Analysis

WHERE WE STAND – A relatively subdued end to the week for markets on Friday, as we meandered into the weekend amid some modest de-risking, and a lack of significant external catalysts.

Perhaps the most interesting development came late in the day, amid President Trump touting the possibility of “flexibility” when it comes to reciprocal tariffs, though again pouring cold water on the idea of any exemptions. I struggle, in all honesty, to get especially excited about this – flexibility is somewhat obvious, really, when the tariff that the US levy on imports will correspond to whatever it thinks the nation in question charges. The reciprocal measures shan’t be a blanket levy on all imports, and the late-day risk rally seems like a bit of an over-reaction to a statement of the obvious in relatively thin trade.

I remain a rally seller, here, in the equity complex, particularly with uncertainty on the policy front showing no sign of dying down any time soon, and with both economic and earnings growth expectations still needing to re-rate substantially lower. Of course, one can’t forget the absence of a ‘Fed put’ to cushion riskier assets, which also adds to the bear case. Plus, for the technicians out there, failure of the S&P to break above the 200-day moving average, despite a couple of tests last week, will be a bit of a red flag, even if the index did last week snap a 4-week losing run.

Elsewhere, on Friday, the dollar continued its recent rebound, as the DXY reclaimed the 104 handle, and closed above that level for the first time in a fortnight, with the buck advancing against all G10 peers.

This feels like a mere ‘pause for breath’ in the broader USD downtrend, as opposed to any particular sign of the tide turning back in favour of the greenback. Of course, the recent bout of weakness came a very long way, in a very short space of time, with the EUR vaulting 6 big figures higher in the space of a fortnight at the start of the month. Perhaps its no surprise, then, that we’ve seen some wind come out of the dollar bears’ sails, as profits have been taken, though I’d still be keen to fade any USD strength at this juncture, with the idea of US exceptionalism stone dead, and the buck the most exposed of all to the ongoing circus around tariffs.

One thing that has caught some attention is the latest CFTC positioning data, with traders now net short USD for the first time since election day. I’d pay little-to-no attention to this, really, with the CFTC report not being a great proxy for the FX market at large, and with the market having now clearly been running USD shorts for some time in any case.

Meanwhile, Friday was a choppy day on the whole, with Treasuries trading in relatively tight ranges across the curve, to ultimately end the day exactly where they began. That said, I still like the risk/reward of longs here, with 3.95% on 2s and 4.25% on 10s attractive yield levels to be locking in, and with risks tilting in an increasingly bullish direction as the US economy slows, and dovish risks to the Fed policy path mount.

Gold was also indecisive as the week wrapped up, with the yellow metal paring a brief test of the $3,000/oz mark to the downside. I still like gold higher, though, with haven demand, and EM central bank flows, remaining supportive over the medium-term.

Finally, I must have a bit of a rant about something here in the UK – our beloved statistics agency, the ONS. Back in 2023, the ONS told us that they were unable to produce accurate labour market data, due to data quality issues; then, two weeks ago, they informed us that trade figures would be released late, due to errors having been found in the data; on Friday, the latest episode in this soap opera unfolded, with the PPI figures due next week now having been canned because, you guessed it, of errors in the data.

This is, frankly, an utterly farcical situation. I would argue that we are now at the stage where no UK data whatsoever can be trusted – if these are the problems that the ONS has found and admitted to, what on earth else might be lurking out there. This, clearly, will substantially erode the credibility of UK PLC on the global stage. Furthermore, given the delicate juncture that the economy currently sits at, effectively making either monetary or fiscal policy is nigh-on impossible, when one doesn’t have accurate data to rely on.

Let’s hope that the folk in Newport can sort their house out sooner rather than later, though given recent form, I shan’t be holding my breath on that front.

