How to trade FOMC decisions and The Fed’s market impact

The Federal Open Market Committee (FOMC) plays a key role in U.S. monetary policy, impacting interest rates and influencing assets. This guide provides tips for trading around FOMC decisions, helping traders understand market reactions to refine strategy.

Written by: Ioan Smith | Expert Financial Writer

Why Interest Rates Are Important

Interest rates play a pivotal role in the economy, influencing various aspects of daily life, from mortgages and credit cards to investments as well as stock prices. Understanding these rates are critical to identifying economic trends and making informed financial decisions.

Factors Influencing Interest Rates

- Inflation: Higher inflation typically leads to higher interest rates, as lenders demand compensation for the decline in purchasing power.

- Economic Growth: Strong economic growth increases the demand for credit, pushing interest rates up. Conversely, during a recession, lower demand for credit leads to lower rates.

- Monetary Policy: The Federal Reserve adjusts the federal funds rate to influence broader interest rates, managing inflation and stimulating economic growth.

Impact on the Economy

- Low Rates: Encourage borrowing and spending, driving economic growth by making loans more affordable for consumers and businesses.

- High Rates: Increase borrowing costs, leading to reduced spending and investment, potentially slowing down economic growth.

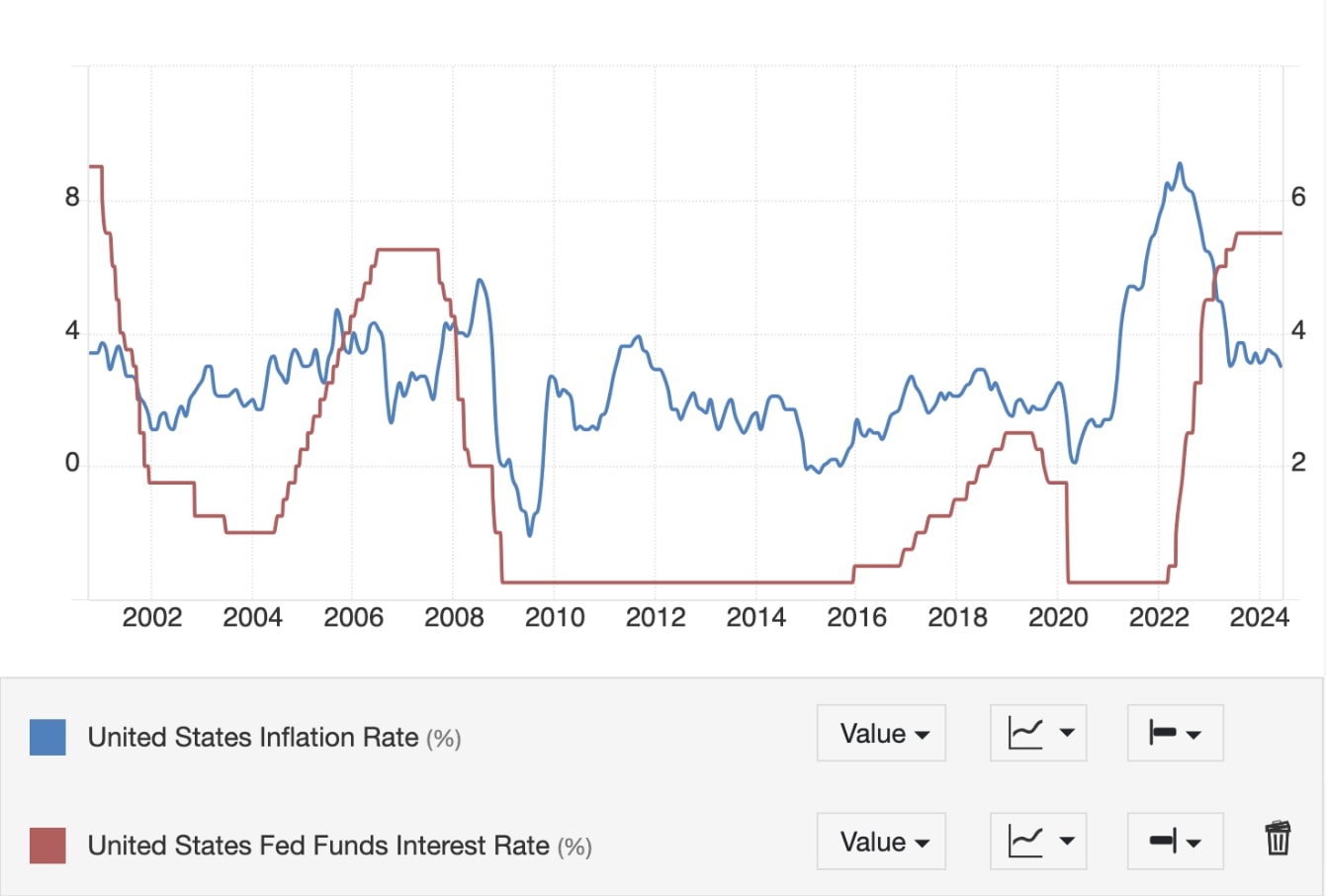

Examples of Interest Rate Changes

An example of how interest rate adjustments can shape the economy occurred during the Great Recession of 2008. To counter the economic downturn, the Federal Reserve cut rates to near-zero levels, spurring borrowing and investment to stimulate recovery. In contrast, in 2018, the Fed raised rates four times to curb rising inflation and prevent the economy from overheating.

