Analysis

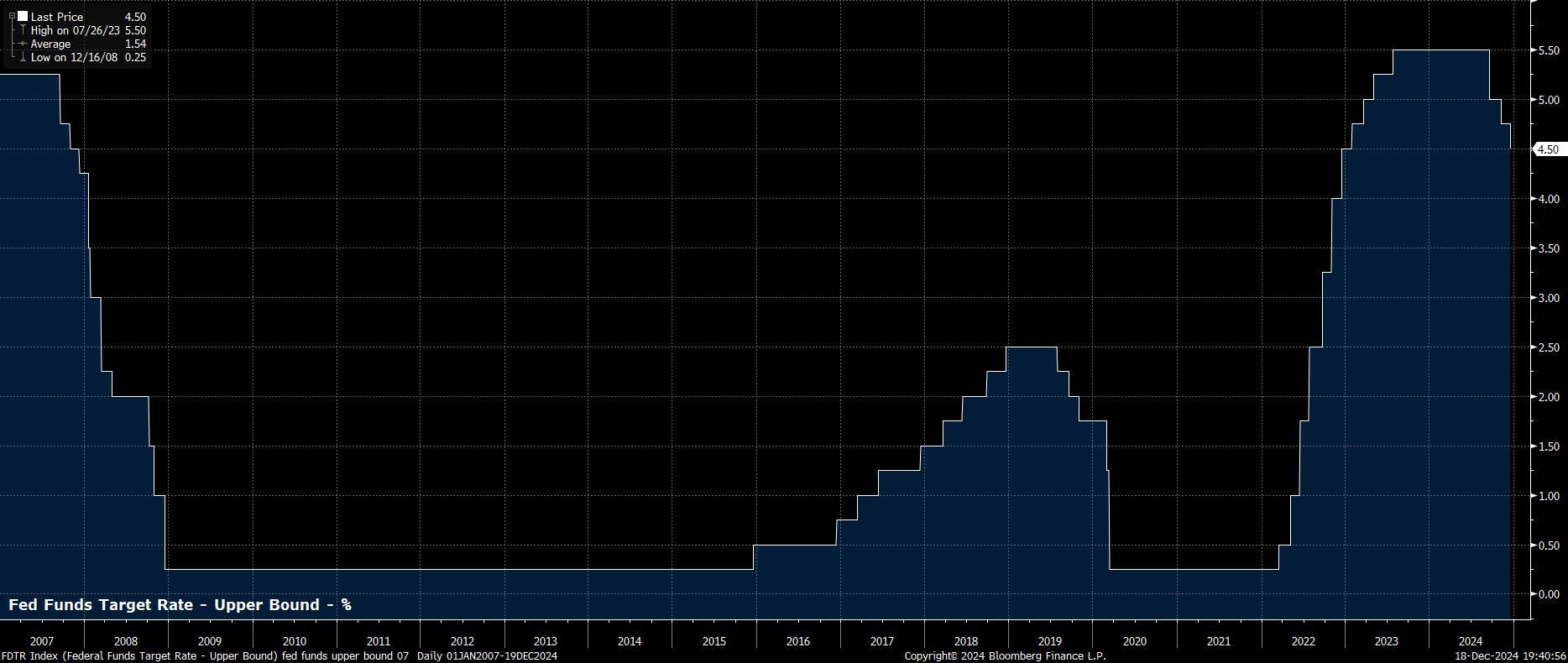

As expected, and in line with money market pricing, the FOMC delivered a 25bp cut at the conclusion of the December FOMC meeting, thus lowering the target range for the fed funds rate to 4.25% to 4.50%.

Said cut marks the third reduction this year, as the Fed continue to move back to a more neutral policy stance, with a cumulative 100bp of easing having been delivered in 2024. This easing has come as policymakers attempt to stick the ‘soft landing’, and as risks to either side of the dual mandate come back into balance.

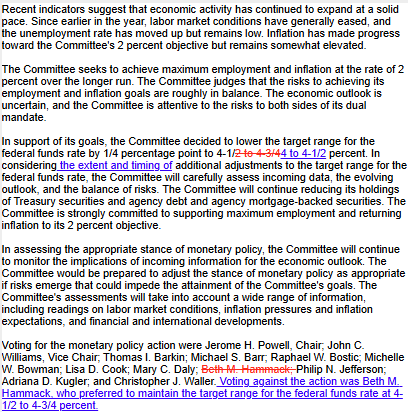

In contrast to the November meeting, the decision to deliver a 25bp cut was not a unanimous one, with Cleveland Fed President Hammack instead preferring to hold rates steady at this meeting.

Meanwhile, as always, accompanying the rate decision was the FOMC’s updated policy statement. Broadly, this was a repeat of that issued after the prior confab, with the Committee reiterating that the economy continues to expand at a "solid pace", that unemployment "remains low", and that inflation remains "somewhat elevated".