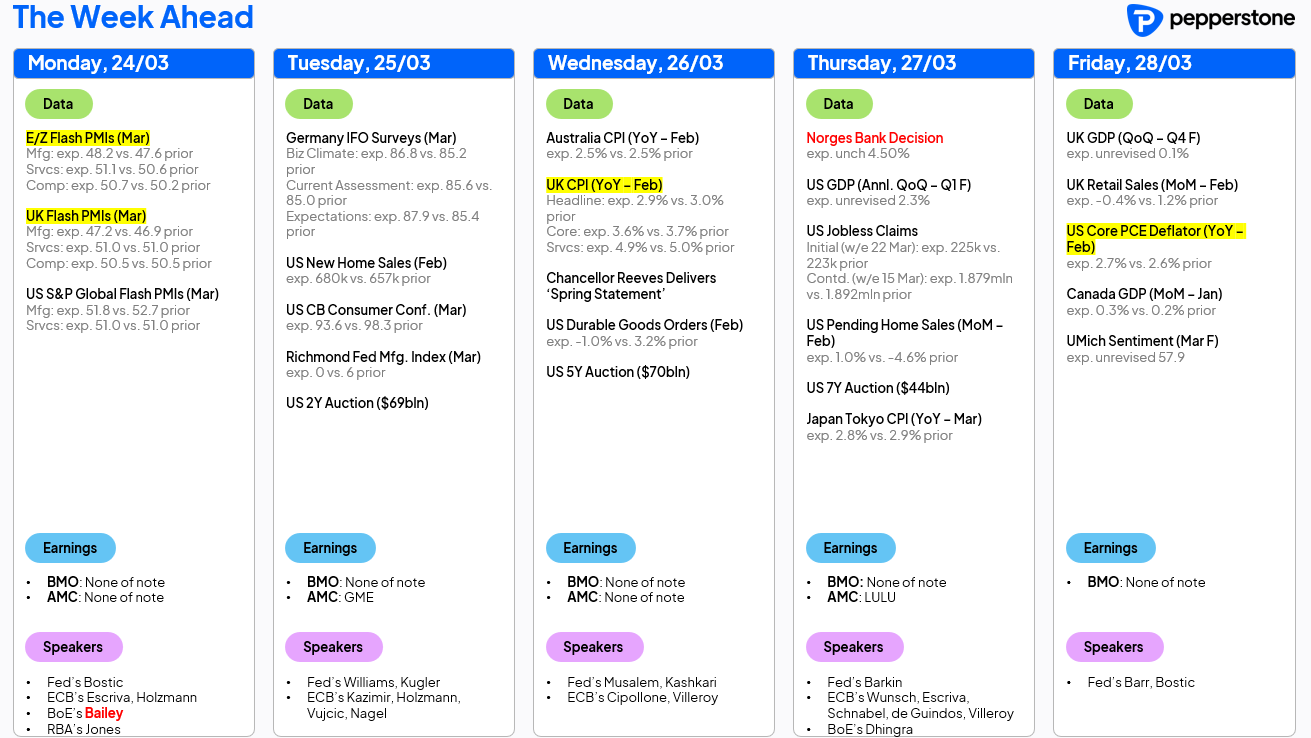

LOOK AHEAD – A quiet-ish week ahead, at least per the data docket, as the month, and the quarter, draw to a close.

Outside of the UK, the data docket lacks top-tier releases this week, likely leading most market participants to begin looking ahead to the aforementioned 2nd April reciprocal tariffs date, as well as the March jobs report at the start of next month. The usual round of rebalancing flows, though, can still be expected, as the week draws on.

In the here and now, though, we do have a whole host of PMI surveys to get our teeth into to kick off the week, though the figures seem unlikely to tell us much we didn’t already know. That said, given ongoing jitters over the US, and global, economy, Mr Market is hardly likely to be particularly forgiving in the event of any downside surprises.

Besides that, Wednesday stands out as the most interesting day of the week, at least here in the City, with the latest UK inflation figures do, along with Chancellor Reeves’s Spring Statement. The latter, of course, has more market-moving potential, particularly with fixed income participants likely to take a relatively dim of the Chancellor’s plans to slash government spending, and the likely narrow degree of fiscal headroom that this leaves here with (once again!). I continue to believe that Reeves’s days in Number 11 are numbered at this stage.

Elsewhere, a busy week of US supply lies ahead with 2-, 5- and 7-year auctions due throughout the week, coming before Friday’s PCE release, though Fed Chair Powell flagged at last week’s press conference that the Committee believe core prices rose 2.8% YoY last month, removing most of the element of surprise from the figures.

Finally, though the docket may be lacking in intrigue, participants will of course continue to pay close attention to incoming news flow, particularly in the geopolitical realm as talks on a Ukraine ceasefire continue, and on the tariff front, as ‘Liberation Day’ (ugh) inches closer.

The full week ahead calendar can be found below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.