Source: Trading Economics

How FOMC Decisions Impact Financial Markets

FOMC decisions significantly influence financial markets because they directly impact interest rates, liquidity, and economic expectations. When the Federal Reserve adjusts the federal funds rate, it affects borrowing costs across the economy. Additionally, quantitative easing (QE) and/or tightening (QT) also plays a role; QE injects liquidity by purchasing assets, boosting markets, while QT removes liquidity by reducing the Fed’s balance sheet, tightening financial conditions. Also, FOMC forward guidance on the economic outlook affects market sentiment. The Fed’s tone on inflation, employment, and growth can trigger volatility as traders adjust positions based on anticipated future policy direction.

- Stocks: Rate hikes tend to reduce consumer spending and business investment, leading to declines in stock prices, while rate cuts stimulate economic activity and often boost equities.

- Bond Market: Rate changes significantly influence bond yields. Higher rates increase yields, lowering bond prices, especially short-term bonds like U.S. Treasury notes.

- Currencies: The U.S. dollar typically strengthens when the Fed raises interest rates, as higher rates attract foreign investment into U.S. assets.

- Commodity Prices: Rising rates may put downward pressure on commodities, like crude oil and gold, by increasing the cost of holding these non-yielding assets.

Understanding Market Expectations

Trading around the FOMC requires understanding market expectations prior to the meeting. Key tools to gauge expectations include:

