Analysis

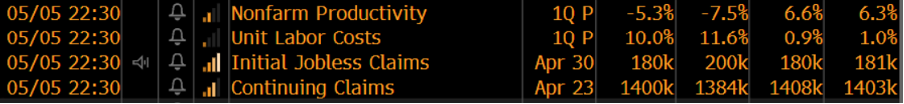

Equity shorts are sitting pretty though and there's two US data points that have jumped out and that speak to the heart of concerns, and have seemingly been the smoking gun as to the drawdown in risk – US nonfarm productivity which fell 7.5% (the worst since 1947) and unit labour costs, which gained a massive 11.6%.

(Source: Bloomberg - Past performance is not indicative of future performance.)

Along with a dour growth outlook from the Bank of England, these two data points speak to the very heart of the issue – rising inflation and deteriorating economics – all the while you have a Fed who is hell-bent on one singular aspect of their mandate – to bring down inflation and they will tolerate a recession if that’s what it takes to get inflation back to target.

The reaction to de-risk portrays a sensitivity to all ongoing inflationary reads and while we know it will take many months for inflation to grow at a slower pace, when the Fed has a myopic focus to get inflation lower, the worse these readings come in the further out the strike on the so-called ‘Fed put’ is priced. The market is almost searching out for the Fed pivot, and they see it at least another 10% away.

By way of the sequencing of market movement after learning these data points were a move higher in US real rates, which led the USD higher and subsequently the VIX traded into 33% and equities were then taken to the woodshed. The aforementioned data was the fundamental trigger, but let’s not forget what really happened – it’s all flow – as volatility (we can look at the VIX index) headed higher portfolio managers deleveraged, options market makers (who are short gamma) had to delta hedge and that meant dynamically selling S&P/NAS futures, while sell programs flooded the market – we can throw in poor top of book liquidity which made getting out at the touch price a tough exercise.

It leads us to today’s US payrolls as a potential event risk by which we need to navigate exposures – the market expects 380k jobs to be created with the unemployment rate to tick down to 3.5% - that’s fine, but the Fed knows the US has close to full employment and according to the JOLTS report there are two jobs available for each applicant. What could really move markets is the inflationary component of the payrolls report – Average Hourly Earnings – here, the market expects 5.5% YoY growth. Given the market's concerns about inflation (as discussed above), should we get a reading above 5.5% and certainly into 6% then bond yields should rise, the USD should rally hard, and equities could face another torrid time.

Just a risk to manage, but that’s what we do as traders and it could be another lively session ahead.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.