Analysis

The bias from clients on gold is to be skewed long and positioned for higher levels – $1733 is the first resistance area (being the 38.2 fibo of the Aug-Sept sell-off), with $1755/60 being the topside supply zone – this being the top of the channel and 61.8 fibo of the mentioned move – if it is to get there it may take a few days to play out.

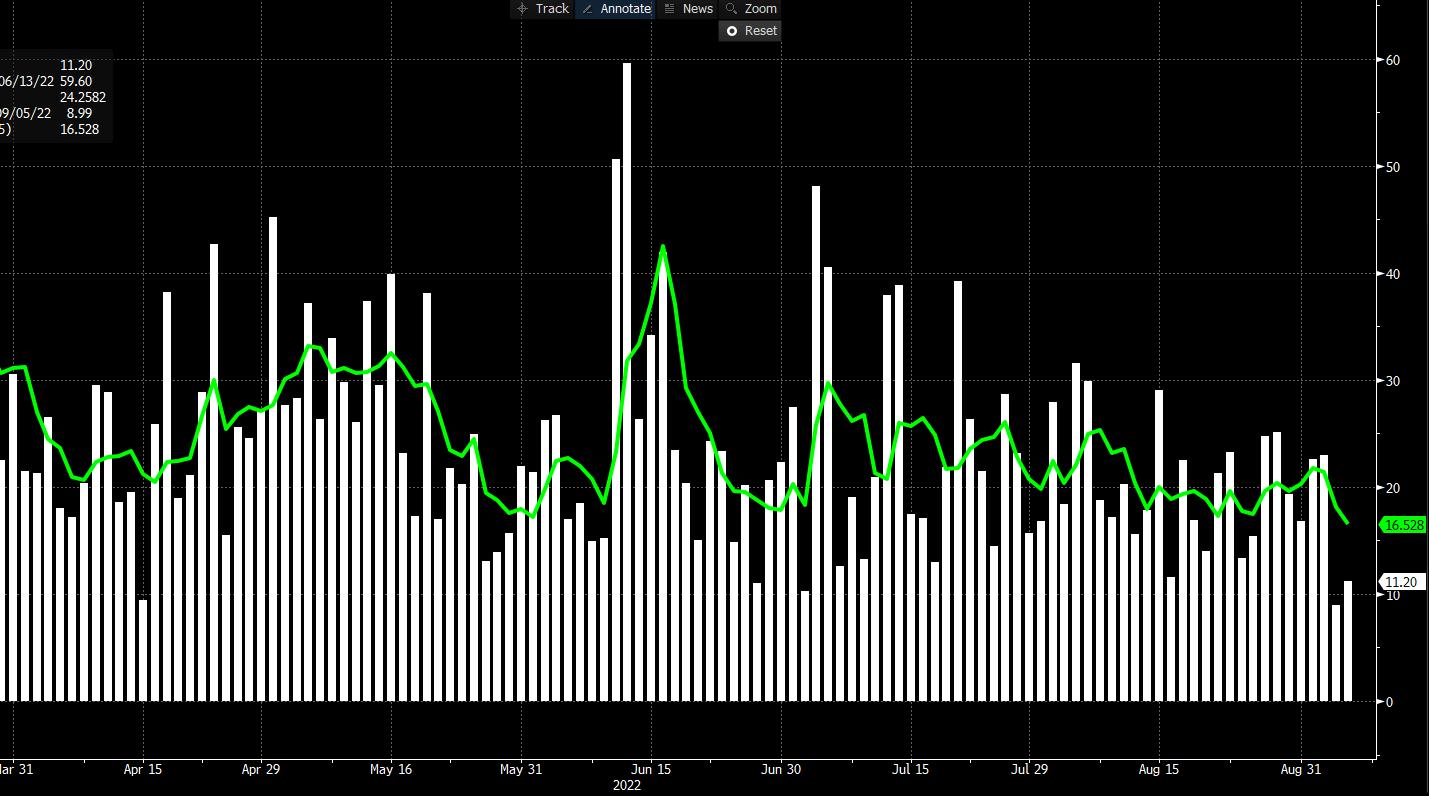

Trading conditions in gold are fairly quiet at this point, and we can see the 5-day average high to low trading range at $16 - not far off the lowest levels of the year. That’s still some movement for traders to work with if utilising leverage, but I am sure many who trade intra-day would prefer conditions similar to June when gold traded in a $40 high-low range – the good news is 1-week (options) implied volatility is pushing higher, suggesting options traders are sensing greater movement - at 15.4%, the daily implied move is priced at $32 (with a 68% level of confidence).

(Gold high – low $ range and 5-day moving average)

Gold’s relationship with the Fed’s reduced balance sheet is rising, but not overly pronounced at this stage, and I think that will change longer term. At this moment, we are seeing a strong relationship with US real rates (can access on TradingView using - TVC:US10Y-FRED:T10YIE) – gold bulls will want to see real rates (i.e. US Treasuries adjusted for inflation expectations) heading lower, and this should cause equity markets to reverse higher, in turn, it should have the effect of bringing out USD sellers. There is no guarantee that will play out and an upside break of 0.80% in US 10yr real rates should see gold roll over and head towards $1678 support.

We know gold is very sensitive to moves in the USD and we’re seeing a heavy skew from clients to be short USDs - this is interesting given this week's ECB meeting and speeches from Fed VC Brainard and chair Powell. The ECB would ideally like a stronger EUR because the weak EUR is seeing the 19 nations in the EMU import inflation – so from this perspective this does favour the ECB hiking by 75bp, although when Europe is facing a far more pressing energy crisis, one questions if aggressive hikes do anything other than squeeze demand. The answer is highly unlikely and therefore and EURUSD rallies immediately after the ECB meeting will likely be sold.

If we are going to see a more sustained move in US real rates and the USD it likely comes from next week’s US CPI print (13 Sept) – the interesting and perhaps phycological aspect is that the headline US CPI is expected to decline month-on-month for the first time since May 2020. A weak CPI print – say below -0.2% MoM - would see risky asset rip (like equities) and the USD would fall in appreciation – gold would likely rally in this situation.

Longer-term, I sit in the camp that Fed QT is not fully priced in and a decline in reserves should see the USD rally higher. That is a story that should keep gold from a sustained bull market unless gold works better as a recession hedge, but for now, there are growing risks we see $1753/66 come into play.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.