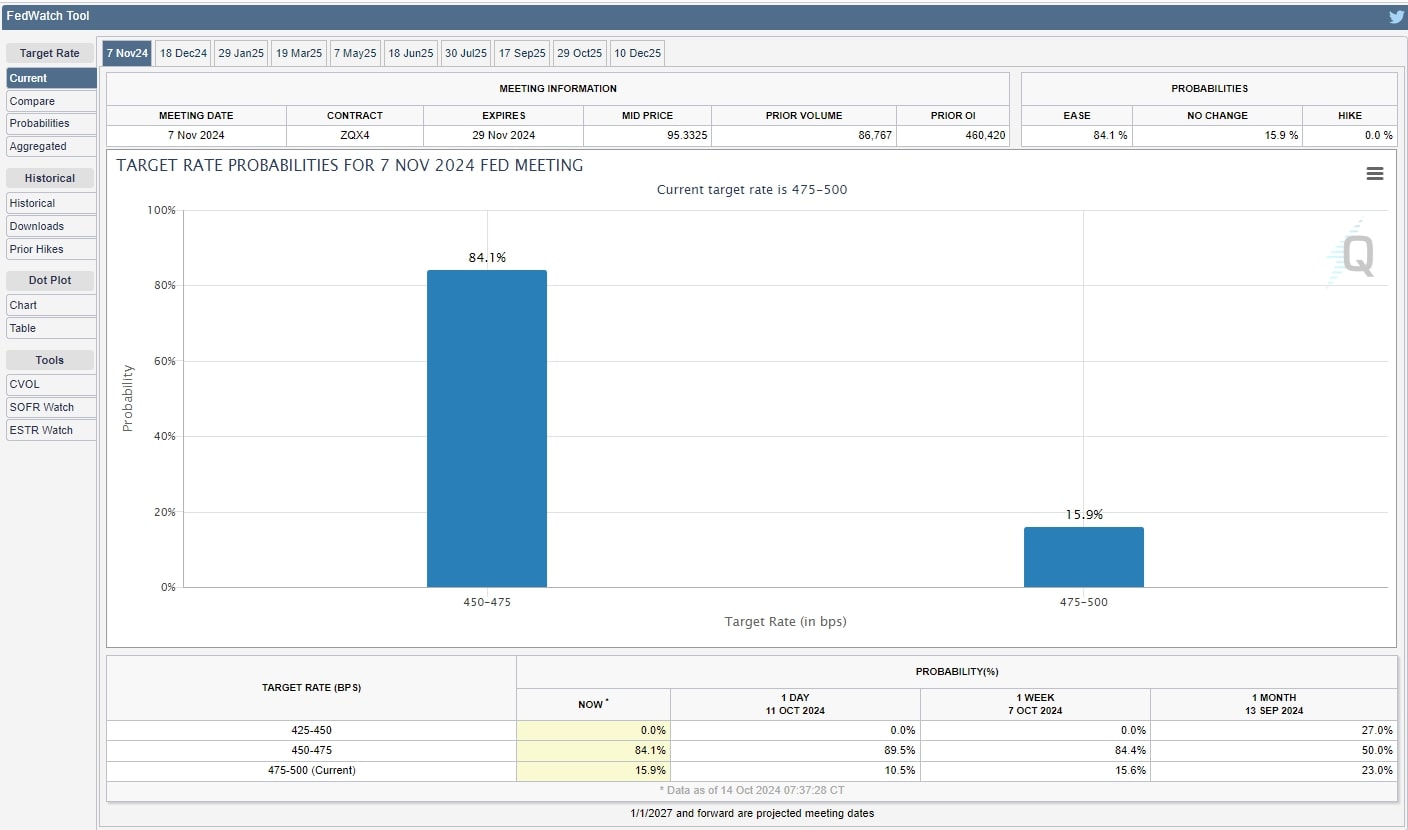

Fed Funds Futures

These contracts track market expectations for the federal funds rate. The CME’s FedWatch Tool quantifies the probability of rate changes. In simple terms, it calculates the probability of rate hikes, cuts, or no change in the federal funds rate for upcoming Fed meetings. Any deviation (e.g., a smaller rate hike/cut than expected) could lead to a volatile reaction. Discrepancies between the Fed's guidance and market expectations can trigger sharp moves in asset prices.

- Current Target Rate: This is the current range in which the Fed has set the federal funds rate. The range is between 4.75% and 5.00%.

- Probabilities: The tool shows the market's expectations for what the Fed will do at their next meeting. In the example above, for the November 7, 2024 meeting, there's a nearly even split between two possible outcomes: a 49.2% chance the rate will be lowered to the 4.25%-4.50% range (a rate cut), and a 50.8% chance it will be lowered to the 4.50%-4.75% range.

Traders use this tool to anticipate how the Fed’s decision will impact the financial markets, particularly currencies, bonds, and stocks. It is updated continuously with real-time market data, reflecting traders' expectations and how they evolve over time as new economic data comes out. This makes it a valuable tool for decision-making, especially when forming strategies around Fed announcements.