One notable change, though, was amending the phrase “additional adjustments” in the fed funds rate, to be prefaced by “the extent and timing of” such changes, perhaps a nod towards some increased flexibility in the policy outlook as we move into 2025.

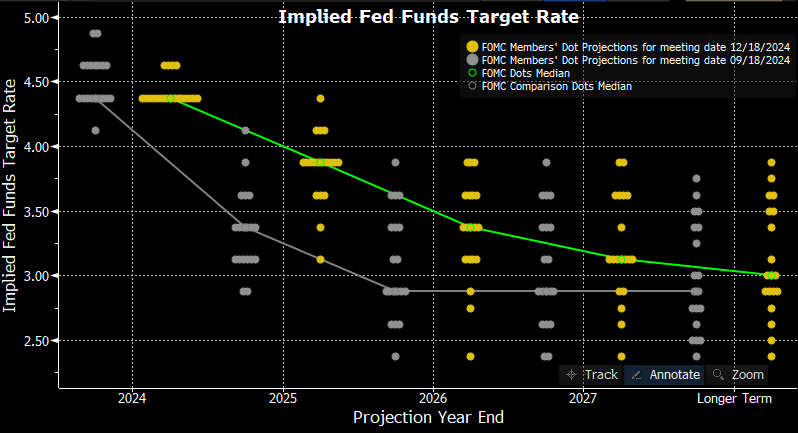

Along with the statement, the December FOMC also saw the release of the Committee’s updated Summary of Economic Projections (SEP), including the all-important ‘dot plot’.

The dots, which had previously implied a median expectation for 100bp of further cuts next year, taking the fed funds rate midpoint to 3.375%, were revised substantially in a hawkish direction. As such, the dots now imply just 50bp of easing next year, with the fed funds rate set to end 2025 at 3.875%, before a further 50bp of easing in 2026, followed by just one 25bp cut in 2027. The longer-run estimate of the fed funds rate, a proxy for the neutral rate, was also nudged higher to a round 3%.

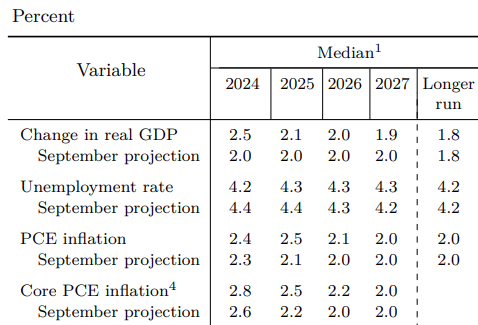

In addition to the dots, the SEP also included the FOMC’s latest round of economic projections, outlined below.

These projections, though, are likely to have a very short shelf life indeed, as they are conditioned on an assumption that the current fiscal ‘status quo’ will continue through the forecast horizon, and do not account for any policies, such as tariffs and tax cuts, that President-elect Trump may introduce after Inauguration Day in January. As such, the projections are not worth losing any sleep over, and are likely to be revised significantly come the next forecast round, in March.

After all of the above had been digested, it was then time to grapple with Chair Powell’s post-meeting press conference.

During the presser, Powell noted that policy is now “significantly less restrictive”, and that the FOMC can now “be more cautious” as further rate adjustments are considered. Furthermore, while stressing that policy is not on a “pre-set course”, and that today’s decision was a “closer call” than in November, Powell flagged that restriction could be dialled back more slowly if signs emerge that inflation is not moving sustainably towards 2%, while also flagging the possibility of faster easing in the event of unexpected labour market weakness, or inflation falling faster than foreseen. The reaction function, then, is considerably more two-sided in 2025, than in 2024.

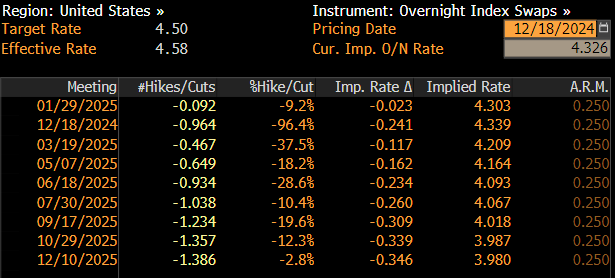

In reaction to the statement, projections, and press conference, money markets repriced in a hawkish direction. The curve now prices next-to-no chance of any policy action at the January meeting, while seeing the March decision as a coin-flip for another 25bp cut. Further out, there are now just 38bp of cuts priced for the entirety of next year, down from around 45bp yesterday.

