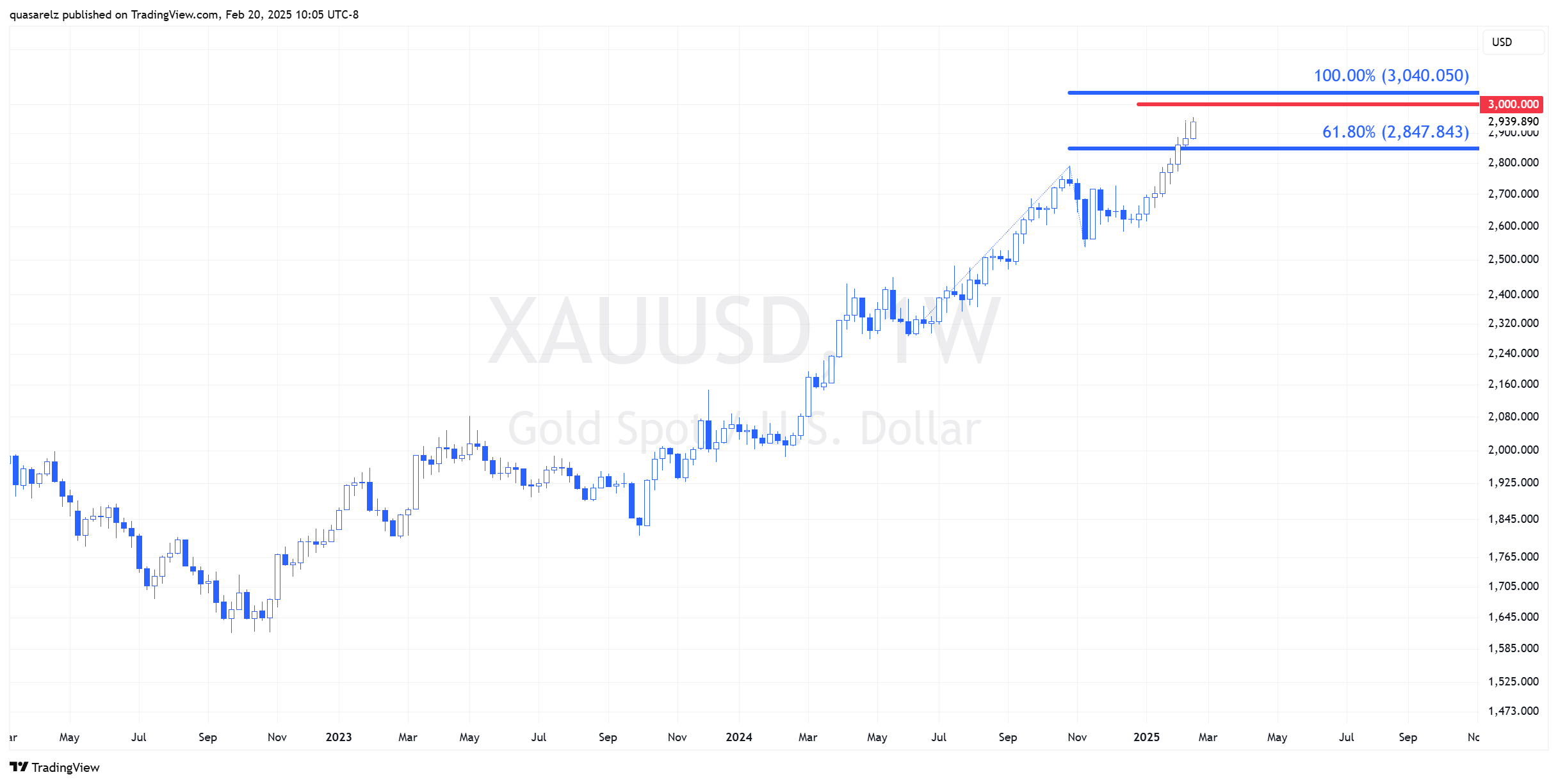

Gold Technical Analysis: No Immediate Signs of a Correction

On the technical front, gold maintains a clear formation of higher highs, a sign of continued upward momentum. There are also no negative divergences in indicators such as the RSI on the daily chart, meaning there are no strong signals of a major correction.

Monthly Chart XAU/USD:

Daily Chart XAU/USD:

The psychological level of $3,000 per ounce stands out as the first major target. In fact, when looking at a weekly chart, potential targets exist around $3,040 per ounce, based on the latest advance structures.

Weekly Chart XAU/USD:

Conclusion

Gold’s remarkable bullish run at the start of 2025 is the result of the new trade tensions under the Trump administration and the still-strong demand from central banks. The intersection of these factors has placed gold in a privileged position compared to other assets, making it the top-performing investment so far this year.

For those looking to diversify their portfolios, gold appears once again to be fulfilling its role as the “ultimate safe haven,” particularly given a geopolitical and macroeconomic landscape still riddled with uncertainties. The $3,000 threshold is no longer seen as a distant illusion but rather as an increasingly plausible target. However, the path is not without challenges—an unexpected inflationary surge could alter the Federal Reserve’s plans and, with them, gold’s upward trajectory.

As long as this climate of volatility persists and questions about the outcome of trade wars remain unresolved, gold will continue to dominate headlines and potentially surpass its own historical records.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.