Economic Indicators

Inflation reports, unemployment data, and growth forecasts drive expectations of Fed actions, influencing the FedWatch tool:

- Inflation Reports (CPI and PCE): The Fed closely monitors CPI and PCE for inflation signals. High inflation (above the Fed’s stated 2% target) normally influences the Fed to raise rates to cool the economy, while low inflation can prompt rate cuts to encourage growth.

- Unemployment Data: The Fed's dual mandate involves managing inflation and maximising employment. Low unemployment can trigger rate hikes to prevent overheating, while high unemployment might prompt cuts to stimulate job growth.

- Growth Data/Forecasts: Strong GDP growth may prompt rate hikes to control inflation; slow growth may trigger cuts to stimulate spending and investment.

U.S. Treasury Yields

The Federal Funds Rate and the U.S. 2-Year Treasury Note yield are closely linked, as both reflect short-term interest rate expectations. The 2-Year yield typically rises when markets anticipate rate hikes and falls when rate cuts are expected, making it a strong indicator of Fed policy direction.

Even after the most recent 50 basis point cut, the spread between the Fed interest rate and the 2-Year Treasury yield is the widest in almost 30 years (chart above). In other words, the market is perhaps expecting more rate cuts and at a faster rate than the Fed is currently projecting.

Understanding the FOMC Report

While the Fed's headline interest rate is closely watched, traders also pay attention to the accompanying statements released after each FOMC meeting. These statements provide insights into the Fed's economic outlook and can hint at potential future policy changes. Because these releases can contain unexpected information, they have the potential to catch the market off guard, leading to increased volatility.

Understanding the nuances of these communications helps traders position themselves ahead of any major shifts in monetary policy. Many market participants will track changes in the Fed statement from the prior meeting to look for clues as to the future direction of interest rates:

Short-Term Trading Strategies During FOMC Announcements

Adopting effective short-term trading strategies during FOMC announcements is crucial due to the volatility these events generate. Consider price action in EUR/USD after the Federal Reserve's rate cut by 50 basis points on September 18, 2024 (below):

- EUR/USD initially experienced a sharp spike, reflecting the market's immediate reaction to the rate cut announcement. This was likely due to traders anticipating a weaker U.S. dollar, as lower interest rates tend to reduce the currency's appeal by offering lower yields. The upward move, however, was short-lived, and the pair quickly reversed direction and posted fresh lows. This sharp drop can be attributed to the market digesting the full implications of the Fed's statement. Despite the rate cut, the central bank's tone may have suggested caution about future economic conditions, or other elements of the release might have indicated that the cut was already priced in by the market.

- During the press conference though Fed Chair Powell said that this policy pivot was a “recalibration”. In other words, the decision to cut interest rates was a normalisation of monetary policy from a restrictive level and not an urgent shift to combat a crisis or a faster than expected slowdown. Thus the pair eventually stabilised at a slightly higher range. This choppy price action is typical of post-FOMC announcements as traders adjust positions and reassess risk based on new monetary policy guidance.

Short-term trading during FOMC announcements requires mobility and robust risk management. Here are some strategies traders commonly use:

Pre-Event Positioning: Traders often reduce positions ahead of the FOMC announcement to avoid getting caught in sudden market volatility. Instead, they wait for the decision and initial market reaction before entering new trades.

Volatility Breakout Strategy: The FOMC announcement can trigger significant price swings. Traders monitor key support and resistance levels, entering positions once the price breaks out decisively, either up or down.

Straddle Strategy: A straddle involves placing both a buy and a sell order above and below the current price. This way, whichever direction the market moves post-announcement, a trader can catch the breakout while managing the downside with stop losses.

Wait-and-See Approach: Risk-averse traders may prefer to wait for the market to stabilise post-announcement before taking any positions. This reduces the risk of being caught in false breakouts or extreme volatility spikes.

Focus on Major Currency Pairs: The USD is the focal point during FOMC announcements, so traders often focus on major pairs like EUR/USD or GBP/USD, which tend to exhibit large moves with greater liquidity.