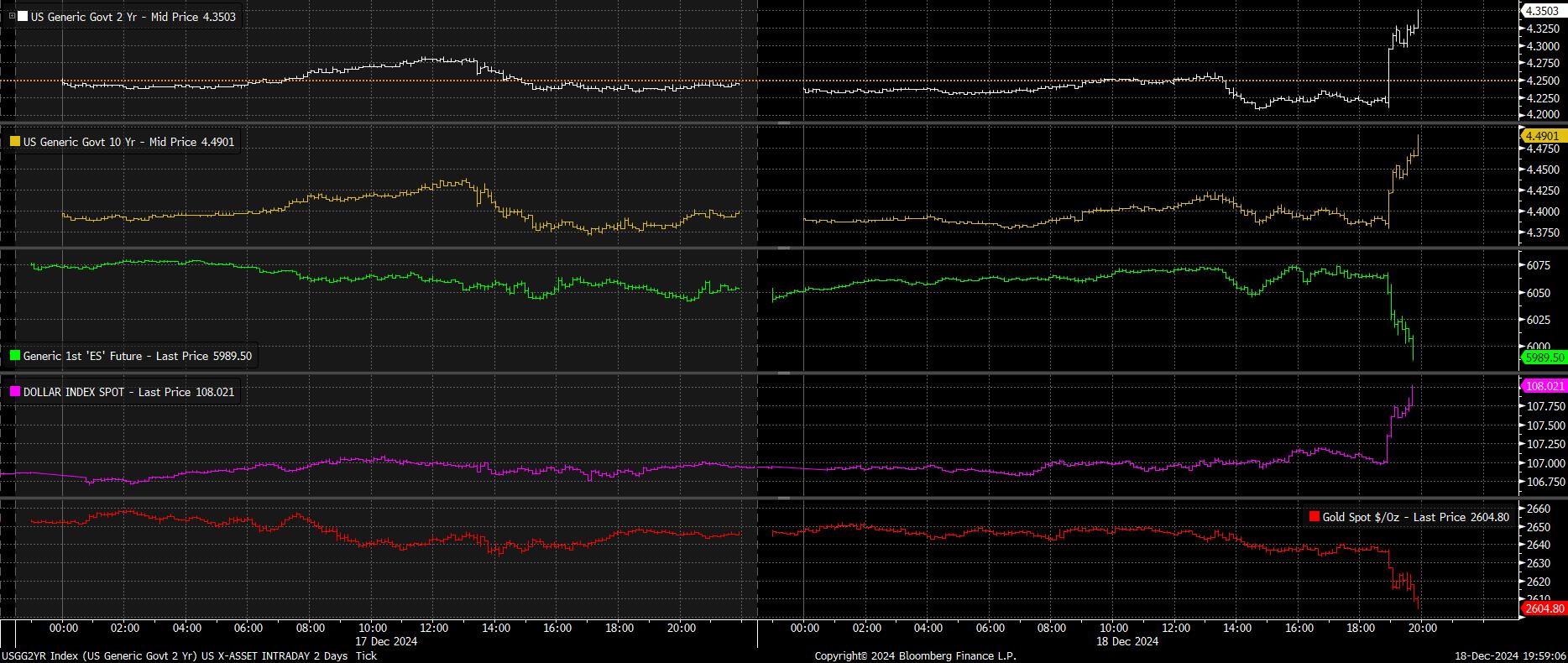

More broadly, markets displayed a hawkish reaction across the board.

Subsequently, Treasuries sold-off across the curve, led by the front-end, with 2-year yields rising over 10bp from pre-release levels, vaulting north of 4.30%. That, in turn, saw the dollar gain ground against all major peers, with the DXY rallying above the 108 figure, the EUR surrendering the 1.04 handle, cable sliding back under 1.26, while the AUD and NZD both slipped over 1.5%. Stocks also lost ground, with the S&P future falling over 1%, and sliding under 6,000.

Taking a step back, the December FOMC, as expected, saw Powell & Co. build in a greater degree of optionality into policymaking next year, broadly reflective of the two-sided inflation, and employment, risks that are likely to present themselves next year. This, subsequently, has opened the door to a ‘skip’ at the January meeting, though incoming data between now and the end of January will determine whether a pause is indeed appropriate to begin the new year.

For now, my base case is indeed that the FOMC will pause in January, in order to allow policymakers to take stock of the impact of the rate cuts delivered to date, and to digest the early economic announcements made by the Trump Administration.

More broadly, the year ahead is likely to see a slower pace of policy normalisation, with risks around the monetary outlook more two-sided in nature – the Committee remain prepared to ease quicker in order to prevent further labour market weakness, but also ease more slowly were disinflationary progress to stall.

Thus, the ‘Fed put’ which has supported risk appetite so forcefully in 2024, is unlikely to do so to the same degree in 2025. Though the path of least resistance for equities should continue to lead to the upside, albeit said path will likely be bumpier, and volatility higher, than seen over the last couple of years.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.