Strategies for Trading Commodities Around FOMC Meetings

Gold is often seen as a hedge against inflation and currency devaluation, which makes it highly sensitive to FOMC meetings. Crude oil prices are also highly correlated to economic growth expectations. Both assets are sensitive to FOMC-driven changes in market sentiment, especially regarding interest rates, inflation, and growth expectations.

On September 18, 2024, crude oil and gold displayed distinct price movements around the Fed's rate cut. Before the announcement, crude fell over 2% due to market uncertainty. In contrast, gold experienced a slight uptick as traders anticipated a dovish outcome. During the announcement, both assets reacted sharply: crude oil rebounded modestly, while gold surged, reflecting increased demand for safe-haven assets. After the rate cut, crude oil stabilised, benefiting from cheaper borrowing costs, while gold continued to rally, driven by weakening dollar sentiment and inflation concerns.

Basic Gold Trading Strategy:

Pre-announcement: Traders expecting dovish signals may buy gold, anticipating a weaker dollar and higher gold demand. Hawkish signals might prompt short positions due to expected dollar strength.

During FOMC: Hikes often drive prices down and cuts push prices up. Short-term traders can profit from rapid price movements.However, these trades also carry the risk of significant losses

Post-announcement: Trend-following traders may hold long positions if dovish signals trigger a gold rally.

Basic Crude Oil Trading Strategy:

Pre-announcement: Economic growth signals often prompt long positions on oil, while hawkish tones may encourage shorts.

During FOMC: Rate hikes typically weaken oil prices; cuts support them.

Post-announcement: Long positions may follow expansion signals; short positions follow contraction signs.

Strategies for Trading Stocks Around FOMC Meetings

Trading stocks around FOMC meetings requires careful analysis of market sentiment and economic indicators. The following basic strategies traders can employ to adapt to changing conditions:

Pre-Announcement Positioning: A dovish stance may prompt long positions in rate-sensitive sectors like utilities and real estate, while hawkish expectations lead to reduced equity exposure or short positions, especially in growth stocks.

Post-Announcement: Market reaction is key. If growth is signalled, traders may go long consumer-sensitive stocks; if caution or tightening is indicated, equity positions might be reduced.

Managing Risks When Trading FOMC Events

Key strategies to consider to mitigate risks include:

Position Sizing: Traders should determine the appropriate position size based on the overall portfolio and risk tolerance. A common approach is to risk only 1-2% of the trading capital on any single trade, which helps prevent significant losses.

Stop-Loss Orders: Implementing stop-loss orders is crucial to limit potential losses. Traders should set these orders at strategic levels, such as below key support or resistance levels, to protect their positions in case the market moves unfavourably .

Avoiding Overleveraging: While leverage can amplify gains, it also increases risk. During FOMC events, it's prudent to use lower leverage or trade without it altogether to manage exposure effectively.

Market Analysis: Continuous monitoring of economic indicators and market sentiment prior to the announcement can provide valuable insights. This analysis can inform decision-making and help traders adjust strategies accordingly.

Best Practices for Monitoring FOMC News

Monitoring FOMC news effectively requires a systematic approach. Consider the following approach to stay informed and respond promptly to Federal Reserve developments:

Fed Speeches: Comments from key Fed officials between meetings often give clues about future policy. The FOMC meets eight times a year, with meeting dates pre-scheduled. Track this calendar to anticipate major announcements:

Source: Federal Open Market Committee calendars

Economic Calendars: Pepperstone, provide schedules of upcoming economic events and forecasts.

News Services: Use financial news platforms like Bloomberg, Reuters, or CNBC to set up real-time alerts for FOMC announcements, speeches, and related updates. Get access to news feeds with timely data releases. Free aggregation platforms like PiQ offer over 100 sources of information from providers like Reuters and Bloomberg.

Follow Analysts and Economists: Expert commentary helps interpret Fed actions and predict potential market impacts. Pepperstone provides comprehensive previews to help prepare for all major market moving events. Follow Pepperstone’s senior analysts Chris Weston (@ChrisWeston_PS) and Michael Brown (@MrMBrown) on X (Twitter) for insight into the various caveats to look out for in the releases.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.